6 Best Gold Trading Brokers

The 6 Best Gold Trading Brokers revealed. We have explored and tested several prominent brokers to identify the 6 best.

In this in-depth guide you’ll learn:

- What is a gold trading broker?

- The Best Gold Trading Strategy – Revealed

- What are the advantages of trading gold with CFDs?

- How to trade gold.

- How does leverage work in gold CFD trading?

And lots more…

So, if you’re ready to go “all in” with 6 best gold trading brokers…

Let’s dive right in…

What is a gold trading broker?

A Forex broker providing access to gold trading and speculation offers a platform where investors can trade gold alongside foreign currencies.

With real-time market data and analysis tools, users can speculate on gold’s price movements, leveraging its status as a valuable commodity within the global financial market.

Best Gold Trading Brokers – Comparison

| 🥇 Broker | 🎖 Open an Account | 💰 Minimum Deposit | 📝 Regulation | 💻 Trading Accounts Offered | 🚀 Trading Platforms |

| 1. IG | Open Account | $250 | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA | IG Trading Account, Limited Risk Account, Islamic Account (Dubai traders only), Demo Account | MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API |

| 2. HFM | Open Account | No minimum deposit requirement | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account | MetaTrader 4 and MetaTrader 5 |

| 3. Pepperstone | Open Account | AU$200 | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | Standard Account, Razor Account, Professional Account, Demo Account, Islamic Account | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, Duplitrade |

| 4. Tickmill | Open Account | $5 | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA | Pro Account, Classic Account, VIP Account | MetaTrader 4, MetaTrader 5 |

| 5. AvaTrade | Open Account | $100 | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA | Retail Account, Professional Account | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 6. Plus500 | Open Account | USD100 | CySEC, FCA, MAS, FSA, ASIC, FMA, FSCA | Retail trading account | WebTrader |

6 Best Gold Trading Brokers (2024*)

- ✔️IG Group – Overall Best Gold Trading Broker

- ✔️HFM – Top AutoCharist Broker

- ✔️Pepperstone – Wide selection of instruments

- ✔️Tickmill – Authorized By Several Reputable Market Regulators

- ✔️AvaTrade – Best Forex Broker for Beginner Traders

- ✔️Plus500 – Best Nasdaq 100 Forex Broker

1. IG Group

IG Group is a renowned online trading provider offering access to various financial markets, including gold trading. Through IG‘s platform, traders can engage in gold trading instruments such as spot gold, gold futures contracts, and gold exchange-traded funds (ETFs).

These instruments provide opportunities for investors to speculate on gold’s price movements, leveraging its status as a popular commodity and safe-haven asset.

IG Group offers a range of features tailored to online price speculators. These include real-time price charts, technical analysis tools, and customizable trading strategies. Traders can access market insights, news updates, and expert commentary to inform their trading decisions.

IG’s user-friendly platform facilitates seamless execution of trades, with access available via desktop, mobile devices, and tablets. Additionally, IG provides risk management tools such as stop-loss and take-profit orders, allowing traders to manage their exposure effectively.

Overall, IG Group empowers traders to capitalize on opportunities in the market with comprehensive tools and resources.

IG Group Features

📝 Regulation FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA 📱 Social Media Platforms LinkedIn, Twitter, Facebook, YouTube 🔎 Trading Accounts IG Trading Account, Limited Risk Account, Islamic Account (Dubai traders only), Demo Account 💻 Trading Platforms MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API 💸 Minimum Deposit $250 🔁 Trading Assets Forex, Indices, Shares, Commodities, Cryptocurrencies, Futures, Options 🚀 USD-based Account? Yes 💳 USD Deposits Allowed? Yes 💰 Bonuses for traders? No 📊 Minimum spread From 0.0 pips ✔️ Demo Account Yes ✔️ Islamic Account Yes (Dubai customers only) 🎖 Open an Account Open Account

