FOMC Minutes Ahead of PCE Inflation Show the FED Slowing Rate Cuts

The U.S. Personal Consumption Expenditures (PCE) report to be released soon, is expected to provide fresh insights into inflation trends, which will provide some direction on the FED monetary policy.

As the Federal Reserve’s preferred inflation measure, the Core PCE data will be closely scrutinized following the earlier releases of Consumer Price Index (CPI) and Producer Price Index (PPI) figures. While the CPI report aligned with forecasts, the PPI data surprised to the upside, prompting analysts to adjust their PCE projections. There were some strong PCE-related components in the PPI release, while other analysts have noted sharp increases in portfolio management prices. up 3.5%, and domestic air transportation costs of up 8.8%. These figures have led Pantheon to revise its Core PCE forecast upward, from 0.26% to 0.30%.

Implications for Fed Policy and Rate Outlook

Federal Reserve Chair Jerome Powell recently commented on the inflation outlook, suggesting that PCE inflation for October is likely to rise to 2.3% year-over-year, up from 2.1% previously, with Core PCE climbing to 2.8% from 2.7%. Current market expectations align with these estimates, anticipating a 0.3% month-over-month increase for Core PCE and a 0.2% rise for the headline figure, maintaining the prior month’s pace.

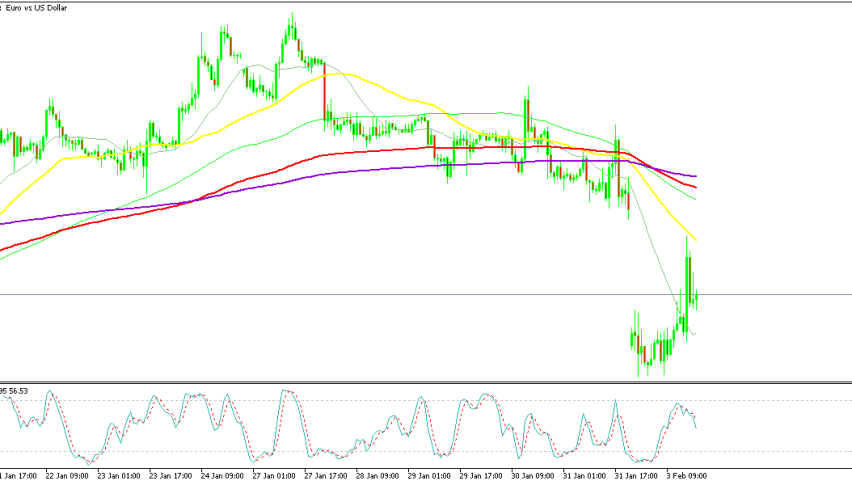

These inflation readings will be pivotal in shaping expectations for the Federal Reserve’s December policy meeting. Money markets are pricing in a modest 14 basis points of easing, reflecting a 56% probability of a 25 basis point rate cut. The upcoming PCE data could tip the scales further, influencing the Fed’s decision-making as it evaluates the balance between inflation control and economic growth. The FED is already anticipating the jump in October PCE inflation after the other inflation measures, as well as considering the jump in the CPI figures for October in other major economies, as shown on the FOMC meeting minutes.

Highlights from the Nov 6–7 FOMC Decision

Future Policy Path

- If data aligns with expectations, showing inflation sustainably moving toward 2% and the economy near maximum employment, a gradual shift toward a neutral policy stance is likely.

Economic Overview

- Economic activity continues to expand at a solid pace.

- Labor market conditions have eased since earlier in the year.

- The unemployment rate has risen slightly but remains low.

Inflation

- Most participants believe inflation data remains consistent with a sustainable return to the 2% target, despite month-to-month volatility.

Risks Assessment

- Almost all members agree that risks to employment and inflation goals are balanced.

December Meeting Expectations

- A majority anticipate a 25-basis-point rate cut at the November meeting, followed by another 25-basis-point cut in December.

Gradual Policy Adjustment

- Many members emphasize uncertainties surrounding the neutral interest rate, advocating a gradual reduction in policy restraint to manage these complexities.

Financial Conditions

- Equity markets saw notable gains, supported by higher yields, improved confidence in growth prospects, and better-than-expected corporate earnings.

Potential Policy Pause

- Some participants suggested pausing rate cuts and maintaining restrictive policy levels if inflation remains elevated.