Gold Makes A Clear Bullish Break As Global Tensions Increase

Gold has been seen as a safe-haven asset in times of violence and instability, the precious metal has frequently which means that it runs higher during such periods. It reached an all-time high during the pandemic-induced financial turbulence in spring 2020 at $2,078 and after a retreat lower it retested the top once again during the start of the Russia-Ukraine conflict in early 2022.

With the Middle East crisis escalating again, Gold is gaining near-term traction, as global tensions stay high. In late September we saw a tumble down to $1,810 in XAU/USD, as the USD gained some strong momentum, but then the reversal came as geopolitics kicked in and now Gold seem to be heading for $2,000 again after gaining around $150 in the last two weeks.

Gold has strengthened dramatically as a result of escalating Middle East tensions, allowing it to rebound fast on Tuesday despite the announcement of positive US Retail Sales data, which increased by 0.7% due to rising gasoline prices. Demand for XAU increased dramatically as a result of the intensifying confrontation between Israel and Palestine following the hit on a Gazan hospital, with Iran previously warning of a possible involvement if Israel launches a ground invasion.

On Wednesday, October 18, XAU/USD rose sharply in early trade in the domestic futures market and continued further during the day, climbing above $1,960, tracking favorable trends in foreign markets on fears about escalation of the conflict. GOLD prices rose around 2% in total during the day to their highest level in a month.

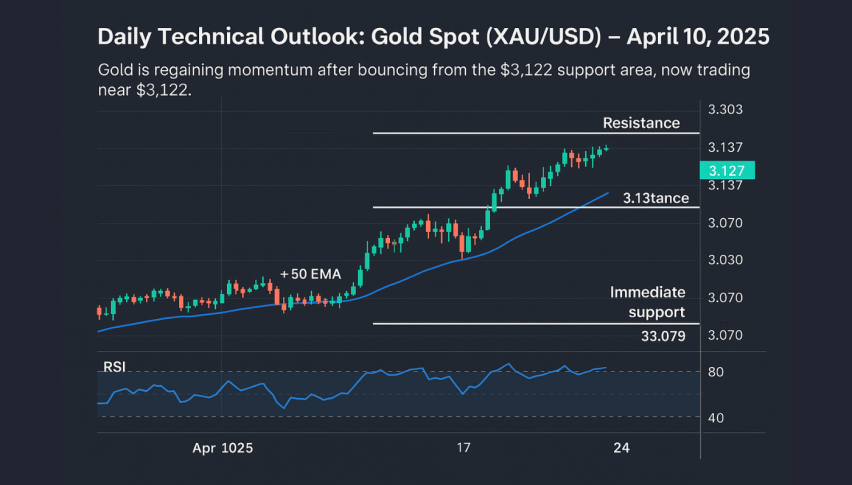

The 100 SMA (green) has been acting as support and resistance in the daily chart and we saw two rejections by this moving average in the last two months. This time the price was hoovering around that moving average again for a few days, but yesterday we saw a clear break of the 100 SMA, which is another bullish signal.