The Euro to Pound Rate Keeps Consolidating in A Range

EUR/GBP was on a steady bearish trend during January, as the price fell around 200 pips lower, with market expectations for an ECB rate cut to come soon increasing. This month the Euro to Pound rate has been steady, as both the Euro and the GBP remain uncertain, awaiting further direction by the ECB and the BOE.

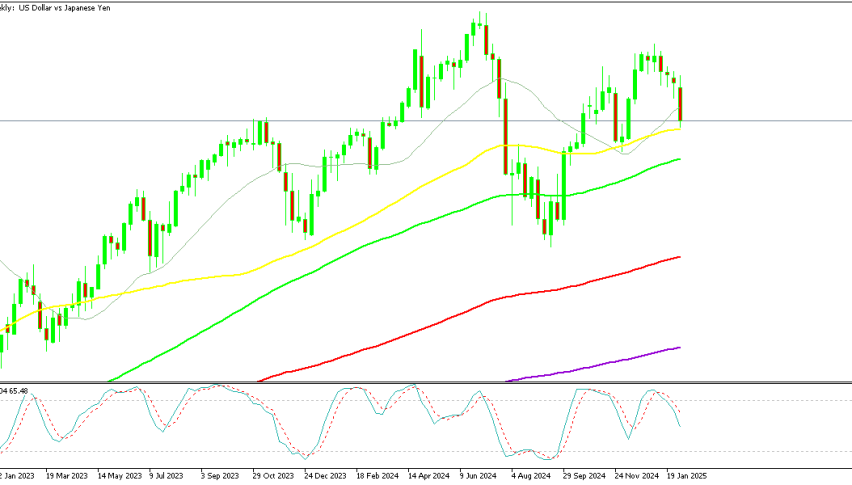

This forex pair was displaying a consistent bearish trend since the final days of last year. Despite occasional attempts at bullish movements, these have been met with resistance from moving averages, which have consistently pushed highs lower. This month, the 200 SMA (purple) is taking over as resistance and yesterday we saw a rejection of the price by this moving average.

Last week EUR/GBP reversed higher from below 0.85 and gained around 80 pips peaking above the 200 SMA (purple) twice. but eventually, it ended up lower, indicating that buyers couldn’t hold the price up there. Yesterday we saw another test of this moving average, and after the failure, we decided to open another sell EUR/GBP signal.

EUR/GBP H4 Chart – The 200 SMA Stops the Climb

The European Central Bank (ECB) now is trying to actively convince markets that expectations of rate cuts are overly optimistic. Yesterday the ECB president Christine Lagarde’s comments in the interview with Kanaal Z underscore the European Central Bank’s (ECB) dedication to achieving its 2% inflation target, which is vital for supporting economic growth and development during the recovery phase. Lagarde’s remarks highlighted the ECB’s recognition of the importance of price stability in fostering sustainable economic progress.

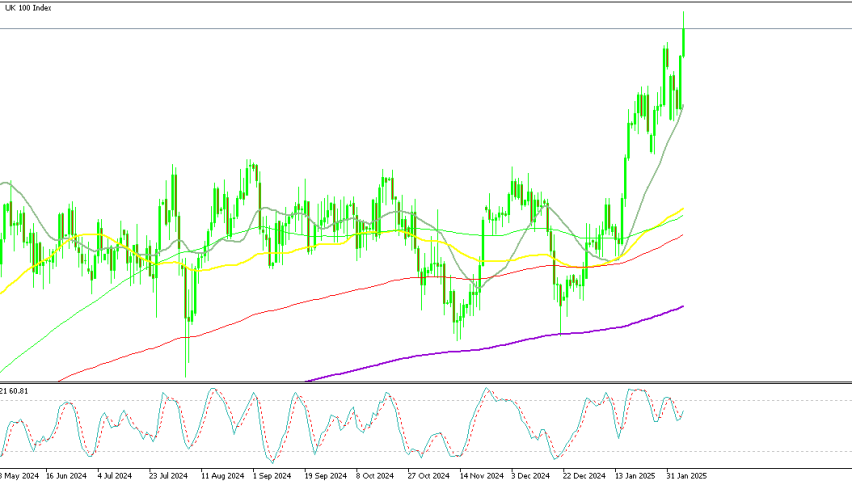

Bank of England Not Thinking on Rate Cuts Yet

Fundamentally, the bearish pressure on EUR/GBP can be attributed to the divergent monetary policy stances of the two central banks involved, namely the European Central Bank (ECB) and the Bank of England (BoE). The ECB has surprised markets by increasingly emphasizing its willingness to consider rate cuts, a stance that contrasts with its previous reluctance. This shift in ECB rhetoric has altered market perceptions of the Euro, leading to a heavy tone on EUR/GBP.

The UK economy is showing signs of improving, and the recent uptick in manufacturing and services Purchasing Managers’ Index (PMI) figures suggests a positive reevaluation of the UK’s growth prospects. This improvement in economic indicators shows that market sentiment regarding the UK’s economic outlook is improving, which will support the British Pound. In contrast, the Eurozone economy is still deteriorating, with Germany suffering the most.