eur-usd

The Eurozone Consumer Is Still Weak, Sending EUR/USD Toward 1.08

Skerdian Meta•Tuesday, January 23, 2024•2 min read

The Euro has been holding up better than most other major currencies, as USD buyers returned in January. But, the selling pressure is catching up with EUR/USD as the European consumer keeps getting weaker, and today this forex pair resumed the decline, losing around 80 pips so far as it heads to 1.08 lows.

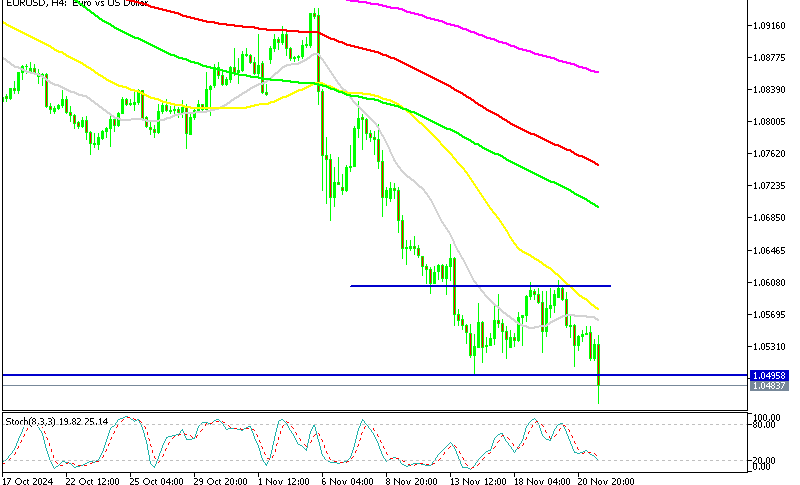

EUR/USD H4 Chart – The 200 SMA Has Turned Into Resistance

Will the price head to 1.05 again?

This pair was pretty bullish in November and December after a dovish shift in rhetoric, which sent the USD tumbling down. However, the USD reversed up at the end of last month and EUR/USD reversed lower at 1.1150. The price fell to the 200 SMA (purple) which was holding as support during the first half of this month on the H4 chart, at around 1.09. Last week the decline resumed and this moving average was broken, which then turned into resistance. However, the price was sticking to this moving average. Today, the USD resumed the bullish momentum and EUR/USD has fallen 80 pips lower to 1.0830s from above 1.09.

Besides the revived strength in the USD, this pair is suffering from disappointing economic data from Europe. The European consumer is getting weaker, which is the opposite of what we’re seeing in the US, where the consumer remains resilient. The Eurozone consumer confidence fell further to -16.1 points this month, against -14.3 points expected. This confirms that the situation is still deteriorating in Europe, so the ECB will have to make a hawkish shift sooner rather than later.

Eurozone Consumer Confidence Report for January

- January Consumer Confidence: -16.1 points

- Expected Consumer Confidence (January): -14.3 points

- Previous Month (December) Consumer Confidence: -15.0 points

Consumer confidence has gradually improved as inflation began to fall while crude Oil is lower, but today’s reading doesn’t go in line with the trend and besides that, this indicator is negative. So, the Euro is feeling this and EUR/USD remains one of the weakest pairs today. The increase in Treasury rates is helping lift the USD, with the 10-year yields up to 4.153%.

EUR/USD Live Chart

EUR/USD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

23 hours ago

Save

Save

1 day ago

Save

Save

2 days ago

Save

Save