Key to Markets Review

- Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Security Measures

- Key to Markets Account Types

- How To Open a Key to Markets Account

- Platforms and Software

- Fees, Spreads, and Commissions

- Leverage and Margin

- Trading Instruments and Products

- Deposit and Withdrawals

- Educational Resources

- Pros and Cons

- In Conclusion

Overall, Key to Markets is a trustworthy Forex Broker that provides transparent trading conditions in a safe and technologically advanced environment. Key to Markets has a significant global presence. It has a trust score of 85 out of 99.

| 🔎 Broker | 🥇 Key to Markets |

| 📈 Established Year | 2010 |

| 📈 Regulation and Licenses | FSC Mauritius, FCA |

| 📊 Ease of Use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| ⏱️ Trading Platforms | MetaTrader 4, MetaTrader 5, Myfxbook AutoTrade |

| 🖱️ Account Types | MetaTrader 4 Standard, MetaTrader 5 Standard, MetaTrader 4 PRO, MetaTrader 5 PRO |

| 🪙 Base Currencies | USD, EUR |

| 📌 Spreads | <1 pip |

| 📍 Leverage | 1:500 (FSC regulation and Professionals), 1:30 (FCA regulation and retail traders) |

| 💴 Currency Pairs | 65; major, minor, and exotic pairs |

| 💵 Minimum Deposit | 100 USD |

| 💶 Inactivity Fee | ✅ Yes, 40 USD after 12 months of inactivity |

| 🔊 Website Languages | English, Portuguese, Spanish, Hindi, Simplified Chinese |

| 💷 Fees and Commissions | Spreads from <1 pip, commissions from $8 per traded lot, round turn |

| 🤝 Affiliate Program | ✅ Yes |

| ❎ Banned Countries | United States, Iran, North Korea |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, indices, commodities, shares, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Analysis of Brokers’ Main Features

- ☑️Overview

- ☑️Summary

- ☑️Measures

- ☑️Account Types

- ☑️How To Open a Key to Markets Account

- ☑️Trading Platforms and Software

- ☑️Fees, Spreads, and Commissions

- ☑️Leverage and Margin

- ☑️Trading Instruments and Products

- ☑️Deposit and Withdrawals

- ☑️Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

Overview

Key to Markets, established in 2010, aims to provide transparent trading conditions in a safe and technologically advanced environment.

Recognizing the industry’s need for fairness and client-centric procedures, the broker has gained a loyal following due to its commitment to reasonable spreads, quick execution times, and access to large liquidity pools.

It has expanded its global reach, establishing regulated corporations in Mauritius and the United Kingdom, ensuring robust investor protection. The broker has received industry accolades for its superior service and dedication to putting customers first.

With a significant global presence, They cater to both experienced and new traders, offering a diverse range of tradable assets and excellent charting tools.

Does Key to Markets provide multilingual support to traders?

Yes, they support various languages, including English, Portuguese, Spanish, Hindi, and Simplified Chinese.

Can I use Key to Markets services from anywhere in the world?

Yes, they have a worldwide presence and admit traders from numerous nations, except for the United States, Iran, and North Korea.

Detailed Summary

| 🔎 Broker | 🥇 Key to Markets |

| 📈 Established Year | 2010 |

| 📈 Regulation and Licenses | FSC Mauritius, FCA |

| 📊 Ease of Use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| ⏱️ Trading Platforms | MetaTrader 4, MetaTrader 5, Myfxbook AutoTrade |

| 🖱️ Account Types | MetaTrader 4 Standard, MetaTrader 5 Standard, MetaTrader 4 PRO, MetaTrader 5 PRO |

| 🪙 Base Currencies | USD, EUR |

| 📌 Spreads | <1 pip |

| 📍 Leverage | 1:500 (FSC regulation and Professionals), 1:30 (FCA regulation and retail traders) |

| 💴 Currency Pairs | 65; major, minor, and exotic pairs |

| 💵 Minimum Deposit | 100 USD |

| 💶 Inactivity Fee | ✅ Yes, 40 USD after 12 months of inactivity |

| 🔊 Website Languages | English, Portuguese, Spanish, Hindi, Simplified Chinese |

| 💷 Fees and Commissions | Spreads from <1 pip, commissions from $8 per traded lot, round turn |

| 🤝 Affiliate Program | ✅ Yes |

| ❎ Banned Countries | United States, Iran, North Korea |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, indices, commodities, shares, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Security Measures

Key To Markets is an FCA-authorized and regulated platform that prioritizes customer security through rigorous safeguards. It ensures that traders’ money remains secure even during bankruptcy by keeping client funds separate from operating funds.

