Chainlink Soars on Successful Fund Tokenization Pilot with DTCC

Chainlink (LINK) is experiencing a bullish surge, rising over 12.5% following a successful pilot program with the Depository Trust and Clearing Corporation (DTCC) aimed at streamlining traditional finance fund tokenization. The pilot, dubbed Smart NAV, paves the way for broader institutional adoption of blockchain technology.

DTCC and Chainlink Collaborate on Fund Tokenization

The DTCC partnered with Chainlink and major U.S. banks to test a method for bringing fund net asset value (NAV) data onto blockchains. Chainlink’s CCIP facilitated standardized data provision across multiple blockchains, a crucial step for interoperability.

Pilot Results Show Promise

The pilot demonstrated the ability to automate data management, reducing reliance on manual processes. The program streamlined workflows for traditional financial institutions, minimizing disruption to existing practices.

Clients gained easier access to historical fund data without manual record-keeping. The pilot paves the way for broader API solutions for price data within the financial sector.

Major Banks Participate in Pilot

The pilot involved prominent U.S. banks like JPMorgan Chase, Bank of New York Mellon, and Franklin Templeton. Their participation signifies growing institutional interest in blockchain-based solutions for traditional finance.

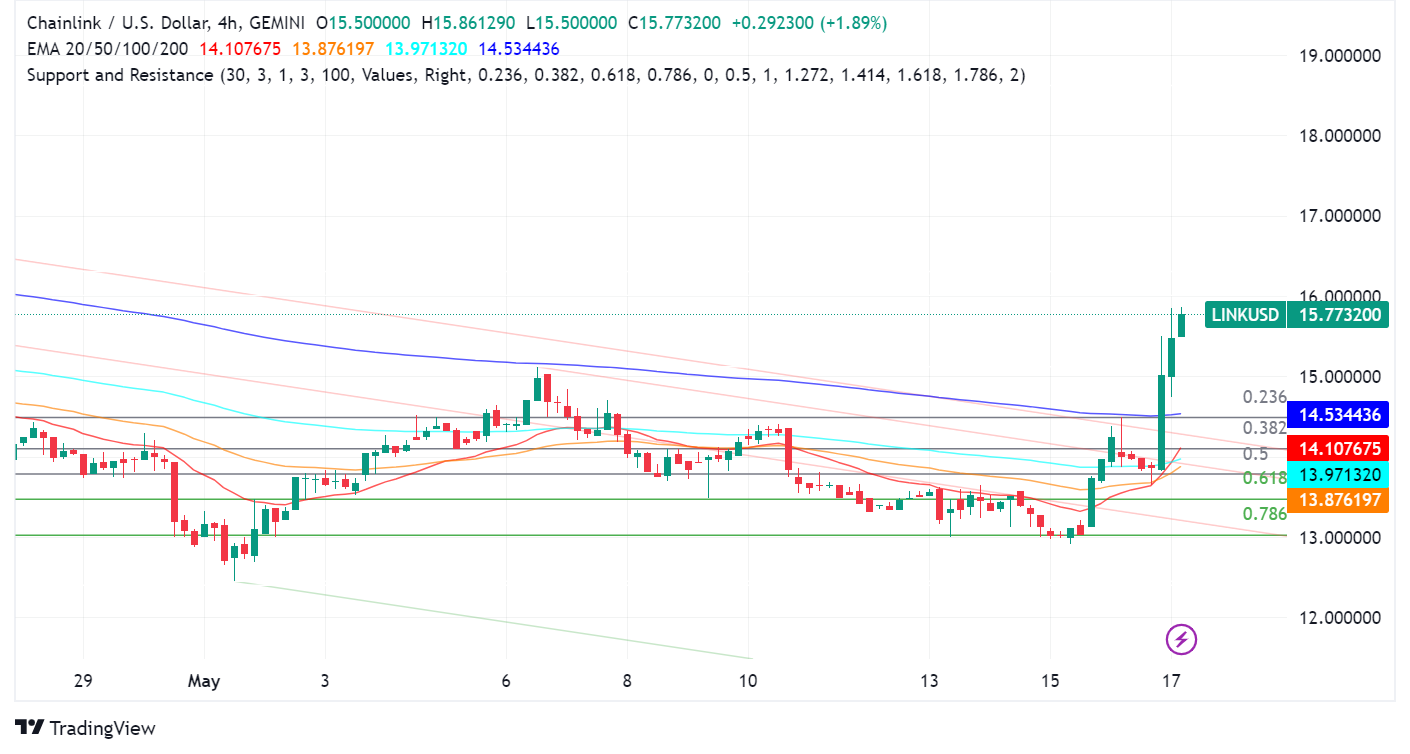

Chainlink Price Responds Positively

The Chainlink token price surged over 12.5% following the DTCC’s pilot report, reflecting investor optimism. This year, LINK has gained over 130%, highlighting its overall positive performance.

Market Buoyed by Easing Inflation

The recent U.S. inflation report showing a slowdown has boosted market sentiment across cryptocurrencies. Chainlink’s price increase comes after a period of correction, suggesting a potential reversal and return to previous highs.

Analysts Remain Bullish on Chainlink

Technical indicators like the RSI and SMA suggest a potential continuation of the bullish trend. Analysts remain optimistic about Chainlink’s long-term prospects due to its unique features and strong roadmap.