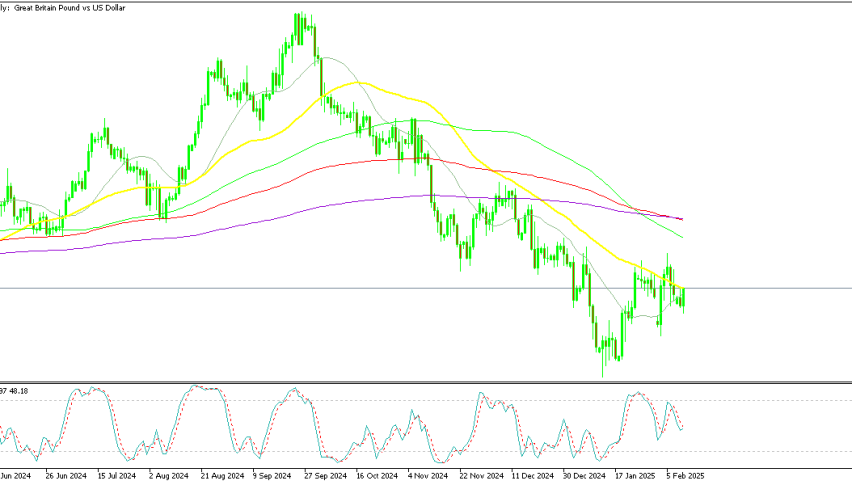

USDCHF Retreat Looks Good for Buyers, Targeting 0.90 First

USDCHF has retreated 1 cent lower together with the bearish gap at the Asian opening, but the main trend is bullish, which makes this a good opportunity for buyers, as the pair remains supported by a dovish SNB policy as well.

USD/CHF Rebound Amid Economic and Political Shifts

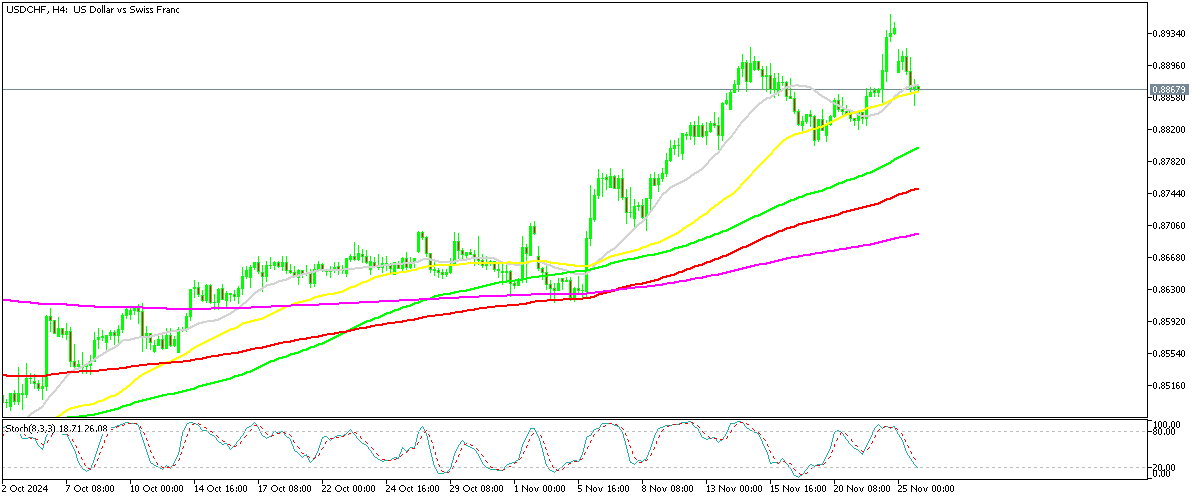

The USD/CHF exchange rate experienced a significant decline between March and September but has staged a strong recovery over the past two months, gaining nearly 5.5 cents.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

After dipping below 0.84 in early September, the pair bounced back decisively, overcoming resistance at moving averages along the way. This upward momentum has been supported by ongoing weakness in the Eurozone economy, where the Services PMI fell into contraction this month. The poor Eurozone performance, combined with growth in U.S. services activity, has bolstered USD/CHF, driving it to its highest level since July.

Swiss National Bank Under Pressure

The Eurozone’s economic and political instability may also weigh on the Swiss economy. Speculation is growing that the Swiss National Bank could be compelled to lower interest rates, adding further pressure to the CHF. On Friday, the USD/CHF surged by one cent following the release of weak Eurozone PMI data, which contrasted with robust U.S. economic indicators.

Swiss Franc Technical Analysis

On the technical side, USD/CHF broke above key moving averages, supported by the 50 SMA (yellow) on the H4 chart. Friday’s doji candlestick signals a potential continuation of bullish momentum, pointing toward a target of 0.90. While the pair experienced a slight pullback today due to U.S. dollar softness following Donald Trump’s political nominations, the overall trend remains supported.

France’s escalating political tensions and dovish comments from ECB officials suggest the Eurozone is bracing for more aggressive rate cuts. These factors add to the supportive environment for USD/CHF’s upward trajectory. So, with Eurozone fragility and Swiss economic pressures aligning with a resilient U.S. economy, USD/CHF appears poised for further gains. A breach of 0.90 seems increasingly likely, presenting a favorable outlook for bullish positions.

ECB Chief Economist Philip Lane

- Approach to Policy Decisions: ECB Chief Economist Lane emphasizes a flexible, meeting-by-meeting strategy to maintain responsiveness to evolving conditions.

- Policy Adjustments: Gradualism is not always applicable; certain situations may demand more decisive actions.

- Risk Management: Agility in addressing emerging risks is critical to maintaining economic stability.

- Rate Move Outlook: Lane highlights the importance of keeping an open mind regarding the pace and magnitude of interest rate adjustments.

- Market Sentiment: Markets are currently split 50/50 on a potential 50 bps rate cut on December 12. Lane’s comments suggest that such a move is being actively considered.