Nansen Report Highlights AI and NodeFi as Promising New Frontiers for DeFi

A new report from blockchain analytics platform Nansen and lending protocol MetaStreet suggests that artificial intelligence (AI) and the

A new report from blockchain analytics platform Nansen and lending protocol MetaStreet suggests that artificial intelligence (AI) and the emerging “NodeFi” market may become the most active verticals in decentralized finance (DeFi) going forward.

The report, titled “Beyond DeFi” and released on October 14, argues that cryptocurrency markets are evolving past their initial focus on ERC-20 tokens and traditional DeFi applications. As these sectors plateau, new verticals like distributed computing and GPU-as-a-service are poised for significant growth.

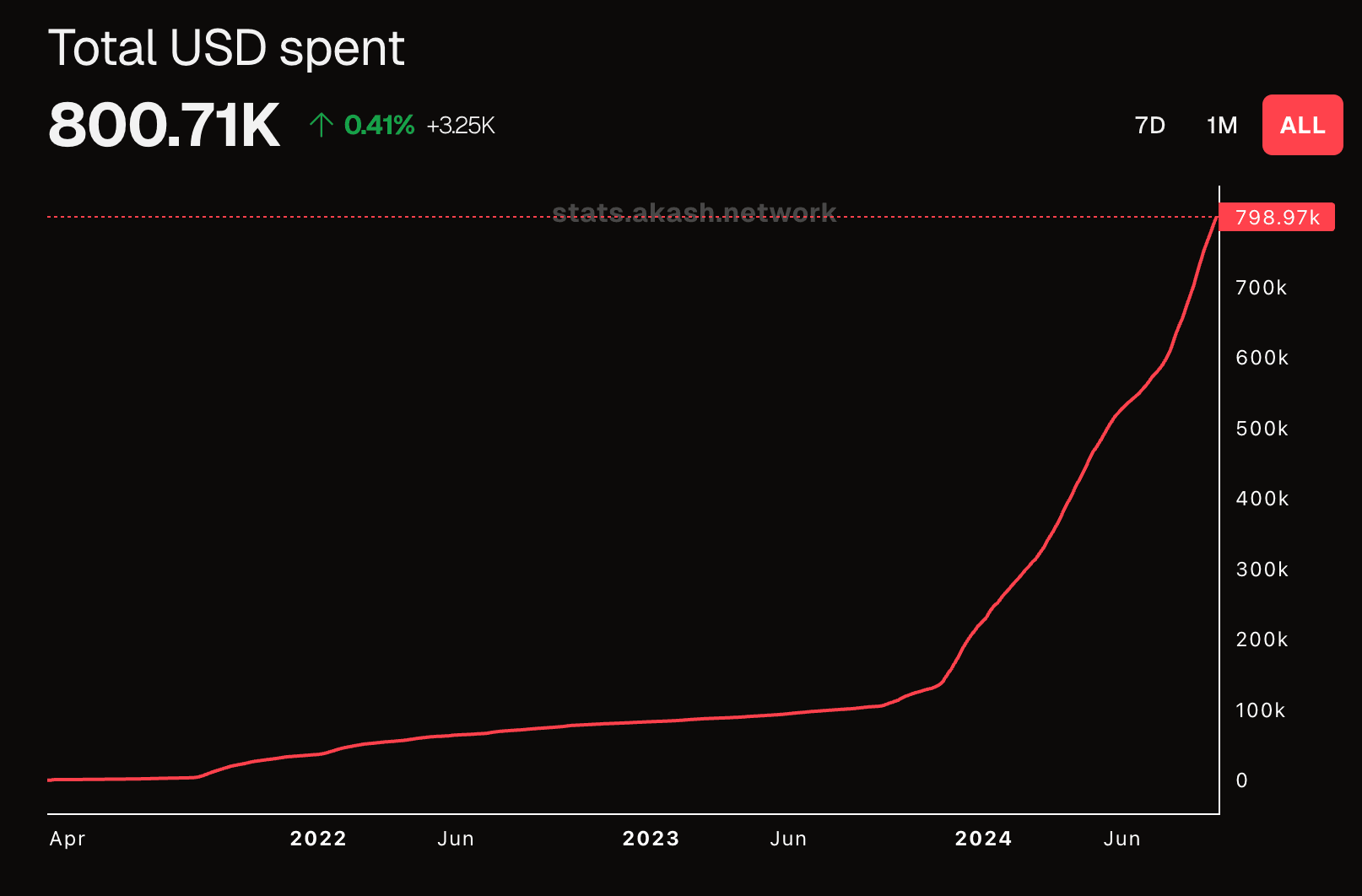

Decentralized Physical Infrastructure Networks (DePIN) projects, which include distributed computing platforms, show particular promise according to the analysis. Citing research indicating the GPU-as-a-service market was worth $3.2 billion in 2023, the report suggests blockchain-based GPU rental services could capture a meaningful share of this expanding market driven by demand for AI model training.

“AI-related compute DePIN appears to be in a prime position to become the next major vertical, with a sizeable and fast-growing market, high yield potential, predictable asset prices, and comparatively low implementation complexity,” the report states.

The analysis also highlights “NodeFi” – an incentive system for node operators – as another area with significant potential, though its success may be more dependent on individual projects compared to the broader AI sector.

Other verticals examined include NFTs, gaming/metaverse assets, and real-world assets (RWAs). While these areas show some promise, they face greater challenges around asset volatility, yield sustainability, and regulatory complexity compared to AI-focused DePIN projects.

The report comes as major tech firms continue pouring massive investments into AI development, despite being potentially years away from profitability. This trend underscores the long-term potential seen in the intersection of AI and blockchain technologies.

As DeFi looks to expand beyond its current paradigms, the Nansen report suggests that tapping into real-world demand drivers like AI compute could provide sustainable new sources of yield and growth for the sector. However, the authors note that breakthrough innovations will likely be needed to successfully integrate these new asset types with existing DeFi infrastructure.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account