The 10 Best Silver Trading Brokers

The 10 Best Silver Trading Brokers revealed. Silver is cherished for its industrial applications and is a popular financial instrument that can be used as a hedge against volatility.

This comprehensive guide identifies the 10 Best Silver Trading Brokers that meet high regulatory standards, provide competitive silver trading conditions, and provide superior customer support.

In this in-depth guide, you’ll learn:

- Why You Should Invest in Silver, is it Profitable?

- Who are the 10 Top Silver Trading Brokers?

- Exploring Silver versus Other Precious Metals.

- Top Silver Trading Strategies and Tips.

- The Future of Silver Trading.

- Conclusion on The 10 Best Silver Trading Brokers

- FAQs on Brokers trading with Silver.

And lots more…

So, if you’re ready to go “all in” with The 10 Best Silver Trading Brokers…

Let’s dive right in…

The 10 Best Silver Trading Brokers (2024*)

- ☑️ CMC Markets – Leading and Top global Commodity provider.

- ☑️ FP Markets – Experience Superior Silver Trading Conditions.

- ☑️ AAAFx – Leading online trading solutions for traders.

- ☑️ Tickmill – offers four bonds for trading.

- ☑️ HFM – Sustainable silver trading Network.

- ☑️ Markets.com – access to direct Silver pricing.

- ☑️ Exness – ultimate online Metals trading platform.

- ☑️ AvaTrade– Silver top available investment.

- ☑️ FBS – Excellent Metals trading opportunities.

- ☑️ Eightcap – Well-known and established Commodity Broker.

Why Should You Invest in Silver?

Silver trading provides a unique option for commodities traders who want to diversify their portfolios and profit from price movements in this lucrative market.

Furthermore, silver has a unique position in the market because it serves industrial and financial functions. Unlike some other commodities, the value of silver is impacted by supply and demand in industries such as technology, manufacturing, and jewelry.

Silver is often seen as more than a valuable meta but a substance that can be used and applied in various industries. Traders must know that the price of silver can fluctuate drastically and quickly, allowing traders to profit. However, silver trading also has significant risks.

A distinguishing factor regarding silver is its cost is often much lower than gold. Therefore, this allows more traders to invest and possibly profit from silver trading.

Silver is used across several developing technologies, including solar panels and electronics, indicating an increasing need.

What does this mean for investors? This means that investing in silver revolves around present market patterns and future growth potential. In other words, silver trading can effectively combine classic financial expertise with cutting-edge industrial innovations.

Who are the 10 Best Silver Trading Brokers?

| 👥Brokers | 👉 Open Account | ⬆️ Typical Silver Spreads | 📉 Maximum Leverage on Silver | 🏴 Short (Sell) Swaps on Silver | 🛒Long (Buy) Swaps on Silver |

| CMC Markets | 👉 Open Account | 2.5 pips | 1:10 | Flexible, customized | Flexible, customized |

| FP Markets | 👉 Open Account | 0.0 pips | 1:500 | 2.77 pips | -4.18 pips |

| AAAFx | 👉 Open Account | 0.003 pips | 1:100 | Flexible, customized | Flexible, customized |

| Tickmill | 👉 Open Account | 0.0 – 0.21 pips | 1:1000 | 2.86 pips | -4.8 pips |

| HFM | 👉 Open Account | 0.028 pips | 1:100 | 0.0 pips | -1.5 pips |

| Markets.com | 👉 Open Account | <1 pip | 1:30 (Retail), 1:300 (Pro) | Variable, customized | Variable, customized |

| Exness | 👉 Open Account | 6 pips | Depending on equity, it can be 1:500 to unlimited | 0.0 pips | -0.29 pips |

| AvaTrade | 👉 Open Account | $0.029 over-market | 1:50 | 0.0060% | -0.0176% |

| FBS | 👉Open Account | 0.029 pips | 1:500 | 0.0 pips | -3.8 pips |

| EightCap | 👉 Open Account | 0.001 USD | 1:10 (ASIC), 1:100 (SCB) | 2.8 pips | -4.9 pips |

CMC Markets

Overview

CMC Markets is well-known for its low trading costs, easy-to-use online and mobile interfaces, and comprehensive training materials.

