Forex Signals Brief September 24: RBA Keeps Rates Unchanged

Yesterday the week started with the USD continuing the post-FOMC price action from late last week, falling further against most major currencies. However, it ended up against the Euro, after some really weak Manufacturing and Services numbers, which show that the activity in both sectors continues to slow.

The Australian and UK Services and Manufacturing data painted a similar picture, with manufacturing activity diving deeper in contraction while services are heading there, as the RBA and BOE continue to keep interest rates elevated. However, the GBP and the AUD remained bullish on positive risk sentiment, which sent the Dow Jones to a new record high, while the S&P 500 also closed near the highs.

In the US session, the September 2024 S&P Global PMI data showed mixed results across sectors. The U.S. Services PMI came in at 55.4 points, slightly above the expected 55.2 points, but lower than last month’s two-year high of 55.7 points. Meanwhile, the Manufacturing PMI dropped to 47.0 points, falling short of the anticipated 48.5 points and down from the previous reading of 47.9 points, signaling further contraction in the sector.

The Composite PMI registered 54.4 points, just below last month’s 54.6 points. Both manufacturing and services sectors experienced a sharp rise in selling price inflation, hitting six-month highs and exceeding pre-pandemic averages, as prices for goods and services surged at the fastest rate since March. Cost inflation in the service sector also reached a one-year high, largely driven by increasing wages for employees.

Today’s Market Expectations

The Reserve Bank of Australia (RBA) is expected to leave the cash rate unchanged at 4.35%, with no major changes in its policy stance. The central bank remains committed to its aggressive approach due to persistently high inflation. Markets are currently forecasting the first rate cut in February 2025, with a total easing of 101 basis points anticipated by the end of next year.

In the United States, consumer confidence is expected to rise slightly to 103.5 points from the previous 103.3. The latest report showed a surprising uptick, with Dana M. Peterson, Chief Economist of The Conference Board, noting that consumer confidence increased in August but remained within the narrow range seen over the past two years. In August, consumers conveyed mixed sentiments. While they were more optimistic about current and future business conditions compared to July, they expressed growing concern about the labor market. Despite still positive perceptions of the current labor situation, confidence in the labor market continued to erode, likely influenced by the recent rise in unemployment. Additionally, consumers were less hopeful about future income prospects, signaling increasing financial uncertainty.

Yesterday the USD continues the decline from last week, while safe havens such as the USD and CHF continued the retreat as well. We followed the same trading strategy, booking profit on 6 trading signals during most of the day, but later in the US session the risk sentiment turned around and safe havens turned higher, but we played it safe and had another winning forex signal at the end of the day, out of a total of 7 closed forex signals.

Gold Prints Another New Record high

Gold has continued its upward trajectory, briefly surpassing $2,600 on Thursday after the Federal Reserve’s 50 basis point rate cut. Although prices dipped by $50 following the announcement, strong buying pressure resumed overnight, pushing gold toward a new high of $2,625. The demand for safe-haven assets remains robust, suggesting gold is on track for further gains.

XAU/USD – Daily chart

AUD/USD Fails at the 100 Weekly SMA

Australia’s PMI report highlighted increasing challenges for its economy, especially in the manufacturing sector, which is in sharp decline. This has caused a slight contraction in the broader economy. While the services sector is still expanding, its growth has slowed significantly. Despite these economic concerns, the AUD/USD rose on Tuesday, reaching its first major resistance level at the 100 SMA (red) around the weekly high of 0.6840. This level could be pivotal in determining whether the pair can sustain its upward momentum or face resistance in the near term.

AUD/USD – Weekly Chart

Cryptocurrency Update

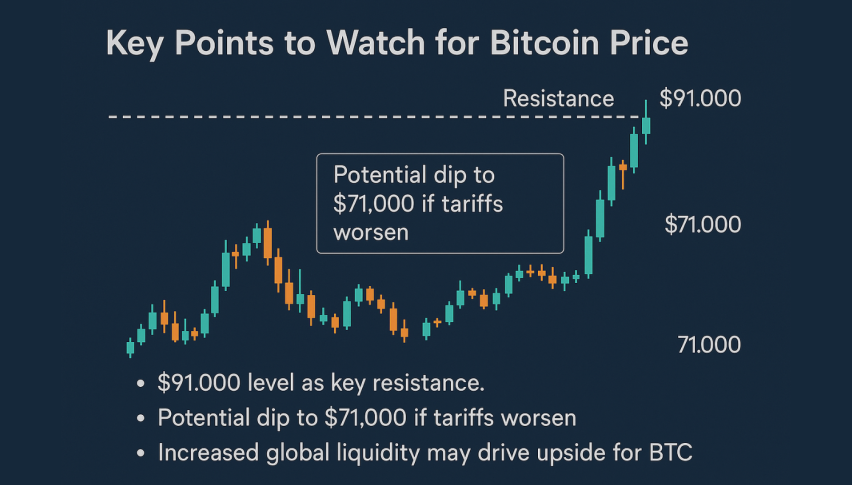

Bitcoin Rejected by the 200 SMA

Bitcoin has been in a steady decline since its surge from $20,000 in October 2023 to over $70,000 by April 2024. The pattern of lower highs and lows has persisted, largely due to economic concerns in the U.S., which triggered a global sell-off in early August, driving Bitcoin below $50,000. The 50-day Simple Moving Average (SMA) has acted as a key support during this downturn, with buyers stepping in to limit losses. However, Bitcoin has struggled to break through key resistance levels, unable to reclaim the $60,000 mark. After attempting to reach this level yesterday, buyers were once again stopped at the 200-day SMA.

BTC/USD – Daily chart

Ethereum Bounces Off the 200 Weekly SMA

Similarly, Ethereum has been in a downtrend since March, dropping from $3,830 to below $3,000 by June. Despite a brief recovery above the 50-day moving average, heavy selling pressure quickly returned, pushing the price below $2,200. Nevertheless, Ethereum found strong support at that level and has recently bounced back from the 100-week SMA, forming a bullish candlestick. This suggests growing buying interest and the potential for a reversal in Ethereum’s bearish trend.

ETH/USD – Weekly chart