10 Low Swap Fees Forex Brokers

The 10 Best Low Swap Fees Forex Brokers – Revealed. Our team has compiled a list of the top 10 Forex Brokers based on swaps, focusing on their swap conditions to help traders select the broker that suits their trading style and financial goals.

In this in-depth guide, you’ll learn:

- The Best Low Swap Fees Forex Brokers – a List

- What are Swap Fees?

- Can I avoid paying rollover fees? – Answered

- Can Swap Fees be Positive?

- Best Brokers with no Overnight Fees.

and much, MUCH more!

The 10 Best Low Swap Fees Forex Brokers – a Comparison

| 🔎 Broker | 🔁 Low Swap Fees | 💶 Min. Deposit | 🚀 Open an Account |

| 🥇 Tickmill | ✅Yes | 100 USD | 👉 Click Here |

| 🥈 Exness | ✅Yes | 10 USD | 👉 Click Here |

| 🥉 Pepperstone | ✅Yes | None | 👉 Click Here |

| 🏅 AvaTrade | ✅Yes | 100 USD | 👉 Click Here |

| 🎖️ HF Markets | ✅Yes | 100 USD | 👉 Click Here |

| 🥇 RoboForex | ✅Yes | 10 USD | 👉 Click Here |

| 🥈 IC Markets | ✅Yes | 200 USD | 👉 Click Here |

| 🥉 Admirals | ✅Yes | 100 USD | 👉 Click Here |

| 🏅 FXTM | ✅Yes | 100 USD | 👉 Click Here |

| 🎖️ FP Markets | ✅Yes | 100 USD | 👉 Click Here |

The 10 Best Low Swap Fees Forex Brokers (2024)

- Tickmill – Overall, the Best Low Swap Fees Forex Broker

- Exness – No swap fees on selected currencies

- Pepperstone – Low-cost ECN trading service

- AvaTrade – Competitive Fee Structure

- HF Markets – Trusted Broker Choice for Professionals

- RoboForex – Low trading commissions

- IC Markets –Low Swap Fees from -0.5 Pips

- Admirals – Low Commissions Broker for Beginners

- FXTM – Best MetaTrader Forex Broker

- FP Markets – Advanced Trading Tools

Tickmill

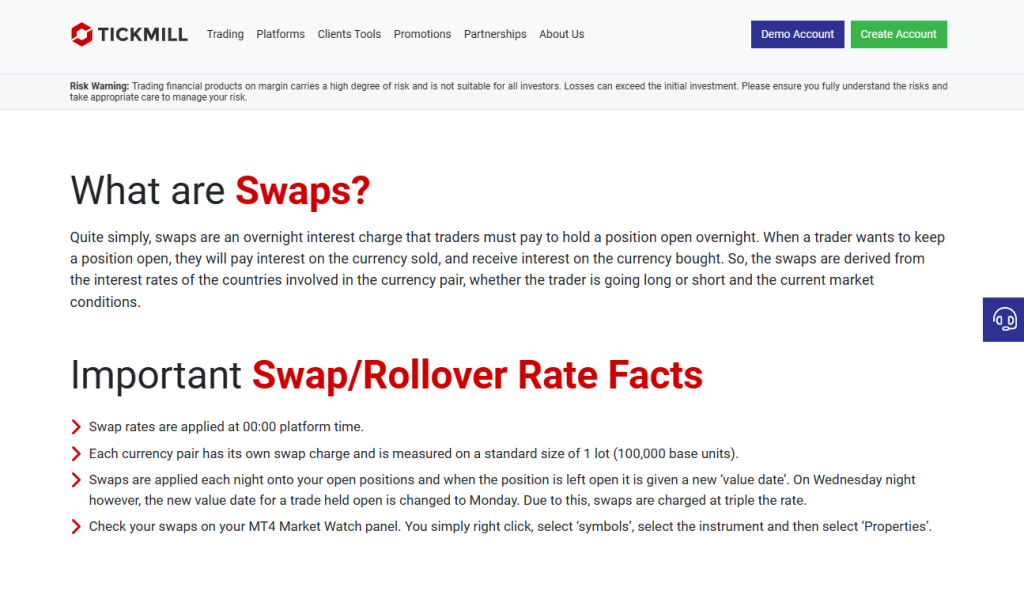

This Broker is well-regulated in several regions globally. Tickmill offers competitive zero-pip spreads on popular instruments like EUR/USD and a transparent swaps fee schedule.

