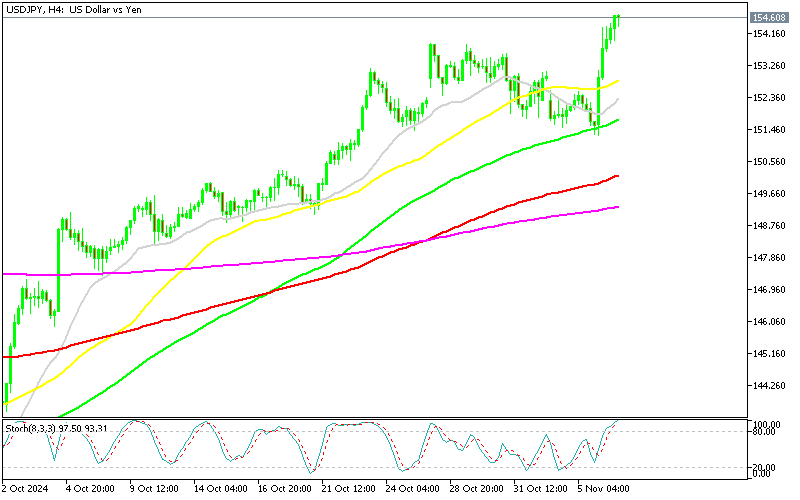

USDJPY Approaches 155 As Japanese Earnings Miss Again

USDJPY has been on a strong trend for more than a month and the Republican victory in the US gave this pair another push higher toward 155.

USDJPY has been on a strong trend for more than a month and the Republican victory in the US gave this pair another push higher toward 155. The retreat lower after the Bank of Japan mentioned rate hikes found support at the 100 SMA where buyers jumped in and USD/JPY resumed the uptrend.

The USD/JPY has been on an upward trend since early August following an initial decline. From mid-September to October, the pair gained 12 cents, rising from below 140 to around 153. After a brief two-cent dip, the USD rebounded as U.S. election results pointed toward a victory for Donald Trump, further boosting the dollar.

Trump’s election has strengthened the USD, with markets expecting a policy environment favorable to the currency. Additionally, a Republican “red sweep” is likely if the party wins control of both the House and Senate, adding to the dollar’s appeal. The Federal Reserve may consider pausing rate hikes as early as 2025, earlier than expected, in response to strong U.S. economic data and the evolving political landscape.

USD/JPY Chart H4 – The 100 SMA Held As Support

The election results could significantly influence the Fed’s stance on interest rates. On the technical side, USD/JPY has maintained key support at 152.00, reinforcing a bullish trend. Buyers are now setting their sights on the 160.00 level to confirm continued strength. However, if the price drops below 152.00, this could signal a shift away from the bullish outlook.

Japanese Average Cash Earnings Report

- Labor Cash Earnings (YoY): Increased by +2.8%, slightly below the expected +3.0%.

- August Comparison: Also +2.8%, showing no change in the growth rate month-over-month.

- Real Cash Earnings (YoY): Declined by -0.1%, marking the second consecutive month of decline, versus an expected rise of +0.1%.

- August Real Cash Earnings: -0.8%, indicating a slight improvement but still in negative territory.

Japan’s Labor Cash Earnings for September grew by 2.8% year-over-year, in line with August’s rate but missing the 3.0% forecast. Real Cash Earnings, however, fell by -0.1%, extending a two-month decline as inflation pressures reduce purchasing power, underscoring potential headwinds for consumer spending. We also had some comments from Japanese officials on the Yen depreciation, but it couldnt help the JPY much.

Japan’s Currency Official Overview:

- Atsushi Mimura: Japan’s Vice Finance Minister for International Affairs, known as the “top currency diplomat.”

- Monitoring FX Markets: Observing currency movements closely, with a strong sense of urgency.

- Policy Stance: Prepared to take appropriate measures if there are excessive fluctuations in foreign exchange (FX) markets.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account