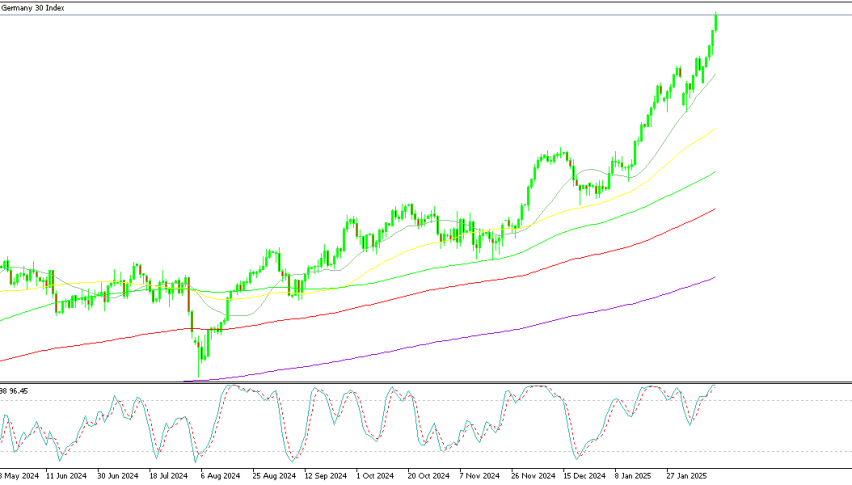

DAX Sets 3 Consecutive All-Time Highs – ECB Member Floats Greater Easing

German stocks continue to rally on bullish momentum despite weak economic data. Helped by monetary easing forecasts and Trump euphoria.

- DAX prints 3 consecutive all-time highs

- ECB Rehn talks of room for further easing

- Weak economic data beaten by monetary easing and bullish Trump sentiment

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

The DAX charged past the 20,000 barrier today after yesterday’s close at 20,025. The momentum seems to be picking up led by a weak euro, the EUR/USD is near 2-year lows.

The monetary easing outlook in the US and Eurozone is helping the stock market despite what looks likely to be a second year of contraction in the German economy. The ECB set to lower rates in the next meeting and continue into Q1 2025.

The sharp decline in rates from the ECB is taking its toll on the common currency with the euro down 6.3% since its high in September. A weak euro is helping DAX listed companies that are heavily reliant on exports.

German stock investors are also hoping for the China stimulus package to start kicking in and help exports to the country that is often Germany’s largest importer. The market also sees the upcoming election as a chance for a new start and stable government.

DAX Live Chart

Trump Euphoria

The US stock market is hoping for an administration that is going to reduce taxation and bureaucracy. Both factors can be bullish for stocks. That’s despite the tariff war floated by Trump on various occasions.

The threat of tariff wars has created a lot of talk of inflation risks and a reduction of GDP output. Both of which could be offset by lower bureaucracy and lower taxation.

The DAX has also caught onto this sentiment despite the possibility German companies may see higher export tariffs to one of its largest trading partners.

ECB Rehn Dovish Remarks

ECB policymaker Rehn stated in an interview with a Finnish newspaper that the grounds for a rate cut in December had increased. He also added that the cuts would likely continue in the coming months.

Rehn mentioned the weak economic growth in the Eurozone area and the decline in inflation to the 2% target of the ECB.

Stating “These factors have increased the justification for lowering the key interest rate in December, and this direction of monetary policy is likely to continue in the coming months,”

These comments have given increased confidence to the market regarding the path for monetary easing. Which seems to me one of the main reasons the DAX continues to rise despite a contracting economy.