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Controlled by trustworthy regulators all around the world, which promotes confidence and a sense of security. | Some traders may believe that the fees and taxes are excessive when compared to other brokers. |

| Indices, stocks, currencies, and commodities are among the many investment possibilities that allow for a variety of trading approaches. | They have less access to specific markets or assets than brokers with specialized knowledge. |

| Transparent charge rules and competitive commission agreements assist traders in properly managing costs. | |

| Trading platforms that are easy to use and offer comprehensive tools and analytical capabilities encourage rapid trade execution and decision-making. | |

| Massive customer service through many channels guarantees that traders receive timely advice and direction. |

Trust Score

✅ IG has a very high trust score of 99%

2. HFM

HFM is a leading online broker offering access to a diverse range of financial markets, including gold trading.

Through HFM’s platform, traders can access various trading instruments such as spot gold, futures contracts, and gold-based ETFs. These instruments provide ample opportunities for investors to capitalize on gold’s price fluctuations, leveraging its status as a valuable commodity and safe-haven asset.

HFM provides a suite of features tailored to traders. These include advanced charting tools, technical indicators, and analysis resources to aid in informed decision-making.

Traders can access real-time market data, news updates, and economic calendars to stay abreast of developments influencing prices.

Additionally, HFM offers competitive spreads and flexible leverage options, enabling traders to optimize their trading strategies.

With user-friendly platforms compatible with desktop, web, and mobile devices, HFM ensures seamless access to trading opportunities, coupled with robust risk management tools like stop-loss orders and negative balance protection, fostering a secure trading environment for gold enthusiasts.

HFM Features

📝 Regulation FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA 📱 Social Media Platforms Facebook, Twitter, Telegram, Instagram, YouTube, LinkedIn 🔎 Trading Accounts Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account 💻 Trading Platforms MetaTrader 4 and MetaTrader 5 💸 Minimum Deposit No minimum deposit requirement 🔁 Trading Assets Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs 🚀 USD-based Account? Yes 💳 USD Deposits Allowed? Yes 💰 Bonuses for traders? Yes 📊 Minimum spread From 0.0 pips ✔️ Demo Account Yes ✔️ Islamic Account Yes 🎖 Open an Account Open Account

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM protects negative balances and a maximum leverage of 1:2000, which is beneficial to traders. | Because of the MT4 and MT5 platforms' vast features, beginner traders may need to devote a significant amount of time to the learning process. |

| Competitive commissions and zero-pip spreads benefit HFM traders. | HFM's incentive and advancement programs may lag behind those of its competitors. |

| Traders can select MetaTrader 4 or 5 based on their account type and device. | Providing a high amount of leverage could be quite hazardous. |

| Aside from currency exchange, HFM offers a variety of other financial solutions. | If HFM insists on using foreign exchange and compound interest rates (CFDs), potential investors will be more inclined to examine other investment options such as bonds and stocks. |

| HFM assists users of all skill levels by offering a diverse set of account, instructional, and research categories. | |

| Muslims who trade can open Sharia-compliant accounts, known as swap-free accounts. |

Trust Score

✅ HFM has a trust score of 85%

3. Pepperstone

Pepperstone is a reputable online broker renowned for its comprehensive trading services, including access to trading opportunities.

Through Pepperstone’s platform, traders can engage in various trading instruments such as spot gold, gold futures contracts, and gold CFDs (Contracts for Difference).

These instruments provide diverse opportunities for investors to speculate on gold’s price movements, leveraging its role as a key commodity in the financial markets.

Pepperstone offers specific features tailored to traders, including advanced charting tools, technical indicators, and customizable trading strategies. Traders can access real-time market data, economic calendars, and expert analysis to make informed trading decisions.

With competitive spreads, fast execution speeds, and flexible leverage options, Pepperstone ensures optimal trading conditions for gold enthusiasts.

Additionally, Pepperstone provides a user-friendly platform accessible via desktop, web, and mobile devices, along with risk management tools like stop-loss orders and margin alerts, enabling traders to manage their positions effectively and navigate the markets with confidence.

