Can the Intel Chip Rival Nvidia’s H100 Chip?

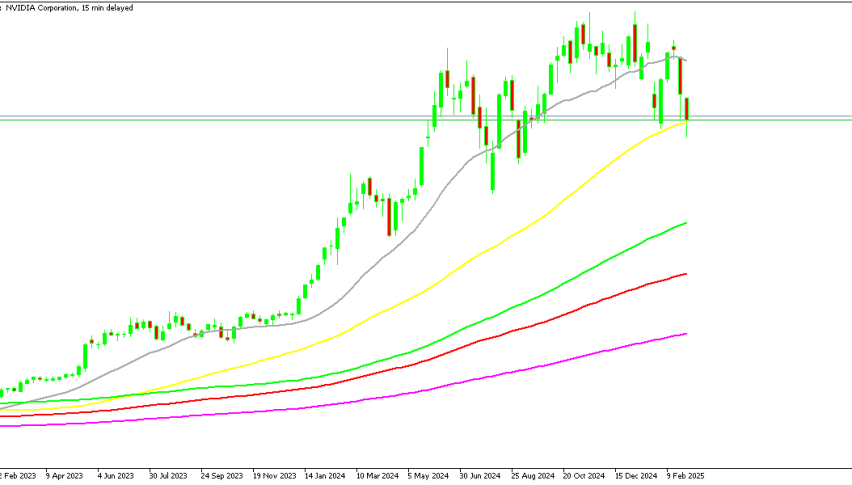

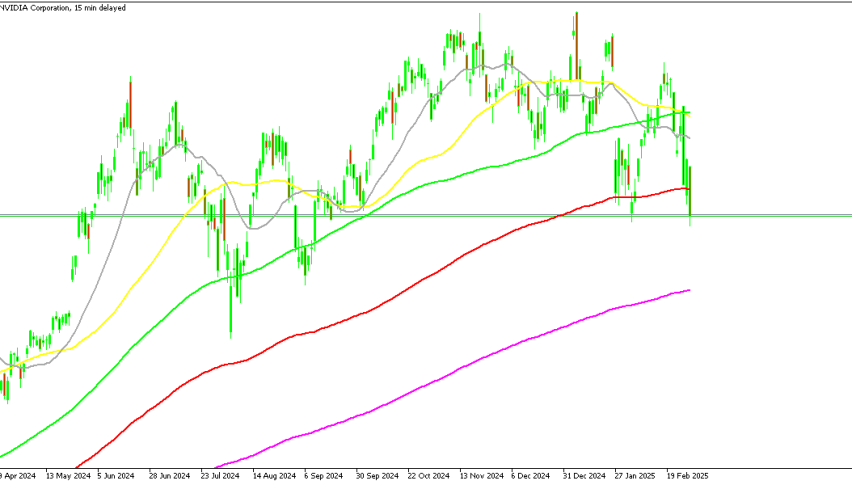

Stock markets have been surging since October with Nvidia stock (NVDA) leading the way. They kept making new record highs, with the NVDA stock price attempting to reach the $1,000 milestone a couple of times, however, it failed and sellers have taken control in the last several days, with one possible reason being the new Intel chip which might steal some shine off Nvidia’sH100 chip.

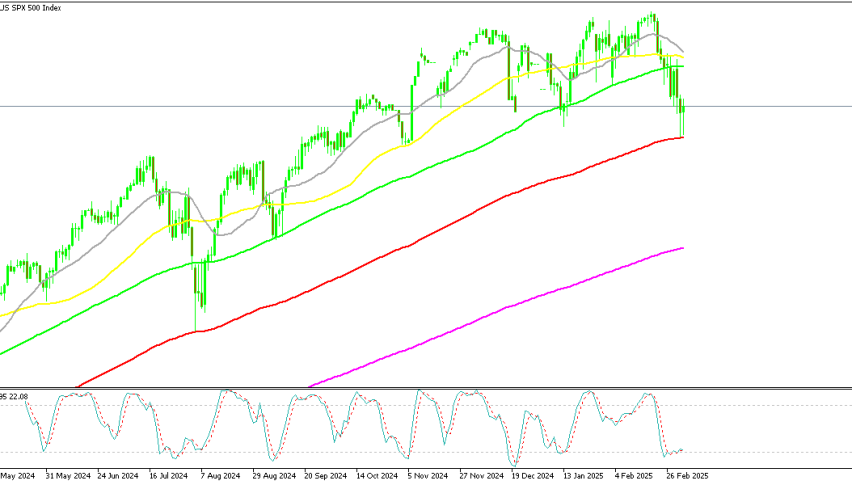

Nvidia Stock Chart Daily – The Support Zone Held the Decline

The recent surge in risk aversion in global markets has been attributed to various factors, including a significant decline in Nvidia (NVDA) shares following less optimistic comments from a UBS analyst. While the analyst had been warning about October NVDA revenues for some time, the market reacted strongly to the news, particularly after NVDA’s shares broke below the $850 level. Furthermore, Intel’s introduction of the Intel Gaudi 3 AI accelerator, which boasts impressive performance and efficiency metrics and is cheaper than Nvidia’s H100 chip, has generated significant interest in the industry.

Intel’s assertion regarding its AI chip surpassing Nvidia’s H100 processors in training specific large language models in half the time is a significant development within the realms of artificial intelligence and semiconductor technology. Moreover, the additional claim that Intel’s chip can execute generative AI responses, or inference, quicker than Nvidia’s processors in select models further amplifies its potential impact.

Should these assertions hold true, and Intel’s Gaudi 3 processor indeed outperforms Nvidia’s H100 devices in training language models and inference tasks, it could signify notable strides for Intel within the AI and semiconductor sectors. Such advancements may precipitate a shift in market dynamics and competitive positioning between Intel and Nvidia within the domain of AI hardware. Nonetheless, it is imperative to exercise caution as these claims originate from Intel itself. Independent validation and real-world performance evaluations are necessary to accurately gauge the Gaudi 3 chip’s capabilities and its broader implications for the industry.

Elon Musk Buying 100K Nvidia H100 Chips

Elon Musk’s announcement regarding the demand for H100 chips for training the next generation of Grok 3 underscores the high demand for AI chips globally. Intel’s claim that the Gaudi 3 chip will be widely available by Q3 and its potential to capture market share with competitive pricing could have significant implications for both Intel (INTC) and Nvidia (NVDA).

If Intel’s chip performs as well as Nvidia’s Cuda and is available at a lower cost, it could disrupt Nvidia’s dominance in the market, especially if customers become more price-sensitive. The market will closely monitor Intel’s developments and the performance of its new chip, as well as the US government’s support for Intel’s efforts, which could potentially aid its comeback in the semiconductor industry.