Markets At A Glance

The U.S. Federal Reserve Chair, Jerome Powell, recently addressed lawmakers and stated that he and his colleagues would focus on their jobs

The U.S. Federal Reserve Chair, Jerome Powell, recently addressed lawmakers and stated that he and his colleagues would focus on their jobs and remain impartial during the charged presidential election year. Powell said that the interest rate cuts would be implemented only if warranted by further evidence of falling inflation.

He emphasized that the Fed’s focus is on maximum employment and price stability, and they will be looking at incoming data to make decisions. Powell also stated that rate reductions will “likely be appropriate” later this year, “if the economy evolves broadly as expected” and once officials gain more confidence in inflation’s steady decline.

Though progress on inflation “is not assured,” Powell regarded the economy as clear of immediate recession risks, with a low 3.7% unemployment rate and broad growth likely to continue, and an expectation that inflation will remain in decline. However, the decision on when and how far to reduce the benchmark interest rate is complex and consequential in the upcoming rematch between incumbent President Joe Biden, a Democrat, and Republican former President Donald Trump.

Meanwhile, Bitcoin (BTC) investors have been keeping a close eye on spot ETFs and the upcoming halving, but it’s worth noting that central bank monetary policy can also have a significant impact on the cryptocurrency’s price outlook for 2024.

