Dow Jones Futures (DJIA) Down Despite Softer US Retail Sales

Today US retail sales came in soft, but Dow Jones and other stock indices are ignoring the numbers

Today we had a batch of economic data from the US, with retail sales expected to have the most impact, but Dow Jones and other stock indices are slipping lower, ignoring the softer sales. Instead, the market is focusing most on the producer inflation and employment numbers, helping the USD along the way while sending risk assets such as stock markets down.

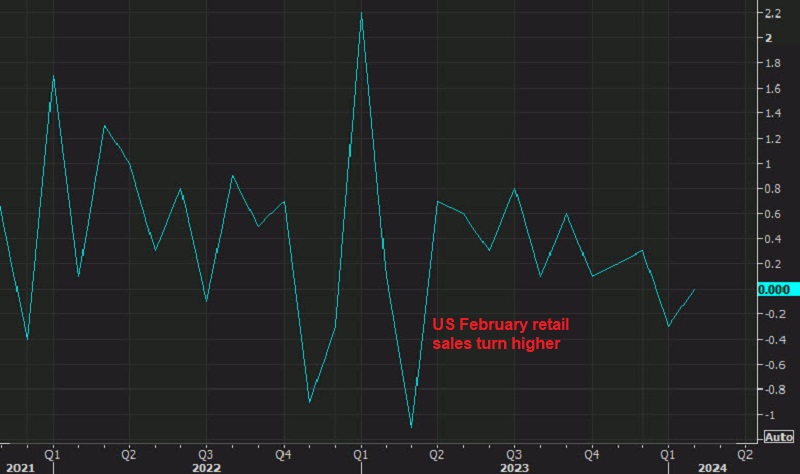

US Retail Sales Chart for February

The market’s reaction to recent economic data, particularly the Producer Price Index (PPI) and unemployment claims suggests a nuanced response. While there was initially a positive reaction to the positive PPI and improved unemployment claims report, the disappointing retail sales print tempered overall optimism and the futures market is down now.

The foreign exchange market is closely tracking bond yields, with the US 10-year bond yield surpassing 4.20%, indicating a significant shift in 2024. This suggests that market participants are closely monitoring the jobs and inflation indicators and adjusting their positions accordingly, while they don’t seem too worried about retail sales. Overall, the mixed data highlights the uncertainty surrounding the economic outlook in the US at the moment, prompting investors to reassess their expectations and strategies in response to evolving economic conditions. The Dow Jones Index has retreated lower, opening with a bearish gap, but moving averages continue to keep i supported, so we might open a buy signal for Dow Jones shares.

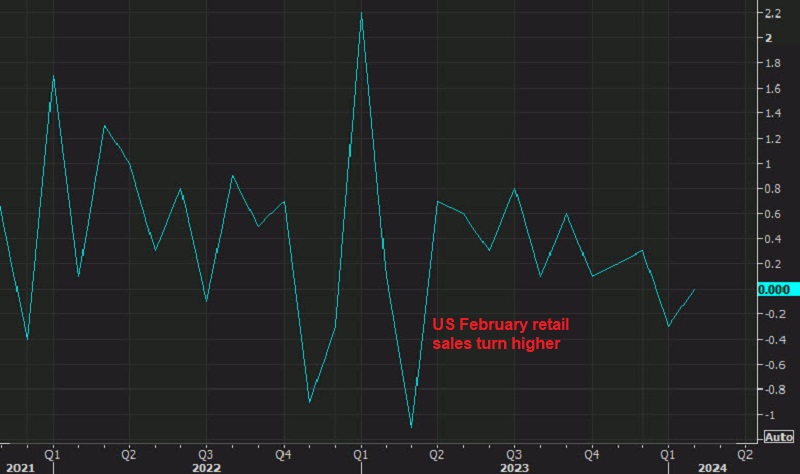

Dow Jones H4 Chart – The Retreat is A Good Chance to Buy DJIA Shares

Moving averages are keeping Dow index supported

February 2024 US Retail Sales

- February retail sales MoM +0.6% vs +0.8% expected

- January retail sales Mom were -0.8% (revised to -1.1%)

Details:

- Core sales excluding autos increased by 0.3%, falling short of the expected 0.5% rise. The previous month’s figure was revised from a decrease of 0.6% to a decrease of 0.8%.

- The control group, which is used for GDP calculations, remained unchanged at 0.0%, missing the expected increase of 0.4%. The prior month’s figure was revised from a decrease of 0.4% to a decrease of 0.3%.

- Retail sales excluding gas and autos increased by 0.3%, showing improvement from the previous month’s decline of 0.5%.

DJIA Index Dow Jones Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account