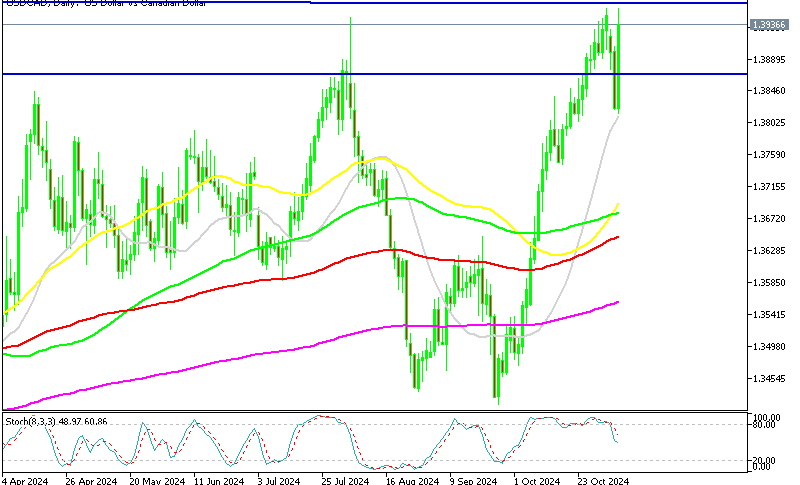

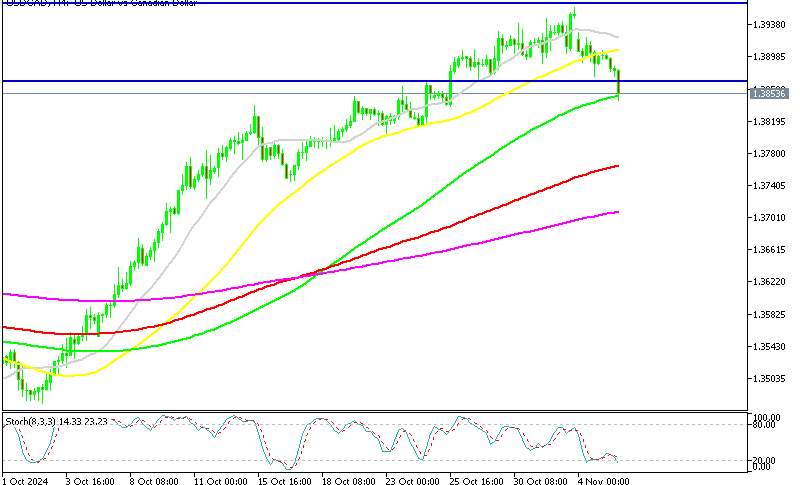

USD/CAD continues to make higher highs since July after reversing around 1.31 and breaking through the resistance zone at 1.38 early this month. The price was heading toward the next resistance zone, close to 1.39, on the daily chart, and it breached slightly over 1.3903, signaling that the decline in crude Oil and the disappointing employment data from Canada in October were factors that kept this pair bullish, although we have been seeing lower highs this month with the trading range getting narrower, which shows uncertainty.

Reacting to drastically reduced Oil prices, USD/CAD continued higher, which means a weaker CAD. The price of crude Oil declined almost 10% from the top to the bottom last week, as it headed to $72 lows, which is the lowest point since early July. Although the 40 SMA (yellow) has been holding as support on the daily chart since the beginning of this month, pushing the lows higher.

The recent CPI inflation report from the US fell short of all forecasts, which raised the prospect of rate cuts by the FED. The US PPI significantly underperformed estimates last week as well, however, the US Retail Sales came above predictions. Although the FED has been sounding more hawkish recently, last week’s inflation reports essentially proved that the FED may be done with the hiking cycle, which has turned the USD bearish.

But the economic situation in Canada might be worse, with the most recent labor data coming in below all forecasts, showing negative numbers for full-time employment and a deceleration in wage growth, which should keep the BOC dovish. The Bank of Canada was pleased to see that the recent inflation numbers fell short of all predictions and that the underlying inflation indicators moderated. Governor Macklem also gave a less aggressive statement at the press conference than he had in the past. So, the trading range in this pair continues to narrow, until we see a breakout in either direction.

USD/CAD Live Chart

USD/CAD