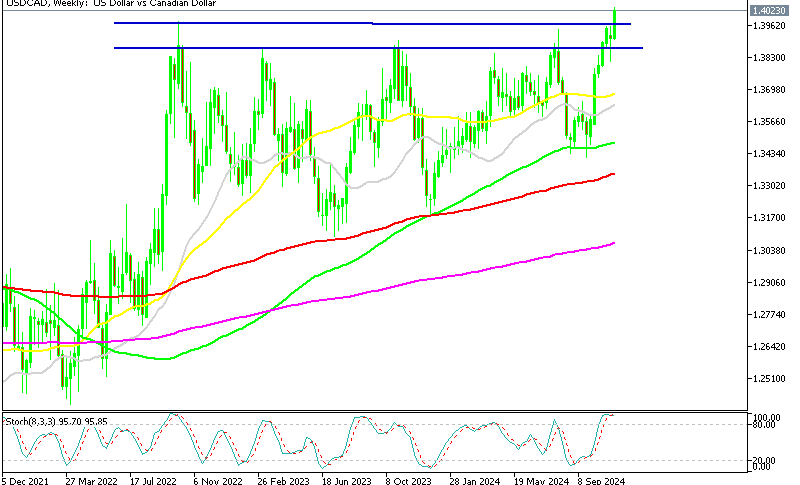

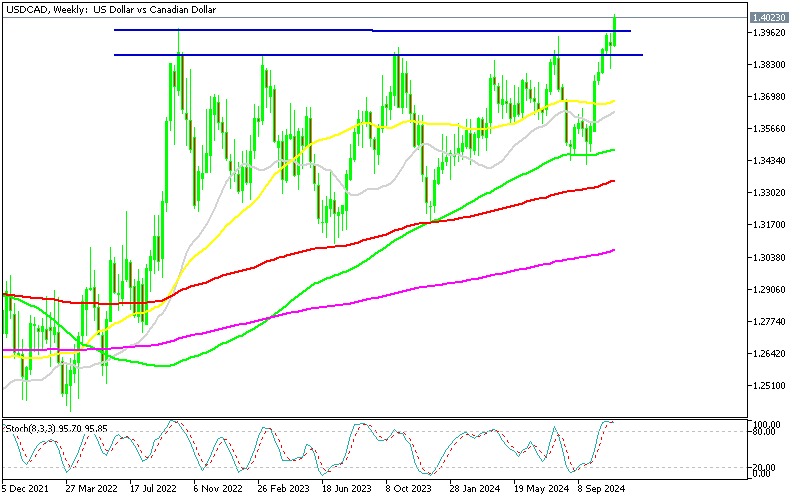

Fundamentals Finally Push USD/CAD Above 1.40 for First Time Since 2020

USD/CAD tested 1.40 yesterday after the US CPI inflation but failed, however, today buyers managed to push the price above, after the PPI inflation and the Unemployment Claims, which leaned on the positive side, helping the USD further.

The USD/CAD exchange rate has risen by over 5 cents since late September, though its momentum slowed in November as the pair entered a period of consolidation. Recently, however, the upward trend resumed, with the pair breaking through the key resistance zone at 1.3950-1.3960 after a stronger-than-expected CPI report.

Initial Jobless Claims for Last Week![initial jobless claims]()

Weekly Initial Jobless Claims:

- Reported at 221K, slightly below the 223K expected.

- Prior week’s claims were also 221K.

- Four-Week Moving Average:

- Latest average is lower than prior, which was 227.5K.

Continuing Jobless Claims:

- 1.873 million claims, slightly below the 1.880 million expected.

Yet, buyers struggled to push past the significant 1.40 level yesterday, but we’re above it today. Despite disruptions to the labor market from recent hurricanes and election impacts, unemployment claims have returned to early 2024 levels, indicating labor market resilience. Yesterday the jump came after the US October core CPI rose year-over-year from 2.6% to 3.3%, while headline CPI climbed from 2.4% to 2.6%, reinforcing USD strength.

Comments from Richmond Fed President

- Progress on Inflation:

- Fed is making strong progress in addressing inflation but needs to maintain efforts.

- Housing Market Demand:

- Demand for housing remains high relative to supply.

- Emphasizes that increasing housing supply, rather than reducing demand, is a better solution to address this imbalance.

- Labor Market Conditions:

- Companies report long-term labor shortages, leading to slowed job growth rather than layoffs.

- Current unemployment rate is acceptable, but it’s uncertain whether the trend indicates stabilization or a weakening labor market.

This places the USD/CAD weekly chart on the cusp of a bullish breakout. For the Canadian dollar, the bearish oil market presents a challenge. Although crude prices rebounded by $2 today after two days of declines, much of that gain has already been erased, and the EIA inventories showed a decent buildup.

Even if OPEC continues with its production cuts, the IEA warns of an additional 1 million barrels per day in global oil supply from non-OPEC countries, with rising production expected from Argentina, Guyana, Canada, and the US. This increase could limit gains in oil prices, creating headwinds for the Canadian dollar.