7 Best EA Programs for Forex Traders

The 7 Best EA Programs for Forex Traders revealed. Automated trading has become a saving grace for traders with busy schedules. However, because the market is saturated with these trading bots, traders might find it impossible to choose the right one.

Therefore, we have tested some of the most prominent programs to find the 7 that show the most promise for those using automated strategies to trade forex.

In this in-depth guide, you’ll learn:

- What is the Role of EAs in Automated Forex Trading?

- What are the 7 Best EA Programs for Forex Traders?

- What are the Key Features to Look for in Forex EAs?

- What are the Advantages and Limitations of EAs in Forex Trading?

- Our Conclusion on The 7 Best EA Programs for Forex Traders

- Popular FAQs about The 7 Best EA Programs for Forex Traders

And lots more…

So, if you’re ready to go “all in” with The 7 Best EA Programs for Forex Traders…

Let’s dive right in…

🏆 7 Best Forex Brokers

🏆 7 Best Forex Brokers

| 🥇 |  | Minimum Deposit $100 |  |

| 🥈 |  | Minimum Deposit $5 |  |

| 🥉 |  | Minimum Deposit $25 |  |

| 4 |  | Minimum Deposit $200 |  |

| 5 |  | Minimum Deposit $5 |  |

| 6 |  | Minimum Deposit $200 |  |

| 7 |  | Minimum Deposit $1 |  |

What is the Role of EAs in Automated Forex Trading?

Expert Advisors, dubbed EAs, are the linchpin in automated forex trading strategies. These trading bots transcend the typical restrictions of human analysis by relying on accurate, sophisticated algorithms that can be used directly on the trading platform.

These bots operate according to sets of coded instructions, and they take the mundane task of analyzing markets out of the trader’s hands to execute trades according to predefined parameters. Therefore, EAs mitigate any emotional biases while simultaneously enhancing precision.

EAs have opened the doors to data-driven trading decisions using mathematical models and historical data to forecast market movements. Furthermore, EAs allow traders to keep trading without constantly monitoring their trading terminals.

Best EA Programs for Forex Traders

| 👥 Broker | 💰 Cost / Fees | ⚖️Trading Instruments | 💻 Platform Compatibility |

| 1. Forex Fury | License options are offered with free updates for life | Forex, Indices, Crypto | NFA, FIFO, ECN, MT4, MT5 Build 600+ |

| 2. Forex Flex EA | Various licensing options are available | All major forex pairs | MT4, MT5, NFA, FIFO |

| 3. Night Hunter Pro | One-time license | Forex major and minor pairs | MetaTrader 4 and 5 |

| 4. Odin Forex Robot | Typically costs $199, with discounts reducing the price to $99. There are no refunds | Several markets | MetaTrader 4 |

| 5. Happy Forex | Offers a pack of 10 EAs with a single license | Major, Minor, Exotic Forex Pairs | MT4, MT5 |

| 6. FX Pattern Pro | From $129 with different upsells | Various markets | Compatible with most major platforms, including MT4 and 5 |

| 7. Forex Diamond EA | Offers a lifetime license at $297 | Optimized for major forex pairs | MT4, MT5 |

7 Best EA Programs for Forex Traders

- ☑️Forex Fury – Best fully automated trading bot.

- ☑️Forex Flex EA – Rated The Best Forex EA Of 2024.

- ☑️Night Hunter Pro – The #1 rated scalping Forex robot.

- ☑️Odin Forex Robot – Powerful trading robot designed for traders.

- ☑️Happy Forex – A MetaTrader expert advisor for forex trading.

- ☑️FX Pattern Pro – An easy-to-use software package.

- ☑️Forex Diamond EA – High-Performance Forex Trading System

What are the 7 Best EA Programs for Forex Traders?

Forex Fury

Overview

Forex Fury is one of the most well-known trading robots compatible with MetaTrader 4 and 5. Forex Fury is renowned as a powerhouse in automated trading technology, with a substantial winning track record of 93%.

The broker is known for being robust and backed by live verified trading results. Forex Fury supports several trading strategies, and the bot offers traders safe and aggressive trading solutions.

Furthermore, Forex Fury has full-length installation guides, dedicated customer support, and profitable settings.

Unique Features

| Feature | Information |

| ⚖️ Track Record | Verified by Myfxbook accounts, 93%-win rate |

| ✔️ Drawdown | Aims to balance aggressive trading and safety |

| 💵 Win Rate vs. Profitability | High win rate, strategies for sustainable profits |

| 💸 Cost/Fees | License options are offered with free updates for life |

| 📱 Trading Style | Low, medium, and high-risk strategies |

| 📈 Market Conditions | Varying conditions |

| 📊 Trading Instruments | Forex, Indices, Crypto |

| 📉 Backtesting Capabilities | Tested and proven set files |

| 💻 Platform Compatibility | NFA, FIFO, ECN, MT4, MT5 Build 600+ |

| 🪪 Ease of Use | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Forex Fury can be used across markets | The initial investment might be too high for some |

| The installation is easy | Extreme volatility in the markets could affect the predictability of the bot’s performance |

| Traders can customize the bots to suit their risk tolerance and strategies | |

| The bot has a 93%-win rate | |

| Verified with Myfxbook accounts | |

| Compatible with several platforms |

Forex Flex EA

Overview

Forex Flea EA is innovative and renowned for being flexible across MetaTrader 4 and 5 platforms. Forex Flex EA is known for its “virtual trades” that monitor markets to identify the best entry points.

Furthermore, Forex Flex EA has won the Best EA of 2024 award, demonstrating its effectiveness and reliability. Other benefits of Forex Flex EA are its customizability and range of supported markets.

Unique Features

| Feature | Information |

| ⚖️ Track Record | Good track record, award-winning |

| ✔️ Drawdown | Virtual trade technology to minimize drawdowns |

| 💵 Win Rate vs. Profitability | Optimized settings balance win rates to achieve long-term growth |

| 💸 Cost/Fees | Various licensing options are available |

| 📱 Trading Style | Various strategies and trading styles |

| 📈 Market Conditions | Adaptable due to built-in indicators and parameters |

| 📊 Trading Instruments | All major forex pairs |

| 📉 Backtesting Capabilities | Accurate backtests with high configuration |

| 💻 Platform Compatibility | MT4, MT5, NFA, FIFO |

| 🪪 Ease of Use | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Award-winning bot | Beginners might face a learning curve with the range of settings and options |

| Highly customizable and supports several strategies | Relies heavily on constant updates |

| Ideal for beginner and professional traders | |

| Offers innovative technology | |

| Offers direct developer support | |

| The performance can be verified with real accounts |

Night Hunter Pro

Overview

Night Hunter Pro is a sophisticated program ideal for the forex market. This bot uses the market times when liquidity is at its lowest to maximize efficiency.

Night Hunter Pro works seamlessly with the MetaTrader 4 and 5 platforms, offering effortless setup and use. Furthermore, Night Hunter Pro supports several currency pairs across major and minor currencies.

Unique Features

| Feature | Information |

| ⚖️ Track Record | Verified through live accounts |

| ✔️ Drawdown | Aims for stability, balancing aggressive scalping and risk management to decrease drawdown |

| 💵 Win Rate vs. Profitability | Uses scalping strategies for high rates and profitability |

| 💸 Cost/Fees | One-time license |

| 📱 Trading Style | Scalping |

| 📈 Market Conditions | Less volatile market hours |

| 📊 Trading Instruments | Forex major and minor pairs |

| 📉 Backtesting Capabilities | 20-year backtesting period using tick data |

| 💻 Platform Compatibility | MetaTrader 4 and 5 |

| 🪪 Ease of Use | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are Myfxbook verified results that show the bot’s returns since its launch | Mainly operates during low liquidity times, which is not compatible with all strategies |

| The program uses aggressive scalping strategies | Scaling can be extremely risky |

| It is easy to set up and use the program | Performance can depend on the broker used |

| The program offers high-parameter adjustments |

Odin Forex Robot

Overview

The Forex Robot Trader team created Odin Forex Robot to use advanced grid trading strategies, allowing it to spot entry points in the financial markets. Furthermore, Odin Forex Robot aims to target reversals and trends, allowing it to capture large movements.

