Colmex Pro Review

- Colmex Pro Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Leverage and Margin

- Which Markets Can You Trade?

- Deposit and Withdrawals

- Educational Resources

- Pros and Cons

- Conclusion

Overall, Colmex Pro can be summarised as a trustworthy and highly regulated Forex Broker focused on precision trading and great customer service. It has a trust score of 90 out of 99.

| 🔎 Broker | 🥇 Colmex Pro |

| 📈 Established Year | 2010 |

| 📉 Regulation and Licenses | CySEC, FCA |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | Colmex Pro 2.0, MetaTrader 4, MultiTrader |

| 📊 Account Types | Bronze, Silver, Gold, Titanium, Diamond |

| 💴 Base Currencies | USD |

| 📈 Spreads | From 0.3 pips EUR/USD |

| 📉 Leverage | 1:30 |

| 💵 Currency Pairs | 84; major, minor, and exotic pairs |

| 💶 Minimum Deposit | From 500 USD |

| 💷 Inactivity Fee | ✅Yes |

| 📑 Website Languages | English, Hebrew, Spanish |

| 💳 Fees and Commissions | Spreads from 0.3 pips, commissions from $1 per side |

| 🤝 Affiliate Program | ✅Yes |

| ❎ Banned Countries | Canada, Iran, Japan, Myanmar, North Korea, United States, Belgium, Spain |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, indices, ETFs, ETNs, commodities, shares |

| 🚀 Open an Account | 👉 Click Here |

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Colmex Pro Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Leverage and Margin

- ☑️ Which Markets can You Trade?

- ☑️ Deposit and Withdrawals

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

Overview

Colmex Pro’s origins are in financial technology innovation. Founded in 2010, the firm aims to provide modern technology solutions to the often-inaccessible realm of Internet trading.

With a focus on speed, precision, and great customer service, Colmex Pro has established itself as a popular alternative for active traders and beginners.

However, Colmex Pro has a global presence, servicing clients on all continents and experience levels. Their array of platforms, which includes the proprietary Colmex Pro 2.0 and interaction with the industry-standard MetaTrader 4, offers traders a wide range of advanced tools.

With substantial forex offers, Colmex Pro provides access to various CFDs on indices, commodities, and major stocks. Additionally, the broker enjoys remaining ahead of the curve, always adjusting to industry changes and customer demands.

This dedication to expansion and innovation underscores Colmex Pro’s long-standing ambition to create a competitive and accessible trading environment.

Detailed Summary

| 🔎 Broker | 🥇 Colmex Pro |

| 📈 Established Year | 2010 |

| 📉 Regulation and Licenses | CySEC, FCA |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | Colmex Pro 2.0, MetaTrader 4, MultiTrader |

| 📊 Account Types | Bronze, Silver, Gold, Titanium, Diamond |

| 💴 Base Currencies | USD |

| 📈 Spreads | From 0.3 pips EUR/USD |

| 📉 Leverage | 1:30 |

| 💵 Currency Pairs | 84; major, minor, and exotic pairs |

| 💶 Minimum Deposit | From 500 USD |

| 💷 Inactivity Fee | ✅Yes |

| 📑 Website Languages | English, Hebrew, Spanish |

| 💳 Fees and Commissions | Spreads from 0.3 pips, commissions from $1 per side |

| 🤝 Affiliate Program | ✅Yes |

| ❎ Banned Countries | Canada, Iran, Japan, Myanmar, North Korea, United States, Belgium, Spain |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, indices, ETFs, ETNs, commodities, shares |

| 🚀 Open an Account | 👉 Click Here |

Safety and Security

Colmex Pro prioritizes securing customer finances and sensitive information. As a registered broker, they follow industry requirements. These security precautions include segregated client accounts, which keep trader funds separate from the company’s operating funds.

Furthermore, Colmex Pro uses robust encryption for data transported to its servers and cyberattack defense. Colmex Pro also includes two-factor authentication to increase account login security.

In addition, the fact that Colmex Pro is monitored by credible regulatory agencies such as CySEC and the FCA suggests a commitment to strong security standards.