The platform also offers UK traders extra protection under the Financial Services Compensation Scheme (FSCS), which provides up to £85,000. This provides additional financial security for UK traders during Key To Markets’ bankruptcy.

How does Key to Markets mitigate the risk of fraud and unauthorized access?

This broker implements robust authentication procedures and monitors accounts for suspicious activities.

Are any regulatory measures in place to oversee Key to Markets’ operations?

Yes, they are regulated by respected authorities such as the FCA and FSC, subjecting them to strict regulatory oversight and compliance requirements to ensure fair and transparent trading practices

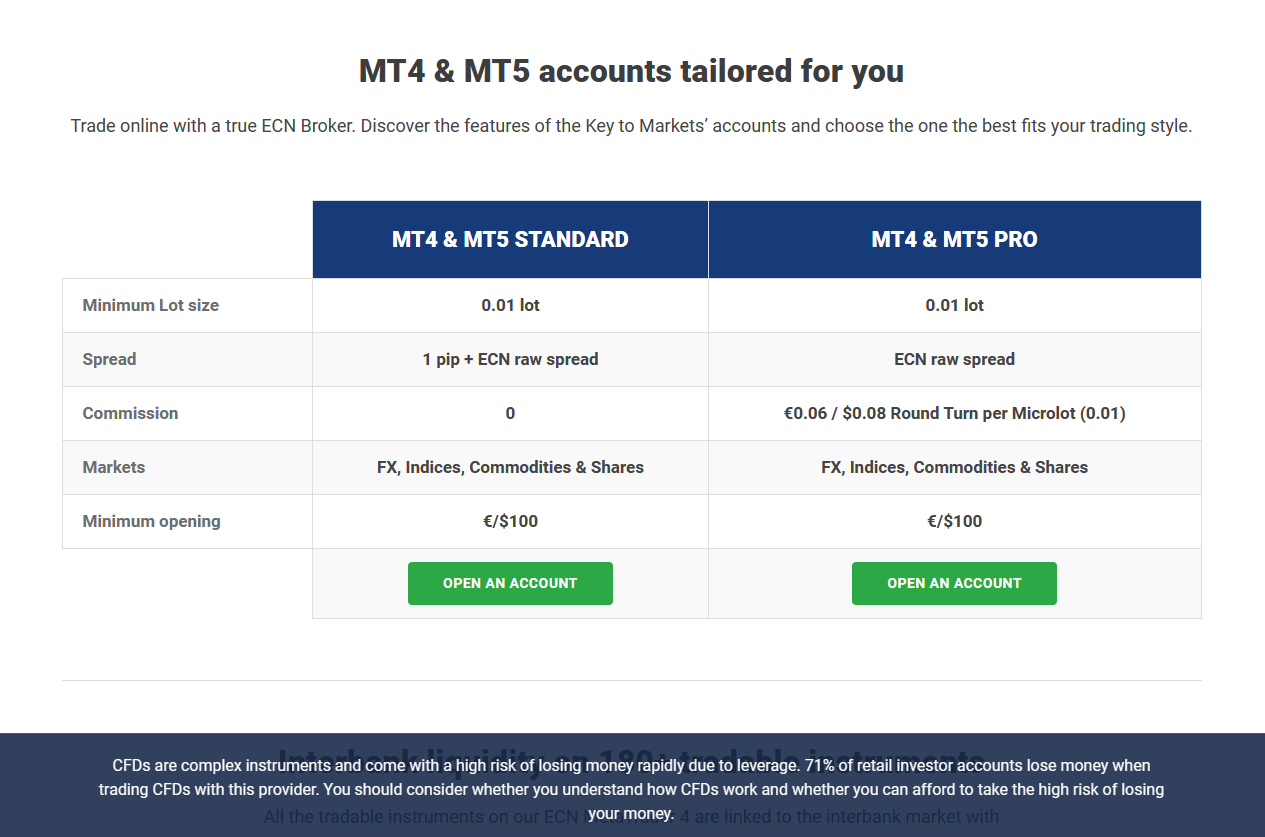

Key to Markets Account Types

| 🔎 Account Type | 🥇 MetaTrader 4 Standard | 🥈 MetaTrader 5 Standard | 🥉 MetaTrader 4 PRO | 🏅 MetaTrader 4 PRO |

| 🩷 Best Suited | Ideal for beginners and casual traders | Ideal for beginners and casual traders | Ideal for scalpers and professional traders | Ideal for scalpers and professional traders |

| 📈 Markets Available | All | All | All | All |

| 💴 Commissions | None. Only the spread is charged | None. Only the spread is charged. | From $8 per lot round turn. | From $8 per lot round turn. |

| 📉 Platforms | MetaTrader 4 | MetaTrader 5 | MetaTrader 4 | MetaTrader 5 |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:30 (FCA, Retail) 1:500 (FSC, Professional) | 1:30 (FCA, Retail) 1:500 (FSC, Professional) | 1:30 (FCA, Retail) 1:500 (FSC, Professional) | 1:30 (FCA, Retail) 1:500 (FSC, Professional) |

| 💷 Minimum Deposit | 100 USD or EUR | 100 USD or EUR | 100 USD or EUR | 100 USD or EUR |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

MetaTrader 4 Standard Account

For MetaTrader 4 users, the Standard Account is simple and easy to use. Traders profit from a spread that includes the interbank market raw spread plus an extra pip. This account has no commission per deal, making it a good choice for people who favor simple pricing systems.

MetaTrader 5 Standard Account

MetaTrader 5 users can access the Standard Account, which is identical to its equivalent on the MT4 platform.

With a comparable spread structure as MT4 Standard, traders can benefit from the same simplicity and cost-effectiveness, paying just the combined raw spread and one pip, with no commission per lot expenses.

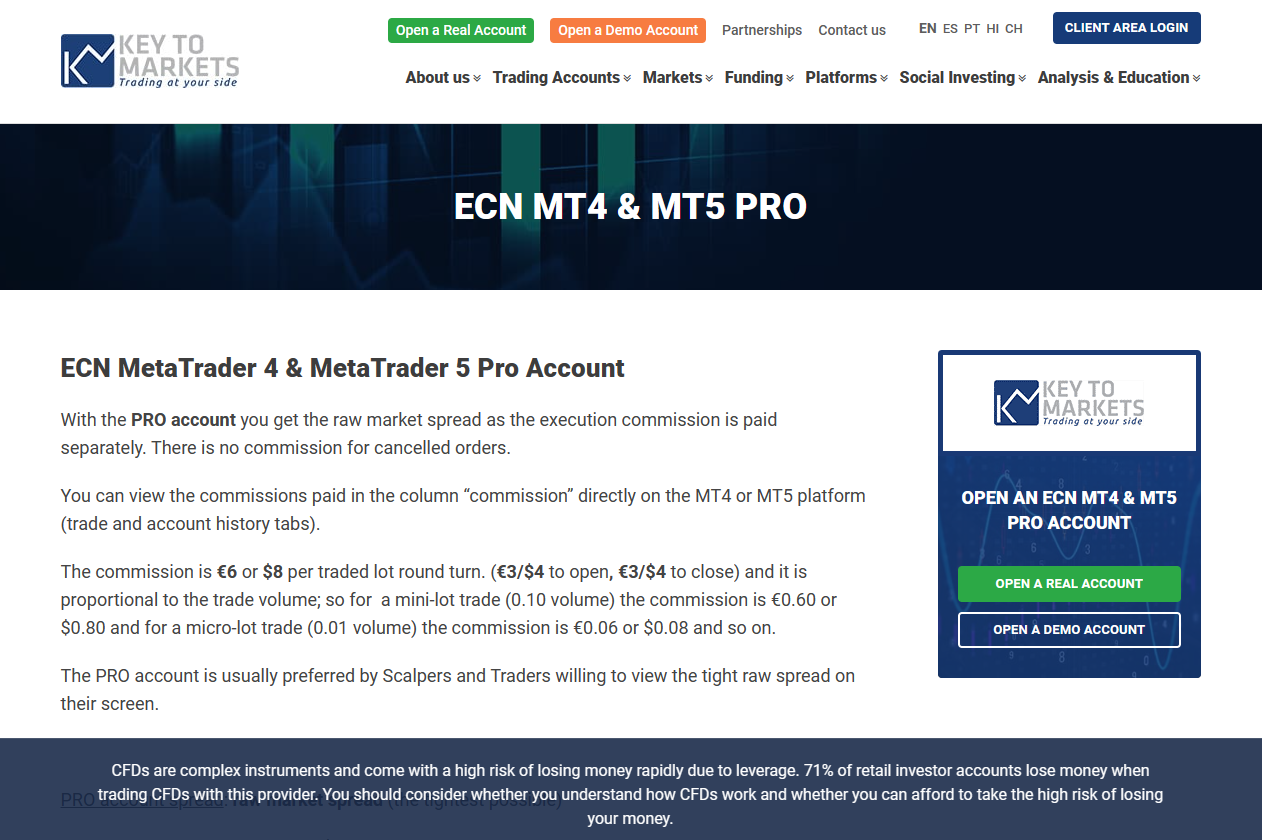

MetaTrader 4 PRO Account

Key to Markets offers the MetaTrader 4 (MT4) PRO Account, providing traders with direct access to raw market spreads and expanded trading capabilities. This account is popular among scalpers and traders who value seeing raw spreads.

The fee is €0.06 or $0.08 Round Turn per Micro-lot. It offers clear pricing and accurate cost management, making it an appealing choice for traders seeking the best trading conditions and flexibility on the MT4 platform.

MetaTrader 5 PRO Account

Key to Markets offers the MetaTrader 5 (MT5) PRO Account, catering to expert traders seeking better trading tools and narrow spreads. This account allows access to raw market spreads directly from the MT5 platform, potentially lowering costs and improving trade execution.

Furthermore, the MetaTrader 5 PRO Account charges €0.06 or $0.08 Round Turn per Micro-lot (0.01 lots), ensuring clear pricing and accurate cost management.

Demo Account

Key To Markets offers a Demo Account for traders to practice trading methods without risking their money. This account mimics real-market scenarios, making it a useful learning tool for novices and a testing ground for experienced traders.

Furthermore, users can trade financial products, including forex and cryptocurrency, with virtual money to build confidence.

Can I swap between account kinds using Key to Markets?

Yes, Key to Markets enables traders to move between account types depending on their changing trading requirements and preferences.

Are there any account maintenance costs related to the Key to Markets account types?

No, Key to Markets does not impose account maintenance fees.

How To Open a Key to Markets Account

To register an account with Key to Markets, follow these steps:

- Visit the Key to Markets website and choose the “Open an Account” or “Register” option.

- Fill out the online application form by entering your personal information.

- Select your account type (individual, joint, or corporate) and base currency.

- Upload the appropriate papers to verify your identity and address.

- Fund your account using various deposit options, including bank transfers, credit/debit cards, or e-wallets.

- Once your account has been authorized and financed, download and install the MetaTrader 4 or MetaTrader 5 trading platforms.

- Log in to your trading platform using your account information and start trading.

Can I modify the base currency of my Key to Markets account after it has been opened?

No, once your account is created with a certain base currency, it cannot be changed later.

Does Key to Markets provide any incentives or bonuses for new account registrations?

No, they do not provide bonuses or promotional incentives for new account registrations.

Platforms and Software

MetaTrader 4

MetaTrader 4, a popular FX and CFD platform, offers a user-friendly design and extensive functionality. They provide ECN trading, transparent pricing, and fast executions.

Traders can create, back-test, and execute EAs, access professional charts, and access technical analysis indicators. Instant deposits, quick withdrawals, and leverage of up to 1:500 are available on Windows and Mac.

MetaTrader 5

MetaTrader 5 (MT5) is a popular Forex and stock trading platform with strong features and analytical tools.

Key to Markets uses ECN technology for transparent pricing and fast executions. It offers access to various markets and automatic trading using robots and signals. Furthermore, it is accessible on desktop, web, and mobile devices.

Myfxbook AutoTrade

Key to Markets offers Myfxbook AutoTrade technology, enabling traders to replicate successful trading methods easily. AutoTrade connects MT4 accounts to preferred trading systems on Myfxbook.com, reducing risk and increasing profits.

It features automatic trade mirroring and the ability to add or delete systems, making it transparent and cost-effective for traders.

