Tickmill Minimum Deposit Review

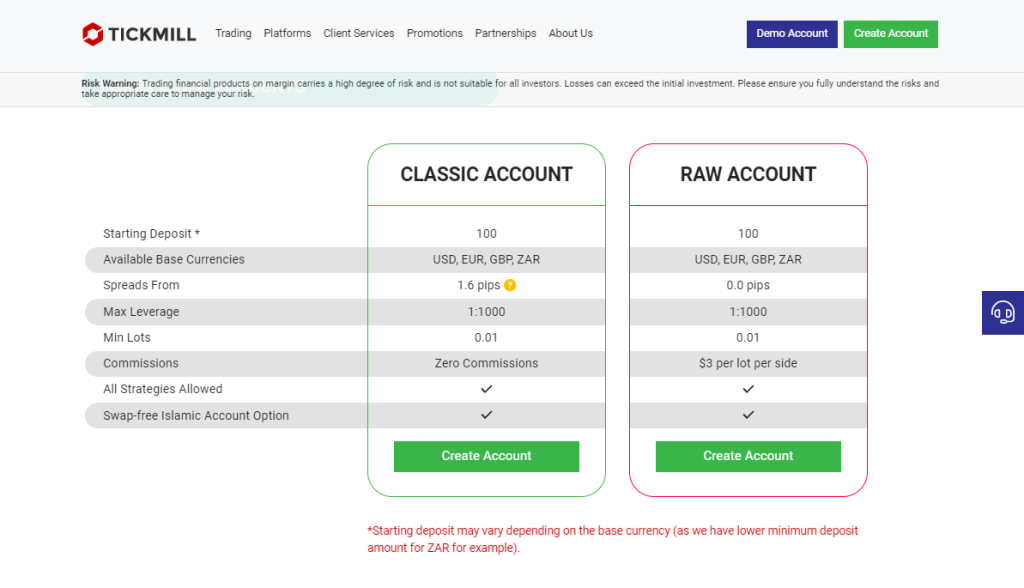

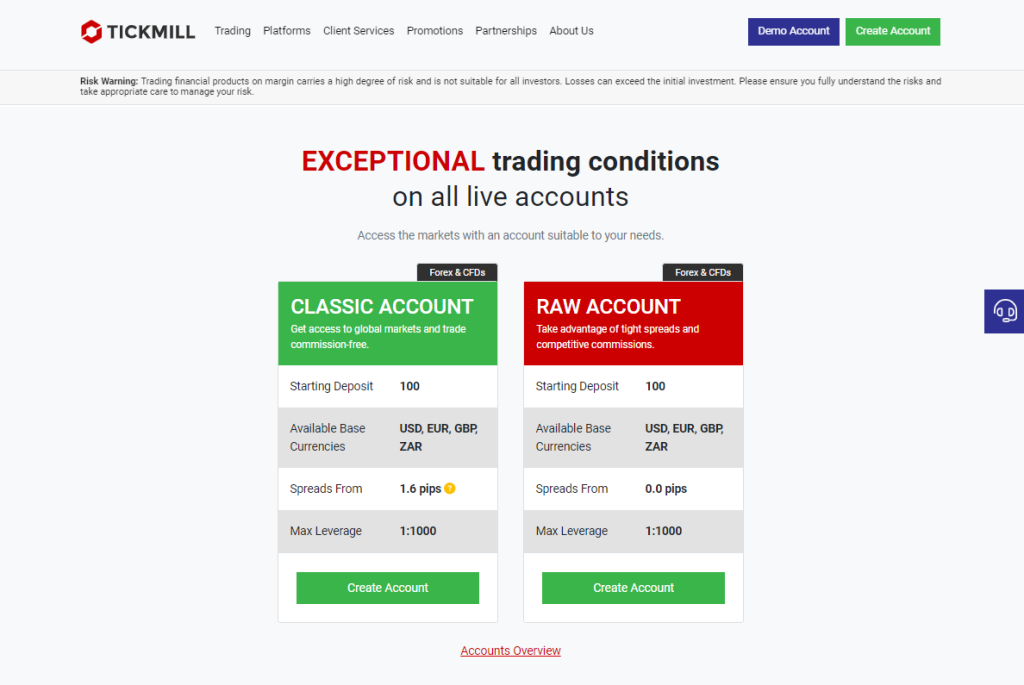

The minimum deposit amount required to register a Tickmill live trading account is 100 USD. Tickmill makes two live trading accounts available with a 100 USD minimum deposit – the Raw and Classic Accounts.

| 🔎 Account | 🥇Raw Account | 🥈 Classic Account |

| 💰 Minimum Deposit | 📌 $100 USD | 📌 $100 USD |

| 💵 Minimum Balance | N/A | N/A |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here |

Minimum Deposit – Key Point Quick Overview

- ☑️ Overview

- ☑️ Regulation and Safety of Funds

- ☑️ Deposit Fees and Options

- ☑️ Deposit Bonuses and Promotions

- ☑️ Pros and Cons

Overview

Tickmill charges a minimum deposit amount of 100 USD. We’ve found that the allure of Tickmill’s modest $100 initial deposit is irresistible for retail traders, regardless of whether they’re newbie traders or seasoned pros.