Unique Features

| Feature | Information |

| ⚖️ Track Record | Backtest performances |

| ✔️ Drawdown | Not provided |

| 💵 Win Rate vs. Profitability | Claims high win rates |

| 💸 Cost/Fees | Typically costs $199, with discounts reducing the price to $99. There are no refunds |

| 📱 Trading Style | Grid trading |

| 📈 Market Conditions | Various market conditions |

| 📊 Trading Instruments | Several markets |

| 📉 Backtesting Capabilities | Available |

| 💻 Platform Compatibility | MetaTrader 4 |

| 🪪 Ease of Use | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The program is fully automated with little setup needed | There are no verified live results |

| The grid strategy is ideal for capturing many opportunities | Grid trading can be extremely risky |

| The broker shield technology shields traders’ information from brokers | There are no refund policies |

| The program is optimized for more than 20 popular forex pairs |

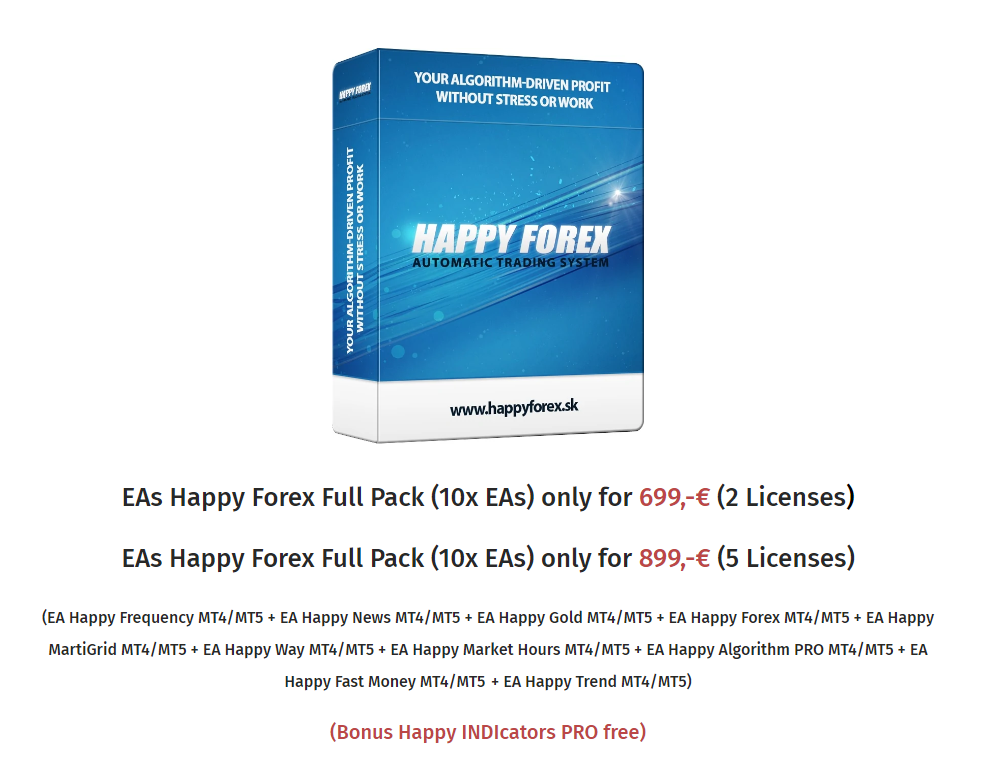

Happy Forex

Overview

Happy Forex aims to transform unprofitable forex trades into successful investment opportunities. This is achieved through a suit of stable, 100% automated Expert Advisors.