Does Key to Markets provide automated trading options?

Yes, they provide automated trading options through platforms like MetaTrader 4 and 5.

Can I personalize my trading interface on Key to Markets platforms?

Yes, their trading platforms allow traders to customize their trading interfaces according to their preferences.

Fees, Spreads, and Commissions

Spreads

Key to Markets’ MetaTrader 4 and 5 PRO accounts offer precise, efficient trading with narrow ECN spreads, while their Standard accounts offer spreads as low as 1 pip.

Commissions

MetaTrader 4 and 5 PRO accounts charge $8 per lot round turn, providing clear pricing and accurate cost management, while MetaTrader 4 and 5 Standard accounts include broker charges in spreads.

Overnight Fees

Key to Markets offers traders clear overnight costs based on instrument and trading direction, enabling informed choices about holdings through instrument specification and spread pages.

Key to Markets Deposit and Withdrawal Fees

They provide low deposit and withdrawal fees, with no EU-based fees and a 2.5% non-EU fee for credit/debit card deposits. Withdrawals via Neteller, Skrill, and Sticpay incur a 1% charge.

Inactivity Fees

Key to Markets charges a $40 inactivity fee after 12 months of inactivity to encourage active trading and customers to maximize their trading accounts and stay active in the market.

Currency Conversion Fees

Traders should know currency translation costs that may apply for trades, deposits, and withdrawals in currencies other than EUR or USD.

Does Key to Markets charge commissions on trades?

Yes, charges commissions on trades for its MetaTrader 4 and 5 PRO accounts, with commissions starting from $8 per lot round turn.

Are there any overnight fees associated with holding positions with Key to Markets?

Yes, they apply overnight fees based on instrument and trading direction.

Leverage and Margin

Key To Markets uses a systematic approach to leverage and margin across various financial instruments, with indices having a minimum margin requirement of 0.01, commodities ranging from 0.005 to 0.01, and shares having varying margin requirements ranging from 5% to 25%.

The platform has a Stop Out threshold of 100%, automatically terminating trades when the free margin is too low. A Margin Call level of 120% alerts traders of nearing Stop Out levels, limiting them to closing existing positions.

The margin level is crucial for risk management and preventing negative equity and can be found in the “Trade” tab of MT4.

What is the maximum leverage offered by Key to Markets?

Indeed, they offer maximum leverage of up to 1:500 for professional traders under FSC regulation.

How do they handle margin calls and stop-out levels?

This broker automatically triggers margin calls when a trader’s margin level falls below 120%, alerting traders to manage their positions. In comparison, stop-out levels at 100% ensure protection against negative equity.

Trading Instruments and Products

Key to Markets offers the following trading instruments and products:

✅ The ECN platform supports over 65 currency pairings. Major Currencies include EUR, USD, GBP, JPY, SGD, HKD, and TRY.

✅ Provides a collection of indexes that enable traders to invest in larger market moves. Exposure to important global indexes such as the S&P 500, FTSE 100, and Nikkei 225.

✅ The platform offers over 12 CFDs on precious metals, energy, and soft commodities, with no dealing desk execution, Rolling Spot CFD type, minimal latency, and platform dependability for efficient trading.

✅ The platform offers traders access to over 60 stocks on four major exchanges, with margin requirements ranging from 5% to 25%, and provides detailed specifications for each share.

✅The platform offers trading for the BTC/USD pair with spreads starting at 2020 pips, allowing traders to speculate on Bitcoin’s price swings against the US dollar despite being limited compared to other asset classes.

Can I trade commodities like precious metals and energy with Key to Markets?

Yes, this broker allows traders to trade commodities such as precious metals like gold and silver and energy instruments like oil.

Is there a restriction on the number of trading instruments I may use with Key to Markets?

No, they offer various trading instruments across forex, indices, commodities, shares, and cryptocurrencies.

Deposit and Withdrawals

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 💴 Bank Wire Transfer | All | USD | 2 – 4 days |

| 💵 SEPA | All | EUR | 1 – 2 days |

| 💶 Credit/Debit Card | All | Multi-currency | Instant |

| 💷 Neteller | All | Multi-currency | Instant – 1 day |

| 💴 Skrill | All | Multi-currency | Instant – 1 day |

| 💵 Sticpay | All | Multi-currency | Instant – 1 day |

| 💶 UnionPay | All | Multi-currency | Instant |

| 💷 Alipay Pay | All | Multi-currency | Instant |

Deposit Methods:

Bank Wire

✅Log in to your Key to Markets account and go to the “Deposit” section.

