USD to NZD Rate Fails at 0.60 Despite Better Chinese Mfg PMI

The USD to NZD rate broke below 0.60 late last week and the attempt to bring it back above this level yesterday as the USD retreated, failed. The fundamental picture has turned bearish for commodity dollars and the New Zealand dollar, which points to further losses in this pair.

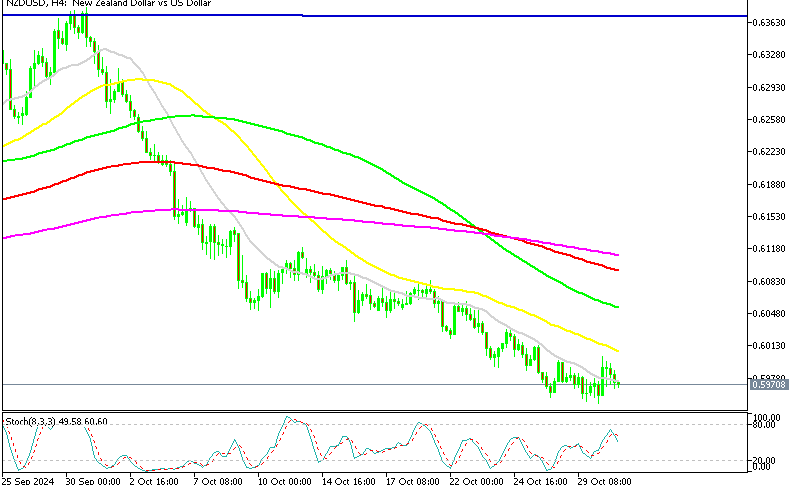

NZD/USD Chart H4 – MAs Keep Pushing the Price Down

At the start of October, NZD/USD saw a swift decline, falling from above 0.64 to below 0.60, a 4-cent drop after gaining 5 cents over the prior two months. The downtrend has held steady since early October, with lower highs indicating a bearish trend, as smaller moving averages like the 20 SMA (gray) and 50 SMA (yellow) provided resistance during brief, week-long retraces. These are significant technical bearish signals, underscored by fundamental concerns stemming from China’s economic challenges, as ongoing struggles to stimulate growth weigh on the NZD.

Last week, heavy selling pressure pushed the pair lower, with the 20 SMA acting as a ceiling; despite an attempted rally yesterday, buyers were unable to overcome the critical 0.60 resistance level, which now marks immediate resistance, followed by the 50 SMA on the H4 chart. This morning’s release of China’s Caixin manufacturing PMI data added to the context, as the NZD remains sensitive to economic indicators from China.

China Caixin Manufacturing Report

- Manufacturing PMI: Recorded at 50.1, moving into expansion territory for the first time in six months, slightly above expectations of 50.0 and up from September’s 49.8.

- Non-Manufacturing PMI: Stood at 50.2, slightly below the anticipated 50.4 but showing continued positive momentum from last month’s 50.0, signaling ongoing expansion in the service and construction sectors.

- Composite PMI: Reached 50.8, an improvement over the previous 50.4, indicating a modest but broad-based expansion across both manufacturing and non-manufacturing sectors.

This data suggests gradual recovery in China’s economic activity, with manufacturing seeing a return to growth and non-manufacturing showing resilience, although slightly below expectations. The expansion in the composite PMI reflects an overall stabilization, with the potential for more robust growth if this trend continues, however not mush impact on the currency market, since this is only a small improvement.