XM Minimum Deposit Review

The Minimum Deposit amount required to register an XM live trading account ranges from USD 5 – USD 10’000. XM makes three live trading accounts available, the Micro Account, Standard Account, XM Ultra Low, and Shares Account.

| 🔎 Account | 🥇 Micro Account | 🥈 Standard Account | 🥉 XM Ultra Low Account | 🏅 Shares Account |

| 💰 Minimum Deposit | 5 USD | 5 USD | 5 USD | 10'000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Overview

XM offers a minimum deposit of just 5 USD, making it an excellent choice for new traders or those looking to trade without a large initial commitment. This low entry barrier allows access to forex, commodities, and indices trading, with a variety of payment methods available, including credit/debit cards, e-wallets, and bank transfers.

Additionally, XM offers a $30 no-deposit bonus, allowing you to start trading and potentially earn profits without risking your capital. While the bonus is non-withdrawable, any profits made after meeting the trading volume requirements are yours to keep.

XM is transparent with fees, so traders can focus on trading without worrying about hidden charges.

Frequently Asked Questions

What is the minimum deposit for XM?

The minimum deposit required to start trading with XM is 5 USD.

Can I withdraw the $30 no-deposit bonus?

No, the bonus is non-withdrawable, but any profits earned are yours to keep once the trading volume is met.

What payment methods can I use for deposits?

XM offers various payment methods, including credit/debit cards, e-wallets, and bank transfers.

Are there any hidden fees with XM?

No, XM is transparent with its fees, and there are no unpleasant surprises for traders.

Our Insights

XM’s 5 USD minimum deposit makes it accessible for new traders, and its $30 no-deposit bonus is a great way to start without risking personal funds. The platform’s transparency with fees and diverse payment methods ensures a smooth trading experience for all.

Minimum Deposit and Account Types

XM offers a range of account types, each designed for different trading needs and experience levels. With a minimum deposit of just $5, traders can select from Micro, Standard, Ultra-Low, and Shares accounts, each featuring unique spreads, leverage options, and trading conditions.

Micro Account

Ideal for beginners, with smaller lot sizes (1,000 units) and no commission fees. The minimum deposit is $5, with 1.7 pip spreads and adjustable leverage. Offers hedging and Islamic account options.

Standard Account

Suitable for both new and experienced traders, using typical lot sizes (100,000 units). It has no commission, 1.7 pip spreads, and adjustable leverage. Supports hedging and Islamic accounts with a $5 minimum deposit.

Ultra-Low Account

Best for traders seeking tighter spreads (starting at 0.7 pips for major pairs). Available in both standard and micro sizes with no commissions and negative balance protection. The $5 minimum deposit applies.

Shares Account

For equity-focused traders, this account gives access to individual shares. Requires a $10,000 minimum deposit, operates only on MT5, and has commissions starting at $1 per share. No leverage or negative balance protection.

Demo Account

A risk-free demo account with virtual funds to practice and test strategies across forex, stocks, indices, and commodities. It expires after 3 months of inactivity.

Islamic Account

Available for Micro, Standard, and Ultra-Low accounts, offering swap-free trading compliant with Islamic finance principles.

Frequently Asked Questions

What is the minimum deposit for XM?

The minimum deposit is just $5 for most account types.

What is the difference between the Micro and Standard Accounts?

The Micro Account uses smaller lot sizes (1,000 units), while the Standard Account uses typical lot sizes (100,000 units).

Can I trade stocks with XM?

Yes, through the Shares Account, which provides direct access to individual stocks.

What is the Islamic Account?

The Islamic Account is available in Micro, Standard, and Ultra-Low accounts, offering swap-free trading to comply with Islamic finance principles.

Our Insights

XM offers a flexible range of accounts with a low $5 minimum deposit, making it accessible for both new and experienced traders. Whether you’re a beginner looking for a Micro Account or a seasoned investor focused on equities with the Shares Account, XM provides options to suit every trading style. The Islamic Account option and no-commission structures enhance the appeal for diverse traders.

How to Open an Account with XM

Opening an account with XM is simple. Follow these steps to get started:

- Go to the XM website and click “Open a Real Account.”

- Select the account type that suits your trading preferences.

- Fill out the online account application form.