Furthermore, CMC Markets adheres to strict restrictions imposed by top-tier authorities and offers a wide range of trading choices in CFDs, including forex, indices, commodities, shares, ETFs, bonds, and cryptocurrencies for customers outside the United Kingdom.

Regarding silver trading, CMC Markets emphasizes its appeal as a trading commodity since it is both a secure investment and has several industrial applications.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | ASIC, CySEC, FSCA, FCA and FSA |

| 📈Starting spread | 0.0 pips |

| 💵 Minimum Commission per Trade | US$3 per side |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | 50 lots |

| 📉 Maximum Leverage | 1:500 |

| 💰 Minimum Deposit | 100 AUD |

| 🏪 Customer Service Hours | 24/7 |

| 🎓 Education for beginners | Yes |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 IRESS cTrader FP Markets App |

| 📉 Trading Assets | Forex Shares Indices Commodities Cryptocurrencies Bonds ETFs |

| ➕ Bonuses for traders? | ❌ No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | 2.5 pips |

| Maximum Leverage on Silver | 1:10 |

| Short (Sell) Swaps on Silver | Flexible, customized |

| Long (Buy) Swaps on Silver | Flexible, customized |

Pros and Cons

| ✔️Pros | ❌Cons |

| CMC Markets provides competitive silver trading conditions | Some CFDs have high fees |

| CMC Markets has a 99.9% fill rate and reliable execution speeds | The price volatility of silver can increase drastically, exposing traders to risks |

| CMC Markets has high platform stability | |

| Traders can use powerful trading platforms to trade silver CFDs |

FP Markets

Overview

FP Markets is well-known for its range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and IRESS, offering the sophisticated tools silver traders need to develop and refine strategies for the commodities market.

Furthermore, FP Markets’ combination of competitive trading conditions and robust tools meets the diverse needs of various traders regardless of their trading skills.

When trading silver against major currencies, FP Markets lets traders use leverage of up to 1:500 on commodities.

In addition, FP Markets emphasizes the advantages of trading metals contracts for difference (CFDs), such as the possibility of hedging and minimal margin requirements.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | ASIC, CySEC, FSCA, FCA and FSA |

| 📈Starting spread | 0.0 pips |

| 💵 Minimum Commission per Trade | US$3 per side |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | 50 lots |

| 📉 Maximum Leverage | 1:500 |

| 💰 Minimum Deposit | 100 AUD |

| 🏪 Customer Service Hours | 24/7 |

| 🎓 Education for beginners | Yes |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 IRESS cTrader FP Markets App |

| 📉 Trading Assets | Forex Shares Indices Commodities Cryptocurrencies Bonds ETFs |

| ➕ Bonuses for traders? | ❌ No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | 0.0 pips |

| Maximum Leverage on Silver | 1:500 |

| Short (Sell) Swaps on Silver | 2.77 pips |

| Long (Buy) Swaps on Silver | -4.18 pips |

Pros and Cons

| ✔️Pros | ❌Cons |

| FP Markets charges competitive spreads on metals CFDs | There are complex commission structures on some account types |

| Traders can access several features with MetaTrader, including EAs, one-click trading, and more | There is a subscription fee to use IRESS |

| FP Markets is well-regulated globally | |

| Traders can expect access to award-winning customer support |

AAAFx

Overview

AAAFx is a global Forex and CFD broker based in Greece. AAAFx offers various financial products, including forex, commodities, indices, stocks, and cryptocurrencies.

With this, traders can participate in silver trading using CFDs (Contracts for Difference), allowing traders to speculate on price swings without physically holding the metal.

In addition, with AAAFx, silver prices can vary greatly because of industrial demand, investment patterns, geopolitical conditions, and fluctuations in the value of the US dollar.

