GBP/USD Price Forecast: Dips to 1.26160 Amid US GDP, Job Claims Anticipation

Arslan Butt•Thursday, March 28, 2024•2 min read

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

The GBP/USD exchange rate today observed a minor decrease, settling at 1.26160, a decline of 0.18%. This movement is indicative of the current market sentiment, reflecting recent economic data releases and anticipated events.

In the United Kingdom, the financial landscape appears mixed, with the current account deficit slightly outperforming expectations at -21.2B GBP, versus the forecasted -21.3B GBP, yet still underscoring a significant shortfall.

The GDP figures for the final quarter remained stagnant at -0.3%, aligning with prior estimates and suggesting a sluggish economic momentum. However, a silver lining emerges with revised business investment showing a modest uptick to 1.4%, hinting at cautious optimism among investors.

Looking ahead, the United States presents a packed economic agenda, with several key data releases poised to influence market dynamics. The final GDP for the quarter is anticipated to confirm a 3.2% growth rate, mirroring previous estimates and indicating robust economic health.

Unemployment claims are expected to slightly decrease to 212,000 from 210,000, reflecting steady labour market conditions. The final GDP price index is projected to remain at 1.6%, suggesting stable inflationary pressures.

Furthermore, the Chicago PMI and pending home sales data will offer additional insights into the US economy’s state. A forecasted downturn in the Chicago PMI to 45.9 from 44.0 and a decrease in pending home sales by -4.9% from a 1.4% increase could signal challenges in the manufacturing sector and housing market, respectively.

The revised University of Michigan Consumer Sentiment Index remains static at 76.5, providing a gauge of consumer confidence amidst economic uncertainties.

These forthcoming US events are critical for investors and analysts, potentially impacting the GBP/USD rate as market participants assess the broader economic outlook and adjust their strategies accordingly.

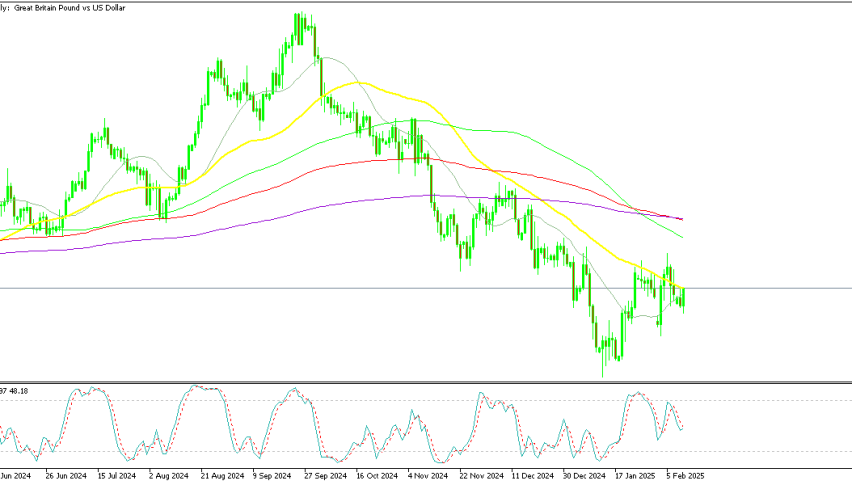

GBP/USD Price Forecast: Technical Outlook

Today’s GBP/USD price analysis sees a modest retreat to 1.26160, marking a decrease of 0.18%. As it navigates near the pivot point at 1.25851, the pair shows potential for resilience or further pullback.

Immediate resistance is charted at 1.26509, with further ceilings at 1.27044 and 1.27560, signaling key hurdles for any uptrend continuation. Support levels emerge at 1.25399, reinforced by 1.25022 and 1.24629, providing critical junctures to halt declines.

The pair’s positioning above a double bottom pattern near the pivot point suggests a bullish inclination, yet the RSI at 42 and the 50-day EMA at 1.26691 indicate a cautious market sentiment. A sustained move above the pivot reinforces a bullish outlook, whereas slipping below it might catalyze a sell-off.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Arslan Butt

Index & Commodity Analyst

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments

Sidebar rates

Top

FX

Crypto

Commodities

Indices

Start Trading

Related Posts

U have been succesfuly subscribed!