Selling the Silver Retrace After Jump in US Waves, Stable Unemployment Claims

Silver has been retracing higher today after the $4 fall, but it seems like the retrace is over, so we decided to open a sell Silver signal.

Silver has been retracing higher in the last few sessions after the $4 fall, but it seems like the retrace is over, so we decided to open a sell Silver signal. Gold and Silver tumbled lower after Trump’s victory, but today we saw some bullish momentum, as the USD retraced some of the gains, which sent XAG $1 off the bottom, however, the retrace seems complete on the H1 chart.

Gold has surged dramatically this year, climbing approximately $700 and reaching $3,485 by late October. This rally pushed prices above the previous highs from 2020–2021. However, after forming a bearish reversal signal with a weekly doji candlestick, gold reversed course and has been falling over the past two weeks.

Silver Chart H1 – The 50 SMA Is Providing Resistance

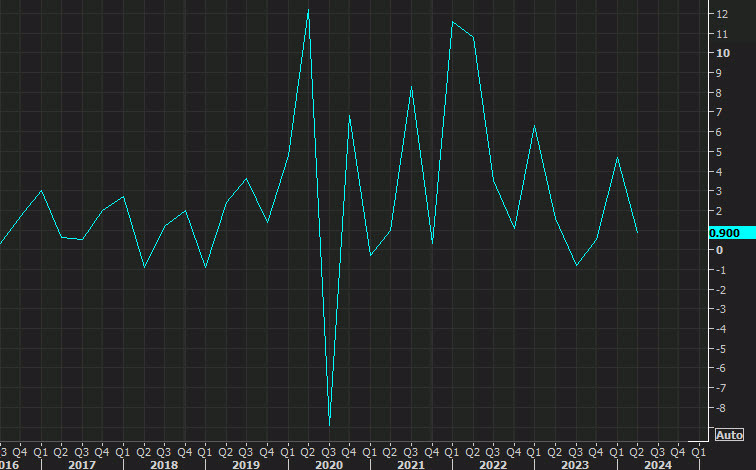

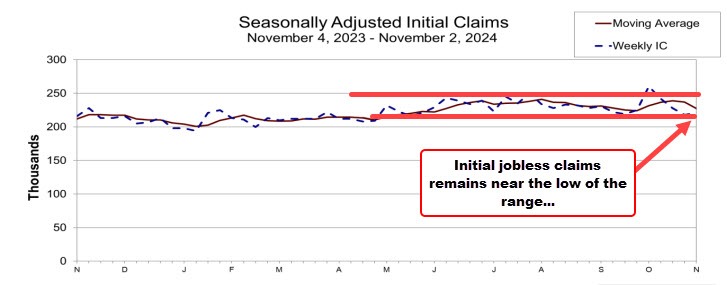

This decline has accelerated following the U.S. presidential elections. Labor market data also affects market sentiment around precious metals. For instance, Q3 Unit Labor Costs rose from 1.0% to 1.9%, suggesting that the Federal Reserve may proceed with rate cuts more cautiously. Meanwhile, stable unemployment claims point to a resilient jobs sector. Within this data, the unit labor cost number is certainly an inflationary one.

US Q3 Unit Labor Costs![US productivity]()

- US Q3 Unit Labor Costs

- Actual: +1.9% (vs. expected +1.0%)

- Prior: Revised to +2.4% (from +0.4%)

- Productivity

- Q3: +2.2% (slightly below the expected +2.3%)

- Prior: Revised to +2.1% (from +2.5%)

US Unemployment Claims for Previous Week

- Initial Jobless Claims

- Current: 221K (matching estimate of 221K)

- Prior Week: Revised to 218K (up from 216K)

- 4-Week Moving Average of Initial Claims

- Current: 227.25K (down from last week’s 237.0K)

- Continuing Jobless Claims

- Current: 1.892M (slightly above estimate of 1.875M)

- Prior Week: Revised down to 1.853M (from 1.862M)

- 4-Week Moving Average of Continuing Claims

- Current: 1.876M (up slightly from last week’s 1.867M)

- Largest Increases in Initial Claims (week ending October 26)

- New York (+1,983)

- Michigan (+1,722)

- Illinois (+1,066)

- Texas (+757)

- Ohio (+706)

- Largest Decreases in Initial Claims

- North Carolina (-2,859)

- Florida (-2,429)

- California (-1,876)

- Virginia (-824)

- Washington (-698)

Silver Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account