AAAFx provides user-friendly platforms like MetaTrader 4 (MT4) and MetaTrader 5, including real-time price updates, comprehensive charting capabilities, and the ability to deploy automated trading strategies while trading commodities like silver.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, HCMC |

| 📈Starting spread | 0.0 pips EUR/USD |

| 💵 Minimum Commission per Trade | $1.5 |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | Unlimited |

| 📉 Maximum Leverage | 1:500 |

| 💰 Minimum Deposit | 100 USD |

| 🏪 Customer Service Hours | 24/5 |

| 🎓 Education for beginners | Yes |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 ZuluTrade ActTrader |

| 📉 Trading Assets | Forex Indices Commodities Stocks Cryptocurrency |

| ➕ Bonuses for traders? | ✔️ Yes |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | 0.003 pips |

| Maximum Leverage on Silver | 1:100 |

| Short (Sell) Swaps on Silver | Flexible, customized |

| Long (Buy) Swaps on Silver | Flexible, customized |

Pros and Cons

| ✔️Pros | ❌Cons |

| Traders can use several graphical objects, customizable charts, and EAs to navigate silver trading | AAAFx does not have Tier-1 regulation |

| There are no restrictions on the use of strategies such as hedging or scalping | There is a narrow range of tradable instruments |

| There are competitive conditions in silver trading, making it affordable for traders | AAAFx does not have proprietary trading software |

| Traders can engage in social trading with ZuluTrade, allowing them to gain insights from experienced silver traders |

Tickmill

Overview

Tickmill is a reputable broker that offers appealing options for trading silver and other metals, including using leverage of up to 1:1000 on hard commodities like silver.

This is appealing to traders who want to open larger positions on silver, allowing them to profit from market volatility and price movements on this commodity.

Furthermore, Tickmill provides three major account types: Classic, Pro, and VIP. Each of these retail accounts is tailored to the objectives and trading styles of various traders.

Tickmill uses the MetaTrader 4 (MT4) platform, which gives users access to powerful trading tools, including customizable charting and over 50 indicators, giving traders a competitive edge in silver trading.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| 📈Starting spread | From 0.0 pips |

| 💵 Minimum Commission per Trade | $1 per side, per standard lot traded |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | 100 lots |

| 📉 Maximum Leverage | 1:1000 |

| 💰 Minimum Deposit | 100 USD |

| 🏪 Customer Service Hours | 24/5 |

| 🎓 Education for beginners | Yes |

| 📊 Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| $ USD Accounts | ✔️ Yes |

| $ USD Deposits | ✔️ Yes |

| Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | $1 per side, per standard lot traded |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | 0.0 – 0.21 pips |

| Maximum Leverage on Silver | 1:1000 |

| Short (Sell) Swaps on Silver | 2.86 pips |

| Long (Buy) Swaps on Silver | -4.8 pips |

Pros and Cons

| ✔️Pros | ❌Cons |

| Traders can use high leverage to trade silver with the benefit that negative balance protection applies | Tickmill does not offer a proprietary platform for desktop or web |

| Tickmill has a strong regulatory framework and guarantees client fund security | The platform has a design that might feel outdated to some traders |

| Traders can expect competitive trading conditions on silver and other metals | Tickmill’s customer support is not available over weekends or on public holidays |

| Tickmill offers dedicated 24/5 support across communication channels |

HFM

Overview

HFM allows traders to diversify their investment portfolios by trading silver and other precious metals using Contracts for Difference (CFDs).

HFM is renowned for charging tight spreads and offering leverage of up to 1:100 on precious metals like silver and gold, allowing traders to open larger positions regardless of their investment amount.

In addition, to create a more dynamic silver trading environment, HFM offers the popular MetaTrader 4 and 5 platforms.

These popular options offer extensive analytical tools, technical indicators, and Expert Advisors for automated trading. HFM also offers several educational materials and resources like webinars, e-books, and market research to help traders make informed decisions while trading commodities.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📈Starting spread | 0.0 pips |

| 💵 Minimum Commission per Trade | From $6 per round turn on Forex |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | 60 lots |

| 📉 Maximum Leverage | 1:2000 |

| 💰 Minimum Deposit | 0 USD |

| 🏪 Customer Service Hours | 24/5 |

| 🎓 Education for beginners | Yes |

| 📊 Trading Platforms | MetaTrader 4 and MetaTrader 5 HFF App |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | 0.028 pips |

| Maximum Leverage on Silver | 1:100 |

| Short (Sell) Swaps on Silver | 0.0 pips |

| Long (Buy) Swaps on Silver | -1.5 pips |

Pros and Cons

| ✔️Pros | ❌Cons |

| Traders can open positions 100x their initial investment when trading commodities | HFM offers negative balance protection, but traders can still lose their invested funds if they abuse leverage |

| Traders can use the feature-rich MetaTrader suite to create a dynamic trading environment | HFM does not offer a proprietary desktop or web profile, and the mobile app has limited functionality |

| Traders can make informed decisions in silver trading because of the market analysis and insights HFM offers | |

| Traders can participate in social trading through HFCopy, allowing them to copy successful metals traders’ strategies |

Markets.com

Overview

Markets.com is a popular platform for trading various financial assets, including silver and other soft and hard commodities.