With Tickmill, rates are applicable at midnight (platform time), and they can vary based on a standard lot size of 100,000 base units per currency pair.

Furthermore, Tickmill swaps accrue daily and they have tripled Wednesday swap values. In addition, traders must know that new value dates are set to allow transparency in management, which traders can view on the MetaTrader 4 platform according to the instrument.

| 🔎 Broker | 🥇 Tickmill |

| 💴 Minimum Deposit | 100 USD |

| 📈 Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA |

| 📉 Starting spread | From 0.0 pips |

| 📊 Minimum Commission per Trade | $1 per side, per standard lot traded |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | 100 lots |

| ↪️ Long (Buy) Swap EUR/USD | -6.19 pips |

| ➡️ Short (Sell) Swap EUR/USD | 2.61 pips |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Tickmill is transparent about its overnight fee schedule | There are triple swaps applied on Wednesdays |

| Traders can view overnight fees on MetaTrader 4 | Tickmill offers a limited range of trading instruments |

Exness

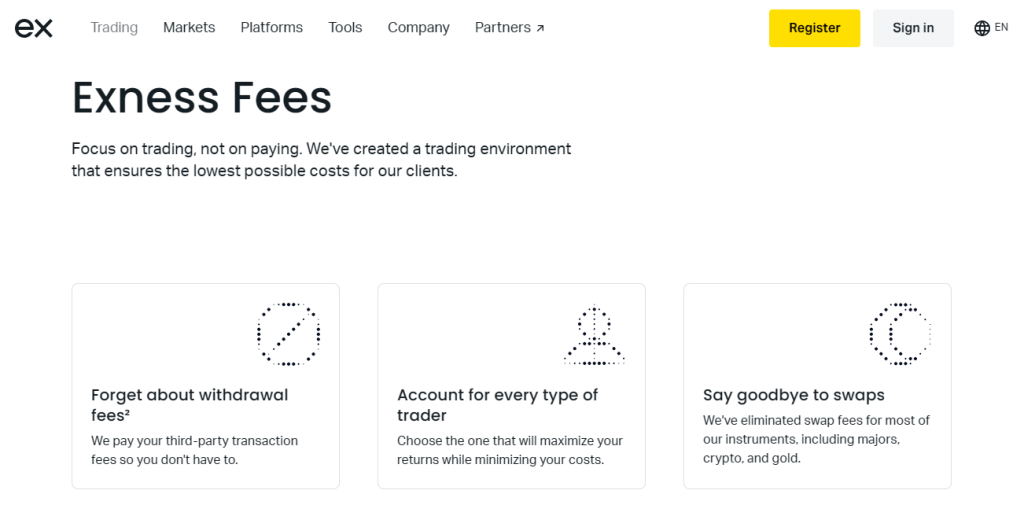

Exness allows traders to participate in several markets from around the world. Swaps with Exness are typically applied daily to orders kept overnight and will continue until the position is closed.

With Exness, traders can expect standard, triple, and no-swap conditions (on Islamic Accounts). Furthermore, Exness offers a transparent fee schedule that details the swaps for every tradable instrument on the website.

| 🔎 Broker | 🥇 Exness |

| 📈 Long (Buy) Swap EUR/USD | -0.58 pips |

| 📉 Maximum Trade Size | Unlimited |

| 📊 Minimum Commission per Trade | From $0.1 per side, per lot |

| 💴 Minimum Deposit | Depends on the payment system |

| 💹 Minimum Trade Size | 0.01 lots |

| 📌 Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA |

| ↪️ Short (Sell) Swap EUR/USD | 0.0 pips |

| 📍 Starting spread | 0.0 pips EUR/USD |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| Pros | Cons |

| Exness’ EUR/USD swaps are competitively low | Exness has limited financial instruments compared to other brokers |

| Exness offers transparent trading conditions | Exness does not have a proprietary desktop platform |

Pepperstone

Pepperstone uses the following method to determine its daily swap costs or credits:

- One point x (trade size x Tom-next)

These rates are generated from top-tier global investment banks and are updated daily to reflect developments in the swap market. Furthermore, Pepperstone typically applies the same principle to commodity metal exchanges.

However, traders must note that the swap rates provided on Pepperstone’s trading platforms are only indicative and may fluctuate due to market volatility.

Pepperstone provides detailed instructions on how traders can access and view swap rates on MetaTrader and cTrader but does not publish these as they are dynamic.

| 🔎 Broker | 🥇 Pepperstone |

| 💴 Minimum Deposit | 200 AUD |

| 📈 Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📉 Starting spread | Variable, from 0.0 pips EUR/USD |

| 📊 Minimum Commission per Trade | From AU$7 |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | 100 lots |

| ↪️ Long (Buy) Swap EUR/USD | Available on MT4 and cTrader |

| ➡️ Short (Sell) Swap EUR/USD | Available on MT4 and cTrader |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Pepperstone publishes comprehensive information about its swap rates | Traders must log into cTrader or MetaTrader to view swap rates for EUR/USD |

| Pepperstone offers an Islamic account to Muslim traders, exempting them from swap fees | Understanding the swap rates of Pepperstone can be daunting for new traders |

AvaTrade

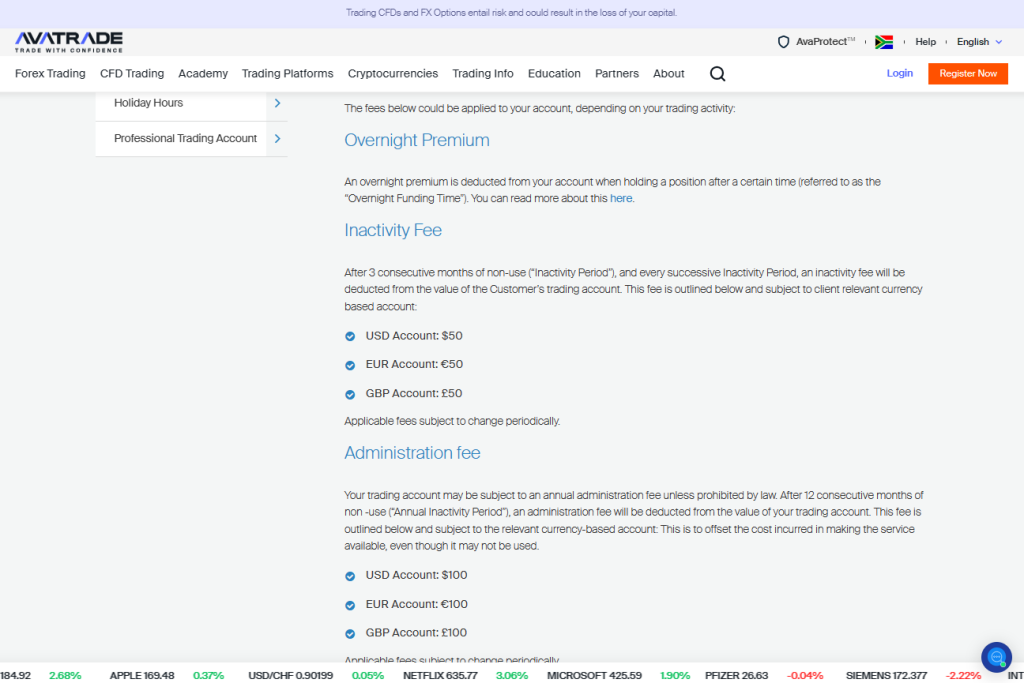

All Swap-Rates are published under each trading instrument, allowing traders to investigate and evaluate these fees easily. AvaTrade offers transparent trading conditions on its retail account. Furthermore, AvaTrade offers a Swap-Free Account to Muslim traders, exempting them from swaps.

AvaTrade offers several powerful trading platforms through which traders can access several asset classes, giving them the ideal opportunity to diversify their trading portfolios.

| 🔎 Broker | 🥇 AvaTrade |

| 💴 Minimum Deposit | 100 USD |

| 📈 Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 📉 Starting spread | 0.9 pips EUR/USD |

| 📊 Minimum Commission per Trade | None; only the spread is charged |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | Unlimited |

| ↪️ Long (Buy) Swap EUR/USD | -0.0070% |

| ➡️ Short (Sell) Swap EUR/USD | 0.0009% |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| AvaTrade publishes swap rates on all instruments | AvaTrade applies inactivity fees to dormant accounts |

| Traders can expect low and competitive swap rates | There are limited retail accounts |

HF Markets

HFM offers global traders access to over 500 financial instruments that can be traded across markets. HFM’s trading fee schedule is published on the website and displays the swap fees for all instruments.

Furthermore, HFM offers flexible account types with competitive trading conditions catered to different types of traders, from beginners to professionals.

| 🔎 Broker | 🥇 HF Markets |

| 💴 Minimum Deposit | 0 USD |

| 📈 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📉 Starting spread | 0.0 pips |

| 📊 Minimum Commission per Trade | From $6 per round turn on Forex |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | 60 lots |

| ↪️ Long (Buy) Swap EUR/USD | 0.0 pips |

| ➡️ Short (Sell) Swap EUR/USD | -6.7 pips |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| HFM has competitively low swap rates on EUR/USD and other major instruments | HFM’s instrument portfolio is limited compared to other traders |

RoboForex

When traders hold overnight positions with RoboForex, they can expect competitive swap rates based on their position. These swap rates are published on the RoboForex website, allowing traders to evaluate whether RoboForex is a cost-effective broker.

RoboForex supports several trading strategies and offers Muslim traders a swap-free account, ensuring they are exempted from swaps according to the Sharia law.

| 🔎 Broker | 🥇 RoboForex |

| 💴 Minimum Deposit | 10 USD |

| 📈 Regulation | CySEC, IFSC, Labuan FSA |

| 📉 Starting spread | From 0.0 pips |

| 📊 Minimum Commission per Trade | 10 USD per million traded |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | 500 lots |

| ↪️ Long (Buy) Swap EUR/USD | -0.96 pips |

| ➡️ Short (Sell) Swap EUR/USD | 0.1 pips |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| RoboForex offers traders the chance to earn swaps according to the interest rate | RoboForex has limited Tier-1 regulation |

| RoboForex offers a swap calculator on the website | While RoboForex offers negative balance protection, traders can still lose significant funds when they use high leverage and the market turns against them |

| Traders can expect competitive swap rates, often better than other brokers | Swap fees can be costly when traders hold positions for extended periods |

IC Markets

Swap rates are competitive compared to other brokers, especially on major currency pairs like EUR/USD. IC Markets is a True ECN broker that ensures traders expect the best trading conditions, deep liquidity, and reliable trade execution.

Furthermore, IC Markets offers a transparent trading environment where traders can expect lucrative trading opportunities across markets and instruments. The spreads with IC Markets typically start from 0.0 pips, with low commissions from $3, depending on the account type and instrument.

| 🔎 Brokers | 🥇 IC Markets |

| 💴 Minimum Deposit | 200 USD |

| 📈 Regulation | ASIC, CySEC, FSA, SCB |

| 📉 Starting spread | From 0.0 pips |

| 📊 Minimum Commission per Trade | From $3 to $3.5 |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | 2000 |

| ↪️ Long (Buy) Swap EUR/USD | 3.9 pips |

| ➡️ Short (Sell) Swap EUR/USD | 0.75 pips |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Because it is a True ECN, IC Markets’ swap rates can be lower than others | Negative swaps can be in both directions, making overnight holdings expensive |

| IC Markets offers a comprehensive breakdown of how swaps are credited or debited | The calculations on swaps can be confusing for beginners |

| There are tools for cost estimation | IC Markets charges triple swaps on some days |

Admirals

Admiral Markets or Admirals is a reputable broker with a long history of outstanding Forex and CFD trading conditions. Admirals charges/credits swaps depending on the instrument and the traders’ direction.

According to the server time, Admirals’ swap charges are typically credited or debited around midnight. Furthermore, traders should note that there are triple swaps on certain days to account for market closure over weekends.

Several tools help traders calculate their overnight fees on the Admirals website. Furthermore, traders can reach Admirals’ customer support across channels should they have questions regarding swap rates and fees.

| 🔎 Broker | 🥇 Admirals |

| 💴 Minimum Deposit | 1 USD |

| 📈 Regulation | FCA, ASIC, CySEC, JSC, FSCA, FSA, CMA |

| 📉 Starting spread | 0.0 pips, Variable |

| 📊 Minimum Commission per Trade | $0.02 |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | 200 lots |

| ↪️ Long (Buy) Swap EUR/USD | -0,842 pips |

| ➡️ Short (Sell) Swap EUR/USD | 0.07 pips |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Admirals publishes the swap rate for each instrument on the website | Long-term positions might face expensive swap fees |

| Traders can start trading in a risk-free demo environment to test strategies to get the most out of swap rates | Calculations can be complex for beginners |

| Admirals offers an Islamic account for those who cannot pay swaps | Currency conversion fees could apply |

FXTM

Best known for its competitive trading conditions across several markets, especially major instruments like EUR/USD. Furthermore, the swap rates for all instruments can be found under “contract specifications” on the FXTM website.

Traders can start trading several markets with a 10 USD minimum deposit, and FXTM offers comprehensive guides and research tools to help traders develop, test, and refine trading strategies.

| 🔎 Broker | 🥇 FXTM |

| 💴 Minimum Deposit | 10 USD |

| 📈 Regulation | CySEC, FSCA, FCA, CMA, FSC Mauritius |

| 📉 Starting spread | 0.0 pips, variable |

| 📊 Minimum Commission per Trade | $0.40 to $2, depending on the trading volume |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | 100 lots |

| ↪️ Long (Buy) Swap EUR/USD | -6.45 pips |

| ➡️ Short (Sell) Swap EUR/USD | 1.37 pips |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Swap rates, especially on major currencies, can be extremely competitive | FXTM’s swap rates are dynamic and can change drastically and quickly |

| FXTM offers swap-free accounts to Muslim traders | Traders who hold overnight positions with FXTM for extended periods could pay high trading fees |

| FXTM prides itself in being transparent about all trading and non-trading fees | FXTM applies triple swaps |

FP Markets

This Broker’ swap rates are dynamic across instruments, influenced by the rates of forex pairs traded. FP Markets publishes all swap rates on the website, allowing traders to evaluate these fees and determine whether they align with their trading objectives and needs.

FP Markets offers powerful trading platforms, tools, and resources to help traders develop, test, and employ trading strategies to capitalize on swap rates in competitive markets.

| 🔎 Broker | 🥇 FP Markets |

| 💴 Minimum Deposit | 100 AUD |

| 📈 Regulation | ASIC, CySEC, FSCA, FSA, FSC |

| 📉 Starting spread | 0.0 pips |

| 📊 Minimum Commission per Trade | US$3 per side |

| ➖ Minimum Trade Size | 0.01 lots |

| ➕ Maximum Trade Size | 50 lots |

| ↪️ Long (Buy) Swap EUR/USD | -5.75 pips |

| ➡️ Short (Sell) Swap EUR/USD | 2.59 pips |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| FP Markets’ swap rates are attractive across markets | Swap rates can change quickly, and long-term positions can be costly |

What is The Impact of Swap Fees on Forex Trading?

The Basics of Swap Fees

Swap fees in forex trading are comparable to the interest or profits traders can incur when holding a position overnight. These costs are determined by the interest rate difference between the currencies involved in a trade, and they could considerably influence a trader’s ultimate profit or loss.

These fees can be especially beneficial or detrimental for those who hold positions for long periods.

The Duality of Swap Fees

Swap costs can impact forex trading in two ways. Firstly, traders who hold positions open overnight will incur additional fees. This could eat into their profits or even increase losses, especially if the interest rate differential is negative.

In contrast, skilled traders can easily start earning on exchange costs when the disparity works in their favor (also known as “carry trading”). Subsequently, swap costs can increase the complexity of forex trading.

Therefore, traders must consider currency movement and the interest rate environment to avoid incurring unexpected costs.

How To Minimize Swap Fees In Forex Trading

Choosing the Right Broker

One of the best ways for traders to reduce swap costs is to choose a broker with reasonable rates. Because brokers’ cost structures differ, some charging lower swap fees than others, traders must compare brokers side-by-side to choose the most ideal one.

One of the best ways traders can evaluate swaps from different brokers is to register a demo account on the platform.

Swap-Free Accounts

Swap-free accounts (Islamic Accounts) provide a solution for traders worried about swap fees. This is especially true where Muslim traders who follow the Sharia law are concerned.

