Oil Prices Above $71 As OPEC Delays Production Hike

Oil prices climbed around $2.5 higher today, with OPEC delaying the production hike as the rumors suggested last week. WTI closed last week below $70, but opened with a 50-cent gap higher last night and climbed higher, peaking at $71.80 where sellers returned, pushing the price to $70 in the last two hours.

After a steep drop to yearly lows late last month, crude oil prices saw some bullish momentum in early October. This rebound has been driven partly by rumors that OPEC may delay upcoming production increases, helping to curb supply concerns. Ongoing geopolitical tensions in the Middle East continue to add volatility to oil prices, particularly with the looming possibility of regional conflict.

Impact of U.S. Presidential Election on Oil Prices

Tomorrow’s U.S. presidential election also has the potential to significantly impact global energy markets, adding to the uncertainty around oil price movements. A contested election could weaken the USD and create further instability in markets, increasing demand for safe-haven assets and putting upward pressure on oil.

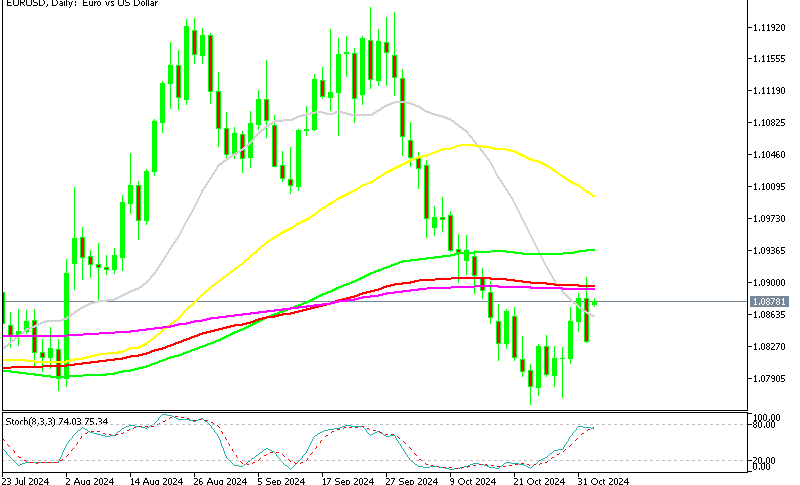

WTI Crude Oil Chart Daily – Buyers Facing the 50 SMA Again

Crude Oil Supply Data and OPEC+ Production Delays

Recent data from the U.S. Energy Information Administration (EIA) revealed a substantial drop in both U.S. crude and gasoline inventories, marking the lowest gasoline stockpiles in two years. This indicates strong fuel demand and has further supported a bullish outlook. Additionally, OPEC+ announced a one-month delay on the planned December production increase, which could stretch into 2024. This extended cut, along with a reduced USD, is likely to support oil prices.

- Eight OPEC+ countries (Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman) extended their voluntary production cut of 2.2 million barrels per day from November 2023 through December 2024.

- The Joint Ministerial Monitoring Committee (JMMC) will oversee compliance, with a deadline set for September 2025 to compensate for any overproduction since January 2024.

- Iraq, Russia, and Kazakhstan reaffirmed their commitment to the agreed production adjustment and compensation timeline.

- OPEC’s October production was recorded at 26.33 million barrels per day, an increase of 195,000 barrels per day from September, based on a study of secondary sources by Reuters.

Outlook for November and Key Support Levels for Oil

November, typically a slower month, finds oil trading in the lower half of its 2024 range. However, strong technical support around the $65–$67 range offers some reassurance to bulls, suggesting that prices could stabilize or increase if current conditions persist. The cumulative effect of OPEC+ production adjustments, Middle East tensions, and evolving political dynamics in the U.S. points to potential price volatility as the year ends.

US WTI Crude Oil Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |