5 Best Forex Startups of the Year

What distinguishes a forex startup in the highly competitive financial market? Is it breakthrough technology, strategic market insights, or the ability to scale quickly in an uncertain economy?

In this article, we look at several potentially award-winning Forex Startups, the criteria to win the award as the best Startup of the year, and other topics surrounding Forex Startups.

In this in-depth guide, you’ll learn:

- What is the “Startups of The Year” Award?

- Who are the Potentially Award-Winning Startup of The Year?

- Exploring the Criteria for Winning “Startup of The Year”

- Understanding Startups in Today’s Market

- Funding and Investment for Startup Brokers

- Our Conclusion on The Startups of the Year

- Popular FAQs about The Startup of the Year

And lots more…

So, if you’re ready to go “all in” with The Startups of the Year…

Let’s dive right in…

What is the “Startup of The Year” Award?

The “Startup of The Year” Award is highly regarded, honouring emerging companies with exceptional innovation, market impact, and growth potential.

This recognition highlights startups creating innovative solutions and poised for substantial growth and impact in their respective industries.

The criteria for this award usually centre around significant innovation, proven impact or potential impact on the industry, and a strong vision for future growth.

Best Forex Startups of the Year – Comparison

| 👥 Brokers | 📝 Amount Raised | 🚀 Founders | 👉 Market | 💰Partnerships |

| 1. Finzly | $10 million in Series A | Booshan Rengachari | Financial institutions | None Specified |

| 2. LemFi | $33.86 million over 4 rounds | Ridwan Olalere, Rian Cochran | 24/7 | ClearBank |

| 3. Currensea | £6.5 million since launch | James Lynn and Craig Goulding | UK travelers and SMEs that engage in international transactions | Several charities |

| 4. iBanFirst | $51.88 million | Pierre-Antoine Dusoulier | Small and medium-sized enterprises that engage in international trade across Europe | Strategic partnerships not detailed |

| 5. Veraman FX | None mentioned | None mentioned | Individual retail traders who require high-quality and reliable trading tools | None available |

5 Best Forex Startups of the Year (2024*)

- ☑️Finzly – Overall Best Forex Startup of the Year

- ☑️LemFi – Simplifies Cross-border Transactions

- ☑️Currensea – Effortlessly Integrates Bank Accounts

- ☑️iBanFirst – Offers Specialized Solutions

- ☑️Veraman FX – Designed to Meet the Needs of all Traders

1. Finzly

Finzly distinguishes itself from other forex companies by utilizing an inventive strategy to transform banking procedures. The platform impressed us with its user-friendly interface, simplifying complex foreign exchange transactions.

Finzly stands out for its unwavering commitment to enhancing the operational efficiency of financial institutions. Finzly revolutionizes traditional banking systems by seamlessly integrating cutting-edge technology, empowering banks to provide customers with real-time transaction capabilities.

This eliminates the inefficiencies commonly experienced in traditional banking processes, offering a streamlined and hassle-free experience. Their solution stands out in the fintech sector by benefiting banks and providing faster and more reliable service to end-users.

Unique Features

🚀 Year Established 2012 📝 Stage of Development Growth; still expanding product offers 💰 Amount Raised $10 million in Series A 🗣 Investors None Specified ✅ Founders Booshan Rengachari 🎉 Product/Service Bank operating system modernizing digital experience for various financial institutions and banks 🌐 Market Financial institutions ⌛ Unique Selling Proposition Parallel core banking system allowing banks to launch new financial products 💸 Revenue Model Subscription-based 🧾 Traction Recognized for innovative solutions 👥 Partnerships None Specified 💻 Technology Stack Core agnostic, plug-and-play 🏢 Team Led by the founder, who has a strong background in technology and banking 🗺️ Roadmap Focussing on expanding regionally 📍 Challenges Competing in a rapidly evolving fintech landscape 🏆 Achievements Won 5 awards from Nacha, PayTech, Global BankTech ❌ Exit Strategy None Specified 🏛️ Sustainability None Specified 🗪 Social Impact Enhances operational efficiency of financial institutions, with customer service quality being impacted positively

Pros and Cons

✔️ Pros ❌ Cons Offers modern, technology-driven solutions There is a lot of competition from other fintech solutions There is a high degree of customization The regulatory environments across countries are complex The company has won several other awards Scalability might become an issue due to rapid expansion in the market There is a strong focus on security

Our Insight

Finzly is a great option for all traders alike. They have a user-friendly interface which simplifies complex foreign exchange transactions.

2. LemFi (Previously Lemonade Finance)

LemFi, formerly Lemonade Finance, has made a remarkable impact on the forex market by prioritizing the specific requirements of the African diaspora.

The testing of LemFi’s services showcased their ability to tackle the challenges encountered by Africans during international transactions effectively. LemFi simplifies cross-border transactions in Africa by enabling users to transact in their local currencies, avoiding the usual inconveniences and excessive fees linked to currency conversion.

Furthermore, in our experience, LemFi’s platform showcases the power of targeted financial solutions in enabling seamless economic interactions across borders, solidifying its position as a frontrunner in its niche.

Unique Features

🚀 Year Established 2020 📝 Stage of Development Growth, with expansion 💰 Amount Raised $33.86 million over 4 rounds 🗣 Investors Left Lange Capital, Zrosk, Y Combinator, Global Founders Capital, Olive Tree Capital ✅ Founders Ridwan Olalere, Rian Cochran 🎉 Product/Service Mobile app that offers payment services, global accounts, international money transfers 🌐 Market Those who need to send money abroad ⌛ Unique Selling Proposition Simplifies money transfers, versatile accounts 💸 Revenue Model Transaction fees and foreign exchange spreads 🧾 Traction More than $2 billion in annual transaction volume, profitable with 60% of active monthly users 👥 Partnerships ClearBank 💻 Technology Stack None Specified 🏢 Team Led by the CEO Ridwan Olalere, who has a strong background in payment solutions and fintech 🗺️ Roadmap Expanding into more countries and developing new products 📍 Challenges Navigating diverse regulatory requirements in various countries 🏆 Achievements Successfully rebranded, significant Series A funding, expansion into new markets ❌ Exit Strategy None Specified 🏛️ Sustainability None Specified 🗪 Social Impact Financial inclusion across countries

Pros and Cons

✔️ Pros ❌ Cons The platform is user-friendly There are several regulatory challenges The company simplifies international transactions and currency management Depends on the remittance market The company has grown significantly Still faces challenges with capturing a larger market share There is strong funding for expansion and development

Our Insight

LemFi is a good option as it simplifies cross-border transactions allowing users to transact in their local currencies. Their platform also enables seamless economic interactions across borders.

3. Currensea

Currensea’s direct debit forex card streamlines overseas transactions by minimizing complexity and costs. Based on our first-hand experience, one of the most impressive aspects of Currensea is how effortlessly it integrates with your current bank accounts.

Users do not need to create a separate account or load money in advance, unlike other forex cards that often have this requirement. This integration not only enhances the user experience but also helps save money by minimizing foreign transaction fees.

Overall, Currensea has revolutionized how individuals and small businesses handle their foreign spending, establishing itself as an innovative solution in the forex industry.

Unique Features

🚀 Year Established 2018 📝 Stage of Development Growth stage, having launched the product and actively working on expansion 💰 Amount Raised £6.5 million since launch 🗣 Investors Blackfinch Ventures, 1818 Venture Capital ✅ Founders James Lynn and Craig Goulding 🎉 Product/Service Direct debit travel card, international payments 🌐 Market UK travelers and SMEs that engage in international transactions ⌛ Unique Selling Proposition Eliminates the need to manage separate balances 💸 Revenue Model Revenue is earned through interchange fees from merchants, subscription fees from users 🧾 Traction Over 45,000 users 👥 Partnerships Several charities 💻 Technology Stack Open banking technology 🏢 Team Led by co-founders James Lynn and Craig Goulding, a team of professionals with experience in finance, technology, and banking 🗺️ Roadmap Aims to expand its user base to 300,000 by the end of 2024, continuous development of products for individuals and businesses 📍 Challenges Significant challenges due to COVID-19, which affected travel shortly after the launch 🏆 Achievements Raised significant funding, grew its user base despite the pandemic, and was recognized for fintech innovation ❌ Exit Strategy None Specified 🏛️ Sustainability Committed to environmental sustainability, offers clients the option to contribute to plastic removal and reforestation initiatives 🗪 Social Impact Strong focus on social impact by allowing clients to donate to support environmental causes

Pros and Cons

✔️ Pros ❌ Cons Offers direct banking integration using innovative technology The company and its services are extremely susceptible to changes in the travel industry Offers clients the chance to donate to environmental causes There is a limited market, with services only focused in the UK Offers innovative products and services There is no need to preload funds or manage separate balances

Our Insight

Currensea is a good choice for individuals and small businesses. They do not require users to create a separate account or load money in advance.

4. iBanFirst

iBanFirst has established itself as a leader in the industry by offering specialized solutions designed specifically for businesses involved in global trade.

The platform we reviewed demonstrated high effectiveness in efficiently managing multicurrency transactions. iBanFirst provides a digital platform that enables faster payments and delivers essential real-time market data for businesses to make well-informed decisions.

iBanFirst is a trusted partner for businesses looking to streamline their international financial operations, thanks to their strong focus on transparency and security in transactions. This commitment to trust and reliability enhances their appeal to businesses.

Unique Features

🚀 Year Established 2013 📝 Stage of Development Growth, focusing on international expansion and product development 💰 Amount Raised $51.88 million 🗣 Investors Marlin Equity Partners, Elaia, Bpifrance, Xavier Niel, Serena ✅ Founders Pierre-Antoine Dusoulier 🎉 Product/Service Financial services platform facilitating cross-border payments and currency exchange, multicurrency accounts, real-time competitive exchange rates, API for international payments 🌐 Market Small and medium-sized enterprises that engage in international trade across Europe ⌛ Unique Selling Proposition Next-gen cross-border payment experience combining a powerful platform with the support of forex experts 💸 Revenue Model Revenue is generated through transaction fees, cross-border payments, currency exchanges 🧾 Traction Processes a transaction volume of more than €1.4 billion monthly, user base of more than 10,000 clients globally 👥 Partnerships Strategic partnerships not detailed 💻 Technology Stack Robust core banking infrastructure supporting multicurrency transaction services 🏢 Team Led by the CEO and over 350 employees 🗺️ Roadmap Expansion into Central and Eastern Europe, M&A opportunities to strengthen market positions 📍 Challenges Navigating diverse regulatory environments, maintaining a competitive edge in the fintech landscape 🏆 Achievements Listed in the Financial Times FT1000, established a significant presence in Europe ❌ Exit Strategy None mentioned 🏛️ Sustainability Focus on efficient and transparent financial transactions 🗪 Social Impact Supports economic growth and stability in various regions by facilitating international trade for SMEs

Pros and Cons

✔️ Pros ❌ Cons Offers a range of services, including currency exchange The products and services are complex and might be hard for SMEs to understand Has an established presence in Europe Operates in an extremely saturated market with other services available The company uses innovative technology to provide real-time access to currency markets Sensitive to global economic changes that could affect currency markets Has several strategic partnerships to enhance services and products

Our Insight

iBanFirst offers specialized solutions which are specifically designed for professional users and businesses. They also provide a digital platform that enables faster payments.

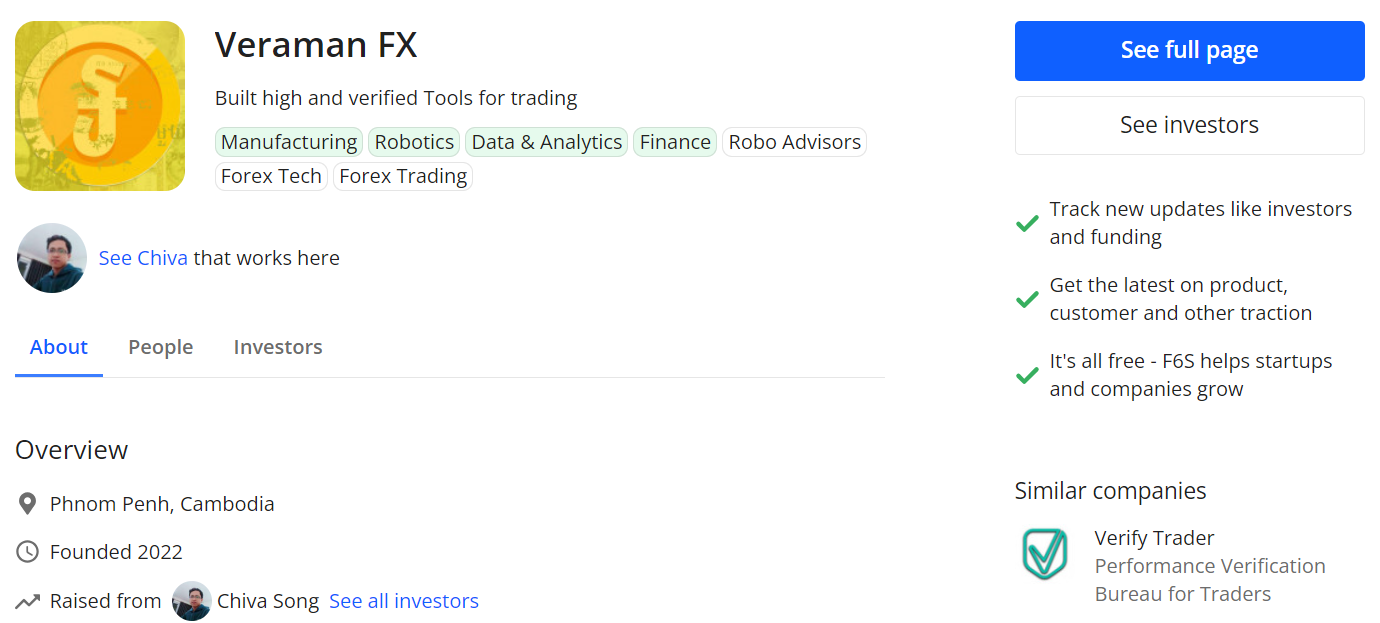

5. Veraman FX

Veraman FX has made a name for itself in the forex market due to its advanced trading tools, despite being relatively new.

We were highly impressed by their sophisticated algorithmic strategies, which greatly enhance trading accuracy and efficiency. Veraman FX is designed to meet the needs of traders at all levels of experience.

The platform is easy to navigate and helps simplify the process of making trading decisions, whether you’re a beginner or an expert. Veraman FX has become a trusted resource for traders looking to improve their performance, thanks to their technology-driven approach to forex trading.

Unique Features

🚀 Year Established 2022 📝 Stage of Development New entrant, early stages 💰 Amount Raised None mentioned 🗣 Investors None mentioned ✅ Founders None mentioned 🎉 Product/Service Trading-centric tools for individual traders using algorithmic strategies 🌐 Market Individual retail traders who require high-quality and reliable trading tools ⌛ Unique Selling Proposition Advanced algorithmic strategies aiming for 90% accuracy in predicting trading positions 💸 Revenue Model Selling subscriptions or licenses for access to analytical tools and trading algorithms 🧾 Traction None mentioned 👥 Partnerships None available 💻 Technology Stack None mentioned 🏢 Team None mentioned 🗺️ Roadmap None mentioned, likely to expand globally 📍 Challenges Market penetration, building a user base, innovating to remain ahead of technological advancements in trading tools 🏆 Achievements None available ❌ Exit Strategy None mentioned 🏛️ Sustainability None mentioned 🗪 Social Impact None mentioned

Pros and Cons

✔️ Pros ❌ Cons Offers sophisticated trading tools and advanced algorithms that promise high accuracy Still a new player in a competitive market with many established firms Focuses on individual retail traders Limited track record Uses robust platforms to remain ahead in the competitive forex market There might be scalability challenges The interface on the platform is extremely user-friendly and easy to navigate, even for beginner traders

Our Insight

Veraman FX is relatively new, but they do offer advanced trading tools. They are a good choice for traders of all levels with a platform that’s easy to navigate.

Exploring the Criteria for Winning the Award

Grasping the Core of Innovation

Innovation is crucial for any startup aiming to win the coveted “Startup of the Year” title. The startup sets itself apart by introducing something new, whether it’s a product, service, or business model.

This innovation should be one-of-a-kind and useful, offering practical solutions to current challenges. It’s all about exploring new frontiers and pushing the limits boldly and ingeniously.

Market Impact and Growth Potential

In our experience, a startup that significantly impacts the market usually achieves this by addressing unmet needs or revolutionizing existing methods.

The assessment of growth potential is based on the scalability of the business model and its ability to adapt to market conditions.

Therefore, such a startup shows great potential for success, with strong indications of growing its customer base, entering new markets, and expanding operations while maintaining the quality and essence of its offerings.

Visionary Leadership and Cohesive Teamwork

The success of any startup hinges on the calibre of its leadership and team. Visionary leaders often can envision grand ideas and possess the unwavering drive to transform those ideas into tangible results.

They motivate their teams, cultivate a culture of creativity, and navigate the ups and downs of the startup journey. We believe that a strong team is defined by its capacity to work together harmoniously, using each member’s diverse skills and perspectives, all driven by a shared objective.

Sustainability and Social Impact

In today’s world, it is crucial to consider a startup’s dedication to sustainability and the positive social impact it creates.

According to our research, this entails the development of business practices that prioritize environmental sustainability and social responsibility.

A startup that incorporates these principles into its core operations showcases a forward-thinking and accountable approach, qualities that are becoming more and more crucial to clients, investors, and partners.

The Importance of Strategic Partnerships

Successful startups understand the importance of building and nurturing strategic partnerships. They recognize that they cannot thrive in isolation and actively seek collaborations to enhance their chances of success.

Often, these partnerships offer valuable resources, expertise, and market access that may otherwise be difficult to obtain. In our opinion, such a startup demonstrates a deep understanding of the importance of collaboration and has proven to be highly skilled at navigating complex business ecosystems.

Continuous Improvement and Adaptability

From what we can tell after conducting intensive research, the path of a startup is never straightforward. Adaptation is crucial, and being open to learning from both successes and failures is essential.

Successful startups prioritize continuous improvement, constantly seeking ways to enhance their products, services, and processes. This adaptability enables them to overcome immediate challenges and supports long-term growth in a constantly changing market landscape.

Understanding Startups in Today’s Market

Startups are like the trailblazers of new ideas and approaches in today’s corporate world. These companies are more than just that; they manifest the aspirations of pioneers who wish to bring a revolutionary product or service to clients.

Startups aren’t just little companies; they’re possible paradigm shifters testing established practices and opening up new frontiers.

How an Idea Comes to Fruition

The core of every startup is a concept, be it a product, a service, or a way to fill a need in the market. However, putting that plan into action is the true test.

Many obstacles must be overcome to transform a concept into a product, such as securing sufficient funding and navigating intricate regulations. The chance of failure is always present, and the competition is severe. However, entire sectors can be transformed by those that succeed.

The Crucial Role of Funding

Funding is the lifeblood of entrepreneurs. It is essential for the commercial success of any project. Funding for new businesses has evolved significantly in recent years.

Angel investors, crowdfunding, and government subsidies are some alternatives to traditional venture financing. We found various funding options available to startups, and selecting the best one can determine the extent to which the venture succeeds.

Embracing Innovation for Long-Term Success

For entrepreneurs, innovation isn’t merely a buzzword; it’s a survival mechanism. People who succeed are constantly thinking of new things to do.

They respond quickly to client requests, incorporate input into product development, and adjust their company strategy. They can maintain their significance and competitiveness in dynamic markets by being adaptable.

The Impact of Technology and Market Forces

Startups are built on technology. Cloud computing and artificial intelligence have lowered the bar for entrepreneurs to enter the market and disrupt established sectors.

Additionally, we found that consumer behavior, economic conditions, and regulatory frameworks impact startups. Startups can better handle challenges and seize opportunities if they monitor these items.

Looking Ahead: Where Do Startups Go From Here?

From what we can tell, the future is bright, especially for forex and financial startups. There are fresh opportunities to do things differently because of new technologies like blockchain and an emphasis on being environmentally responsible.

Furthermore, the advent of the internet has also made it possible for new businesses to reach customers all over the globe.

In addition, we know that the importance of sticking out from the crowd will only increase as the number of businesses continues to grow. This pushes startups to grow their user bases, continuously innovative, and expand across countries and markets to stay ahead of the competition.

Funding and Investment

In the realm of foreign exchange (FX) brokerage firm startup, a well-thought-out investment strategy and sufficient capital are the lifeblood of the enterprise.

Our research into this field as writers and reviewers has shown us that the first round of funding is monumental since it determines the viability and expansion of the business going forward.

Getting Started with Funding

Startup brokers could feel overwhelmed when trying to secure initial capital. The legislative and technological prerequisites appear to necessitate a substantial initial investment to launch a forex brokerage.

According to our findings, the launch costs can differ substantially based on the selected technology and the need for regulatory compliance.

A white-label forex brokerage, for instance, might necessitate an initial investment of $15,000 to $25,000. The choice of site also has a significant impact on the starting costs.

Furthermore, Cyprus is a popular choice among brokers because of its advantageous tax and legislative frameworks, which impact operational strategies and expenses. Both financial planning and the capacity to acquire a worldwide client base are affected by this strategic choice.

Strategic Investors and Their Significance

We can see that the types of investors supporting a forex brokerage business greatly affect its trajectory as we delve more into funding techniques.

Although conventional venture capital might appear to be the most apparent option, investors in the foreign exchange market frequently need to provide more than just financial backing due to the sector’s complexity.

In addition to financial backing, strategic investors—frequently seasoned pros in the financial markets—offer invaluable advice, connections, and guidance.

Their knowledge of regulatory hurdles and market trends is invaluable in the early stages of a brokerage’s development. Their impact extends beyond monetary donations; they frequently have a say in major policy shifts and operational fine-tuning.

Leveraging Collaboration and Technology

In this digital age, a forex brokerage’s technology foundation is equally important as its financial stability. Based on our research, two of the most important things for a new broker to do to succeed are to choose trustworthy payment systems and trading platforms.

To keep client funds safe, the technological stack must allow quick trading while simultaneously satisfying demanding security requirements. Another way to invest strategically is to form partnerships with technology companies.

By teaming up with IT companies, new broker startups can save a lot of money on expensive trading platforms and backend systems. In our experience, these relationships usually involve continuous support and updates for the brokerage to keep up with the ever-changing market.

A Financial Plan for the Future

In addition to the initial setup, a forex brokerage’s sustainability depends on a carefully planned financial strategy for the long term.

Achieving this goal requires juggling the competing demands of rapid expansion and the need to keep enough cash on hand to satisfy regulatory requirements.

Furthermore, we believe that the brokerage’s ability to grow and adapt to changing market conditions depends on its financial strategy, which must not sacrifice compliance or service quality in expanding operations.

Conclusion

When we reflect on the startups we’ve identified that could potentially be award-winning, it becomes evident that innovation and prioritizing customers are crucial in today’s forex and financial industry.

These startups have embraced advanced technologies and demonstrated a remarkable ability to adapt to the constantly evolving market, establishing new benchmarks in forex trading.

Our Insight

In our view, financial backing and investment in new forex brokerages entails more than simply exchanging money; it also necessitates the development of a long-term plan that integrates technological advancements, regulatory requirements, and financial planning.

Brokers who see their investors as allies in their growth, their technology as a weapon in the market, and their financial plans as the bedrock of their future success are the ones who succeed in the long run.

Faq

A startup is regarded as one of the greatest due to its new solutions, market influence, and the strength of its trading platform, all of which improve user experience and financial outcomes.

Award-winning businesses frequently implement revolutionary technology and techniques that increase transparency, lower costs, and greater accessibility in forex trading.

Leading startups frequently use AI and machine learning for market prediction, blockchain for security, and automated trading systems to increase trading efficiency.

Regulatory compliance is critical since it assures the legality and security of the platform, encouraging trust among users and stakeholders in the heavily regulated financial market.