USD/CAD Falls to 1.35 After Strong Canada Retail Sales Details

After the Canadian retail sales report and Jerome Powell's comments at the Jackson Hole Symposium, USDCAD broke below the 1.36 support.

After the Canadian retail sales report and Jerome Powell’s comments at the Jackson Hole Symposium, USDCAD broke below the 1.36 support. The currency pair dropped over 4 cents this month, falling to the 1.35 range after breaking through the 1.36 support level yesterday. This movement came after a strong bullish trend in July, where the USD/CAD saw significant gains.

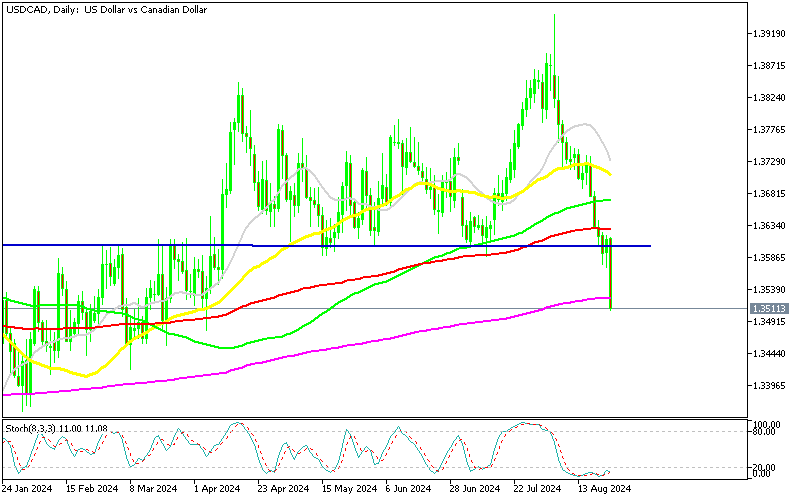

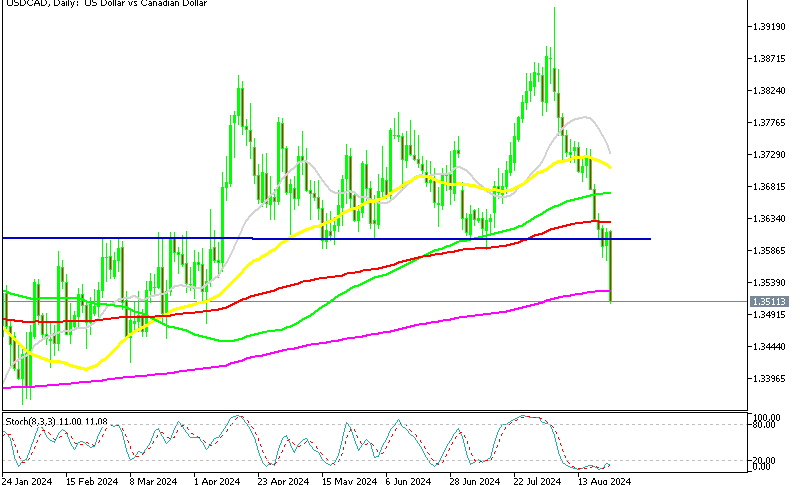

USD/CAD Chart Daily – Sellers Facing the Support Zone

However, those gains were quickly erased as the pair began to decline, driven by improved risk sentiment and a bearish shift in the USD. This shift was due to growing market expectations for Federal Reserve monetary easing. Yesterday’s release of the Canadian retail sales data initially appeared negative, but a closer look revealed more positive details. The June figures showed an increase, and the advance numbers for July also indicated growth. In response to this data, the USD/CAD broke below the 200-day SMA support, indicating a further bearish trend.

Canada Retail Sales Data for June and Advance July Reading

- June retail sales: -0.3% (matched expectations)

- May retail sales: -0.8%

- Preliminary June reading: -0.3%

- Sales down 0.5% in Q2

- Preliminary July reading: +0.6%

- June retail sales excluding autos: +0.3% (vs. -0.2% expected)

- Prior retail sales excluding autos: -1.3% (revised to -1.2%)

- June retail sales excluding autos and gasoline: +0.4% (vs. -1.4% prior)

Market’s Reaction to Canada’s Retail Sales Data

Before Powell’s speech at Jackson Hole, Canada’s June retail sales briefly took the spotlight. The preliminary reading came in at -0.3%, which matched consensus expectations so the focus shifted to the details and the advance reading for July. While there’s no established consensus for July, RBC’s consumer tracker, which uses credit card data, suggested a decline of -0.6%, but the number was totally the opposite, showing a 0.6% increase, while the core numbers for June were positive as well.

So, even though the headline numbers might not seem promising, the underlying data reflects stable demand by Canadian consumers. The preliminary estimate for July is surprising, especially given some earlier indicators of softness, and the June ex-autos number also exceeded expectations.

In June, auto sales declined by -2.1%, with new car sales dropping even further by -2.9%. This is part of the ongoing strain that high interest rates are putting on sectors such as car sales or housing. Meanwhile, higher sales at food and beverage stores (+1.2%) were driven primarily by supermarkets and grocery retailers, despite a -1.9% decline from convenience stores and vending machine operators.

Gains in food retailers and beer, wine, and liquor stores also contributed to a +0.4% rise in core retail sales. The steepest decline in core retail sales came from sporting goods, hobbies, musical instruments, and book retailers, which fell by -0.8% in June. Overall, this is encouraging news and should help to quash speculation about a possible 50 basis point rate cut in September.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account