Bullish Break in GBP/USD As US Unemployment Claims Jump

GBP/USD was testing the 200 SMA without success, but today it broke above this resistance after some USD weakness following the Unemployment Claims from the US.

The British Pound experienced a notable rebound last week after enduring a sharp decline of approximately 10 cents over the previous two months. This recovery comes amid a backdrop of deteriorating UK economic conditions, as highlighted by recent data releases. Earlier in the week, the GBP/USD exchange rate briefly fell below the key 1.25 level, reflecting persistent downward pressure.

GBP/USD Chart Daily – The 200 SMA Has Been Broken

However, the pair staged a significant recovery, gaining 2.5 cents to close the week at 1.2749. Despite this rebound, the 200-day simple moving average (SMA) on the daily chart acted as a strong resistance level, rejecting the price at that level. Today, renewed buying momentum emerged, allowing GBP/USD to break above the 200 SMA, suggesting a potential shift in market sentiment. This development could signal further upside potential if buyers maintain control, although economic fundamentals will remain a key influence on the pair’s trajectory.

Comments from the BOE MPC Member Greene

- Impact of US Tariffs on UK Inflation:

- Uncertainty remains regarding the direction of influence that U.S. tariffs might exert on UK inflation. The effects could vary depending on the scope and sectors impacted.

- Stubborn Services Inflation:

- UK services inflation remains persistently high, primarily driven by robust wage growth, which continues to exert upward pressure on costs in the services sector.

Bank of England’s Inflation-Growth Dilemma

The Bank of England (BoE) is navigating a challenging economic landscape where inflationary pressures remain a concern despite lackluster growth. The persistent strength in services inflation adds complexity to the BoE’s decision-making, especially as higher wages sustain price pressures in this key sector.

At the same time, broader economic performance is faltering, indicating that the UK economy may face continued struggles in achieving balanced growth. This environment highlights the BoE’s tightrope act as it seeks to manage inflation without further stalling economic momentum, which is helping the GBP today.

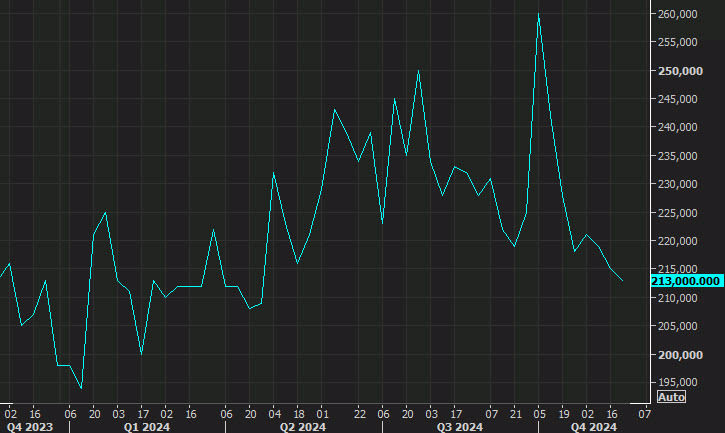

US Weekly Initial Jobless Claims and Continuing Claims for the Week Ending Nov 30![initial jobless claims]()

- Initial Jobless Claims:

- Reported at 224,000, exceeding expectations of 215,000.

- This marks an increase from the prior week’s revised figure of 213,000, indicating a rise in the number of people filing for unemployment benefits for the first time.

- Continuing Jobless Claims:

- Came in at 1,871,000, slightly better than the forecast of 1,905,000.

- Improved from the previous week’s revised figure of 1,907,000, suggesting fewer people remain on unemployment rolls.

Analysis:

- Initial Claims:

- The increase to a six-week high may reflect seasonal shifts, such as fewer temporary hires ahead of the holiday season, or potentially post-election layoffs in certain industries.

- Although the rise is modest, it could hint at a softening labor market as the year ends.

- Continuing Claims:

- The decline suggests that while more people are filing initial claims, others are moving off unemployment rolls, which may indicate that laid-off workers are finding jobs relatively quickly or exiting the workforce.

GBP/USD Live Chart

Sidebar rates

Add 3442

Related Posts

Add 3440

XM

Best Forex Brokers