Ethereum Eyes $2.9K Support Amid Bearish Momentum – Is a Rebound Ahead?

Ethereum (ETH/USD) currently trades at $3,134, following a strong rally from $2,585 to $3,868 earlier this month. Despite its recent gains, ETH is facing bearish momentum with a key support level at $3,090, marked by the 50-day EMA.

This zone has historically provided a robust floor for buyers, though mounting selling pressure could drive prices lower. Immediate resistance sits at $3,188, with further upside targets at $3,450 and $3,633.

The Fibonacci retracement tool identifies $3,028.87 as a crucial support zone. A break below this level could lead to a dip toward $2,900.87, representing a 50% retracement of ETH’s recent rally. Historically, such levels have acted as springboards for recovery, including two prior bullish rallies.

Key Metrics Signal Selling Pressure

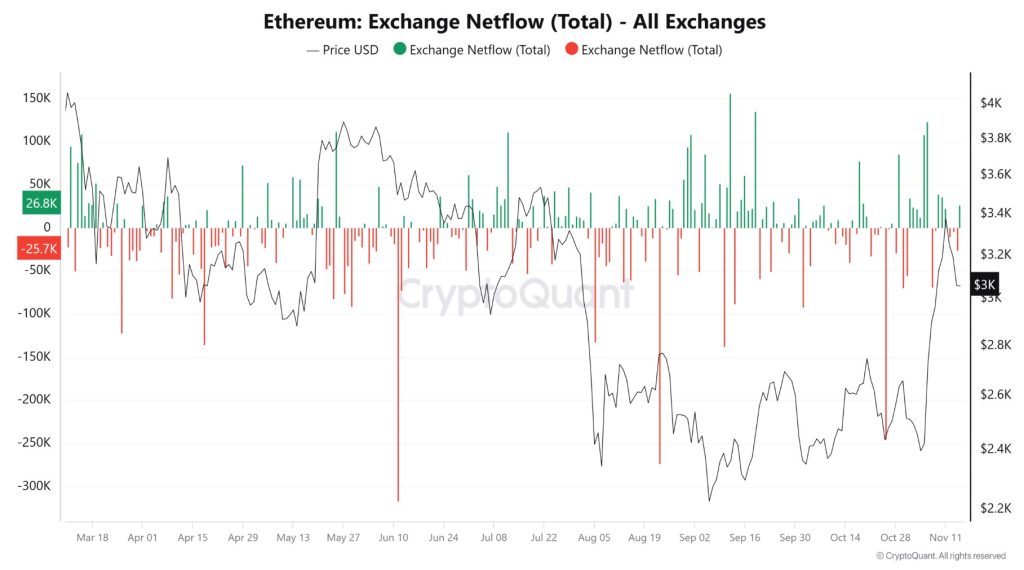

Multiple indicators suggest selling pressure may increase. Over 32,600 ETH were recently moved to exchanges, indicating potential liquidations. Positive netflows to exchanges often signal heightened selling activity, limiting upward momentum.

Additionally, active Ethereum wallet addresses have surged, traditionally signaling increased selling when paired with price declines. These metrics align to suggest that ETH may break below the $3,090 support zone, testing lower levels in the short term.

However, the Exchange Reserve shows only minimal daily and weekly increases in circulating supply, at 0.03% and 0.32%, respectively. This indicates that while selling pressure exists, it remains relatively controlled, suggesting any decline may be temporary.

Potential for a Rebound Beyond $3K

If Ethereum holds above the $2,900.87 support, it could reignite bullish momentum, targeting $3,971.02 in the medium term. Key resistance levels to watch include $3,188 and $3,450. These levels will likely determine Ethereum’s ability to sustain its upward trajectory.

Key Insights:

- Resistance Levels: $3,188, $3,450, $3,633.

- Support Levels: $3,090, $2,900.87, $2,770.

- Momentum: RSI at 50 reflects neutrality but indicates potential for volatility.