✅Select “Bank Wire Transfer” and provide the relevant bank information for the transfer.

✅Initiate a wire transfer from your bank account using the information supplied and your Key to Markets account number.

✅Bank wire processing periods might take anywhere from 2-4 business days.

Credit or Debit Card

✅Go to the “Deposit” section in your customer area.

✅Choose your chosen card issuer (Visa or MasterCard).

✅Enter your credit card information (number, expiration date, CVV) and the amount you want to deposit.

✅Complete the payment procedure by following the on-screen directions.

✅Card deposits are often processed instantly.

e-wallets or Payment Gateways

✅Choose your favorite e-wallet or payment gateway under “Deposit.”

✅Fill up your e-wallet account ID and deposit the amount.

✅To complete the transaction, you will be redirected to the e-wallet platform.

✅Deposits made using these methods are often immediate.

Withdrawal Methods:

Bank Wire

✅ Navigate to the “Withdrawal” section of your Key to Markets site.

✅ Choose “Bank Wire Transfer” and enter your bank account information.

✅Determine the amount you want to withdraw. Submit your withdrawal request and wait for processing, which might take 1-2 business days.

Credit or Debit Cards

✅ It is important to note that card withdrawals are often restricted to the amount initially deposited with that card.

✅Enter the amount you desire to withdraw (up to your deposit limit) in the “Withdrawal” area. Traders should note that card withdrawal processing timeframes may vary.

e-wallets or Payment Gateways

✅ In the “Withdrawal” section, choose your preferred e-wallet.

✅ Enter the e-wallet account ID and the amount you want to withdraw.

✅Submit the withdrawal request. Processing timeframes are typically one business day.

Can I use several payment methods to deposit and withdraw with Key to Markets?

Yes, They accept various payment options, including bank wire transfers, credit/debit cards, and e-wallets.

Are there any withdrawal limitations set by Key to Markets?

They do not impose specified withdrawal limitations.

Educational Resources

The blog section provides market analysis, trading recommendations, and economic insights to inform traders about the latest market developments and their potential impact on their trading decisions. Furthermore, articles provide comprehensive analysis, specific strategies, and instructional guidance for novice and experienced traders, covering various financial instruments like forex, CFDs, stocks, and stocks.

Can I access educational resources on the go with Key to Markets?

Yes, They ensure accessibility to its educational resources on the go through its mobile-friendly website and trading platforms.

Are there any costs associated with accessing Key to Markets’ educational resources?

No, Key to Markets offers its educational resources free of charge to all registered traders.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker generally charges narrow spreads on popular currency pairings | Accounts that are kept inactive for 12 months will incur penalties |

| Key to Markets supports MetaTrader 4, MetaTrader 5, and Myfxbook AutoTrade | Certain deposit and withdrawal methods incur fees |

| Provides negative balance protection, which prevents traders from losing more than their invested funds | Account financing choices and base currencies are limited |

| Key to Markets has licenses from respectable authorities such as the FCA (UK) and the FSC (Mauritius) | While competitive, spreads on particular instruments can be wider than those of rivals |

| Forex, commodities, indices, and stocks are among the markets available | Key To Markets does not accept customers from the United States |

In Conclusion

In our experience, Key to Markets touts itself as a well-rounded FX and CFD broker with various account kinds to accommodate traders of all skill levels.

With tight spreads, support for major trading platforms like MetaTrader 4 and 5, and licenses from reputable organizations like the FCA and FSC, it provides a strong basis for traders looking for dependability and security.

Faq

Key to Markets accepts various deposit options, including bank transfers, credit/debit cards, and e-wallets.

Withdrawal choices are often identical to deposit methods, including bank transfers, e-wallets, and popular credit and debit cards.

Key to Markets’ withdrawal processing timeframes vary based on the method used, with bank wire transfers requiring 1-2 business days and e-wallet withdrawals lasting one business day.

Key to Markets requires a minimum investment of 100 USD or EUR.

Spreads, commissions, and overnight fees are examples of key market costs. These costs vary based on the account type and the assets you trade.