Account Types

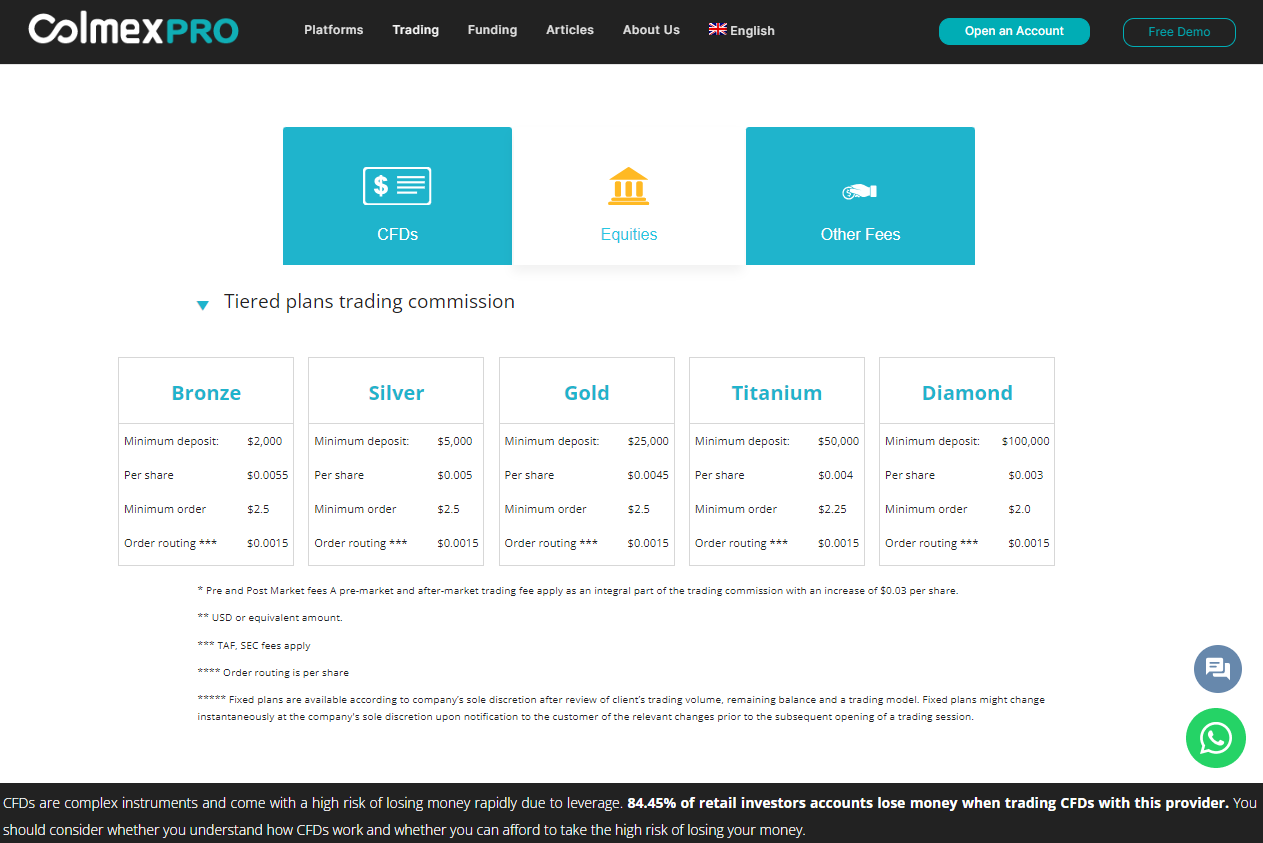

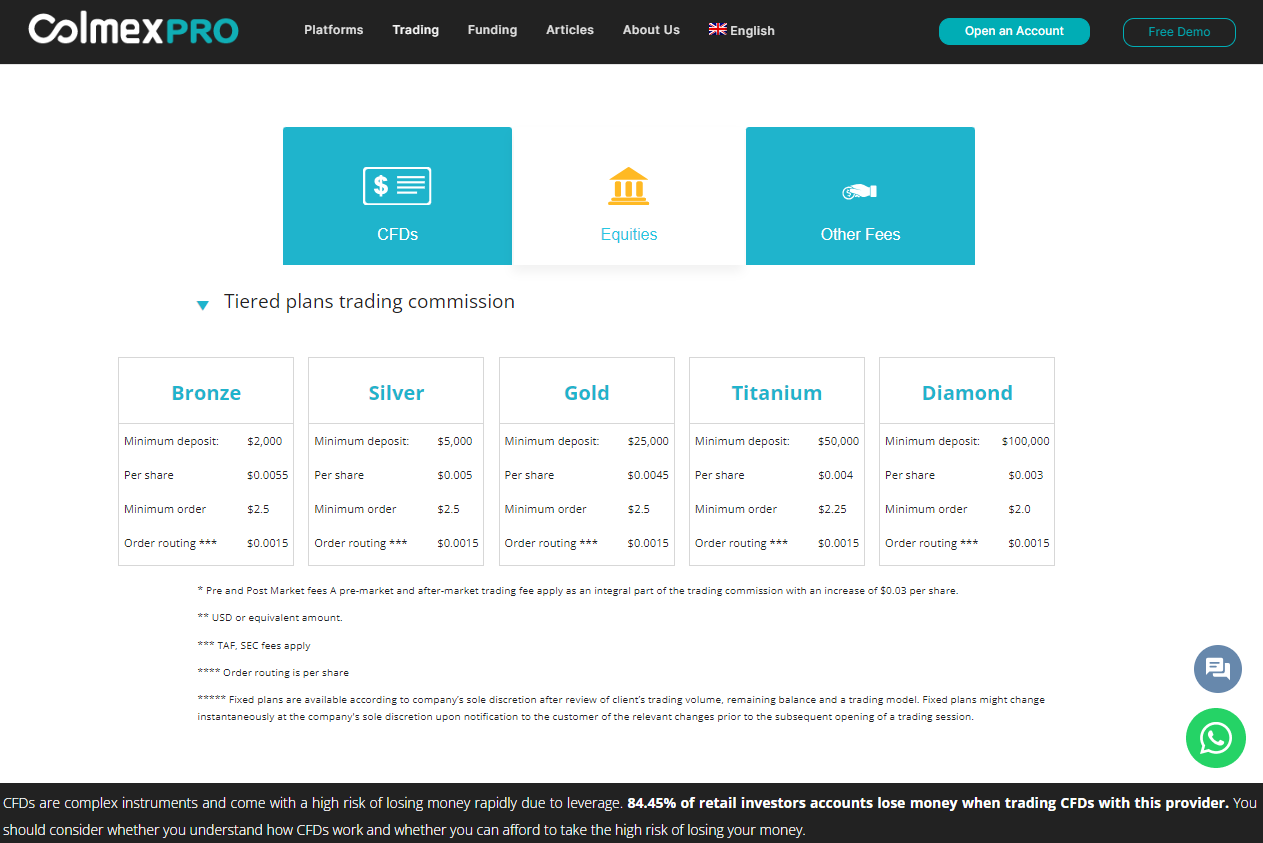

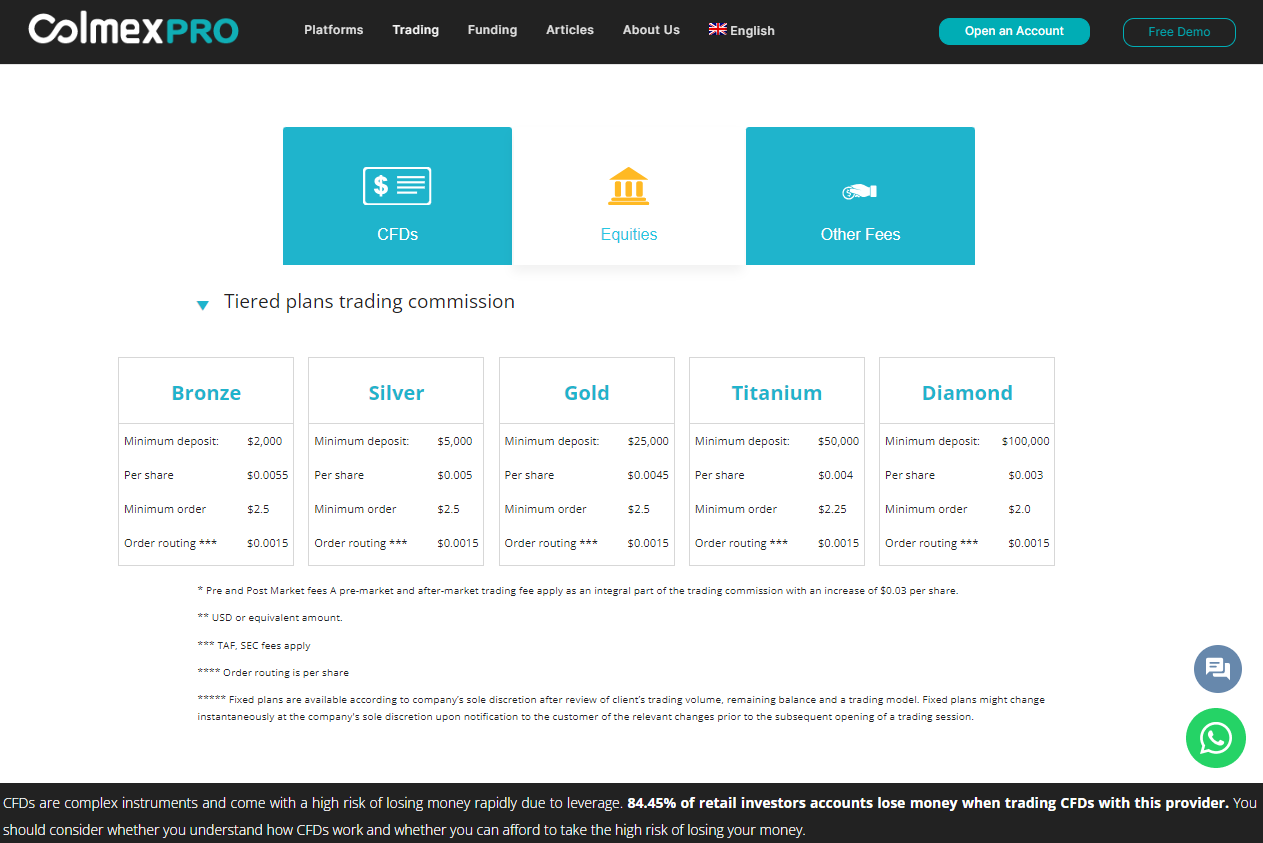

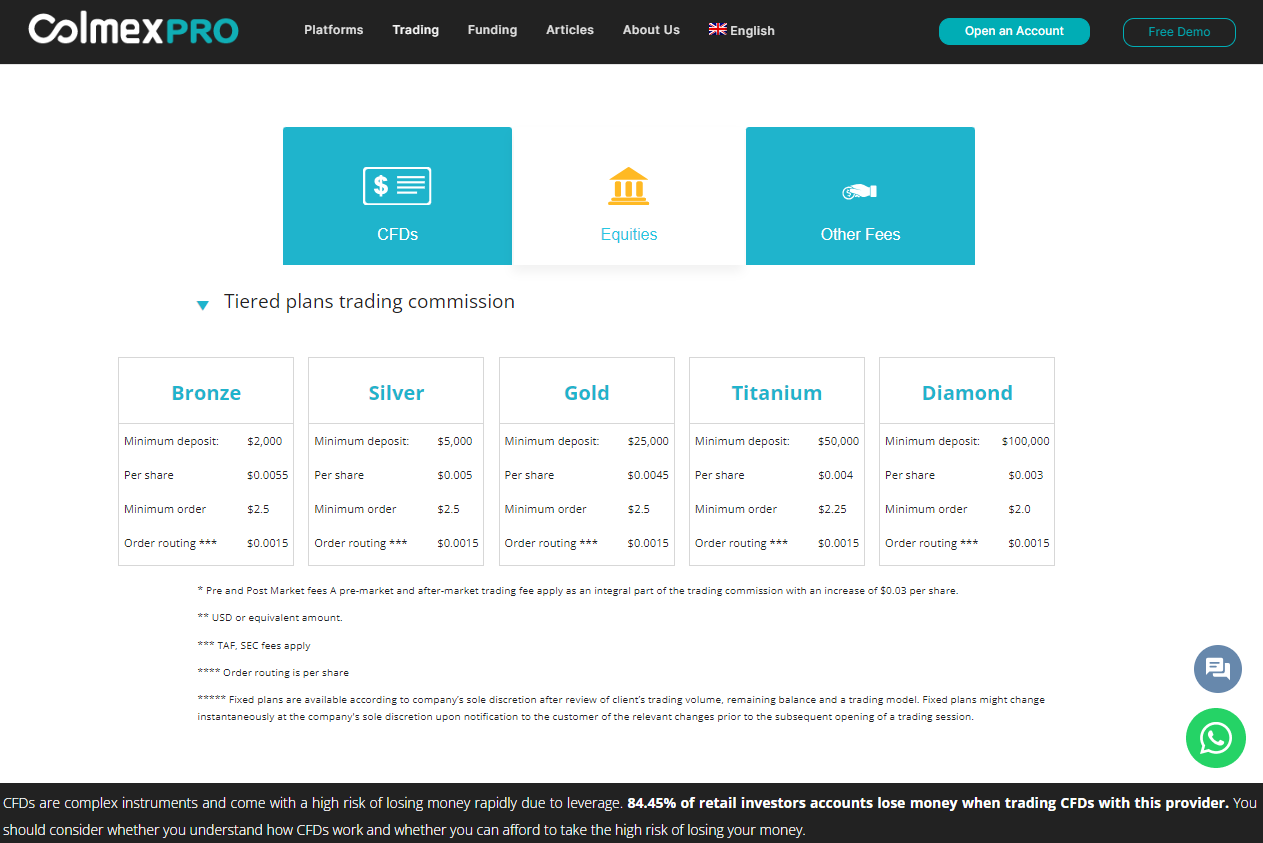

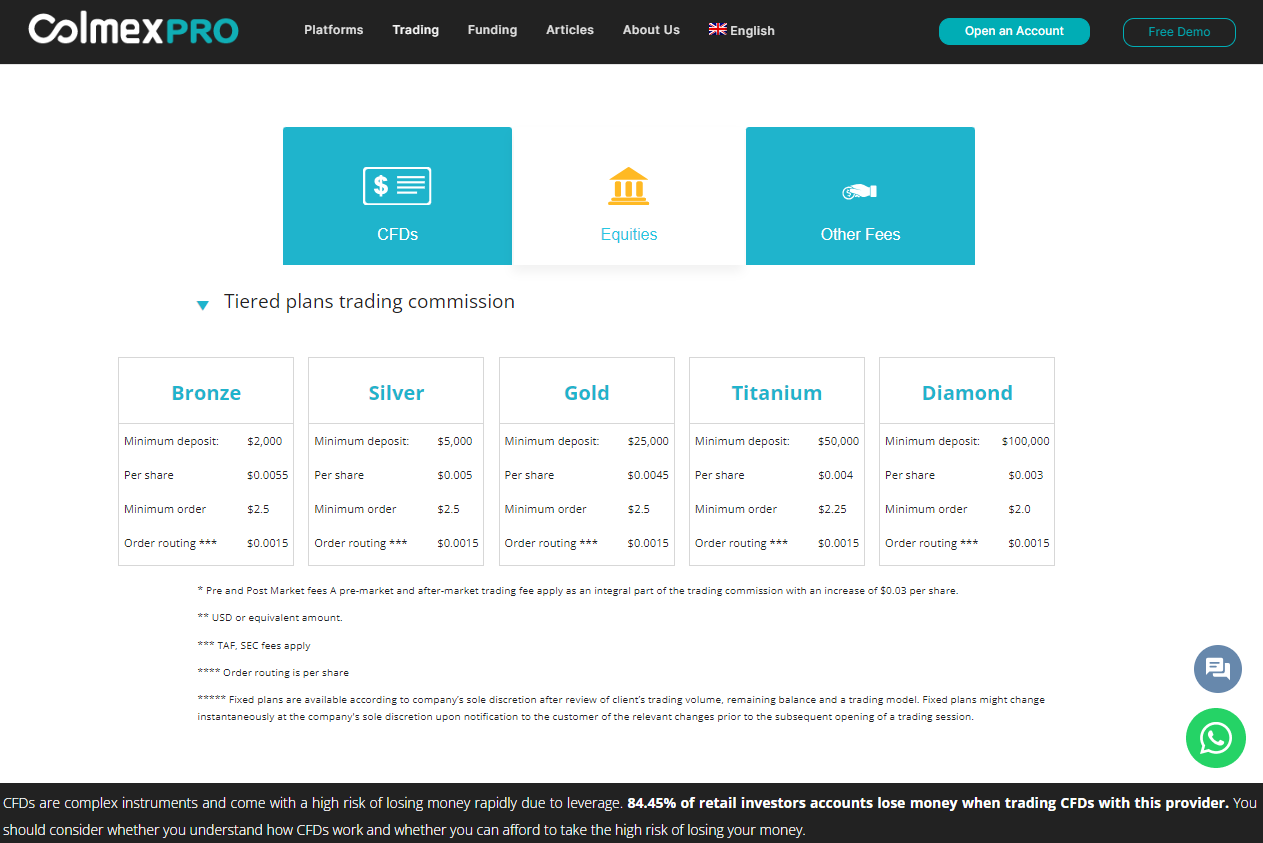

| 🔎 Account Type | 🥇 Bronze | 🥈 Silver | 🥉 Gold | 🪙 Titanium | 💎 Diamond |

| 🩷 Availability | All | All | All | All | All |

| 📈 Markets | All | All | All | All | All |

| 💴 Commissions | From $1.5 | From $1.5 | From $1.5 | From $1.25 | From $1 |

| 📉 Platforms | Colmex Pro 2.0, MT4, MultiTrader | Colmex Pro 2.0, MT4, MultiTrader | Colmex Pro 2.0, MT4, MultiTrader | Colmex Pro 2.0, MT4, MultiTrader | Colmex Pro 2.0, MT4, MultiTrader |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | Up to 1:30 | Up to 1:30 | Up to 1:30 | Up to 1:30 | Up to 1:30 |

| 💶 Minimum Deposit | 500 USD | 5,000 USD | 10,000 USD | 25,000 USD | 50,000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Bronze Account

The Bronze Account is intended for traders who are just starting or have minimal expertise. Stock CFDs demand a minimum deposit of $500 and a minimum order size of $1.50.