Pepperstone Features

📝 Regulation ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB 📱 Social Media Platforms LinkedIn, Twitter, Facebook, YouTube 🔎 Trading AccountsCysec ✔️Yes 🔎 Trading Accounts Standard Account, Razor Account, Professional Account, Demo Account, Islamic Account 💻 Trading Platforms MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, Duplitrade 💸 Minimum Deposit AU$200 🔁 Trading Assets Forex, Indices, Shares, Commodities, Cryptocurrencies, Futures, Options 🚀 USD-based Account? ✔️Yes 💳 USD Deposits Allowed? ✔️Yes 💰 Bonuses for traders? No 📊 Minimum spread From 0.0 pips ✔️ Demo Account ✔️Yes ✔️ Islamic Account ✔️ Yes 🎖 Open an Account Open Account

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone Markets focuses on FX and Contracts for Difference (CFD) trading. The broker follows strict guidelines to protect customer funds and investment interests. | There are no fixed spreads available. |

| Pepperstone Markets provides local deposit and withdrawal alternatives for the convenience of its traders. | Additional fees may apply to the Islamic Account. |

| Pepperstone Markets is subject to intensive regulatory scrutiny in several countries across the world. | Due to geographical constraints, traders must produce documentary evidence proving their place of residence throughout the Islamic Account conversion procedure. |

Trust Score

✅ Pepperstone has a high trust score of 92%

4. Tickmill

Tickmill is a trusted online broker offering access to a wide range of financial instruments, including gold trading opportunities.

Traders on Tickmill’s platform can access various trading instruments such as spot gold, gold futures contracts, and gold CFDs (Contracts for Difference). These instruments provide ample opportunities for investors to capitalize on gold’s price movements, leveraging its status as a valuable commodity and safe-haven asset.

Tickmill provides specific features tailored to gold traders, including advanced charting tools, technical analysis indicators, and customizable trading strategies.

Traders can access real-time market data, economic calendars, and news updates to stay informed about factors influencing gold prices. With competitive spreads, fast execution speeds, and flexible leverage options, Tickmill ensures favourable trading conditions for gold enthusiasts.

Additionally, Tickmill offers a user-friendly platform accessible via desktop and mobile devices, along with risk management tools like stop-loss orders and margin alerts, empowering traders to manage their positions effectively and navigate the markets with confidence.

Tickmill Features

📝 Regulation Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA 📱 Social Media Platforms Facebook, Twitter, LinkedIn, YouTube, Instagram, Telegram 🔎 Trading Accounts Pro Account, Classic Account, VIP Account 💻 Trading Platforms MetaTrader 4, MetaTrader 5 💸 Minimum Deposit $5 🔁 Trading Assets Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies 🚀 USD-based Account? Yes 💳 USD Deposits Allowed? Yes 💰 Bonuses for traders? Yes 📊 Minimum spread From 0.0 pips ✔️ Demo Account Yes ✔️ Islamic Account Yes 🎖 Open an Account Open Account

Pros and Cons

| ✅ Pros | ❌ Cons |

| Tickmill is known for offering some of the tightest spreads in the industry, reducing trading costs for investors. | Tickmill's educational resources may be relatively limited compared to some other brokers, which could hinder the learning curve for novice traders. |

| Tickmill boasts lightning-fast execution speeds, ensuring timely order processing and minimizing slippage. | Tickmill may not be available in all regions, limiting accessibility for some potential traders. |

| Tickmill provides access to a wide range of financial instruments beyond forex, including commodities, indices, and bonds, diversifying trading opportunities. | Tickmill's platform may lack comprehensive social trading features, which could be a disadvantage for those seeking to engage in social trading or copy-trading strategies. |

| Tickmill maintains transparent pricing with no hidden fees or commissions, fostering trust and confidence among traders. | Customer support may not be available in as many languages as some other brokers, potentially posing a challenge for traders who prefer support in languages other than English. |

| Tickmill employs cutting-edge trading technology and infrastructure, enhancing the overall trading experience for clients. | While Tickmill provides essential research tools, it may offer fewer advanced research resources compared to some competitors, potentially limiting the depth of analysis for traders. |

Trust Score

✅ Tickmill has a trust score of 82%

5. AvaTrade

AvaTrade is a reputable online broker offering a comprehensive suite of trading services, including access to gold trading opportunities.

