USD/JPY Dynamics: Inflation Data and BoJ Speculations Shape Market Movements

The Japanese Yen (JPY) saw a downward adjustment after the release of weaker-than-anticipated core consumer inflation data in the Asian session on Friday. However, increasing expectations of a policy shift by the Bank of Japan (BoJ) provided some support.

Inflation in Japan, both headline and core, has consistently exceeded the BoJ’s 2% target for the 19th month in a row. Market predictions are now solidifying around the BoJ moving away from its negative interest rate policy early in 2024, driven by the prospect of another significant round of salary increases next year underpinning ongoing inflation.

Concurrently, the USD/JPY pair didn’t manage to surpass the weekly high, impacted by the subdued au Jibun Bank flash Japan Manufacturing PMI, which indicated a contraction for the sixth consecutive month in November. Nevertheless, the pair’s downside is limited due to a slight rise in the US Dollar (USD). The recent hawkish Federal Open Market Committee (FOMC) minutes and positive US labor and consumer sentiment data have cast doubts on the Fed’s future actions. This uncertainty, coupled with an increase in US Treasury bond yields, has rejuvenated demand for the USD, providing a boost to spot prices.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Japanese government data released on Friday showed the nationwide core Consumer Price Index (CPI) increasing by 2.9% year-on-year in October, marginally below the 3.0% forecast. This persistent inflationary trend, significantly above the BoJ’s 2% target, signals that inflation pressures in Japan are more tenacious than previously anticipated.

The core-core index, which excludes both fresh food and fuel costs, also slowed down from 4.2% in September to 4.0% in October, but remains near a 40-year high. The headline CPI accelerated to a 3.3% year-on-year pace in October. Furthermore, anticipated wage hikes next year in Japan could further drive consumer spending and demand-driven inflation, necessitating a policy shift by the BoJ.

The growing consensus that the Federal Reserve might refrain from further rate hikes continues to pressure the US Dollar, capping any significant gains for the USD/JPY pair. The flash Japan Manufacturing PMI decreased to 48.1 in November, continuing its trend below the 50.0 expansion-contraction threshold since June. Investors are now awaiting the release of the flash US PMI data during the early North American session for short-term trading cues on the week’s final day.

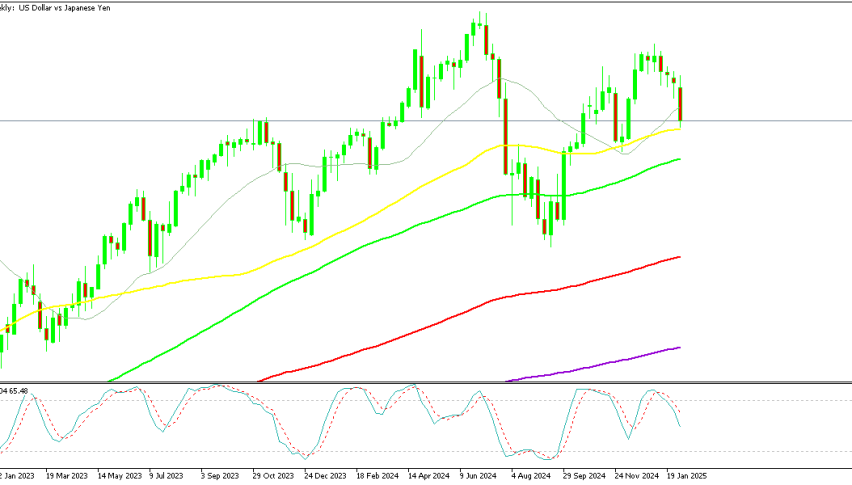

From a technical standpoint, the USD/JPY pair is oscillating around the EMA50 following its recent decline, with stochastic indicators now showing negative signals. This suggests a continuation of the expected bearish trend, aiming first at the 148.30 level.

From a technical standpoint, the USD/JPY pair is oscillating around the EMA50 following its recent decline, with stochastic indicators now showing negative signals. This suggests a continuation of the expected bearish trend, aiming first at the 148.30 level.

However, it’s important to note that if the pair breaches 149.70, it could halt this bearish trend and potentially lead to a resurgence in the primary bullish trajectory. The trading range for the day is projected between 148.60 support and 150.10 resistance, with a bearish trend anticipated for the day.