However, Fixed equity programs need a minimum deposit of $2,000 and the account charges inexpensive spreads starting at 0.3 pips for forex and leverages up to 1:30 for forex products. Furthermore, the Forex fee is $14.50 per contract side for basic accounts.

Silver Account

The Silver Account is aimed at more experienced traders, with increased features and cheaper commissions than the Bronze Account. Furthermore, the minimum deposit is $5,000, with variable spreads and a $4 commission. Finally, it offers leverage up to 1:30 on forex, gold, silver, CFDs, and stocks.

Gold Account

Professional traders will find the Gold Account even more competitive, with a minimum commitment of $10,000. It offers variable spreads and a $2 commission. Furthermore, this account, like others, allows for leverage of up to 1:30 on various products such as forex, gold, silver, CFDs, and stocks.

Titanium Account

The Titanium account has a larger investment amount, ensuring traders can access even more competitive trading conditions, lower commissions, and more. Furthermore, this account type has an initial investment of $25,000.

Diamond Account

The Diamond Account demands a $50,000 deposit from top-tier traders. Furthermore, it has the lowest commission rates among tiered accounts, with a per-share charge of $0.005. This account is intended for high-volume traders seeking optimal trading conditions.

Demo Account

The Demo Account is intended for novices or, additionally, those who want to practice tactics without risk. It comes with a virtual balance that simulates trading situations. Furthermore, this account provides free access to Colmex Pro’s platforms, making it a useful learning tool.

Islamic Account

The Islamic Account is designed for traders who want transactions to conform with Islamic Sharia law. This swap-free account is intended to suit the demands of Muslim traders by eliminating interest.

Specific elements, such as minimum deposit and features, mimic those of the other account types but have been changed to align with Islamic financial principles.

How To Open an Account

- To register an account, follow these steps:

- Navigate to Colmex Pro’s official website and locate the “Open an Account” or “Register” button.

- Next, choose the type of account you want to open.

- Thirdly, complete the online application form with your personal, financial, and trading experience details.

- Supply documentation proving your identity and address.

- Once your account has been authorized, deposit money to begin trading.

- Finally, download and install the Colmex Pro-supported trading platform.

Trading Platforms and Software

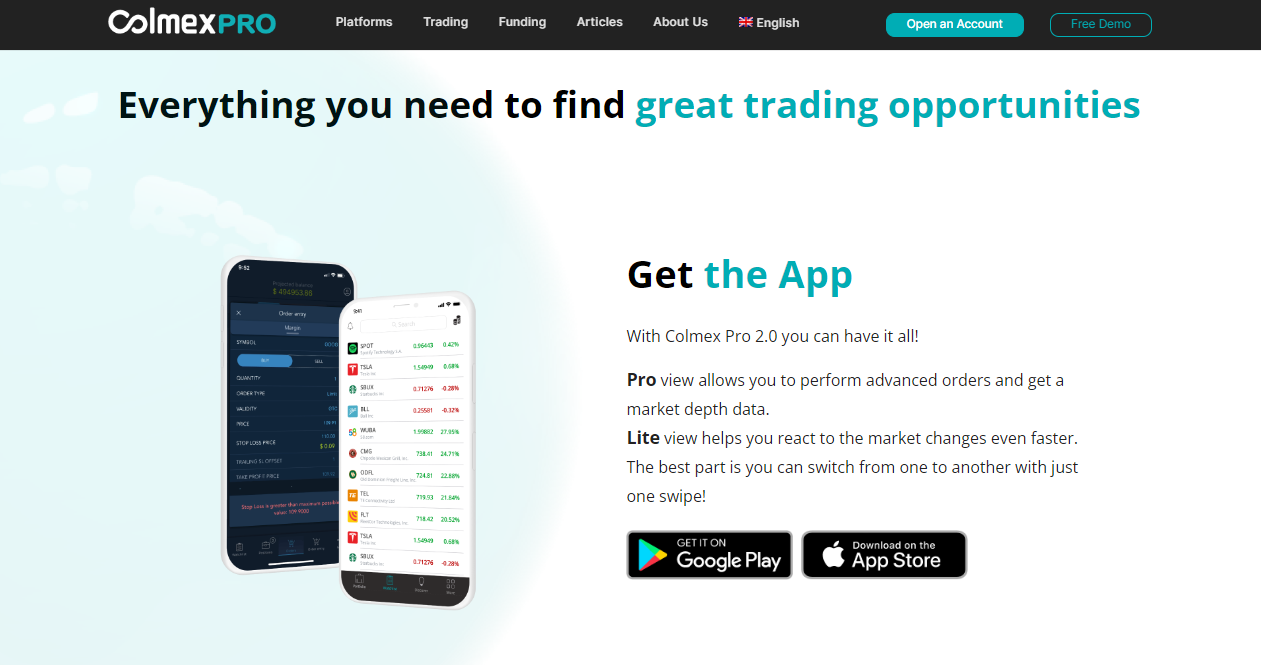

Proprietary Trading Platforms

The broker exclusively developed the Colmex Pro 2.0 platform for traders with diverse expertise.

It provides them with various customizable options on its interface, exhaustive charting capacities incorporating numerous technical indicators, and synthetic instrument-generating capabilities.

The prime focus of this advanced system remains swiftness, and it enables customers to have an individualized trading experience while refining their analysis techniques.

MetaTrader 4

Colmex Pro’s integration of MetaTrader 4 (MT4) brings the universally recognized industry standard for retail trading platforms to clients.

With its familiar interface, powerful algorithmic trading capabilities through Expert Advisors (EAs), and comprehensive collection of community-designed technical indicators, traders can access tried-and-true features that surpass those provided by their brokers alone.

