TRADE.com Review

- TRADE.com Review – 13 key points quick overview:

- Overview

- At a Glance

- TRADE.com Account Types

- How To Open a TRADE.com Account

- TRADE.com Deposit & Withdrawal Options

- Trading Instruments & Products

- TRADE.com Trading Platforms and Software

- TRADE.com Spreads and Fees

- Leverage and Margin

- Educational Resources

- TRADE.com Pros & Cons

- Security Measures

- Conclusion

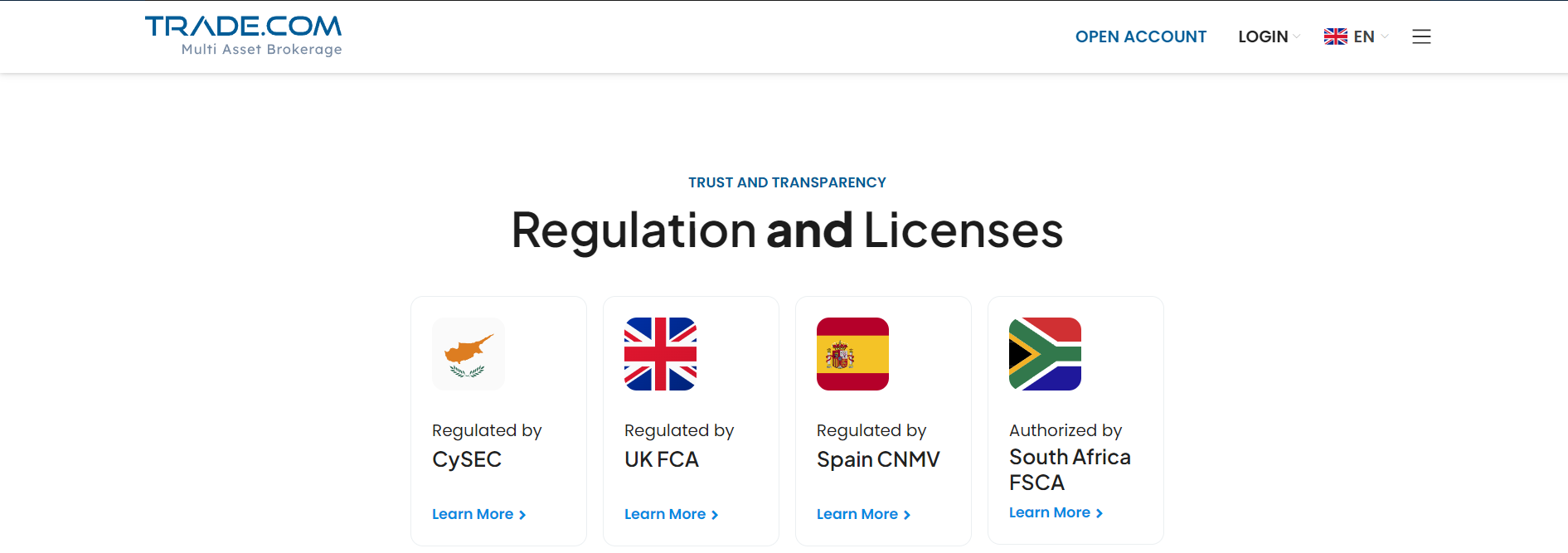

Overall, TRADE.com is considered low risk, with a Trust Score of 92 out of 100. They are licensed by five Tier-1 Regulators (highly trusted), one Tier-2 Regulator (trusted), zero Tier-3 Regulators (average risk), and one Tier-4 Regulator (high risk). TRADE.com offers four retail accounts: Silver, Gold, Platinum, and Exclusive.

TRADE.com Review – 13 key points quick overview:

- ☑️Overview

- ☑️Account Types

- ☑️How to Open A TRADE.com Account

- ☑️Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️Trading Platforms and Software

- ☑️Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

- ☑️Frequently Asked Questions

Overview

TRADE.com, an online trading platform, has operated since 2009 and is now a multi-asset brokerage authorized in many countries, including the UK’s Financial Conduct Authority. The platform focuses on regulatory compliance, providing traders with protection and monitoring.