Markets.com offers tight spreads and commission-free trades, with silver trading spreads starting below 1 pip, depending on market conditions and other factors.

In addition, Markets.com also provides unique trading tools and educational materials, such as Daily Analyst Recommendations, Insiders’ Stuff, Social Sentiment, and Hedge Fund Activities, which provide market trends and behaviors.

These tools are especially beneficial to traders in creating and maintaining positions, developing strategies, and keeping updated with commodity market occurrences.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | ASIC, CySEC, FSCA, FCA, BVI FSC |

| 📈Starting spread | 0.6 pips EUR/USD |

| 💵 Minimum Commission per Trade | Commission-free |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | 100 lots |

| 📉 Maximum Leverage | Retail – 1:30 Professional – 1:300 |

| 💰 Minimum Deposit | 50 USD |

| 🏪 Customer Service Hours | 24/5 |

| 🎓 Education for beginners | Yes |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 Markets.com |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | <1 pip |

| Maximum Leverage on Silver | 1:30 (Retail), 1:300 (Pro) |

| Short (Sell) Swaps on Silver | Variable, customized |

| Long (Buy) Swaps on Silver | Variable, customized |

Pros and Cons

| ✔️Pros | ❌Cons |

| Markets.com’s tight spreads and no commissions attract traders of all skill levels | There may be withdrawal minimums applied |

| Several unique trading tools can help silver traders | Slippage can occur during volatile market periods |

| There is an extensive range of other instruments that allow traders to spread their risk through diversification | The spreads with Markets.com are wider than those charged by other brokers on silver |

| Markets.com’s platforms are feature-rich and user-friendly |

Exness

Overview

Exness is a forex and CFD broker and trading partner that simplifies and streamlines trading in the silver market, among other commodities markets.

Regarding trading platforms, Exness allows traders to choose between MetaTrader 4, MetaTrader 5, and its proprietary trading platforms.

Furthermore, when traders participate in silver markets, they can expect competitively low commission fees, swap rates, and tight spreads.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA |

| 📈Starting spread | 0.0 pips EUR/USD |

| 💵 Minimum Commission per Trade | From $0.1 per side, per lot |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | Unlimited |

| 📉 Maximum Leverage | Unlimited |

| 💰 Minimum Deposit | Depends on the payment system chosen |

| 🏪 Customer Service Hours | 24/7 |

| 🎓 Education for beginners | Yes |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 Exness Terminal Exness Trader app |

| 📉 Trading Assets | Forex Indices Shares Commodities Cryptocurrencies Futures Options |

| 💻 Trading Accounts | IG Trading Account Limited Risk Account Islamic Account (Dubai traders only) Demo Account |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ❌ No |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes (Dubai customers only) |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | 6 pips |

| Maximum Leverage on Silver | Depending on equity, it can be 1:500 to unlimited |

| Short (Sell) Swaps on Silver | 0.0 pips |

| Long (Buy) Swaps on Silver | -0.29 pips |

Pros and Cons

| ✔️Pros | ❌Cons |

| Exness is extremely well-regulated in several regions, instilling investor confidence | Exness offers limited financial instruments, making diversification across markets challenging |

| Exness offers a transparent fee schedule across all markets and instruments | Floating spreads on silver trades can widen during high-volatility periods |

| Silver traders can choose from powerful trading platforms available across different devices | |

| Exness offers several versatile accounts through which traders can participate in commodity trades |

AvaTrade

Overview

AvaTrade is a popular broker for silver trading based on its commission-free trades, fast execution speeds, and fixed spreads. Furthermore, AvaTrade offers a transparent fee schedule across markets, showing traders all trading and non-trading fees they could incur.