For anyone seeking a reliable option with vast resources at their fingertips, MT4 is an exceptional choice.

MultiTrader

MultiTrader by Colmex Pro is designed to cater to individuals who manage multiple accounts simultaneously. Furthermore, the user-friendly interface prioritizes expeditiousness and efficacy while executing transactions across numerous accounts.

It is targeted at expert traders or financial managers seeking a consolidated platform that offers precision and bulk management functionalities in one place.

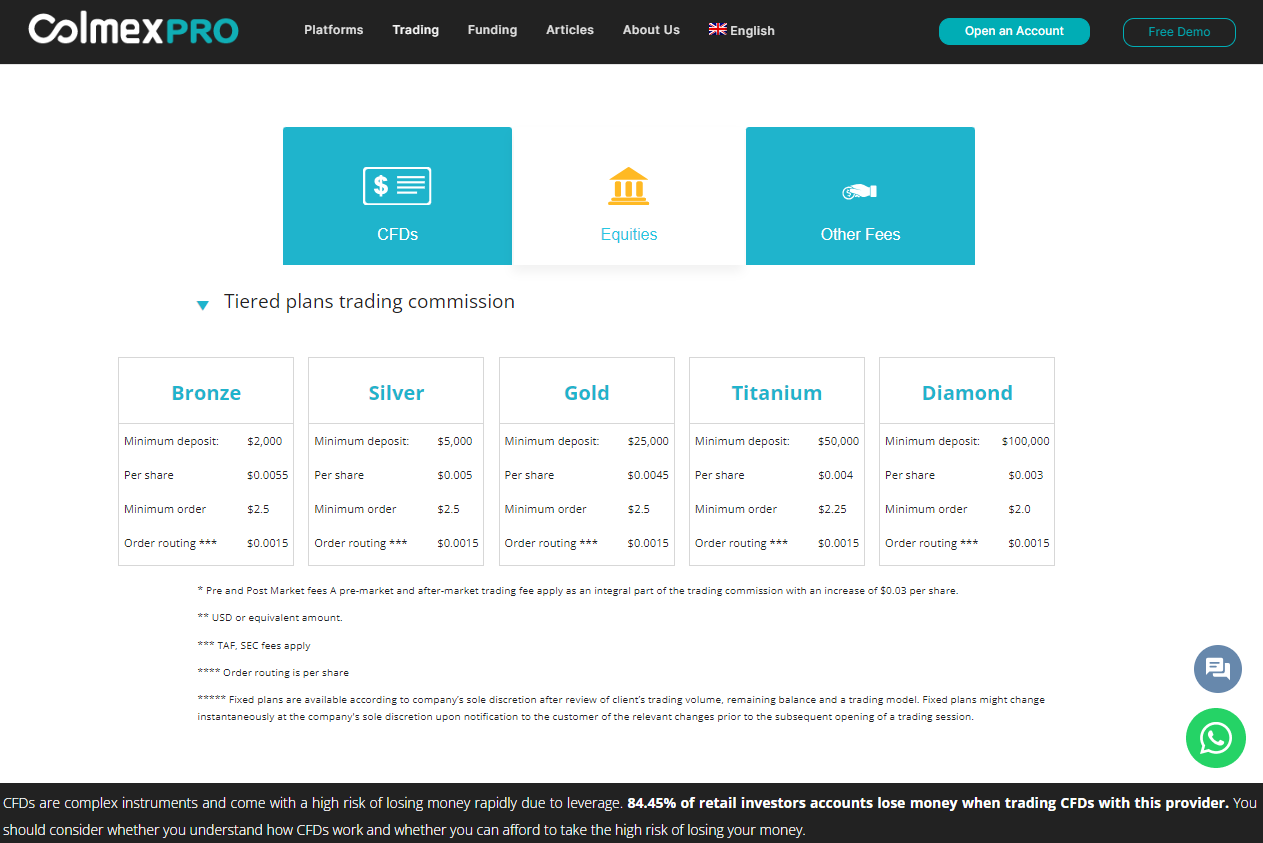

Fees, Spreads, and, Commissions

Spreads

The site is noted for its variable spreads, which start at 0.3 pips on key currency pairings like EUR/USD. This competitive spread rate improves trading efficiency, especially for forex traders who rely on narrow spreads to reduce trading expenses and increase earnings.

Commissions

Colmex Pro commission rates vary based on the account type and the instruments exchanged. For example, CFD trading on stocks needs a minimum deposit and commission costs ranging from $1.50 to $9.95 per transaction.

This tiered commission system enables traders to select the account that best suits their trading volume and strategy.

Overnight Fees

Traders holding positions overnight will pay or swap fees based on their leverage and position size.

The overnight daily margin interest is 0.026%, which applies to leveraged holdings. These fees are industry customary and compensate brokers for the funds provided to traders to maintain positions overnight.

Deposit and Withdrawal Fees

To make financing and withdrawal operations as seamless as possible, Colmex Pro does not charge any deposit fees. However, withdrawals incur a price, with the first transaction of the month costing less than or equal to $500 being free, followed by a $40 fee for future withdrawals.

This pricing structure promotes effective capital management by traders, giving one free withdrawal option every month.

Inactivity Fees

Accounts that have not traded continuously are assessed a $30 monthly inactivity cost. This cost is common among brokers, encouraging traders to stay active or close their accounts if they no longer want to trade.

Currency Conversion Fees

If your Colmex Pro account base currency differs from the currency you deposit or trade, currency conversion fees may apply. These fees are calculated as a percentage of the converted amount.

Leverage and Margin

Colmex Pro offers a customized trading environment for retail and institutional traders. Additionally, leverage and margin restrictions are tailored to traders’ needs.

