AUD/USD Price Outlook: Aussie Dips to 0.6565 on Weak CPI, Eyes Fed and NFP

Arslan Butt•Wednesday, January 31, 2024•2 min read

The Australian dollar (AUD/USD price) experienced a notable decline of over 0.50% to trade near 0.6565 during the Asian trading session, reacting sharply to the latest Consumer Price Index (CPI) data release.

The quarterly CPI rose by 0.6%, underperforming the expected 0.8% and the previous 1.2%. Yearly CPI figures also fell short, coming in at 3.4% against the forecasted 3.7% and preceding 4.3%, indicating tempered inflationary pressure.

The Trimmed Mean CPI, a measure that excludes volatile items, was similarly disappointed with a 0.8% rise compared to predictions of 0.9% and the prior rate of 1.2%.

Despite this, private sector credit month-on-month remained steady at 0.4%, aligning with market expectations. FOMC and US NFP are going to have an impact on the AUD/USD price. Looking ahead, the market’s gaze shifts towards the United States, where significant economic announcements loom.

The Federal Reserve’s rate decision is the imminent focal point, with a majority of the market not expecting a rate change this week. However, nearly half of the rate swap market, as per the CME’s FedWatch Tool, still harbours hope for a March rate reduction.

Compounding the anticipation, the upcoming US Non-Farm Payrolls (NFP) are projected to display a slight deceleration in job growth, with forecasts suggesting a figure of 180K for January, down from December’s 216K.

Should the NFP figures exceed expectations, it could jolt investors by diminishing prospects for an early rate cut, considering the resilience of the US labour market. This potential ‘rate tantrum’ underscores the delicate balance investors are navigating amid shifting economic indicators and central bank policies.

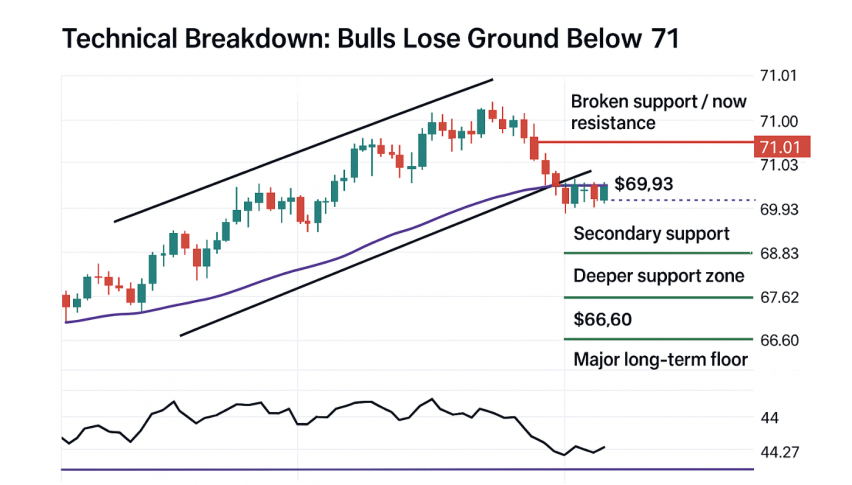

AUD/USD Price Outlook: Technical Outlook

The Australian Dollar (AUD/USD) presents a complex technical picture in today’s session. According to the green line on the four-hour chart, the pair is currently trading just below the crucial $0.65747 level.

Resistance levels above this pivot are identified at $0.6589, $0.6603, and $0.6646, each representing potential turning points for price advancement. Conversely, the currency pair finds immediate support at $0.6565, with further downside protection at $0.6524 and $0.6544, which may halt declining prices.

The Relative Strength Index (RSI) is positioned at 51.23, indicative of neutral momentum without clear directional bias. Moreover, the 50-day Exponential Moving Average (EMA) at $0.6589 offers a confluence with the pivot point, underscoring a significant technical juncture.

AUD/USD price has recently breached a bearish flag pattern at $0.6585 on the four-hour chart, signaling the potential for an extension of the selling pressure.

Concluding this technical outlook, the recommendation is to consider a bearish stance, eyeing opportunities to sell below the $0.65747 level, with a vigilant watch on the aforementioned support and resistance zones for further cues on price movement.

AUD/USD Live Chart

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Arslan Butt

Index & Commodity Analyst

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments