USDJPY Pops Higher After US Elections, Despite BOJ Rate Hike Comments

USD/JPY retreated 2.5 cents lower, but last night we saw a jump as US presidential elections started to come out and the USD popped higher.

USD/JPY retreated more than 2 cents lower, but last night we saw a jump as US presidential elections started to come out and the USD popped higher. The Bank of Japan released their minutes from the last meeting, where they mentioned rate hikes which was what triggered the retrace in this pair, but they didn’t move the markets too much.

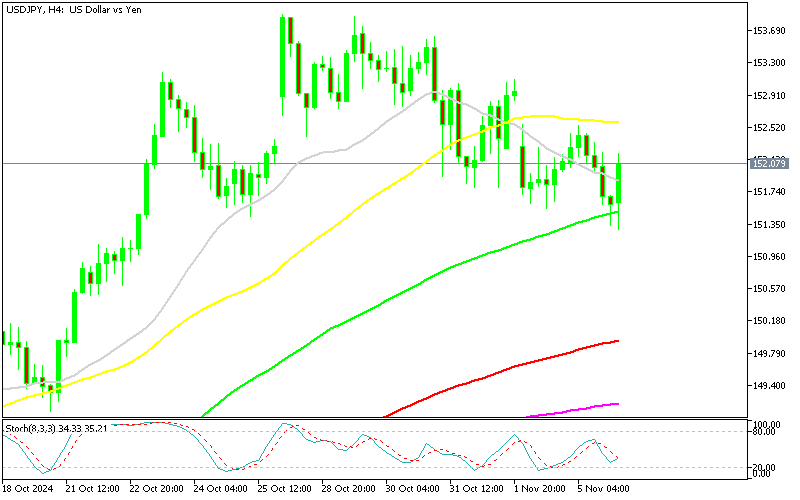

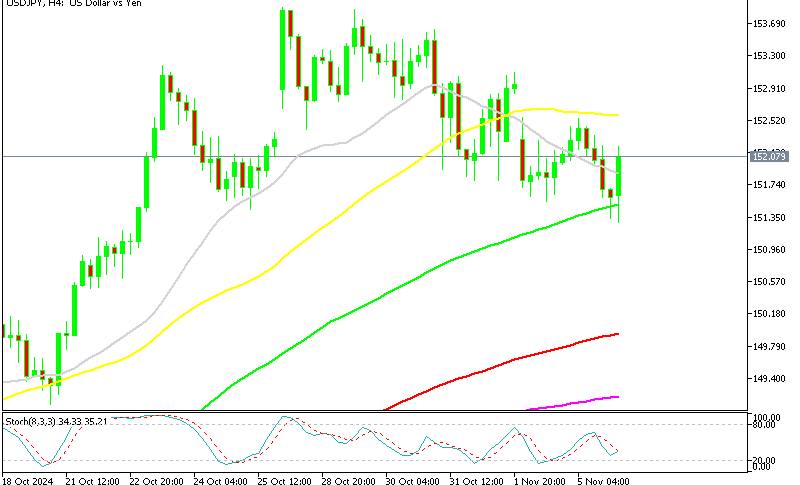

USD/JPY Chart H4 – The 100 SMA Held As Support

After a sharp drop in early August, USDJPY shifted to a bullish trend, with recent volatility reflecting strong buying momentum. From mid-September through October, the pair climbed from below 140 to around 153, marking an impressive 12-cent gain. This week, USD/JPY opened with a 50-pip bullish gap, reaching 154, where the 20 SMA on the H4 chart now serves as a key support level, highlighting ongoing buying interest.

BOJ Meeting Minutes Highlights:

- Rapid market sentiment decline in August 2024, driven by fears of a U.S. economic slowdown.

- Japanese markets particularly volatile due to swift position adjustments.

- Global Economic Concerns:

- Uncertainty around U.S. economic outlook impacts global stability.

- Potential divergence in economic cycles among advanced economies raises concerns.

- U.S. Economic Conditions:

- Growth led by strong private consumption, but inflation poses risks.

- Potential downside if high expectations for AI-driven growth are not met.

- Japan’s Economic Outlook:

- Moderate recovery in line with July 2024 outlook; stable wage and consumption growth.

- External factors weigh on the economy despite resilient domestic demand.

- BOJ Policy Approach:

- Plans for gradual rate increases, with caution toward overseas economic uncertainties, particularly from the U.S.

- Emphasis on enhancing market transparency, focusing on data-driven policy rather than forward projections to minimize market shocks.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account