AvaTrade offers a choice between several trading platforms, each with unique features that can benefit different silver traders.

Furthermore, traders can use AvaSocial and ZuluTrade to participate in social trading, where they can copy the trades of successful commodities traders.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 📈Starting spread | 0.9 pips EUR/USD |

| 💵 Minimum Commission per Trade | None; only the spread is charged |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | Unlimited |

| 📉 Maximum Leverage | 1:30 (Retail) 1:400 (Pro) |

| 💰 Minimum Deposit | Depends on the payment system chosen |

| 🏪 Customer Service Hours | 24/5 |

| 🎓 Education for beginners | ✔️ Yes |

| 📊 Trading Platforms | AvaTrade WebTrader AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 📉 Trading Assets | "Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals" |

| 💻 Trading Accounts | Retail Account, Professional Account |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | $0.029 over-market |

| Maximum Leverage on Silver | 1:50 |

| Short (Sell) Swaps on Silver | 0.0060% |

| Long (Buy) Swaps on Silver | -0.0176% |

Pros and Cons

| ✔️Pros | ❌Cons |

| AvaTrade stands out as a well-regulated and secure option for silver trading | AvaTrade has an inactivity fee, which could mean high fees for those using long-term silver trading strategies |

| AvaTrade charges low, fixed spreads across instruments | Withdrawal limits apply |

| Traders can use AvaTrade’s educational resources to get started in commodities trading, giving them a solid foundation | The spreads on fixed accounts can be higher when compared to STP and ECN accounts |

| There are robust trading platforms that cater to different traders and strategies |

FBS

Overview

As a prominent Broker, they welcome silver traders and is a flexible and well-regulated CFD and Forex broker. FBS supports powerful trading platforms and offers a versatile retail account, with leverage options of up to 1:3000 on forex major pairs and 1:500 on metals.

They are known for their low minimum investment, giving silver traders access to dynamic trading environments where they can start with small positions. FBS offers 24/7 customer support across channels, and traders can expect multilingual support.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | IFSC, CySEC, ASIC, FSCA |

| 📈Starting spread | 0.7 pips |

| 💵 Minimum Commission per Trade | None; only the spread is charged |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | 500 lots |

| 📉 Maximum Leverage | 1:3000 |

| 💰 Minimum Deposit | 5 USD |

| 🏪 Customer Service Hours | 24/5 |

| 🎓 Education for beginners | ✔️ Yes |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5 FBS Trader App |

| 📉 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 🔎 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 🚀 USD-based Account? | ✔️ Yes |

| 💳 USD Deposits Allowed? | ✔️ Yes |

| 💰 Bonuses for traders? | ✔️ Yes |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | ✔️ Yes |

| ✔️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | 0.029 pips |

| Maximum Leverage on Silver | 1:500 |

| Short (Sell) Swaps on Silver | 0.0 pips |

| Long (Buy) Swaps on Silver | -3.8 pips |

Pros and Cons

| ✔️Pros | ❌Cons |

| FBS offers several other instruments, allowing traders to diversify their portfolios | FBS no longer offers copy trading |

| There are no commissions charged on trades | FBS removed all other account types, including the Cent account, which was beneficial to beginners |

| FBS offers high leverage and the benefit of negative balance protection | High leverage can lead to substantial losses if used incorrectly or abused |

| FBS offers a single trading account that offers competitive trading conditions suited to most types of traders |

Eightcap

Overview

Eightcap is renowned for its CFD and forex offer across several popular markets. Eightcap provides access to over 800 financial products, including silver trading, ensuring traders can build a diversified portfolio and spread their risks.

Furthermore, Eightcap provides a full trading experience using the MetaQuotes and TradingView platforms.

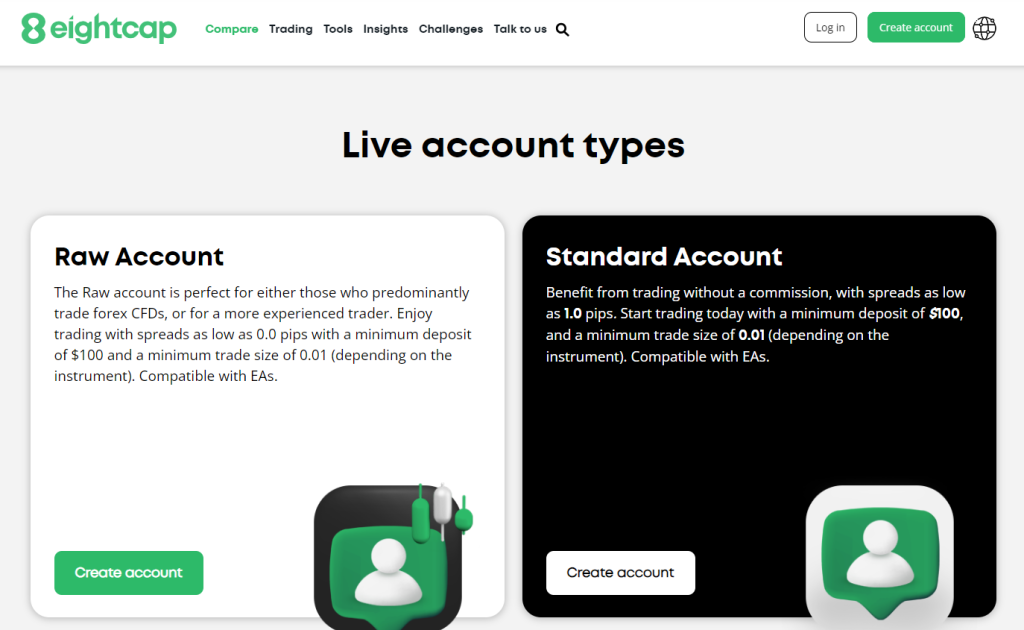

With Eightcap, traders can choose between three versatile trading accounts according to their trading needs and experience level: Standard, Raw, and TradingView Account, each with unique features and trading conditions.

The Standard and TradingView accounts are ideal for beginners and casual traders, featuring commission-free trading.

In contrast, the Raw account is designed for experienced traders, featuring narrower spreads, but requires a $3.5 commission fee per side.

All three accounts provide competitive leverage of up to 1:500, a choice between account-based currencies, and a straightforward account setup procedure.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | ASIC, VFSC |

| 📈Starting spread | 0.0 pips |

| 💵 Minimum Commission per Trade | $3.5 per side |

| 📈 Minimum Trade Size | 0.01 lots |

| ➕📊 Maximum Trade Size | 100 lots |

| 📉 Maximum Leverage | 1:500 |

| 💰 Minimum Deposit | 100 USD |

| 🏪 Customer Service Hours | 24/5 |

| 🎓 Education for beginners | ✔️ Yes |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 TradingView |

| 📉 Trading Assets | 800+ including Forex, CFDs on Shares, Indices, Cryptocurrencies, Commodities |

| 🔎 Trading Accounts | Standard, Raw ECN |

| 🚀 USD-based Account? | ✔️ Yes |

| 💳 USD Deposits Allowed? | ✔️ Yes |

| 📲 Social Media Platforms | Instagram You Tube |

| 💰 Bonuses for traders? | ✔️ Yes |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | ✔️ Yes |

| ✔️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Silver Trading Conditions

| 🔎 Feature | 👁️🗨️ Information |

| Typical Silver Spreads | 0.001 USD |

| Maximum Leverage on Silver | 1:10 (ASIC), 1:100 (SCB) |

| Short (Sell) Swaps on Silver | 2.8 pips |

| Long (Buy) Swaps on Silver | -4.9 pips |

Pros and Cons

| ✔️Pros | ❌Cons |

| There are three powerful trading platforms to choose from, giving silver traders a feature-rich experience | There are some limitations on Eightcap’s stock trading options as the broker only offers CFDs and no direct trading, limiting diversification |

| Traders can diversify their portfolios with Eightcap’s range of other instruments | Eightcap might impose limits on leverage according to regulations |

| Eightcap is well-regulated and ensures client fund security | |

| Traders can expect commission-free options on the TradingView and Standard Accounts |

Exploring Silver versus Other Precious Metals – How does it stand out?

Silver, a “democratic metal,” is less expensive and has a wider range of applications than gold, platinum, and palladium.