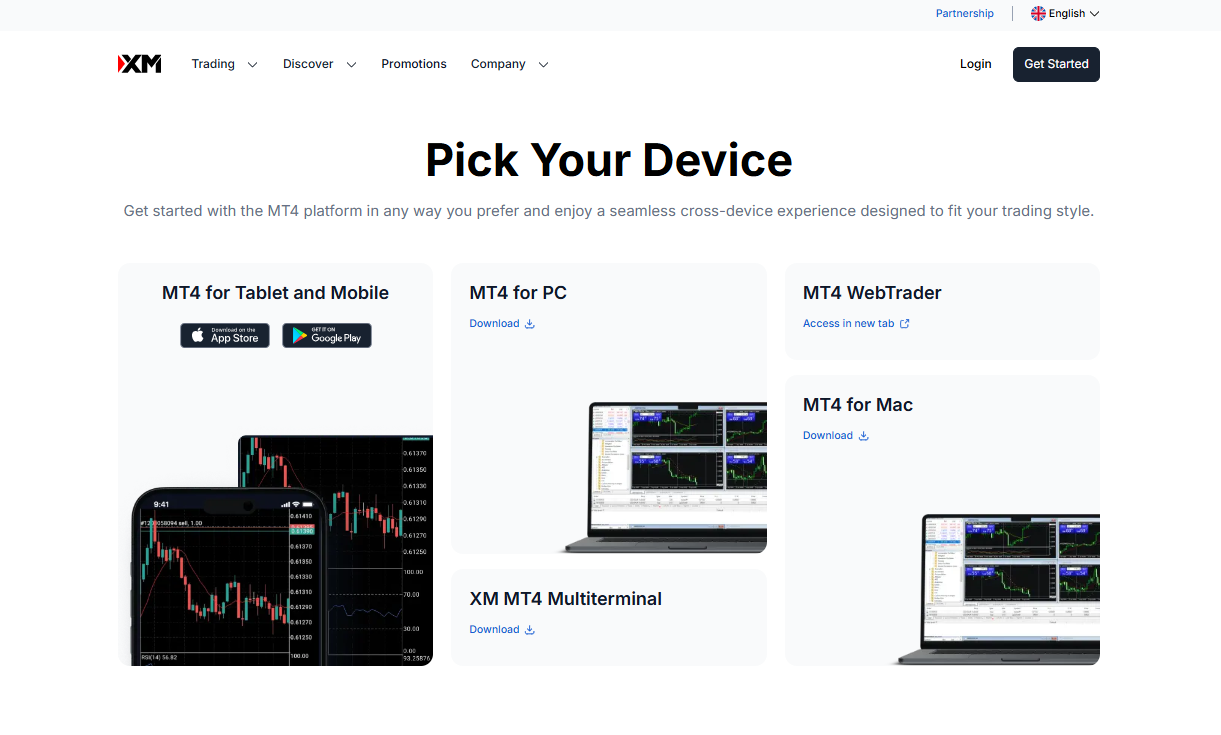

- Choose between MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

- Specify your desired account leverage.

- Complete the identity verification process.

- Deposit funds via bank wire, credit card, or e-wallet.

Once your account is verified and funded, you can start trading on your chosen platform.

Inactivity and Trading Fees

XM offers no deposit or withdrawal fees, making it easy for traders to move funds without incurring extra costs. However, there are fees for inactivity and currency conversions.

Inactivity Fees

XM charges an inactivity fee if an account remains dormant for 12 months. After 12 months, a $15 maintenance fee applies, followed by a $5 monthly fee for continued dormancy. Traders should stay active to avoid these charges.

Currency Conversion Fees

Currency conversion fees are applied when depositing or withdrawing in non-base account currencies. These fees vary depending on the exchange rates at the time of the transaction.

Frequently Asked Questions

Are there any deposit or withdrawal fees at XM?

No, XM does not charge any deposit or withdrawal fees.

How much is the inactivity fee at XM?

After 12 months of inactivity, XM charges a $15 maintenance fee, followed by a $5 monthly fee for continued dormancy.

Does XM charge currency conversion fees?

Yes, currency conversion fees apply when deposits or withdrawals are made in non-base account currencies.

How can I avoid inactivity fees?

Simply ensure that your account remains active by executing trades or making deposits/withdrawals at least once every 12 months.

Our Insights

XM stands out by offering no deposit or withdrawal fees, simplifying fund management for traders. However, inactivity fees apply after 12 months, and currency conversion fees are charged for non-base currency transactions. Traders should monitor their account activity to avoid these fees.

Pros and Cons

| ✅ Pros | ❌ Cons |

| XM has an extremely low 5 USD minimum deposit | XM charges currency conversion fees |

| There are several bonuses offered | There are strict bonus terms and conditions |

| Traders can access fee-free deposit methods | There are limited payment methods for deposits |

In Conclusion

XM offers a range of features that cater to traders of all levels, from low minimum deposits of just $5 to a variety of account types designed to suit different trading styles. The platform’s no deposit or withdrawal fees and competitive spreads enhance its appeal, especially for beginners and those seeking low-cost trading options.

You might also like:

Faq

No, XM doesn’t currently accept PayPal as a deposit method. However, they provide additional payment options, including credit/debit cards, bank transfers, and e-wallets.

XM does not charge any deposit or withdrawal fees internally. However, your bank or payment provider might charge a fee for their services.

No, XM only allows deposits from accounts or cards with the same name as the trading account holder.

XM has no set restriction on the number of deposits daily. However, they might require additional verification for substantial or regular deposits.