USDCAD 1 Cent Lower, Ignoring Lower Canada Trade Balance

USDCAD has retreated 1 cent lower this week, despite the economic weakness in Canada, as the growing trade deficit in the Canadian trade balance report shows. However, this move is due to the US elections being held today, so the outcome will also determine the trend in the following months in this pair.

USD/CAD Chart H4 – The 100 SMA Holding for Now

Canada’s latest trade data offers a mixed outlook. Real trade volumes saw an increase, but falling commodity prices weighed on nominal values. While this creates some vulnerability in the election context, the expanding trade surplus with the U.S. is a positive sign. The USD/CAD rate has dropped 25 pips to 1.3876 today. After a strong rally that pushed above 1.38 and reached the 1.3950s, USD/CAD saw a reversal lower this week.

Canada September 2024 Trade Balance Report![Canada trade balance]()

- Trade balance: -$1.26B vs. expected -$0.80B

- Previous month: -$1.1B

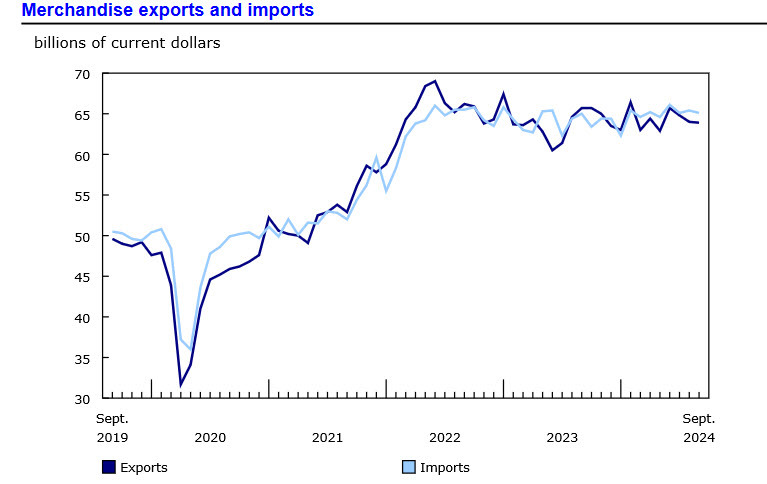

- Exports and Imports

- Exports: $63.88B, down from $64.31B prior

- Imports: $65.15B, down from $65.41B prior

- Trade deficit narrows to -$1.3B from -$1.5B previously

- Trade with the U.S.

- Trade surplus with the U.S.: $8.3B, up from $7.8B prior

- Exports to the U.S. rose by 1.6%

- Imports from the U.S. increased by 0.8%

- Sector-Specific Changes

- Energy exports declined by 2.6% due to lower crude oil prices

- Aircraft exports surged 10.3%, driven by private jet shipments to the U.S.

- Metal and mineral exports dropped 5.4%, influenced by reduced gold transfers

- Real exports (adjusted for volume): +1.4%, indicating growth despite nominal declines

Canada’s trade balance for September showed a narrower-than-expected deficit of $1.26B, with both exports and imports declining slightly. The U.S. trade surplus expanded as exports and imports increased modestly. Sector-wise, energy exports fell due to lower oil prices, while aircraft exports saw a notable rise. Despite the overall nominal decline, real exports grew, reflecting positive volume gains in trade.

A downturn followed last week’s GDP report, which indicated flat growth for Canada in August, and today’s trade balance data showed a notable increase in the deficit. The Canadian dollar has strengthened in anticipation of the U.S. elections, bringing USD/CAD down by 1 cent to 1.3845. However, the recent decline has paused as traders await election results, with buyers returning at the 100 SMA level on the H4 chart.

Highlights of the BOC Meeting Minutes for October 2024

- Ahead of the Bank of Canada’s October 23 rate announcement, the governing council anticipated inflationary pressures would continue to ease, reducing the need for restrictive policy.

- Members considered a 25 basis point rate cut, with strong consensus for a larger adjustment due to recent economic data since July.

- Council emphasized the potential impact of a slower population growth rate, which could dampen total consumption growth.

- It was noted that lower rates would take time to significantly influence per capita spending, which could help offset the slowdown in total consumption due to reduced population growth.

- Some members observed that domestically focused companies, facing a subdued demand outlook, were planning only modest investments.

- The council acknowledged that, unless growth exceeded potential, excess supply could keep inflation trending downward.

- There were discussions about potential risks from lower interest rates, pent-up demand, and new mortgage qualification rules potentially fueling a larger-than-expected rise in housing demand and prices.

- Members anticipated sustained strength in energy exports throughout next year.

- Council highlighted that geopolitical risks and potential shocks posed a heightened risk to the bank’s outlook.

- The council decided to continue its balance sheet normalization policy by allowing maturing bonds to roll off.