It offers a variety of trading platforms catering to different expertise levels, with user-friendly interfaces for beginners and complex capabilities for seasoned traders.

The platform also emphasizes trader education, offering tools like webinars, market research, and instructional materials to help traders make informed decisions.

How long has TRADE.com been in operation?

TRADE.com has been in business since 2009, giving traders over a decade of experience and knowledge in the Internet trading sector.

Is TRADE.com good for both new and experienced traders?

Yes, it provides a variety of account categories and instructional materials for traders of all skill levels, from beginners to seasoned experts.

At a Glance

| 🗓 Established Year | 2009 |

| ⚖️ Regulation and Licenses | CySEC, FCA, CNMV, FSCA, FINRA, CONSOB, FSC |

| 🪪 Ease of Use Rating | 4/5 |

| 💰 Bonuses | No |

| 📞Support Hours | 24/5 |

| 💻 Trading Platforms | WebTrader, MetaTrader 5, TradingView |

| 🛍 Account Types | Silver, Gold, Platinum, Exclusive |

| 🤝 Base Currencies | USD, EUR, GBP, etc. |

| 📊 Spreads | From 0.8 pips EUR/USD on Exclusive |

| 📈 Leverage | 1:30 for retail clients |

| 💸 Currency Pairs | 50; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 100 USD |

| 🚫 Inactivity Fee | Yes, 50 USD after 3 months of inactivity |

| 🗣 Website Languages | English, Spanish, Portuguese |

| 💰 Fees and Commissions | Spreads from 0.8 pips, commissions from 0.08% on shares |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | Australia, Canada, the Democratic Republic of Congo, Eritrea, Hong Kong, Israel, Japan, Libyan Arab Jamahiriya, New Zealand, North Cyprus, North Korea, Russia, Somalia, Sudan, all USA jurisdictions, all EU Countries |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, indices, cryptocurrencies, commodities, shares, ETFs |

| 🎖 Open an Account | 👉 Open Account |

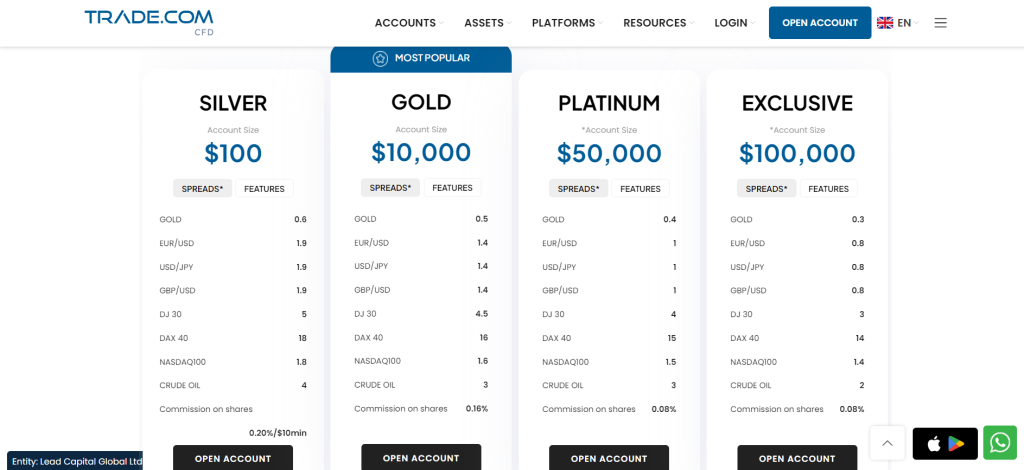

TRADE.com Account Types

| Silver | Gold | Platinum | Exclusive | |

| ✅ Availability | All; ideal for beginners | All; ideal for casual traders | All; ideal for scalpers and high-volume traders | All; ideal for professional traders |

| 🛍 Markets | All | All | All | All |

| 💸 Commissions | 0.20%, minimum 10 USD on shares | 0.16% on shares | 0.08% on shares | 0.08% on shares |

| 💻 Platforms | All | All | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 📈 Leverage | 1:30 (retail) | 1:30 (retail) | 1:30 (retail) | May have access to leverage higher than 1:30 |

| 💰 Minimum Deposit | 100 USD | 10,000 USD | 50,000 USD | 100,000 USD |

Silver Account

The Silver Account is an entry-level trading option suitable for beginners in the financial markets. It provides essential tools and resources like instructional materials, customer assistance, and basic trading conditions.

This account offers a simple platform for learning and growth, making it an ideal choice for those with little investment.

Gold Account

Gold Account is designed for experienced traders with smaller spreads, a dedicated account manager, and access to in-depth market information. It offers additional assistance and tools for advanced trading methods to take their trading to the next level.

Platinum Account

Platinum Account is intended for serious traders who want the greatest trading conditions and the highest quality of service. It features additional perks such as reduced spreads, a dedicated account manager, and access to special webinars and events.

Furthermore, with sophisticated tools and customized assistance, this account suits experienced traders looking for optimum performance and profitability.

Exclusive Account

The Exclusive Account, exclusively for top traders, offers competitive spreads, personalized trading assistance, and direct market analyst access. Available by invitation, it provides a customized trading experience with top-tier tools and bonuses.

Demo Account

Demo Account on TRADE.com allows traders to improve their trading skills without the risks of real-money trading.

It uses virtual funds to provide a simulated trading experience, allowing users to explore TRADE.com’s intricacies, experiment with strategies, and boost confidence before live trading. It serves as an intermediary between theoretical understanding and real-world scenarios.

Islamic Account

The Islamic Account is a swap-free trading environment designed for customers with Islamic religious views, offering a lower interest rate on overnight deals. It can be removed if misuse is suspected, ensuring fair usage and conformity with financial and religious values.

Can I swap account types on TRADE.com?

Yes, traders on TRADE.com can switch between account options depending on their changing trading requirements and preferences.

Are there any account limits depending on your geographical area on TRADE.com?

Yes, while TRADE.com operates in several countries, some account types and functionalities might be prohibited due to geographical location and legal limitations.

How To Open a TRADE.com Account

To register an account with TRADE.com, follow these steps:

Step 1 – Click on the Open Account option.

Visit TRADE.com’s official website and find the “Sign Up” or “Open Account” button in the main menu bar or homepage. Clicking the “Sign Up” or “Open Account” button will take you to a registration form where you can enter your personal information.

Step 2 – Select the preferred account type.

Next, you must choose the trading account you want to open (e.g., Silver, Gold, Platinum, Exclusive, Demo, or Islamic Account).

Step 3 – Complete the form.

After choosing your account type, you must enter further information to comply with regulatory requirements. This typically includes your birth date, residence address, work position, trade history, and financial information.

TRADE.com will require that you validate your identity and address as part of the Know Your Customer (KYC) procedure. Upload clear copies of any needed papers, including a government-issued ID (passport or driver’s license) for identity verification and a recent utility bill or bank statement for proof of residency.

Review all information and TRADE.com’s terms and conditions. It is important to understand the risks associated with trading and the precise terms of the account type you have selected.

TRADE.com will assess your application and supporting papers when they are submitted. This procedure might take several days, depending on the quality and clarity of the papers given.

After your account is authorized, you will get a confirmation email containing your account information and instructions on how to fund it. Follow these steps to deposit funds to your account using one of the supported payment methods.

Finally, after your account has been funded, you can begin trading. Access the trading site using your login information, familiarize yourself with the UI, and start trading with TRADE.com.

What is the first step in registering an account with TRADE.com?

The first step in creating an account with TRADE.com is to go to the official website and click the “Sign Up” or “Open Account” buttons.

Is there a verification step for establishing an account on TRADE.com?

Yes, as part of the Know Your Customer (KYC) process, TRADE.com asks traders to verify their identity and address by submitting clear copies of government-issued ID and evidence of residence.

TRADE.com Deposit & Withdrawal Options

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| Credit/Debit Card | All | Multi-currency | 3 – 5 days |

| Bank Wire Transfers | All | Multi-currency | 3 – 7 days |

| e-Wallets | All | Multi-currency | Instant – 48 hours |

Deposit Methods:

Bank Wire

✅Sign into your TRADE.com account and go to the “Deposit” or “Funding” area.

✅Choose “Bank Wire Transfer” as your deposit option.

✅Obtain TRADE.com’s bank account information, which includes the account name, number, IBAN, SWIFT/BIC code, and bank address.

✅Initiate a wire transfer from your bank account using the information you got from TRADE.com.

Credit or Debit Card

✅Log in to your TRADE.com account and go to the “Deposit” or “Funding” area.

✅Select “Credit/Debit Card” as the chosen deposit method.

✅Enter the desired deposit amount.

✅Enter your card information, including the number, expiration date, and security code (CVV).

Cryptocurrency

✅Go onto your TRADE.com account and navigate to the deposit area.

✅Click your desired cryptocurrency from the available choices.

✅TRADE.com will provide a unique deposit address for your coin.

✅Transfer funds from your crypto wallet to the deposit address given.

✅Once the blockchain has confirmed the transaction, your TRADE.com account should be credited.

e-Wallets or Payment Gateways

✅Log in to your TRADE.com account and go to the Deposit area.

✅Select your preferred e-wallet or payment gateway.

✅You will be redirected to the e-wallet’s or payment gateway’s website to log in and complete the transaction.

✅Enter the amount you wish to deposit and finish the transaction on the e-wallet/gateway website.

Withdrawal Methods:

Bank Wire

✅Sign in to your TRADE.com account and go to the “Withdrawal” section.

✅Choose “Bank Wire Transfer” as your withdrawal option.

✅Include your account name, account number, IBAN, SWIFT/BIC code, and bank address.

✅Enter the amount that you want to withdraw, and submit the request.

Credit or Debit Cards

✅Log onto your TRADE.com account and go to the “Withdrawal” area.

✅Select “Credit/Debit Card” as your desired withdrawal method. Funds will be returned to the card used for the most recent deposit.

✅Enter your desired withdrawal amount (limits may apply).

Cryptocurrency

✅Log onto your TRADE.com account and navigate to the withdrawal area.

✅Choose the coin you want to withdraw.

✅Provide your crypto wallet address.

✅Enter your desired withdrawal amount.

✅Submit your withdrawal request, and the transaction will be completed on the blockchain.

e-Wallets or Payment Gateways

✅Log in to your TRADE.com account and go to the “Withdrawal” area.

✅Select your preferred e-wallet or payment gateway.

✅Enter the amount you wish to withdraw.

✅Submit your withdrawal requests, and the funds will be withdrawn per the e-wallet/gateway’s terms.

Are there any costs for deposits on TRADE.com?

No, TRADE.com does not charge deposit fees.

Can I make a withdrawal from my TRADE.com account at any time?

Yes, traders can request withdrawals from their TRADE.com accounts anytime, subject to the platform’s withdrawal restrictions and processing delays.

Trading Instruments & Products

TRADE.com offers the following trading instruments and products:

- Forex – It offers over 50 currency pairings, allowing traders to trade the forex market 24/5, utilizing various strategies like scalping and swing trading to speculate on currency changes.

- Indices – TRADE.com offers traders access to over 20 global indices, including the Dow Jones, S&P 500, NASDAQ, FTSE 100, and DAX, allowing them to diversify their portfolios.

- Cryptocurrencies – They provide a platform for trading over 20 popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and Litecoin, offering a convenient and secure way for traders to speculate on price movements.

- Commodities –In fact they give traders over 15 commodities, including gold, silver, oil, natural gas, coffee, sugar, and wheat, allowing them to hedge against inflation, diversify portfolios, and profit from global economic and geopolitical changes.

- Shares – a global stock exchange platform is available for trading more than 2,000 shares, allowing traders to invest in various businesses, including digital giants and traditional manufacturing organizations, promoting diverse investment techniques and potential capital development.

- ETFs – The broker offers over 100 Exchange-Traded Funds (ETFs) for traders to diversify their investments and minimize risk. These financial instruments offer exposure to various sectors, indexes, commodities, and bonds, allowing for low-cost portfolio creation.

Does TRADE.com provide commodity trading?

Indeed, they enable traders to trade over 15 commodities, including gold, silver, oil, natural gas, coffee, sugar, and wheat.

Is there any trading leverage available on TRADE.com?