The inherent value of silver lies in its thermal and electrical conductivity, reflectivity, and resistance to microbes, which make it essential in electronics, solar panels, and medical equipment.

Silver’s market value is directly linked to the global economy’s health, making its price more volatile than other metals, especially gold.

Furthermore, this volatility presents traders with risks and profitable opportunities, further setting silver trading apart from more stable, long-term gold trading.

In addition, Silver’s lower price point makes it more accessible to a wider range of investors and traders, allowing them to invest in precious metals without spending as much money as they would on gold or platinum.

Top Silver Trading Strategies

Silver traders employ several unique strategies to make educated trading decisions in this volatile market, including the following

✅Technical analysis involves examining charts and indicators to forecast how prices will move in the near term. Because silver prices are very volatile, indicators such as moving averages, the Relative Strength Index (RSI), and Fibonacci retracements are often employed to identify trends and possible turning points.

✅Following macroeconomic news – Silver prices are susceptible to global economic shifts, so news regarding industrial development, solar energy investments, and technological breakthroughs can have a significant influence.

Besides these top strategies, traders must know that several seasonal factors can affect the silver market. Furthermore, historical trends demonstrate that certain periods of the year produce predictable price changes.

For example, rising demand from sectors toward the conclusion of the fiscal year might drive silver prices upward. Knowing these trends might offer traders an edge in the market.

The Future of Silver Trading

The future of silver trading looks extremely promising for industries and investors alike due to a combination of classic and innovative tendencies.

Because silver is critical in industries, continuous technological improvements, particularly in areas like renewable energy and electronics, are projected to maintain demand in the long term.

Furthermore, as economies worldwide continue to flourish, the demand for silver in sectors is expected to rise, possibly leading to higher prices and more volatile market conditions.

At the same time, the appeal of silver as an investment is likely to increase. This is especially true when there is instability in the economy or with inflation fluctuations. During these times, precious metals are often sought after as secure investments.

With traders’ ease of access to silver trading, the number of investors exhibiting interest in precious metals is increasing. Because of this, we can see more individuals participating in the silver market.

However, despite these considerations, traders and investors must be cautious of issues that could impact the future of silver.

These include prospective technical breakthroughs that can diminish industrial demand for silver, changes in energy policy, and changes in the general economic environment.

Therefore, traders are urged to stay updated and adaptive to ensure they can successfully navigate the silver market in the years ahead.

Conclusion

According to our findings, silver trading has a unique position in precious metals. It has a long history of conserving riches and is often used in contemporary enterprises.

In our experience, this dichotomy makes silver trading dynamic, presenting investors with challenges and possible benefits. Therefore, to thrive in this market, traders must be well-informed and possess excellent tactics for dealing with its ups and downs.

According to our analysis, top silver trading brokers such as Exness, AvaTrade, Tickmill, Exness, and other brokers on our list provide outstanding silver trading opportunities and support services.

Furthermore, these brokers provide reliable trading platforms rich educational resources, and maintain regulatory compliance.

Overall, these features appeal to traders of all skill levels, from seasoned pros to novices.

Frequently Asked Questions

How can I choose the best silver trading broker?

Factors such as fund rules and safety, fees, available silver trading instruments (CFDs, ETFs, etc.), platforms/technology, and instructional resources are examined. Furthermore, select brokers that share your investing objectives and degree of expertise.

Is silver trading appropriate for beginners?

Yes, it can be. However, silver is a volatile market. Therefore, before trading, educate yourself on market dynamics and risk management. Furthermore, most brokers provide demo accounts, educational materials, and tools tailored to beginner silver traders.

What are the advantages of choosing a specialist broker for silver trading?

Specialized brokers often provide a broader selection of silver-related instruments, superior pricing, and in-depth market information tailored to the silver market.

Can I trade silver directly or only via derivatives?

You can trade both. However, most individual investors trade silver using derivatives such as CFDs (Contracts for Difference) or ETFs. In contrast, direct ownership of real silver bullion is possible, but it is often best suited for institutional traders who use more specialized broker firms.

What are the standard fees related to silver trading?

Costs may include spreads (the difference between buying and selling prices), commissions, overnight financing costs, and sometimes inactivity fees.

Find us on social media as well.