Its cautious leveraging approach benefits inexperienced traders or those who manage risk carefully. Forex traders can increase their positions by up to 1:30, aligning with regulatory requirements for individual investors.

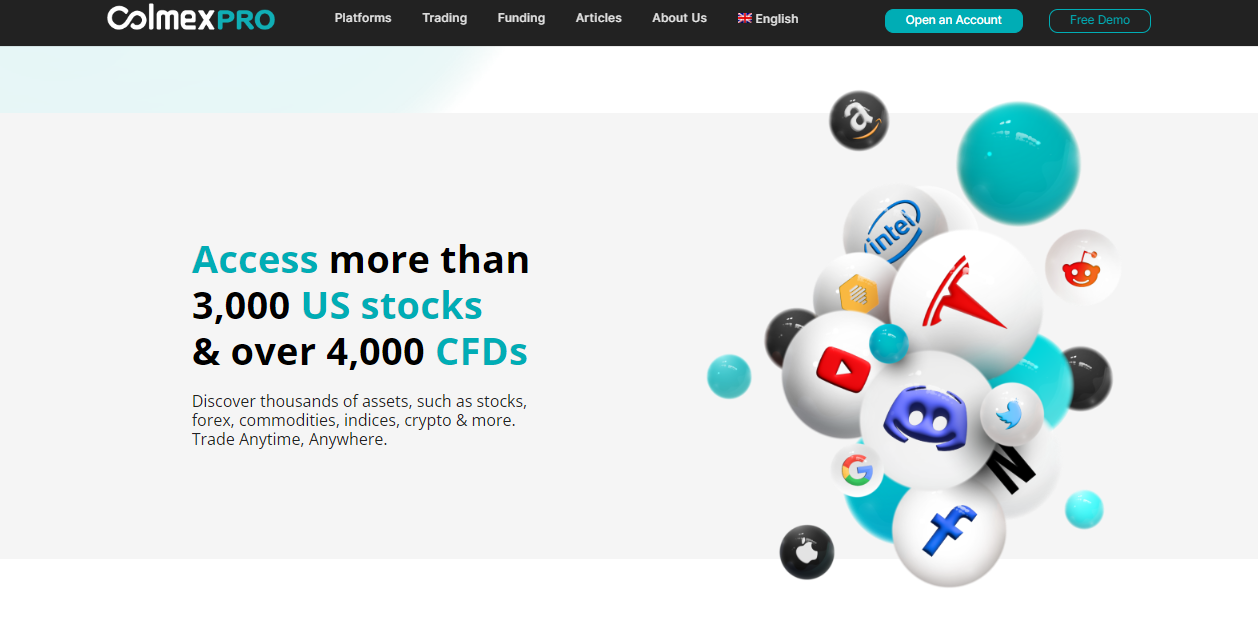

Which Markets Can You Trade?

The following trading instruments and products are on offer:

- Major, minor, and exotic currency pairings on the forex market.

- Indices including the S&P 500, Dow Jones, and NASDAQ

- Various hard and soft commodities

Furthermore, Colmex Pro gives traders access to the stock market, including NASDAQ and the New York Stock Exchange, allowing them to purchase and sell publicly listed stocks.

Deposit and Withdrawals

| 🔎 Payment Method | 🌎 Country | 💰 Currencies Accepted | ⏰ Processing Time |

| 💳 Credit/Debit Card | All | Multi-currency | 1 – 5 days |

| 📊 Bank Wire Transfer | All | Multi-currency | Several days |

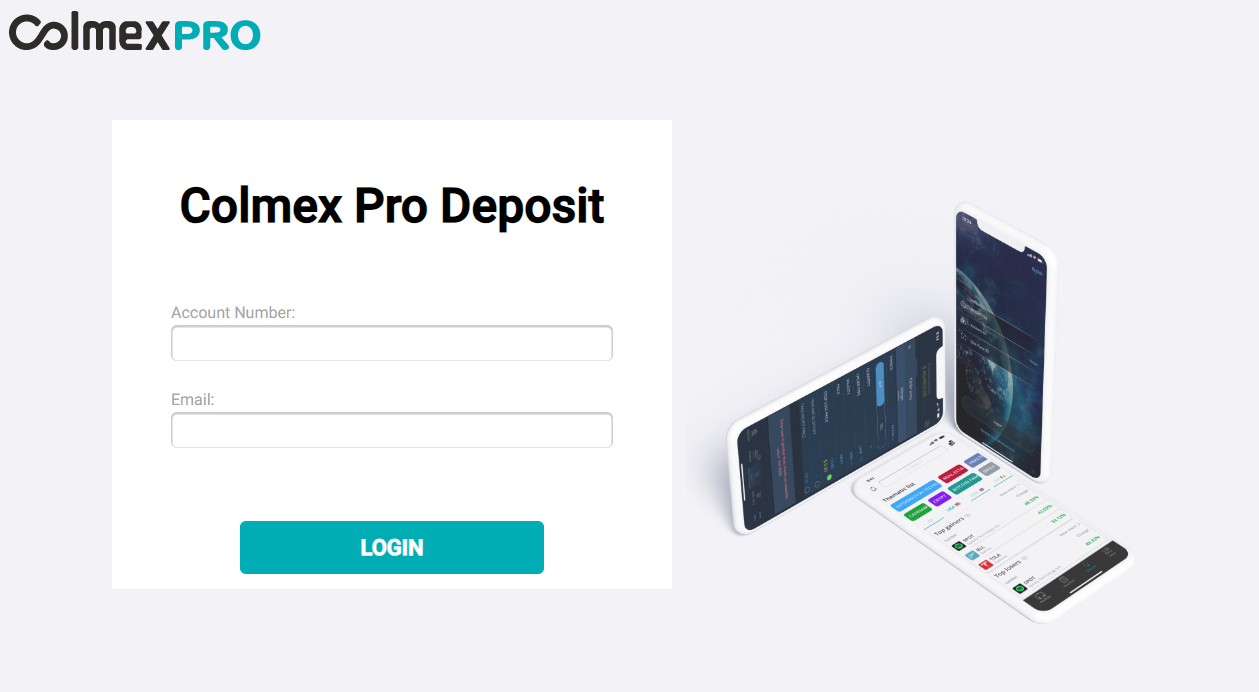

Deposit Options:

Bank Wire

- First, Log in to your account.