There are several EAs included in Happy Forex, including Happy Bitcoin, Happy Brexit, and more. Each of these is tailored to different trading strategies and market conditions. Happy Forex is compatible with MT4 and 5 and offers several trading approaches and risk management practices.

Unique Features

| Feature | Information |

| ⚖️ Track Record | Fully verified Myfxbook results |

| ✔️ Drawdown | - |

| 💵 Win Rate vs. Profitability | - |

| 💸 Cost/Fees | Offers a pack of 10 EAs with a single license |

| 📱 Trading Style | No grid, no arbitrage, no martingale, and more. |

| 📈 Market Conditions | Various market conditions |

| 📊 Trading Instruments | Major, Minor, Exotic Forex Pairs |

| 📉 Backtesting Capabilities | Offers extensive backtesting over many years |

| 💻 Platform Compatibility | MT4, MT5 |

| 🪪 Ease of Use | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Supports a range of trading strategies | The bundle of programs can be complex for beginners |

| Can perform well under various market conditions | Relies heavily on MetaTrader 4 and 5 |

| Offers 10 EAs in a single bundle | |

| Compatible with MT4 and MT5 | |

| Offers a lifetime of free updates | |

| Provides access to VPS |

FX Pattern Pro

Overview

FX Pattern Pro is a comprehensive program streamlining Crypto and Forex Markets trading. FX Pattern Pro uses Artificial Intelligence (AI) to provide several trading tools that can enhance trading skills.

By automating trading, FX Pattern Pro can simplify the overall trading process, which is typically daunting for beginners.

Unique Features

| Feature | Information |

| ⚖️ Track Record | Verified through live accounts |

| ✔️ Drawdown | Performance is optimized to minimize drawdown |

| 💵 Win Rate vs. Profitability | Focuses on exploiting market trends |

| 💸 Cost/Fees | From $129 with different upsells |

| 📱 Trading Style | Adaptable, uses 60+ indicators |

| 📈 Market Conditions | Can easily adjust to different conditions |

| 📊 Trading Instruments | Various markets |

| 📉 Backtesting Capabilities | Indicators and trend analysis support backtesting |

| 💻 Platform Compatibility | Compatible with most major platforms, including MT4 and 5 |

| 🪪 Ease of Use | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is no need to monitor the program constantly | There is a sharp learning curve for beginners |

| There is AI-driven analysis that can improve trading decisions | Relies heavily on technical analysis |

| Several trading tools support different trading styles | |

| Uses advanced risk management tools |

Forex Diamond EA

Overview

The WallStreet Forex Robot Team developed Forex Diamond EA. This unique EA program offers robust automated forex trading solutions. Forex Diamond EA is compatible with MetaTrader 4 and 5 and was developed to execute trades using dynamic logic to secure profits.

Furthermore, Forex Diamond EA has a high-performance, advanced trading system that uses several flexible trading strategies to outperform the financial markets in which traders participate.

Unique Features

| Feature | Information |

| ⚖️ Track Record | Proven data over more than 10 years |

| ✔️ Drawdown | Manages risks using features like high slippage protection |

| 💵 Win Rate vs. Profitability | Combines several strategies to ensure high profitability |

| 💸 Cost/Fees | Offers a lifetime license at $297 |

| 📱 Trading Style | Adapts to different conditions |

| 📈 Market Conditions | Implements several strategies to make it adaptable |

| 📊 Trading Instruments | Optimized for major forex pairs |

| 📉 Backtesting Capabilities | 99% modeling quality backtests across several currency pairs |

| 💻 Platform Compatibility | MT4, MT5 |

| 🪪 Ease of Use | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Supports various trading strategies | Not suitable for complete beginners |

| Updates are done automatically by the program | Relies heavily on MetaTrader |

| Offers comprehensive risk management solutions | |

| Myfxbook verifies the program |

What are the Key Features to Look for in Forex EAs?