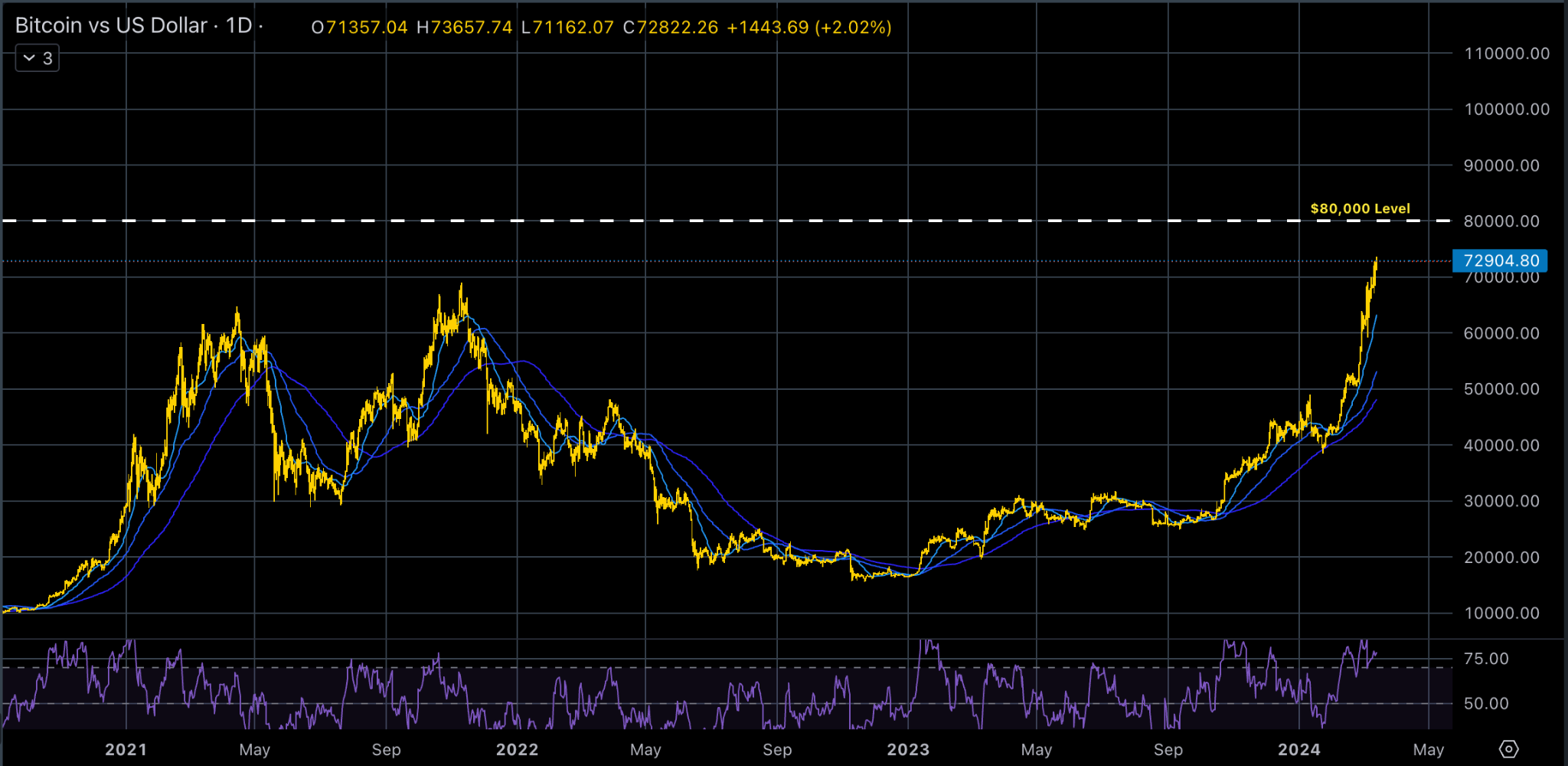

The previous week saw BTC hit an all-time high, and BTC bulls have gained momentum, especially after the UK’s FCA opened the door for institutional investors to build a crypto-backed ETN market. This move has given Bitcoin a boost. However, it’s important to note that these products would only be available to professional investors, as retail consumers remain banned, according to the regulator.

With Bitcoin recently hitting an all-time high and with the possibility of US interest rates decreasing later this year, some experts believe that the cryptocurrency could potentially surpass $80,000. It will be fascinating to see how these factors play into the future value of Bitcoin.

Traders and investors were closely watching the recently released February US inflation data. The latest US CPI data has shown an increase in inflation compared to market expectations. The year-on-year headline number came out at 3.2%, exceeding expectations of 3.1%, while the previous month’s figure was 3.1%. Similarly, core inflation also came out higher than expected, with a YoY figure of 3.8% compared to market expectations of 3.7%, although it was slightly lower than the previous month’s 3.9%.

The previous month’s CPI data (January) had a negative impact on the stock market, and there were concerns that Tuesday’s data could have a similar effect. Despite the higher-than-expected inflation figures, the index showed resilience and closed with a gain of +0.87% on the day. It’s worth noting that the S&P 500 Index has been performing well lately, with gains in 16 out of the past 19 weeks.