Yes indeed, TRADE.com provides leverage for trading various financial instruments, enabling traders to expand their trading positions and perhaps boost their earnings.

TRADE.com Trading Platforms and Software

WebTrader

TRADE.com’s WebTrader is a mobile-friendly trading platform with over 2,100 assets designed for easy funds management. It features multi-chart windows, in-platform price alerts, real-time balance updates, and account levels.

The platform also offers tools for detailed market research, Trading Central, and an Economic Calendar. A practice account with $10,000 in virtual funds allows traders to test methods without risk.

Furthermore, SSL security ensures a secure trading environment, making WebTrader an ideal solution for TRADE.com customers.

MetaTrader 5

TRADE.com has introduced MetaTrader 5, a superior trading platform that surpasses its predecessor in speed, efficiency, and functionality. It offers a user-friendly interface, improved charting tools, a strategy tester, and a new market depth function.

The platform also offers auto trading using the new MQL5 language, allowing for more complex order types and automated trading methods. It offers access to over 350 assets and provides financial news and a live economic calendar.

TradingView

Firstly , TradingView, a trading tool partnered with TRADE.com, offers traders a comprehensive charting platform and social networking features. It provides over 100 signal-generation indicators and technical analysis tools, catering to traders of all skill levels.

The platform’s stock screeners and active community ensure traders can set trading alerts based on asset prices or indicator violations. Its extensive collection of prebuilt technical indicators and ability to analyze multiple assets on a single chart make it an effective tool for deep market analysis.

What are the main features of TRADE.com’s WebTrader platform?

Their WebTrader platform has an easy-to-use interface, several chart windows, real-time balance updates, and access to educational materials and market research tools.

Does TRADE.com provide any proprietary trading platforms?

TRADE.com mainly provides third-party trading platforms such as WebTrader and MetaTrader 5, but it also gives access to exclusive tools and features that improve the trading experience.

TRADE.com Spreads and Fees

Spreads

It charges competitive spreads on all trading instruments, starting at 0.8 pips for Exclusive accounts. This enables cost-effective trading, especially for high-volume traders and scalpers, promoting efficient trading.

Commissions

Furthermore, they offer a tiered fee structure for share trading, ranging from 0.08% on the Exclusive account to 0.20% on the Silver account, ensuring that traders with higher account levels benefit from reduced trading expenses, potentially boosting profitability.

Overnight Fees

TRADE.com charges an overnight or swap fee on open positions after trading, covering the cost of leverage used overnight. The charge can be credited or debited based on trade outcome, interest rate difference, and product requirements.

Furthermore ,the fee structure for Forex pairings and share CFDs is doubled on Wednesdays and Fridays to compensate for weekend market closures, urging traders to consider the long-term costs of holding positions.

Deposit and Withdrawal Fees

TRADE.com charges no deposit and withdrawal fees, enabling traders to manage assets effectively. However, intermediaries like banks and payment gateways may impose transaction charges.

Inactivity Fees

The broker charges an inactivity fee to accounts that have not transacted in a specific time frame, a common practice among online brokers.

The fee is intended to encourage frequent trading activity or account checks, and traders should monitor their trading frequency and account status to avoid inactivity penalties.

Currency Conversion Fees

They charge a currency conversion fee when a trader’s account currency differs from the underlying asset’s stated currency.

This fee applies to account activities like margin computations, profit and loss computations, overnight rollovers, CFD rollovers, and corporate action adjustments.

Do TRADE.com spreads vary depending on market conditions?

Indeed, spreads on TRADE.com may fluctuate based on market volatility and liquidity, with spreads often expanding during times of strong activity.

How is the overnight charge computed on TRADE.com?

Overnight costs are determined on TRADE.com using the interest rate difference between the currencies being traded and the position size, and they are doubled on Wednesdays and Fridays to account for weekend market closures.

Leverage and Margin

The broker, through its subsidiary Lead Capital Global Limited, offers leveraged trading on various financial products, including foreign currencies, allowing customers to manage significant holdings with minimal invested funds.

Leverage, or ‘gearing,’ can lead to significant profits or losses, but it also increases the risk of losses exceeding the original investment.