Traders on AvaTrade’s platform can engage in various trading instruments such as spot gold, gold futures contracts, and gold CFDs (Contracts for Difference). These instruments present diverse opportunities for investors to capitalize on gold’s price movements, leveraging its status as a sought-after commodity and hedge against economic uncertainty.

AvaTrade provides specific features tailored to gold traders, including advanced charting tools, technical indicators, and customizable trading strategies. Traders can access real-time market data, economic calendars, and expert analysis to make informed decisions.

With competitive spreads, rapid trade execution, and flexible leverage options, AvaTrade ensures favourable trading conditions for gold enthusiasts.

Additionally, AvaTrade offers a user-friendly platform accessible via desktop, web, and mobile devices, along with risk management tools like stop-loss orders and price alerts, empowering traders to manage their positions effectively and navigate the markets confidently.

AvaTrade Features

📝 Regulation Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA 📱 Social Media Platforms Instagram, Facebook, Twitter, YouTube 🔎 Trading Accounts Retail Account, Professional Account 💻 Trading Platforms AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade 💸 Minimum Deposit $100 🔁 Trading Assets Forex, Stocks, Commodities, Cryptocurrencies, Treasuries, Bonds, Indices, Exchange-Traded Funds (ETFs), Options, Contracts for Difference (CFDs), Precious Metals 🚀 USD-based Account? Yes 💳 USD Deposits Allowed? Yes 💰 Bonuses for traders? Yes 📊 Minimum spread From 0.0 pips ✔️ Demo Account Yes ✔️ Islamic Account Yes 🎖 Open an Account Open Account

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade offers a unique risk management tool called AvaProtect, which allows traders to protect their trades against adverse market movements for a specified period, offering peace of mind. | AvaTrade's spreads may be slightly higher compared to some other brokers, potentially increasing trading costs for investors. |

| AvaTrade provides access to a diverse range of financial instruments, including forex, stocks, commodities, cryptocurrencies, and more, offering extensive trading opportunities. | AvaTrade's educational resources may not be as comprehensive as some competitors, which could hinder the learning curve for novice traders. |

| AvaTrade offers a user-friendly mobile trading app called AvaTradeGO, which provides access to trading tools, market analysis, and real-time updates on the go, enhancing flexibility for traders. | AvaTrade imposes inactivity fees on accounts that remain dormant for an extended period, potentially affecting traders who trade infrequently. |

| AvaTrade's platform supports copy trading functionality, allowing traders to replicate the trades of experienced investors automatically, facilitating passive investment strategies. | While AvaTrade offers cryptocurrency trading, the selection of cryptocurrencies available for trading may be more limited compared to specialized cryptocurrency exchanges. |

| AvaTrade offers AvaSocial, a social trading platform where traders can interact, share trading ideas, and follow successful traders, fostering a collaborative trading community. | AvaTrade's platform customization options may be relatively limited compared to some other brokers, potentially limiting flexibility for advanced traders who prefer highly customizable trading environments. |

Trust Score

✅ AvaTrade has a high trust score of 96%

6. Plus500

Plus500 is a popular online broker offering a straightforward trading experience, including access to gold trading opportunities.

Traders on Plus500’s platform can engage in trading through various instruments such as gold CFDs (Contracts for Difference), allowing speculation on gold’s price movements without owning the underlying asset. These instruments offer flexible trading opportunities for investors seeking exposure to gold’s price fluctuations.

Specific features tailored to gold traders on Plus500 include real-time price quotes, customizable charting tools, and technical indicators for analyzing gold’s performance.

Plus500 also provides risk management tools such as stop-loss and take-profit orders, allowing traders to manage their positions effectively.