Creating a Strong Foundation for Forex Strategies

Forex Expert Advisors (EAs) will only ever be as effective as their underlying trading strategy.

Therefore, to choose an ideal EA Program, traders must emphasize EAs that use fully studied and transparent methodologies and substantial backtesting over long periods.

Overall, a high-quality EA should adjust its strategy to changing market conditions. Furthermore, the following factors are crucial when evaluating an EA program for use in forex trading.

Tailoring to individual needs and growth

Adaptability is essential in fast-paced financial markets. Therefore, top-tier EAs must have various configurable settings to accommodate users’ risk tolerances and trading preferences.

In addition, these EA programs must be scalable, accommodate a wide range of account sizes, and facilitate expansion without affecting performance.

Effective Risk Management

If you can integrate money management capabilities into an EA, it could minimize risk exposure. These features assist in controlling position sizes and leverage, ensuring that transactions are proportionate to account balances and specified risk limits.

Compatibility and Accessibility

EA programs can be more adaptable when integrating with several brokers and platforms. Therefore, it must work seamlessly with a range of platforms, including MetaTrader 4 and 5, and support a variety of account types, such as ECN, STP, and micro-accounts.

Real-time Monitoring and Security

EAs that provide real-time trade monitoring and reporting give traders updated and real-time information about their transactions’ progress.

This provides detailed transaction logs, performance indicators, and analytical findings. Furthermore, security measures are also essential for protecting trade data from external dangers such as broker manipulation.

Continuous Support and Updates

Markets constantly change, and so should EAs. Therefore, automated updates guarantee that the program stays updated with new market trends. Furthermore, dedicated and helpful customer support is critical for quickly resolving emerging concerns.

What are the Advantages and Limitations of EAs in Forex Trading?

Advantages

- EAs let traders execute several strategies on different instruments simultaneously. This helps traders diversify their portfolios and distribute risk across markets and trading strategies.

- In-depth backtesting on historical data provides traders with valuable insight into past performance and can help them forecast future results.

- EAs follow established protocols, removing the effect of human emotions such as fear or greed, resulting in more consistent trading results.

- By automating trading procedures, EAs can evaluate large amounts of data and execute transactions continuously, saving traders important time.

Disadvantages

- EA Programs are not immune to technical difficulties that can cause missed trading opportunities because of incompatibility with platforms, system disruptions, or network failures.

- While EAs do not have human emotions, they lack the intuition and emotional intelligence required for subjective analysis and decision-making when unexpected market fluctuations occur.

- The forex market is always changing, and it can be extremely unpredictable. This drawback makes it difficult for EA programs to depend solely on part data and fixed parameters. Therefore, this could result in poor trading decisions when the markets are especially volatile.

- Based on previous data, EA Programs could be over-optimized, affecting future profitability because of inherent market fluctuations.

For more information on FXLeaders

Conclusion

In our experience, EA programs can be an extremely valuable tool for forex traders. They can help traders participate in trading across markets and apply diverse strategies without emotional biases. However, EA programs are not without fault.

Because they are trading bots that rely heavily on pre-set parameters and algorithms to identify entry points in the market, they can falter when market volatility or unique events occur.

Therefore, traders must choose an EA program that aligns with their unique circumstances and objectives. Furthermore, we urge traders to avoid relying too heavily on these programs to make calculated decisions that might require emotional intelligence and intuition.

Faq

Yes, Forex EAs are potentially profitable, but there are no guarantees. Success depends on the individual EA, market conditions, the settings, and adequate risk management by the trader.

Yes, some free EAs can be useful, but they frequently have limits or lack a good long-term track record compared to premium (paid) EA programs.

You must consider your trading style, risk tolerance, the EA’s proven track record, strategy, customization, dependability, and support availability.

Forex EAs have profit potential, but they also pose a major risk. Furthermore, EA Programs are not a get-rich-quick scheme and must be managed carefully.

Yes, some professional traders include EAs in their trading strategies, especially for trade execution or specialized responsibilities.