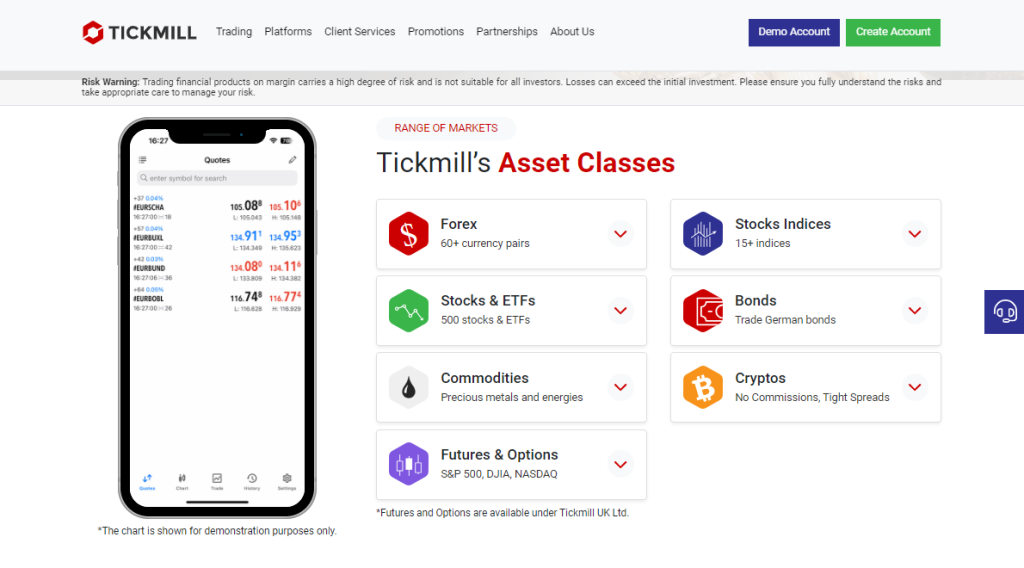

Furthermore, the platform has intelligently integrated multiple funding options, such as bank transfers, cards, and e-wallets, to cater to diverse preferences and ensure a smooth and hassle-free process.

In addition, depositing funds in different currencies is a valuable advantage, particularly for individuals engaged in global trading.

Tickmill’s fee structure is known for its transparency, ensuring no hidden surprises await you in the fine print. Their highly competitive spreads and the lack of hidden charges are truly refreshing.

In addition to the benefits of being a new trader, you can also take advantage of a $30 no-deposit bonus when you sign up. This bonus allows you to try out trading without any risk.

However, we must mention that there are withdrawal restrictions. To withdraw any profits earned from this bonus, a deposit of $100 is necessary. This promotes authentic trading activity rather than solely focusing on bonus hunting, which we consider to be a fair and equitable approach.

Although our experience with Tickmill has generally been positive, it’s important to remember that each trader has unique needs and preferences. Thorough research is vital when selecting a broker that aligns with your goals.

Regulation and Safety of Funds

| 🔎 Registered Entity | 🌎 Country of Registration | 📈 Registration Number | 📉 Regulatory Entity | 📊 Tier | 💹 License Number/Ref |

| 1️⃣ Tickmill UK Ltd. | United Kingdom | 09592225 | FCA | 1 | 71720 |

| 2️⃣ Tickmill Europe Ltd | Cyprus | 340249 | CySEC | 2 | 278/15 |

| 3️⃣ Tickmill South Africa (Pty) Ltd. | South Africa | 2017/531268/07 | FSCA | 2 | FSP 49464 |

