BNB Market Analysis: Recent Price Movements and Future Outlook

In recent weeks, Binance Coin (BNB) has experienced notable price fluctuations, drawing attention from investors and market analysts alike. The cryptocurrency, which serves as the native token of the Binance Smart Chain, has demonstrated resilience above the $500 mark since March, outperforming many top coins that have seen significant discounts from their spring highs.

Recent Price Action and Support Levels

BNB recently dipped below the crucial $500 support level, triggering a resurgence of buy pressure. On September 6th, the price touched a low of $471 before rebounding. At the time of writing, BNB is trading at $509.6, once again confirming strong demand below $500.

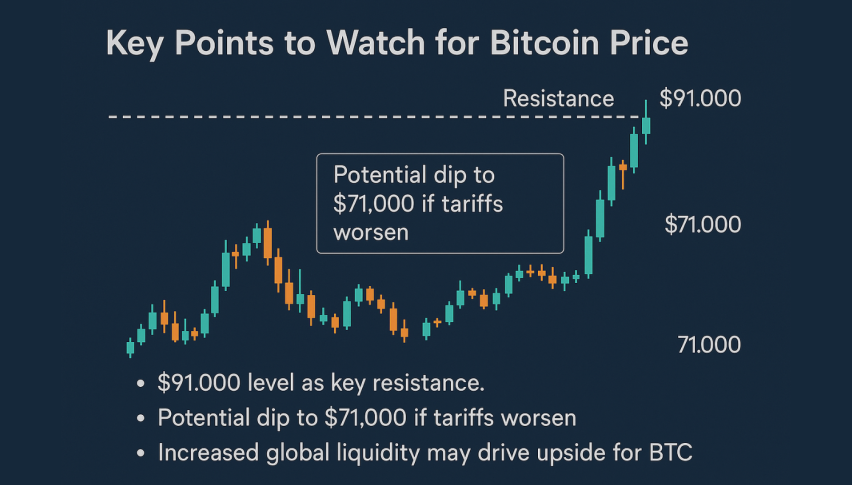

The price chart reveals clear support and resistance levels established by recent swing lows and highs. This pattern suggests that BNB may be building momentum towards another swing high, potentially setting the stage for a 15% rally that could push the price above $590.

Market Indicators and BNB Chain’s On-Chain Activity

Recent on-chain data presents a mixed picture of BNB’s prospects:

- A 6.19% surge in weekly active addresses indicates growing interest.

- However, weekly transactions have dropped by 1.1%, suggesting a slight decline in network activity.

- Network fees have also decreased over the weekend.

- On-chain volume has seen a significant decline over the last five months, reflecting broader market uncertainty.

These findings highlight the importance of organic demand in driving BNB’s price. Strong network activity typically triggers more demand for BNB, which in turn drives its price upward.

BNB/USD Technical Indicators and Whale Activity

Technical indicators offer additional insights into BNB’s potential price movements:

- The Stochastic RSI shows a small bullish crossover, hinting at possible near-term price appreciation.

- Whale activity has increased since July 15, with wallets holding over $5 million in BNB now accounting for 54% of all Binance coins. This accumulation by large holders could contribute to price stability.

However, some indicators suggest caution:

- The Chaikin Money Flow (CMF) has dipped below the zero line, signaling a bearish divergence with the rising price.

- A negative Bull Bear Power reading of -17.1 indicates that bearish forces currently dominate the market.

Future Outlook and Potential Scenarios

Looking ahead, BNB’s price action could unfold in several ways:

- If support at $462.6 holds, BNB might test the resistance level at $555.4, with a potential push towards $634.1 in the coming months.

- A more bearish scenario could see BNB retesting lower support levels if the current momentum fails to sustain.

Futures traders remain optimistic, as evidenced by the positive funding rate of 0.0005% across exchanges. This sentiment, combined with broader market trends, could fuel further price appreciation.