USOIL Price Forecast: Rebound Potential at $69.30 with Key Resistance at $70.75

Oil fell $3+ as Israel didn’t hit Iran’s oil and nuke infrastructure over the weekend. So supply disruptions concerns are off the table

Oil fell $3+ as Israel didn’t hit Iran’s oil and nuke infrastructure over the weekend.

So supply disruptions concerns are off the table and prices are consolidating after last week’s big move up in Brent and WTI. Investors are still watching broader Middle East tensions, the US election and OPEC+ policy changes.

Market Adjusts to Reduced Risk Premium

The limited nature of the strikes allowed oil’s geopolitical risk premium to ease, as noted by Sydney-based energy analyst Saul Kavonic.

“The absence of direct impacts on oil facilities has fostered hopes for a de-escalation, knocking a few dollars off the risk premium,” Kavonic explained.

Analysts now anticipate a wait-and-see approach, with a cautious focus on Iran’s next moves. According to Commonwealth Bank of Australia analyst Vivek Dhar, ceasefire discussions between Israel and Iranian-backed forces have resumed, yet stability remains uncertain.

Dhar emphasizes that the tensions are unlikely to subside entirely, hinting that an enduring ceasefire might still be distant.

#USOIL Opened with a sharp drop today after closing above $71 on Friday. Market opened below $68. Oil price could be reacting to Israel attack on Iran over the weekend. #USOIL Down ⬇️ – 4.5% today.#OilPrices #MarketWatch #Geopolitics #CrudeOil pic.twitter.com/E4pzejYuxQ

— Purity Anthony (@Mr___apo) October 27, 2024

In response to the more stable outlook, Citi analysts led by Max Layton adjusted their three-month Brent price forecast downward to $70 per barrel from $74, citing the softer geopolitical risk in the near term.

Conversely, Evans Energy analyst Tim Evans expressed concerns that OPEC+ might delay its planned production increases if the market remains undervalued, which could impact supply levels heading into the December OPEC+ meeting.

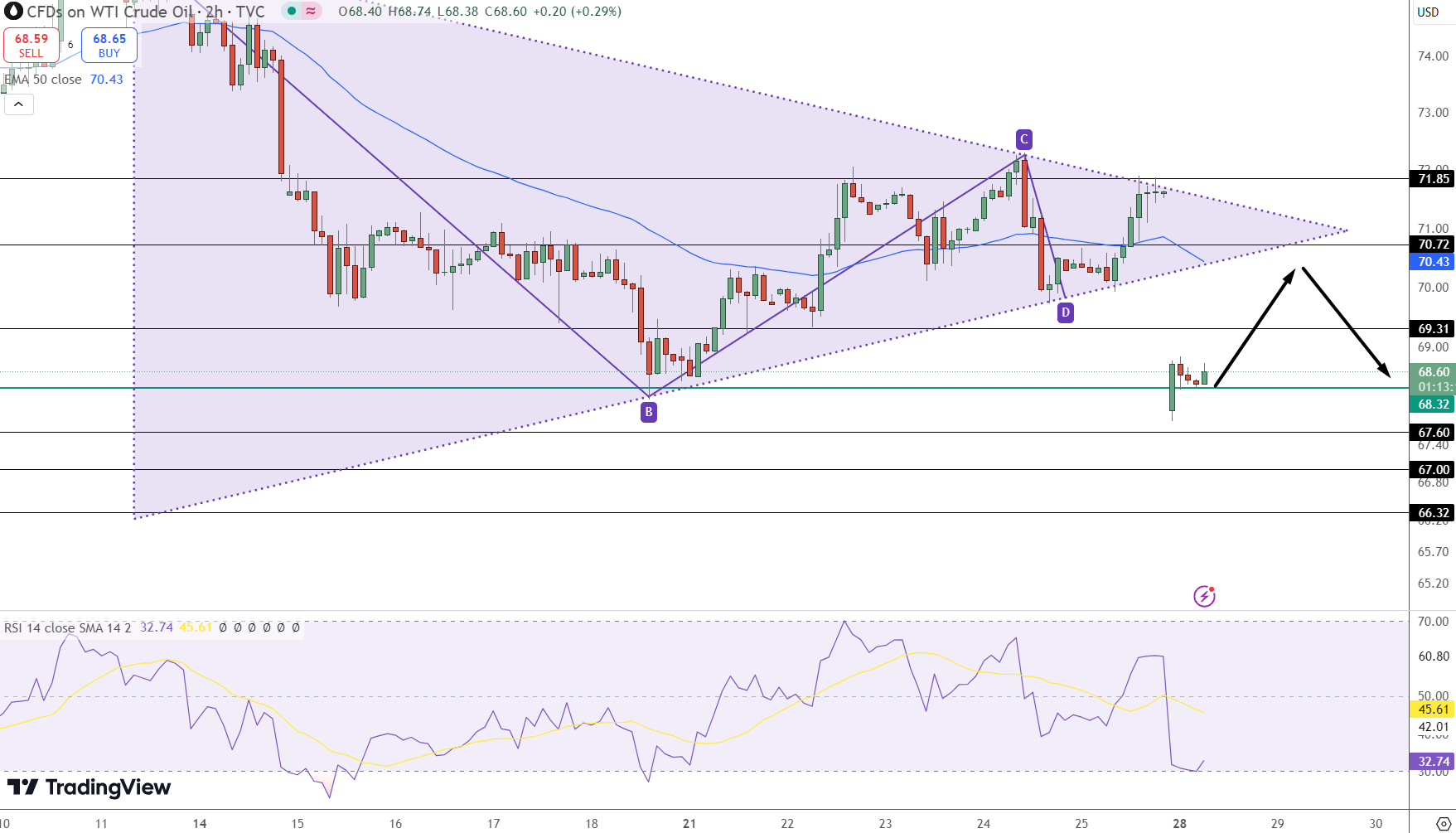

WTI Crude Oil Forecast: Resistance and Support Levels

After the wild start WTI is trying to recover and is trading at a key resistance level of $69.31.

A move above this level could be bullish and then additional resistance at $70.72 and $71.85. RSI at 32.74 is oversold and could attract short term buying.

However, failure to surpass $69.31 might trigger a pullback toward support levels at $67.60 and $66.32.

The 50-day Exponential Moving Average (EMA) at $70.43 further suggests a cautious stance, as WTI needs a close above $70.72 to reinforce bullish sentiment.

Key Insights:

- WTI crude tests $69.31 resistance, crucial for further upside.

- RSI indicates oversold levels, hinting at potential short-term recovery.

- Sustained movement above $70.72 could strengthen bullish outlook, while failure risks a retreat to $67.60.

This evolving dynamic reflects how geopolitical and economic factors interplay in influencing global oil prices, with traders closely monitoring upcoming OPEC+ decisions and U.S. election impacts for further guidance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account