They also have the right to change trading conditions under specific market situations, and clients must indemnify Lead Capital Global Limited for any damages.

The platform also includes ‘negative balance protection’ to prevent losses. Margin requirements vary by instrument and market, and TRADE.com can request extra margin if the account’s equity falls below the required amount.

Furthermore, the margin must be paid in cash and a currency acceptable to TRADE.com.

How does TRADE.com verify that traders are using leverage responsibly?

Furthermore, they educate traders on the hazards of leverage and use risk management tools like margin requirements and margin calls to assist in minimizing excessive losses caused by overleveraging.

What are the margin requirements for trading at TRADE.com?

TRADE.com’s margin requirements vary according to the asset being traded and market circumstances, with volatile or high-risk assets requiring greater margins.

Educational Resources

TRADE.com offers the following educational resources:

➡️Educational Videos – Educational videos on TRADE.com also appeal to a broad spectrum of traders, from novices to seasoned professionals.

How can traders access TRADE.com’s instructional resources?

TRADE.com’s instructional resources are indeed available immediately via the trading platform, website, or dedicated educational portal.

Is there any payment for utilizing TRADE.com’s educational resources?

No, TRADE.com’s instructional tools are indeed free of charge for registered traders.

TRADE.com Pros & Cons

| ✅ Pros | ❌ Cons |

| TRADE.com's user-friendly online platform, MetaTrader 5, and mobile trading app appeal to both new and seasoned traders | Due to laws, notably in European nations, leverage for retail customers is sometimes limited to 1:30 |

| TRADE.com charges competitive spreads on certain assets | TRADE.com's minimum deposit requirement for more premium accounts is higher than that of certain rivals |

| TRADE.com is licensed by respectable financial regulators in several countries, including the UK's FCA | Spreads can increase dramatically amid market volatility, raising trading expenses |

| TRADE.com consistently obtains great comments on their customer service responsiveness and accessibility via numerous channels | TRADE.com does not have a dedicated deposit and withdrawal section |

| Demo accounts allow you to learn and test techniques without risking real money | |

| The platform provides a comprehensive range of tradable assets, including Forex, commodities, indices, equities, bonds, and certain cryptocurrencies |

Security Measures

They certainly adhere to strict financial regulations to ensure operational and financial integrity. It also maintains segregated accounts for customers’ and operational funds, preventing financial abuse. The company also uses modern encryption technologies like SSL to protect customer data.

Strong firewalls and security mechanisms are certainly used to prevent cyber threats. In addition, TRADE.com also offers two-factor authentication (2FA) to prevent illegal account use and ensure secure access.

Does TRADE.com have frequent security audits?

Yes, TRADE.com also undertakes frequent security audits to detect and resolve any vulnerabilities in its systems and infrastructure.

What steps can traders take if they detect fraudulent activity on their TRADE.com account?

If traders suspect fraudulent activity on their TRADE.com account, they should notify customer support conversely and take proper security actions, including resetting passwords and using 2FA.

Conclusion

According to our findings, TRADE.com is also a reliable Forex and CFD broker known for its user-friendly interface, extensive trading instruments, and high regulatory compliance. Its low spreads and extensive training materials certainly appeal to new and experienced traders.

However, our research shows it faces limitations like leverage limits and increased market volatility.

Despite these, we can conclude that TRADE.com prioritizes security measures like segregated accounts and two-factor authentication, demonstrating its commitment to a secure trading environment.

For more information on FXLeaders.

Faq

It is an online broker platform that provides trading in a broad range of financial products. These include equities, currency, commodities, indexes, and others.

TRADE.com’s withdrawal processing time varies based on the method and processes used. However, it typically ranges from 3 to 7 days.

Yes, TRADE.com provides social trading capabilities via its relationship with TradingView.

Yes, TRADE.com is regarded as a secure broker since respected financial authorities authorize it and follow strong security protocols such as segregated accounts, encryption technology, and two-factor authentication.

Yes, TRADE.com enables automated trading methods using the MetaTrader 5 platform.

TRADE.com is headquartered in Cyprus and has other offices and activities in many countries.

No, TRADE.com does not impose deposit or withdrawal limits, enabling traders to handle their funds as needed.