EURUSD Waits for the Big Event Below MAs Despite the Bullish Gap

EURUSD opened with a 50 pip bullish gap last night on US election polls, but remains below MAs on the daily chart, and below 1.10 as well.

EURUSD opened with a 50 pip bullish gap last night on US election polls changes, but still remains below MAs on the daily chart, and below 1.10 as well, which keeps the trend bearish for the moment. The price action last week pointed lower after the strong bearish reversal on Friday, which sent the price almost 1 cent lower from the top, however, it will depend on the US election result and how the market interprets it.

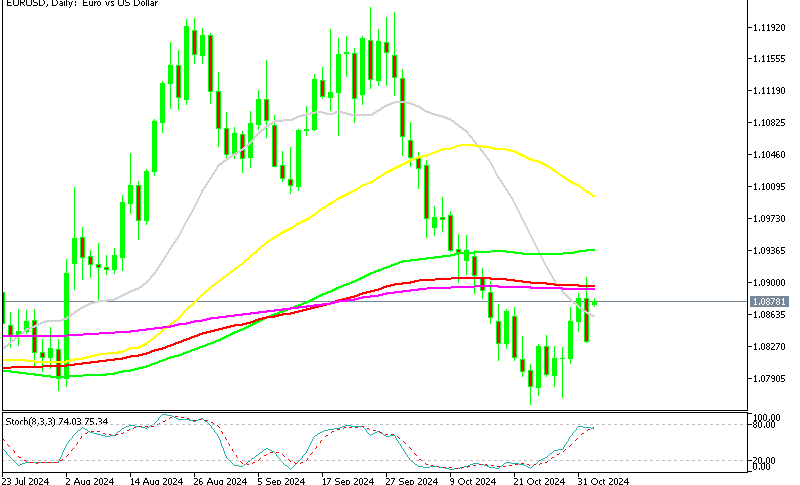

EUR/USD Chart Daily – MAs Remain as Resistance

The EUR/USD struggled last month, dropping 4 cents after failing to hold above 1.12 due to renewed USD buying. However, the pair saw a partial recovery last week, climbing 1.5 cents above 1.09 following disappointing US labor market reports, including a significant miss in the Non-Farm Payrolls (NFP) data. Despite these gains, EUR/USD reversed sharply late on Friday, highlighting ongoing volatility in the pair.

NFP Data Impact on EUR/USD

The October NFP report showed only 12,000 new jobs, well below expectations of 113,000 and far lower than the previously reported 223,000 (which was revised down from 254,000 for September). While the figures were weak, the impact of recent hurricanes and strikes was noted as a significant factor in distorting the data. The unemployment rate remained steady at 4.1%, suggesting minimal changes in overall employment stability.

On the daily chart, EUR/USD formed a bullish engulfing pattern after an 80-pip dip to 1.0830, signaling potential buyer interest despite weak job data. The setup indicates potential for recovery, though ongoing dollar strength and any further weak data from Europe could challenge upside momentum in the near term.

On the Euro side, the odds of a 50 bps rate cut from the ECB this month have diminished, which has abated some of the bearish momentum, however, the Eurozone economy remains in a bad position, so the Euro doesn’t have much to run on.

Eurozone November Investor Confidence Released by Sentix – 4 November 2024

- Eurozone November Sentix investor confidence -12.8 points vs -12.5 points expected

- October Sentix investor confidence -13.8 points

Final European Manufacturing Reports

- Eurozone October final manufacturing PMI 46.0 points vs 45.9 points prelim

- September final manufacturing PMI 45.0 points

Germany October Final Manufacturing PMI

- Final Manufacturing PMI 43.0 points vs. 42.6 points expected and 40.6 points prior.

Key findings:

- HCOB Germany Manufacturing PMI at 43.0 points (Sep: 40.6 points). 3-month high.

- HCOB Germany Manufacturing PMI Output Index at 42.8 points (Sep: 41.3 points). 2-month high.

- Deeper cuts to output prices signalled amid strong competition.

Italy October Manufacturing PMI

- Manufacturing PMI 46.9 points vs. 48.6 points expected and 48.3 points prior.

Key findings:

- Sharper decline in new orders signalled amid subdued export sales.

- Stocks of purchases depleted at one of the sharpest rates on record.

- Input and output prices fall.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account