With a user-friendly interface accessible via desktop and mobile devices, Plus500 ensures seamless access to trading opportunities, coupled with competitive spreads and leverage options.

Overall, Plus500 offers a streamlined trading experience for gold enthusiasts, supported by essential features for informed decision-making.

Plus500 Features

📝 Regulation CySEC, FCA, MAS, FSA, ASIC, FMA, FSCA 📱 Social Media Platforms Facebook, Twitter, Telegram, Instagram, YouTube, LinkedIn 🔎 Trading Accounts Retail trading account 💻 Trading Platforms WebTrader 💸 Minimum Deposit USD100 🔁 Trading Assets Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs 🚀 USD-based Account? Yes 💳 USD Deposits Allowed? Yes 💰 Bonuses for traders? Yes 📊 Minimum spread From 0.0 pips ✔️ Demo Account Yes ✔️ Islamic Account Yes 🎖 Open an Account Open Account

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Plus500 offers user-friendly trading platforms with customizable features, allowing traders to effectively apply their strategies. | While Plus500's design is user-friendly, it lacks comprehensive training resources and information for traders looking to increase their knowledge and skills. |

| Traders can access a wide range of financial assets, such as FX pairings, equities, indices, commodities, and cryptocurrencies, which offer a variety of trading options. | Plus500 may offer fewer research tools and market analysis resources than other brokers, which could be detrimental for traders who rely heavily on such information. |

| Plus500 improves the trading experience by providing new trading tools such as customizable price notifications, powerful charting tools, and risk management options such as guaranteed stop orders. | Plus500 charges inactivity fees for accounts that remain dormant for a fixed period, potentially penalizing traders who do not trade regularly. |

| Plus500 is regulated by reputable financial institutions like as the FCA, ASIC, and CySEC, ensuring the safety and security of customer assets and instilling trust in traders. | While Plus500 offers customer service via email and live chat, some traders may find the lack of phone support frustrating, especially in urgent situations. |

