Bitcoin rallies from worst market week in 2024

Bitcoin surged on Monday and rose close to $58K after Wall Street recovered from its worst week of the year, The digital asset rose from $55.5K to $58K in a few hours, but that gain was fleeting. Rather than continuing northward, it swiftly changed course and fell below $57K on Monday night.

The flagship cryptocurrency’s price increased by 5 percent to $56.5K last time based on Binance data. Bitcoin had its worst weekly performance since August 2023 last week, falling 9%.

The gains in the asset coincide with a breakthrough for U. S. stocks, which saw a sharp decline last week. On Monday, the S&P 500 and Nasdaq saw a 1.15 percent increase.

Coinbase and MicroStrategy increased 5.2% and 9.2%, on Monday during regular trade. These stocks increased as the Nasdaq Composite gained more than 1% and the S&P 500 ended a four-day losing run. Last week, the three major averages had their poorest weekly results since 2024.

Bitcoin is still down 3.5% for September despite such an increase and has dropped over 20% since reaching a record high of over $73,000 in March.

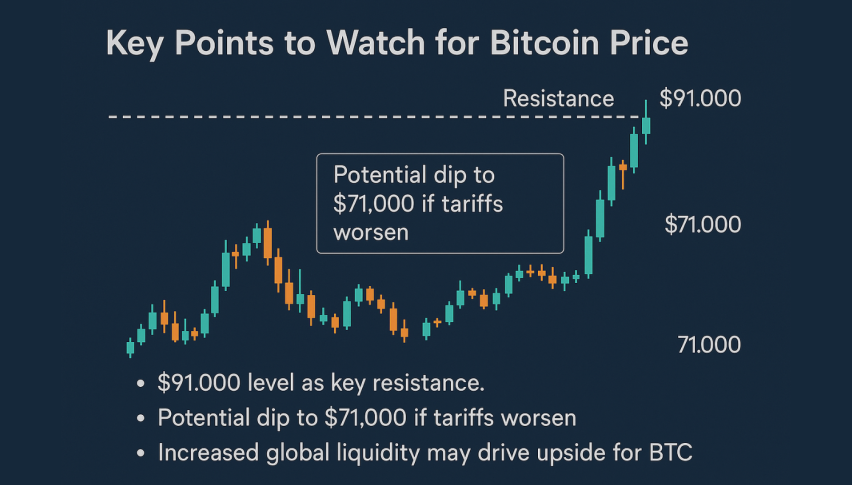

Price action shows that Bitcoin’s 200-day moving average and the psychological barrier of $58,000 have not withstood the selling pressure, perhaps paving the way for a drop toward lower levels. It looks as though the July support at $52,000 is the final hold before another decline.

Bitcoin has been range-bound for most of the year. Last week, it briefly fell below its floor of about $55,000. Experts have issued a warning, stating that there aren’t many powerful catalysts for cryptocurrencies right now and that without them, values would probably stay steady and be influenced by outside factors.

Coinglass records show a $706.1 million outflow from US spot Bitcoin ETFs last week, suggesting a downturn in investor confidence. The cumulative Bitcoin reserves held by the 11 US spot Bitcoin ETFs are currently $40.97 billion, down from $41.68 billion just a week ago. Bitcoin has consistently underperformed in September, similar to other high-risk investments. Seasonality is another factor.