Buying the Retreat in Gold After -818K NFP Revisions

Gold has been retreating since placing a new record high at $2,531 yesterday, but it seems the retreat is over so we decided to buy XAU

Gold has been retreating since placing a new record high at $2,531 yesterday, but it seems the retreat is over so we decided to buy XAU after a negative revision to the NFP numbers. The preliminary benchmark revisions for non-farm payrolls for the March 2024 year revealed a decrease of -818,000 jobs, close to the rumored figure of a 1 million reduction. This aligns with expectations from many economists who anticipated a downward adjustment to the previously reported 2.9 million new jobs added during that year, averaging 242,000 jobs per month. Goldman Sachs had projected a possible reduction of 600,000 to 1,000,000 jobs, so this falls right in the middle.

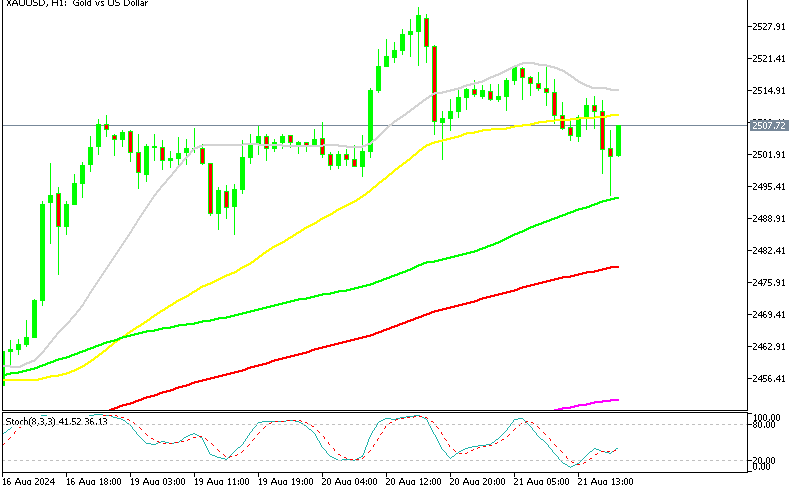

Gold Chart H1 – The 100 SMA Held As Support

Impact on Monthly Job Averages

With this revision, the monthly average job growth would drop by 68K, bringing it down to 174K jobs per month. It’s important to note that these changes are based on reconciliations with initial unemployment claims, which do not account for unregistered workers. Therefore, the non-farm payrolls data, which attempt to capture all employment, including that of undocumented immigrants, might provide a more accurate picture of job growth, especially given the recent increase in inbound migration.

Delayed and Disruptive Release

The release of this data was fraught with issues, as it came out almost an hour later than expected, fueling rumors, including one premature leak. Despite the chaos, the overall employment revision rate stands at 0.5%, with the largest losses observed in professional and business services, however as mentioned, the undocumented migrants should make of for most of this since they can’t claim benefits.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account