Crude Oil Closes the Week Higher, But Quarterly Downtrend Persists

Crude Oil has been bearish for more than a year, although it closed last week and the month of June with gains, after experiencing an increase in during most of this week. The price increase this week was supported by positive economic numbers from the US, as well as indications of cooling U.S. inflation. Now markets are expecting just one more hike by the FED in July and then the Federal Reserve is expected to end the tightening cycle, which could further benefit economic activity in the largest consumer market globally, helping increase the demand for Oil.

Both UK Brent and US WTI Oil gained over 3% during the month of June, with Brent crude achieving its first positive monthly performance this year. Although, the Q2 overall was bearish once again for the fourth consecutive time due to concerns surrounding sluggish global economic activity, as China is not rebounding as expected and weakened fuel demand.

In China, factory activity declined for the third consecutive month in June, as indicated by the official purchasing managers’ index, which fell to 49.0 points. This figure falls below the 50-point threshold which means contraction.

Furthermore, the services sector in China also displayed its weakest reading for June at 53.2 points, since the country eased its strict coronavirus restrictions late last year. In Europe, the economic situation is looking even worse, with the Eurozone experiencing a recession in the first quarter of the year after the downward revisions and subsequent growth showing only marginal improvement in the following months.

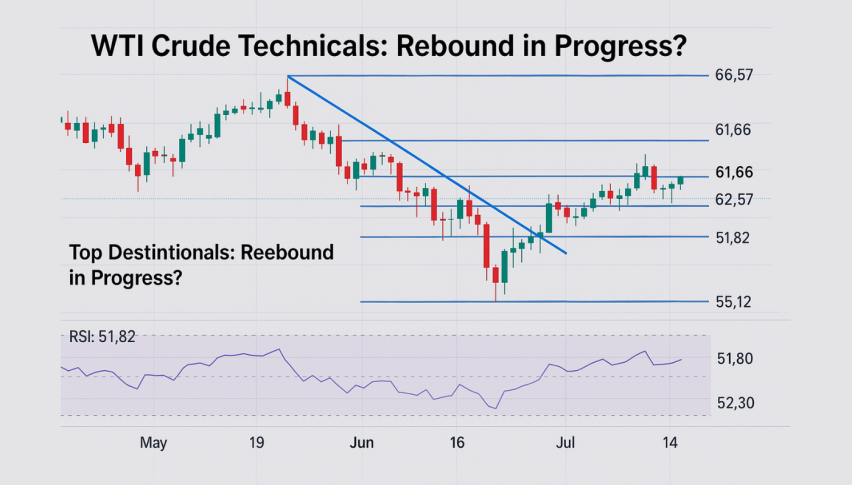

US WTI has formed a support zone above $71, where buyers look to be active. We have seen Oil bounce four times since early May off this area which seems like a good place to buy. Although the main trend still remains bearish and the price is approaching the 50 SMA (yellow) on the daily chart, which has been providing resistance since late May. So, we are waiting it out and will look to open a long term sell signal in Oil this week, depending on the price action as well.