Bitcoin Poised for Major Move as September Looms Large

Bitcoin (BTC) has been stuck in a holding pattern for the past seven months, trading between $74,000 and $52,000. With September approaching, analysts are predicting a potential breakout triggered by several key events that could significantly impact the price.

Crypto Market in ‘Wait and See’ Mode

Experts believe the next move for Bitcoin hinges on how the market reacts to upcoming political and economic developments in the United States. These developments include the upcoming presidential debates, Federal Open Market Committee (FOMC) meeting, and crucial jobs data.

Interest Rates and Employment Data in Focus

- FOMC Meeting (Sept. 18): Market consensus expects a Fed rate cut of 0.525%, seen as positive for risky assets like Bitcoin. However, the actual size of the cut could significantly influence the market.

- Jobs Data (Sept. 6): A higher-than-expected unemployment rate could signal a recession, potentially bearish for Bitcoin. Conversely, it could also pressure the Fed for a larger rate cut, potentially bullish.

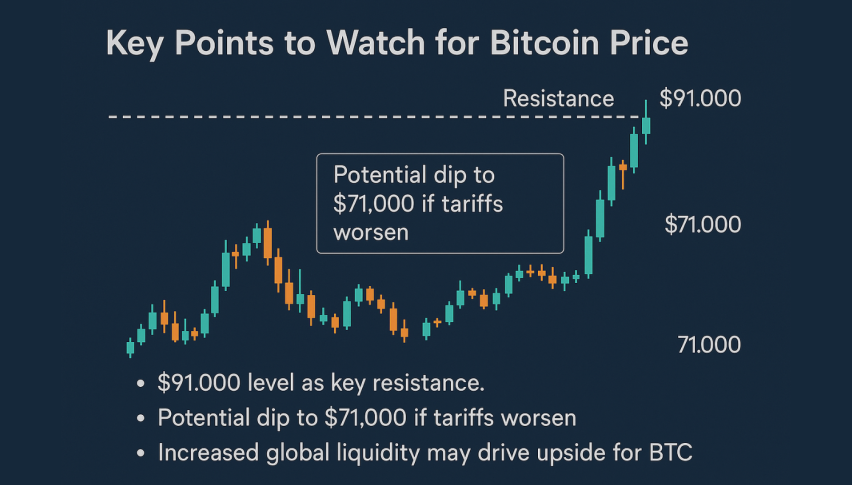

Breaking Through Resistance Crucial

Analysts say a sustained break above the recent high of $65,000 is necessary for Bitcoin to confirm a bullish reversal. Above this level, further resistance is expected between $70,000 and $74,000.

September: Historically a Tough Month

Bitcoin has historically performed poorly in September, averaging a -4.3% return over the past eleven years. However, some analysts remain optimistic due to strong global growth and potential for further upside.

Key Events to Watch in September

- Bureau of Labor Statistics Jobs Report (Sept. 6): This report can significantly impact the crypto market, as evidenced by price drops after the August report.

- Presidential Debate (Sept. 10): The differing stances of the candidates on cryptocurrencies could affect the industry.

- Federal Reserve Interest Rate Decision (Sept. 18): The market expects a 25 to 50 basis point cut, but a higher cut could be bearish.

- Introduction of Euro-Backed Stablecoins: This development could impact the stablecoin sector, potentially influencing the broader crypto market.

Bitcoin Attempts Recovery

Bitcoin recently attempted a recovery wave after falling below $57,200. While currently trading above $58,000, it faces resistance near $60,200 and $61,150.

Key Resistance and Support Levels

- Resistance: $60,200, $61,150, $62,000, $65,000

- Support: $58,750, $58,500, $57,200, $56,200

Technical Indicators Suggest Bullish Momentum

- Hourly MACD: Gaining momentum in the bullish zone

- Hourly RSI: Above 50 level