Daily Crypto Roundup: Crypto Market Surges on Trump Victory as Industry Landscape Shifts

Bitcoin surged past $76,000 and crypto-related stocks posted massive gains following Donald Trump’s victory in the 2024 U.S. presidential election. The market response highlights growing optimism about potential regulatory changes under a second Trump administration.

Market Response and Industry Gains

Cryptocurrency stocks experienced substantial gains, with Coinbase Global Inc (COIN) leading the surge with a 31.11% increase, closing at $254.30. Other major players saw similar upward momentum, with Robinhood (HOOD) rising 19.6%, MARA Holdings Inc (MARA) climbing nearly 19%, and MicroStrategy Inc (MSTR) gaining over 13%.

The rally extended beyond stocks to crypto tokens, with Uniswap (UNI) emerging as the top performer with a 35% increase. Other notable gainers included Aave (AAVE), Lido DAO (LDO), and Maker (MKR), each posting approximately 20% gains.

Industry Leaders React

Coinbase CEO Brian Armstrong expressed optimism about the election’s implications for the cryptocurrency industry. “America is going to follow a path toward economic freedom which is our source of strength, based on limited government, rule of law, meritocracy, fiscal discipline, respecting the free market (not government),” Armstrong stated.

Technical Innovations and Institutional Developments

Amid the market surge, significant technical developments continue to shape the industry. A prestigious team of Bitcoin developers announced a breakthrough in adding “covenants” functionality without requiring a soft fork, potentially unlocking new wallet features and more efficient layer-2 protocols.

Coinbase has also expanded its presence in the Solana ecosystem by introducing cbBTC, a move aimed at filling the bitcoin-sized hole in Solana-based decentralized finance left by FTX’s collapse. With nearly $10 million worth of cbBTC ready to deploy, this initiative could spark a revival in Solana’s DeFi sector.

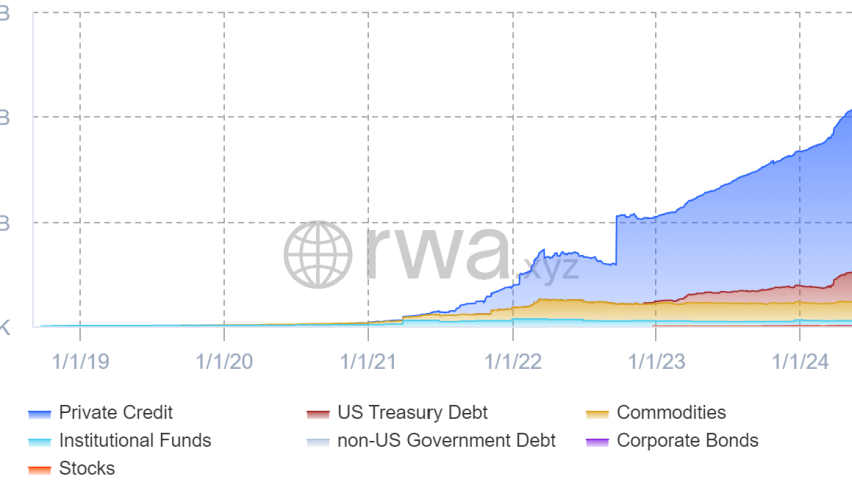

Institutional Interest in Real-World Assets

The real-world asset (RWA) tokenization sector continues to attract substantial institutional interest, with projections suggesting market growth from $4 trillion to $30 trillion by 2030. Major players like BlackRock have already announced over $1 billion in tokenized treasuries, with plans to scale to $10 billion by year-end.

Regulatory Progress

In a notable development for cryptocurrency adoption, Detroit announced plans to accept cryptocurrency payments for taxes and city services starting mid-2025, becoming one of the first major U.S. cities to embrace blockchain technology for civic applications. The initiative will be facilitated through a secure PayPal payment platform.

Legal Developments

In other news, Caroline Ellison, former CEO of Alameda Research, reported to prison on November 7 to begin her two-year sentence for crimes related to the FTX exchange collapse. She joins former FTX CEO Sam Bankman-Fried, who is serving a 25-year sentence, as the third U.S. inmate currently serving time for FTX-related crimes.

Crypto Market Outlook

With Trump’s victory potentially leading to significant changes in regulatory leadership, including the possible replacement of SEC Chair Gary Gensler, the cryptocurrency industry appears poised for a period of potential growth and regulatory clarity. The market’s immediate positive response suggests strong optimism about the sector’s future under the new administration.