US Dollar’s ‘Death Warrant’? How BRICS Is Shaping a New Global Financial Order

The U.S. dollar has long been the backbone of the global economy, serving as the world’s primary reserve currency. However, recent statements by Russian Foreign Minister Sergey Lavrov suggest that the currency’s role may be shifting.

Lavrov argued that the West has effectively turned the dollar into “a weapon of oppression,” using it to punish countries that defy U.S. policies.

Lavrov tweeted that the dollar, once promoted as a “global good,” is now “a tool for punishing dissenters.”

He suggested that the trust which made the dollar globally dominant is eroding, especially among nations increasingly wary of U.S. influence.

Lavrov claimed that the West’s actions have effectively signed a “death warrant” for the dollar as a global reserve currency.

Lavrov’s comments underscore a growing consensus among BRICS nations that they need alternatives to a financial system heavily dependent on the dollar. BRICS leaders see the dollar’s weaponization as a compelling reason to develop more independent financial networks.

https://twitter.com/cryptonws_en/status/1853661097695326706

BRICS’ Push for Economic Independence and De-Dollarization

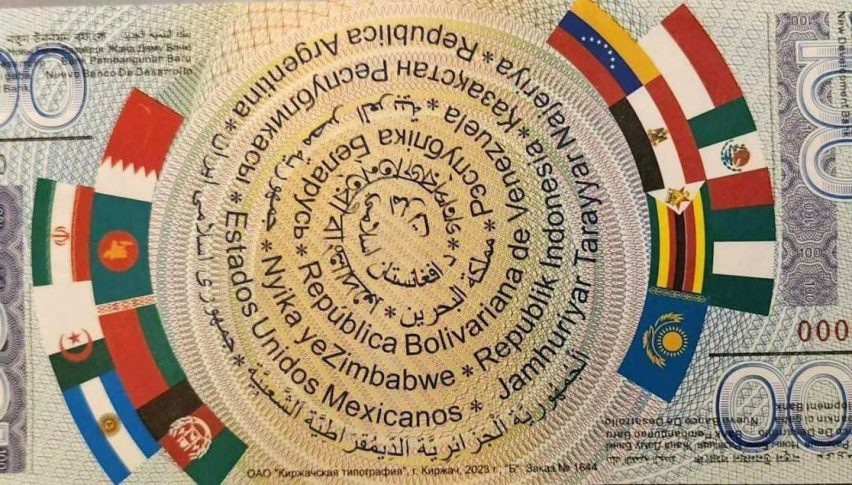

The BRICS coalition—comprising Brazil, Russia, India, China, and South Africa—has been working to reduce its reliance on the dollar by encouraging trade in national currencies.

Lavrov noted that during Russia’s presidency of BRICS, significant progress was made toward establishing “alternative payment mechanisms” that sidestep dollar-based systems.

Key Steps in BRICS’ Financial Strategy:

Interbank Payment Systems: BRICS countries are developing resilient financial systems that enable cross-border payments without relying on the dollar.

National Currency Transactions: Increasingly, BRICS members are using local currencies for trade, strengthening economic ties within the group while reducing exposure to dollar-based volatility.

Expansion Plans: BRICS leaders, including Lavrov, have indicated that more countries are likely to join the alliance, attracted by the prospect of a fairer, more balanced economic order.

This push toward de-dollarization is aimed at insulating BRICS nations from Western sanctions and political pressures, while also promoting a more multipolar global financial system.

BRICS’ Growing Influence: A Shift in the Global Economic Power Balance

Russian Deputy Chief of Staff Maxim Oreshkin has emphasized that BRICS countries are leading the way in global economic growth, especially in emerging markets across Asia and Africa.

According to Oreshkin, BRICS members are already “leaders in the world economy” and are attracting interest from countries eager to reduce dependence on Western-led financial institutions.

https://twitter.com/tut0ugh/status/1853447774060040372

- Oreshkin pointed to rapidly growing economies in regions like South Asia and Africa, specifically naming Nigeria and Ethiopia as examples of nations interested in closer BRICS partnerships.

- Lavrov noted that many global South countries are now voting for politicians who advocate closer ties with BRICS.

- Future BRICS expansion is expected, with talks scheduled to continue in 2025.

Why BRICS’ Influence is Rising:

- Economic Growth: BRICS nations, especially China and India, are outpacing many Western economies, creating an attractive model for other developing nations.

- Regional Reach: With strategic influence across multiple continents, BRICS is seen as a viable alternative to Western-dominated structures.

- Political Appeal: Many countries in Asia, Africa, and Latin America see BRICS as a way to escape the economic volatility tied to U.S. policy shifts.

As BRICS nations continue to promote financial independence, the global economic balance appears to be shifting.

While the dollar remains dominant for now, the rise of BRICS and its currency alternatives could mark the beginning of a new era in international finance.