These accounts do not face overnight fees. However, traders should be wary of additional potential costs linked with these accounts, especially administrative fees and extra commissions.

Strategic timing of trades

Another way to cut swap costs is to plan trades to avoid holding holdings overnight carefully.

Closing positions before the trading day ends might help you avoid these charges. Furthermore, traders must be cautious of holding transactions over the weekend since this can triple the regular swap costs, often called the Wednesday swap triple.

How to Avoid Swap Fees in Forex Trading

Traders can avoid paying swap fees by opening and closing a trade within the same trading session. This is done in High-Frequency and intraday trading, reducing the trading risk for the trader.

What is the Role of Leverage in Managing Swap Fees?

Leverage: A Two-Sided Coin

Leverage in forex trading multiplies the potential gains and losses caused by currency exchange rate changes.

While it enables traders to hold larger positions with relatively smaller investments, it is important to note that leverage can increase the impact of exchange costs. Therefore, the more leveraged the position, the larger the nominal amount that can incur exchange fees.

Balancing Leverage with Swap Fees

Managing swap costs while benefiting from leverage requires a fine balance. High leverage ratios can boost the impact of swap fees on a trading account, highlighting the need to include these costs in one’s trading strategy.

However, by using the right leverage ratio, traders can profit from favorable swap rates, especially when they apply carry trade strategies that typically leverage interest rate differentials.

In Conclusion

In our experience, low swap fees brokers can be advantageous to traders who want access to reduced trading costs, especially when they plan on holding overnight positions. However, traders must approach this idea with a balanced perspective.

According to our research, low swap fees can enhance traders’ profits but should not be the only criteria traders use to choose a broker. Moreover, traders must consider several other factors the broker’s regulation, the platform’s reliability, and overall trading conditions.

Traders must remember that many brokers can compensate for lower swap fees by charging wider spreads or additional commissions. Therefore, traders must evaluate each potential broker before they decide on one and invest capital.

Frequently Asked Questions

Does every broker impose swap fees?

Yes, most brokers impose swap fees. However, others provide Islamic or swap-free accounts that follow Sharia law and waive interest-based costs. However, Islamic Account brokers might charge holding costs, administrative fees, or wider spreads to compensate for the lack of swap fees.

What are swap costs in forex?

Swap fees are interest-based fees or credits typically incurred while holding positions overnight in forex trading.

Why are swaps important?

Swap fees can considerably influence trading costs, especially if you frequently hold positions overnight when using long-term trading strategies. These swap fees can be extremely costly, or they could provide profit-earning potential, depending on the direction of your position.

Do overnight fees usually present themselves as a cost?

No. You can profit from swaps if the interest rate disparity between the swapped currencies works in your favor.

How do I calculate the trading fees I might incur with swap fees?

Many brokers provide swap calculators on their websites. These calculators consider metrics like position size, interest rates, and holding period.

How can I discover brokers who have low swap fees?

You can use online comparing tools built exclusively for swap rates. Furthermore, you can view review sites, register demo accounts with potential brokers, and visit online forums where brokers are often discussed and reviewed.

Do Muslim Traders Pay Swap Fees when Trading Forex?

Muslim Traders will Trade Forex via an Islamic, Swap-Free Account. Unlike with Regular Forex trading accounts, traders will not be required to pay and will not receive swap fees for keeping a position open overnight.

What is a Swap Free Trading Account?

A Swap-Free trading account is a Forex Trading account that will not pay or receive a swap fee.

Can any trader open a Swap-Free Trading Account?

Swap-Free Forex Trading accounts are available to any trader who wishes to abide by Sharia Law and remain halal in their trading practice

What is a Positive Swap Rate?

Positive swap rates indicate that the trader will earn interest on their position.

What is a Negative Swap Rate?

Negative swap rates mean that the trader will incur charges for holding the position overnight.

Why is there a swap fee in forex?

A Swap Fee is the interest paid by Traders for maintaining a position until the end of a trading day.

When will a Swap Fee apply?

If Positions are maintained at the daily rollover point, which occurs at 00:00 server time or “tomorrow next”, the swap fee will be applied.

Do all Brokers charge Swap Fees?

No. Not all Forex Brokers charge fees.