| 4️⃣ Tickmill Ltd. | Seychelles | N/A | FSA | 3 | SD008 |

| 5️⃣ Tickmill Asia Ltd. | Labuan | N/A | LFSA | 3 | MB/18/0028 |

| 6️⃣ Tickmill UK Ltd. | Dubai | N/A | DFSA | 2 | F007663 |

Protection of Client Funds

| 🔎 Security Measure | 📊 Information |

| 🔒 Segregated Accounts | ✅Yes |

| 🔏 Compensation Fund Member | ✅ Yes, FSCS and ICF |

| 🔐 Compensation Amount | FSCS - £85,000 ICF – 20,000 EUR |

| 🔓 SSL Certificate | None |

| 🔒 2FA (Where Applicable) | None |

| 🔏 Privacy Policy in Place | ✅Yes |

| 🔐 Risk Warning Provided | ✅Yes |

| 🔓 Negative Balance Protection | ✅Yes |

| 🔒 Guaranteed Stop-Loss Orders | None |

Deposit Fees and Options

Tickmill’s range of deposit methods is fee-free, allowing traders to save on non-trading fees. Join us as we explore each payment method and its features and go through how each payment category can be used step-by-step.

| 🔎 Payment Method | 🌎 Country | 💰 Currencies Accepted | ⏰ Processing Time |

| 💴 Bank Transfer | All | USD, EUR, GBP, ZAR | 1 – 7 days |

| 💶 Crypto Payments | All | EUR, USD, GBP | Instant – 1 day |

| 💵 Credit/Debit Card | All | USD, EUR, GBP | Instant – 1 day |

| 💷 Skrill | All | USD, EUR, GBP | Instant – 1 day |

| 💴 Neteller | All | USD, EUR, GBP | Instant – 1 day |

| 💶 SticPay | All | USD, EUR, GBP | Instant – 1 day |

| 💵 FasaPay | All | USD, IDR | Instant – 1 day |

| 💷 China UnionPay | All | CNY | Instant – 1 day |

| 💴 WebMoney | All | USD, EUR | Instant – 1 day |

How to Make a Deposit with Tickmill

Bank Wire Transfer:

- Log onto your Tickmill account and go to the deposit area.

- Choose “Bank Wire” as your deposit method.

- Select your desired currency and enter the deposit amount.

- Note the bank information supplied by Tickmill.

- Begin the transfer from your bank account using the given information.

- Upload evidence of transfer to speed up the procedure.

Wait for Tickmill to confirm receipt of payments. (1-7 days).

Credit or Debit Card:

- Access your Tickmill account and proceed to the deposit area.

- Select “Credit/Debit Card” as your payment option.

- Select your currency and enter the deposit amount.

- Enter your card information securely.

Confirm the transaction.

Cryptocurrency:

- Sign in to your Tickmill account and pick the deposit choice.

- Select “Cryptocurrency” as your deposit method.

- Select the coin you want to use.

- Specify the deposit amount in your preferred fiat currency.

- Note the wallet address and the precise amount to transfer.

Transfer the crypto funds from your wallet to the given address.

e-Wallets or Payment Gateways:

- Log in to your Tickmill account and browse to deposits.

- Choose your favorite e-wallet or payment gateway (e.g., Skrill, Neteller).

- Select your currency and enter the deposit amount.

- You will be routed to your e-wallet’s login page.

Authenticate and confirm the transaction.

Deposit Bonuses and Promotions

Tickmill’s “Welcome Account” marketing provides a unique chance for new traders. It provides a $30 no-deposit incentive, allowing you to test the raw trading conditions of their platform without having to use your cash.

From our experience, this is an excellent opportunity to test the waters and see whether Tickmill fits you.

The incentive is valid for 60 days, with 14 days to redeem any earnings made. You can make between $30 and $100 in earnings, which will be paid to your Tickmill wallet.

However, you must first open a live account, verify your identity, and pay a $100 deposit to withdraw these profits.

Tickmill made a wise decision with this campaign; it provides a risk-free environment to explore their platform while motivating you to become a full-fledged client. We feel this offer is worthwhile, especially if you are new to trading or just want to try out Tickmill’s services.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Tickmill does not charge any deposit fees | Traders must deposit 100 USD to withdraw profits made on the 30 USD no-deposit bonus |

| There are reliable payment options available to deposit funds | Some payment methods take a few days to process |

| The process involved with funding a Tickmill account is straightforward | Currency conversion fees apply, and there are limited base account currencies |

Faq

Yes, Tickmill accepts a variety of e-wallets, including Skrill and Neteller, making deposits easy and efficient.

No. Tickmill does not provide deposit insurance other than statutory requirements. To safeguard the safety of customer assets, they keep separate client accounts and follow tight financial standards.

No. Once you have made your initial deposit, you cannot modify the base currency of that account. However, you can establish extra accounts in various base currencies if necessary.

No. Tickmill doesn’t have a dedicated deposit calculator. However, they do provide risk management tools and instructional materials. Depending on your risk tolerance and trading objectives, these can help you choose the right deposit amount.