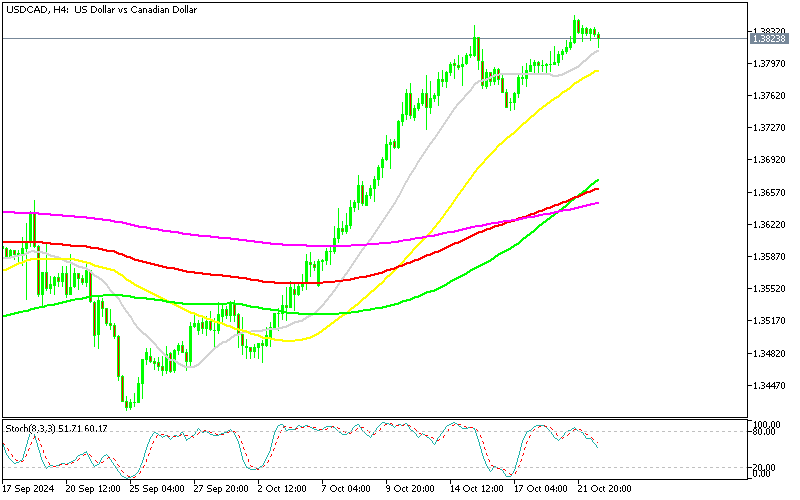

Forex Signals Brief October 23: Can the BOC Send USD/CAD Above 1.40?

Today the Bank of Canada is expected to deliver a 50 bps rate cut, and if they also sound dovish, USD/CAD will likely rally toward 1.40.

Despite a quiet economic calendar, the European Central Bank (ECB) released a full list of speakers on Tuesday, and their key message was one of heightened caution on interest rates. There was also growing confidence that the inflation target would be achieved. While a 50 basis point rate cut wasn’t explicitly discussed, the market is now pricing in a 35% chance of such a move, supported by weak growth data.

As a result, the EUR/USD pair dropped, briefly falling below 1.08 during the U.S. session. Gold, however, was the standout performer, rebounding from the previous day’s decline and hitting a new record high. Every dip was quickly bought, leading to a series of higher highs. Meanwhile, commodity currencies strengthened, supported by a 2% rise in oil prices and a stock market recovery. The Australian dollar led gains, buoyed by expectations that China will announce fiscal stimulus in the coming weeks, though the scale of such measures remains uncertain.

Today’s Market Expectations

Today the Bank of Canada is expected to reduce interest rates by 50 basis points, lowering the policy rate to 3.75%. Governor Macklem’s comments about the possibility of more aggressive cuts, should growth and inflation deteriorate beyond expectations, have reinforced this outlook. While growth data has not been too concerning, inflation has consistently fallen below projections. The latest inflation report further supports the expected 50 basis point cut. Markets are also pricing in an additional 25 bps rate reduction in December, with the potential for a larger cut. Beyond that, four more 25 bps cuts are anticipated by the end of 2025.

Besides the Bank of Canada meeting, we also have the Existing Home Sales which have been quite volatile in the US this year, as higher interest rates from the FED have been increasing mortgage payments, making it harder for home owners of home buyers. However we have seen some improvement in recent months and for September, home sales are expected to increase by 3.88 million, from 3.86 million previously.

Yesterday the USD continued to push higher again, however the bullish pressure didn’t have much momentum behind it, so the advance was slow. Nonetheless, we opened 9 trading signals in total, ending the day with 7 closed trades. We had a great win/loss ratio, with 6 winning forex signals and just one losing trade.

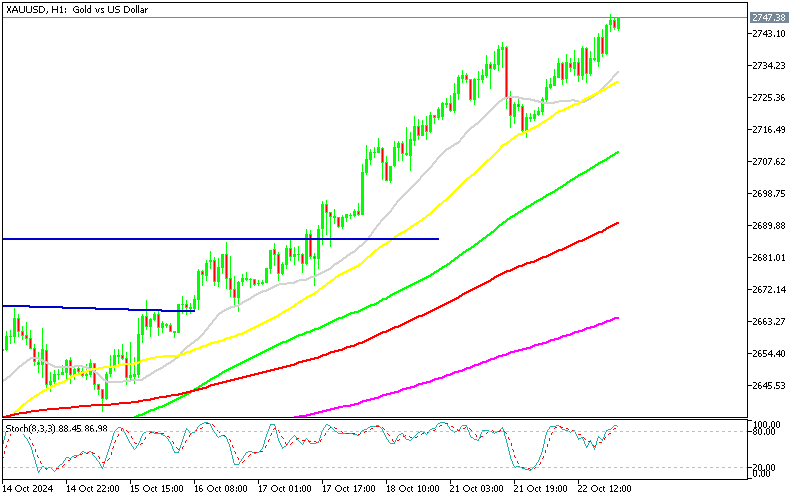

Gold Gets Closer to $2,800

Gold experienced a $25 drop on Monday, reversing its earlier gains after reaching a record high of $2,740. The 50 SMA on the H1 chart provided support even as gold dipped below the 20 SMA for the first time since the prior Thursday. Investors bought at the 50 SMA level, which spurred a recovery amid growing Middle East tensions and uncertainty around the upcoming U.S. presidential election. Speculative buying also contributed, with investors seeking protection from potential market volatility ahead of the election. As a result, gold climbed 1.2% on Tuesday to $2,748. Additionally, discussions around the creation of a BRICS currency, potentially backed by gold, have further fueled demand, as this could lead to increased buying from central banks.

XAU/USD – H1 Chart

USD/CAD Awaits the BOC Meeting

On the currency front, USDCAD regained momentum, rising above 1.38 on Monday following last week’s decline. Expectations of a dovish stance from the Bank of Canada (BoC) and a possible 50 basis point rate cut are supporting further gains for the pair. Changes in Canada’s political environment could also bolster the USD/CAD.

USD/CAD – H4 Chart

Cryptocurrency Update

Bitcoin Consolidtes after the Retreat on Monday

Meanwhile, Bitcoin, which has been under pressure since April, saw a decline from nearly $70,000 to below $50,000 by August. However, it has been rising since the Federal Reserve’s rate cut in September, briefly surpassing $60,000 and reaching $68,000 last week. After a dip below $66,000, buyers returned, pushing it back above $69,000. Nonetheless, the $70,000 resistance level remains strong, with a $2,500 rejection yesterday.

BTC/USD – Daily chart

Ethereum Returns to the the 100 Daily SMA

Ethereum has faced similar buying pressure, climbing to $2,700 in October but struggling to break the 100-day SMA resistance at that level. After stabilizing around $2,600, Ethereum saw a reversal yesterday due to broader economic concerns, preventing a clear breakout above key resistance levels.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account