- Next, select the Deposit section

- Select “Bank Wire” as your deposit method.

- Obtain the bank wire information supplied by Colmex Pro.

- Visit your bank’s online platform or an in-person branch.

- Finally, use the information supplied by Colmex Pro.

Credit or Debit Card

- First, access your trading account.

- Select the Deposit Option.

- Next, choose your preferred deposit method.

- Provide your card number, expiration date, CVV code, and other additional information.

- Enter the deposit amount.

- Finally, complete any verification processes specified by your card issuer.

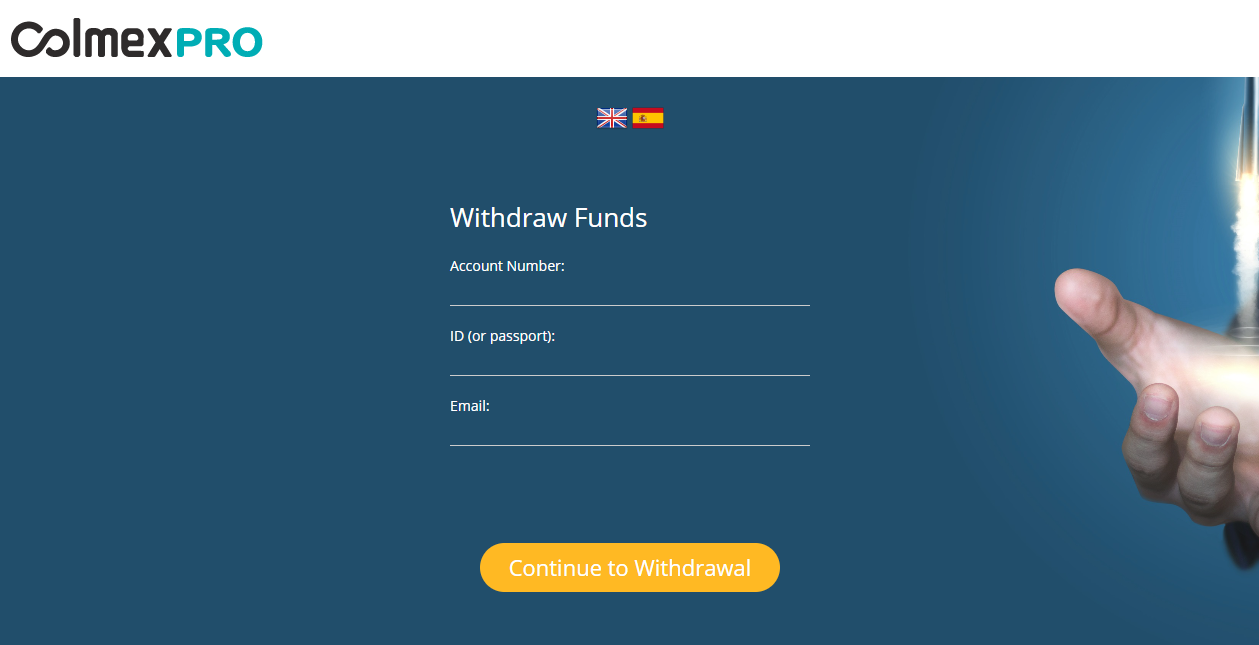

Withdrawal Options:

Bank Wire

- First, log in to your Colmex Pro account.

- Next, find the option to withdraw funds.

- Select this as your withdrawal method.

- Enter the amount you want to withdraw and your bank account details.

- Finally, submit your request after any extra verification procedures requested by Colmex Pro.

Credit or Debit Cards

- First, log in to the Colmex Pro platform.

- Select fund withdrawals.

- Next, choose a Credit/Debit Card for withdrawal.

- Finally, input the amount you want to withdraw to your card.

Educational Resources

To start, the Colmex Pro blog provides instructive articles on various topics valuable to traders of all skill levels. Furthermore, the blog discusses topics like long-term investing vs short-term trading, the benefits of trading bitcoin CFDs, and technical analysis and risk management.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| You can use MetaTrader 4 or Colmex Pro's custom interface, as well as MultiTrader for account administration | In comparison to other brokers, there are fewer training and learning resources available |

| Colmex Pro is regulated by credible financial agencies (CySEC and FCA – Tier-1 entities) | Beginner traders are expected to make large first investments from $500 |

| Trading is accessible for currency, equities, indices, and commodities | Charges higher extra trading costs than other brokers |

| Allows access to leverage of up to 1:30 on forex major pairs | There are charges for inactive accounts and withdrawals |

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Conclusion

Colmex Pro is a professional and adaptable FX and CFD trading broker. It caters to a global clientele with comprehensive platform capabilities and various account options.

Faq

No, Colmex Pro’s customer support only operates 24 hours a day, 5 days a week, from Monday to Friday.

Withdrawals with Colmex Pro can take a few days, depending on the method used.

The minimum deposit for Colmex Pro’s Bronze Account starts from $500 on CFDs.

Yes, Colmex Pro provides Islamic accounts that adhere to Sharia law by not charging swap fees on overnight holdings.

Yes, Colmex Pro is a safe broker regulated by the Tier-1 CySEC and FCA.