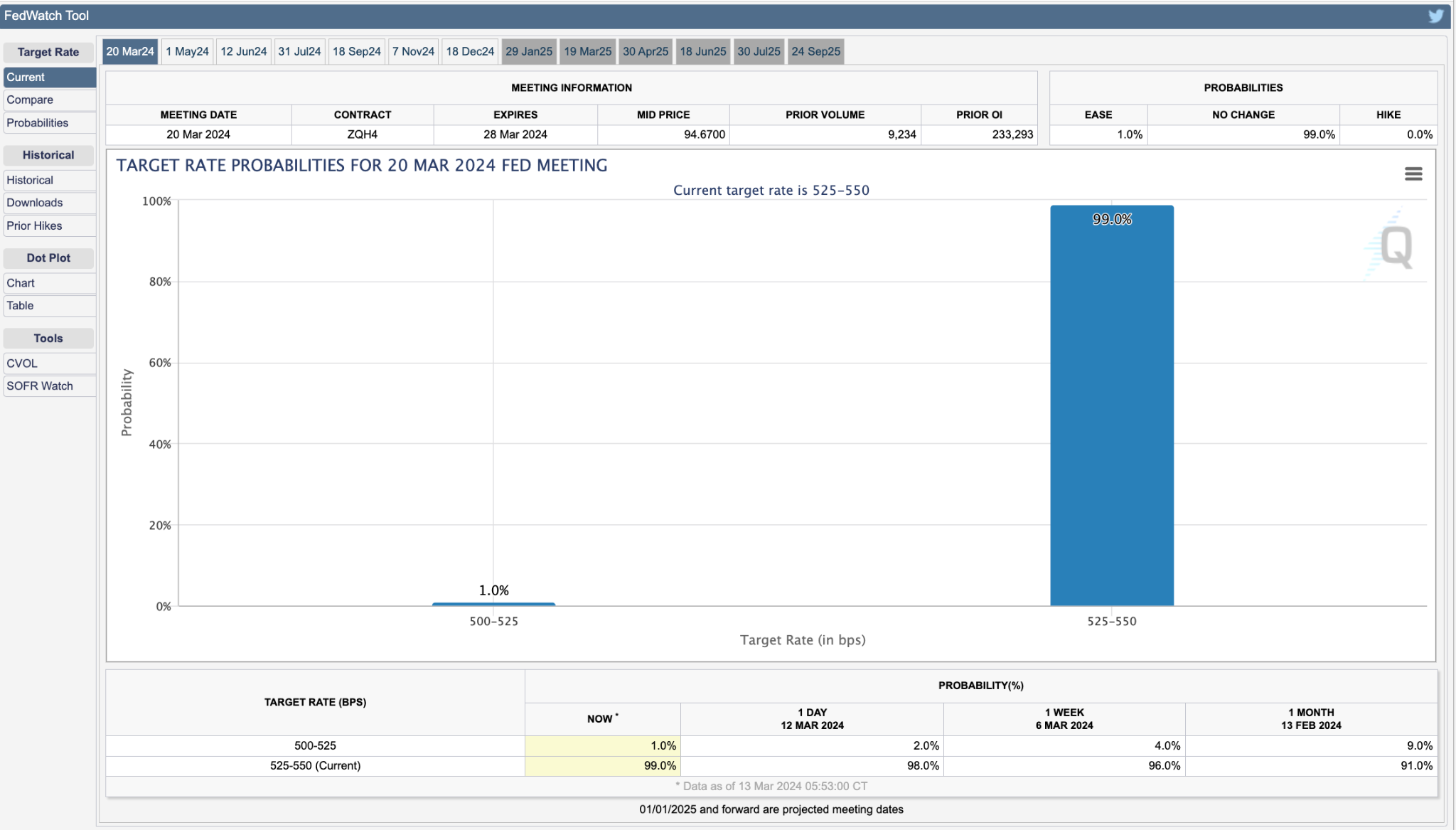

All eyes are now on the much-anticipated US Federal Reserve’s FOMC interest rate decision. Despite initial optimism among traders and investors that the US Fed would cut interest rates at the March meeting, the higher-than-expected inflation data suggests that the US Fed is likely to keep rates on hold.

According to the CME FedWatch Tool, there was a 99% probability of “No Change” to the Target Rate at the time of print. With inflation data remaining elevated, the US Fed will likely wait for more evidence of cooling inflation towards its preferred 2% target before making any changes to interest rates.

The information in this material is provided for informational purposes only and should not be construed as containing investment advice or an offer of solicitation for any transactions in financial instruments. Neither the presenter nor Exness takes into account your personal investment objectives or financial situation and assumes no liability to the accuracy, timeliness or completeness of the information provided, nor for any loss arising from any information supplied. Any opinions made throughout the presentation are strictly personal to the presenters and may not reflect the opinions of Exness. Past performance does not guarantee or predict future performance. Seek independent advice if necessary.

The information in this material may only be copied with the express written permission of Exness.

Risk Warning: CFDs are complex derivative products which are traded outside an exchange. These products come with a high risk of losing money rapidly due to leverage and are thus not appropriate for all investors. Under no circumstances shall Exness have any liability to any person or entity for any loss or damage in whole or in part caused by, resulting from, or relating to any investing activity.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account