Trust Score

✅ Plus500 has a trust score of 85%

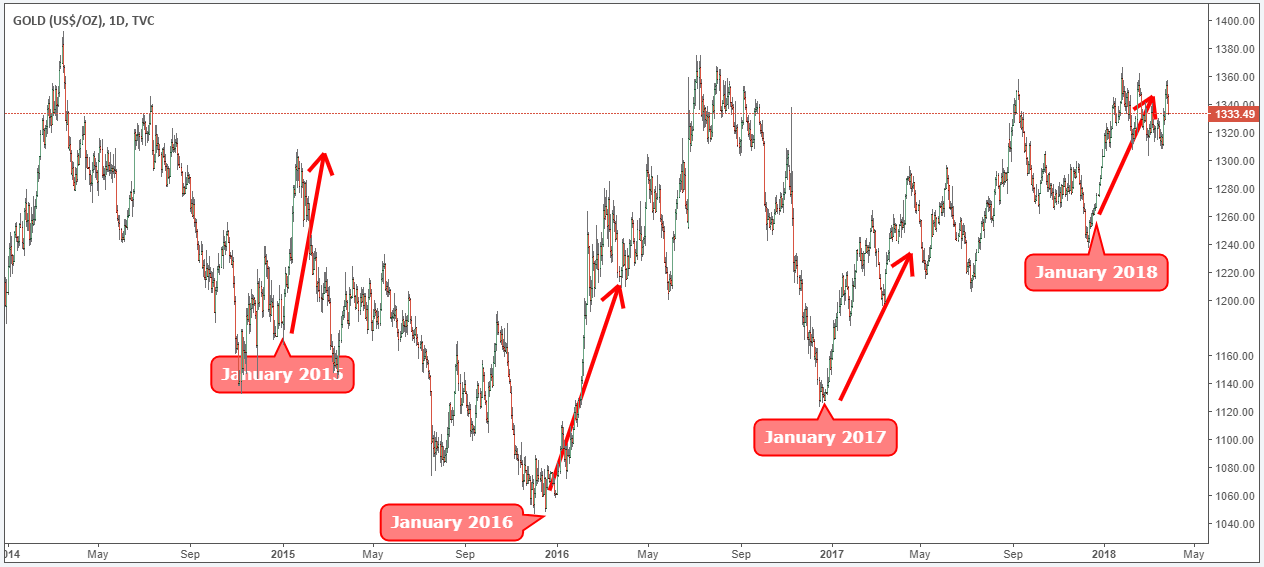

The Best Gold Trading Strategy

The best gold trading strategy often involves a combination of technical analysis, fundamental analysis, and risk management techniques. One popular approach is to use a trend-following strategy, where traders analyze the long-term trends in the market and look for opportunities to buy or sell based on the direction of the trend.

Additionally, traders may use indicators such as moving averages, Fibonacci retracements, and support and resistance levels to identify entry and exit points. Fundamental analysis can also play a role, as traders monitor economic data, geopolitical events, and central bank policies that may impact the price of gold.

Risk management is essential to any trading strategy, and traders should always use stop-loss orders to limit potential losses and protect their capital. Overall, the best gold trading strategy is one that aligns with the trader’s risk tolerance, time horizon, and trading objectives.

How to trade gold – Explained.

Trading gold involves several steps:

➡️Educate Yourself: Before you start trading, it’s essential to educate yourself about the factors that influence its price, such as supply and demand dynamics, geopolitical events, inflation, and central bank policies.

➡️Choose a Broker: Select a reputable broker that offers gold trading. Ensure that the broker provides access to the market and offers competitive spreads, low commissions, and robust trading platforms.

➡️Analyze the Market: Conduct a thorough analysis of the market using both technical and fundamental analysis. Technical analysis involves studying price charts and using indicators to identify trends and potential entry and exit points. Fundamental analysis involves assessing factors like economic data, geopolitical events, and central bank policies that can impact the price of gold.

➡️Develop a Trading Strategy: Based on your analysis, develop a trading strategy that outlines your entry and exit criteria, risk management rules, and position sizing techniques. Consider factors such as your risk tolerance, trading style, and time horizon when developing your strategy.

➡️Place Trades: Once you have a trading strategy in place, use your broker’s trading platform to place trades. You can buy or sell contracts, such as spot contracts or futures contracts, depending on your trading preferences.

➡️Monitor Your Positions: Keep a close eye on your gold trades and monitor market developments that may affect the price of gold. Use stop-loss orders to limit potential losses and take-profit orders to lock in profits.

➡️Review and Adjust: Regularly review your trading performance and adjust your strategy as needed. Learn from both your winning and losing trades to improve your trading skills over time.

➡️Stay Informed: Stay informed about market news and events that can impact the price of gold. Follow financial news outlets, monitor economic calendars, and stay connected with other traders to stay abreast of market developments.

Conclusion

Overall, the best gold trading brokers offer diverse instruments, competitive pricing, and robust features tailored to traders’ needs. Whether through advanced platforms, innovative risk management tools, or comprehensive educational resources, these brokers empower investors to capitalize on gold’s dynamic market with confidence and convenience.

Faq

CFD stands for Contract for Difference. In gold trading, CFDs allow traders to speculate on the price movements of gold without owning the physical asset. Traders can go long (buy) or short (sell) contracts, aiming to profit from price changes.

Trading gold with CFDs offers several advantages, including leverage, which allows traders to control larger positions with a smaller initial investment. Additionally, CFDs provide flexibility to profit from both rising and falling gold prices, and they offer access to real-time market prices with minimal fees.

Leverage enables traders to amplify their exposure to gold’s price movements. For example, with a leverage ratio of 1:20, a trader can control a position worth $20,000 with a deposit of just $1,000. While leverage magnifies potential profits, it also increases the risk of losses, so it should be used cautiously.

When selecting a gold trading broker for CFDs, consider factors such as regulatory compliance, trading platform features, fees and commissions, customer support quality, and the broker’s reputation. It’s essential to choose a broker that aligns with your trading goals, risk tolerance, and preferred trading style.