Crude Oil Price Outlook: OPEC+ Meeting Signals: 3 Key USOil Price Levels to Watch

WTI crude oil is trading near $68.09 as investors anticipate the outcome of the OPEC+ meeting on December 5.

Analysts predict that the producer group will likely extend output cuts through Q1 2025. OPEC+, which controls around half of the world’s oil production, faces mounting pressure to unwind cuts amid surplus supply concerns.

Market analyst Priyanka Sachdeva expects only a temporary extension, suggesting that internal pressures to ramp up production may lead to revised strategies in the coming months.

Oil prices are also constrained by weak consumption forecasts, with China’s oil demand projected to peak as early as next year. Additionally, Saudi Arabia is expected to slash crude prices for Asian buyers to the lowest levels in four years, adding bearish weight to the outlook.

Key Technical Levels for WTI Crude Oil

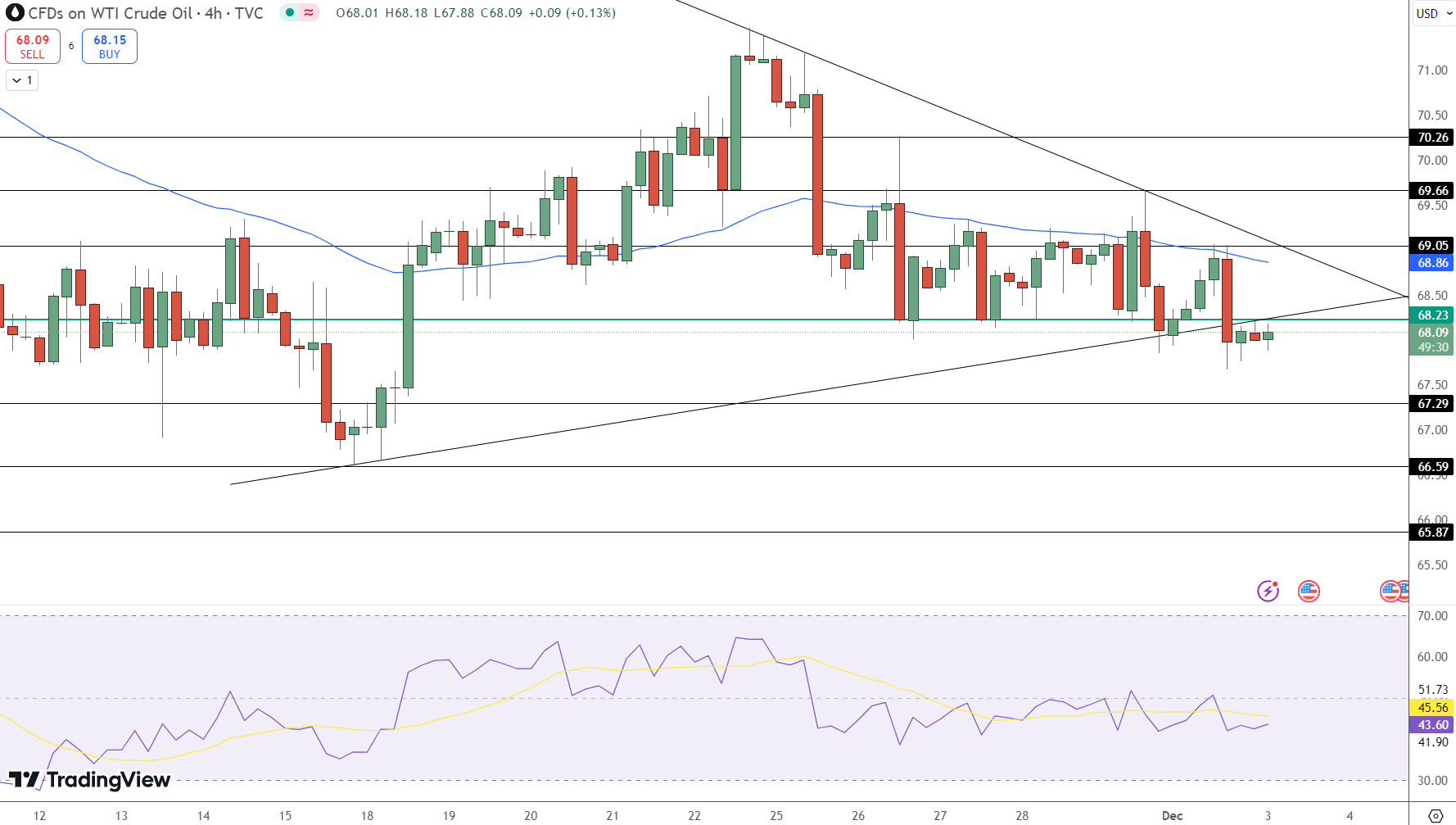

Technical analysis shows WTI crude oil consolidating within a narrowing range near $68.09, hovering close to its 50-EMA ($68.86), a critical pivot for short-term direction.

Resistance Levels: Immediate resistance is at $69.05, with subsequent levels at $69.66 and $70.26. A breakout above these could indicate renewed bullish momentum.

Support Levels: On the downside, $67.29 serves as immediate support, with deeper levels at $66.59 and $65.87. Breaching these could trigger a more pronounced decline.

The RSI at 43.6 signals mild bearish momentum. Converging trendlines suggest a breakout is imminent, with traders eyeing upcoming catalysts such as OPEC+ decisions and U.S. economic data.

Geopolitics and Fed Policy Shape Market Sentiment

Geopolitical tensions and monetary policy debates are creating further uncertainty for oil prices. In the Middle East, renewed strikes between Israel and Hezbollah have underscored instability, while in the U.S., conflicting Federal Reserve signals are dampening rate-cut expectations.

Fed Governor Christopher Waller supports easing measures, but Atlanta Fed President Raphael Bostic remains cautious, citing key jobs data yet to be released.

Key Takeaways:

OPEC+ Production Cuts: Likely extended through Q1 2025 but under pressure for adjustments.

Technical Range: Consolidation near $68.09; breakout depends on $69.05 or $67.29 levels.

Bearish Influences: Weak Chinese demand forecasts and falling Asian crude prices.