Pound Sterling Aims to Extend Recovery Amid Fiscal Measures Against Inflation

The Pound Sterling (GBP) is aiming to stretch recovery as the United Kingdom’s government is looking to inculcate fiscal tools in the battle against stubborn inflation.

Arslan Butt•Monday, June 26, 2023•2 min read

The Pound Sterling (GBP) is aiming to stretch recovery as the United Kingdom’s government is looking to inculcate fiscal tools in the battle against stubborn inflation. The GBP/USD pair recovered after remaining well-supported near 1.2700, after the British administration announced new fiscal measures such as cutting wages of public sector employees. The British government also asked companies to bring down profit margins to tame sticky inflation, which might help trim fears of a bleak economic outlook.Last week, hotter-than-expected headline United Kingdom’s headline inflation and fresh highs in the core Consumer Price Index (CPI) forced the Bank of England (BoE) to announce a fat rate hike of 50 basis points.

Headline inflation remained higher than anticipation as upbeat sales of second-hand automobiles offset a decline in energy prices.The economic outlook of the United Kingdom is facing risks after the Bank of England (BoE) surprisingly raised interest rates by 50 basis points to 5%. This decision was prompted by the persistently high inflation levels in the country. Headline inflation in the UK soared to 8.7%, primarily driven by price increases in recreational cultural goods and services, air travel, and second-hand cars.

Core inflation also rose to 7.1%, reaching new highs despite the continuous tightening measures implemented by the central bank. Although UK Retail Sales exceeded expectations with a monthly expansion of 0.3%, the annualized figure contracted by 2.1%, exceeding the predicted contraction of 2.6%. BoE Governor Andrew Bailey has hinted at the possibility of further interest rate hikes as the journey towards achieving price stability is far from complete.

However, additional rate hikes by the BoE may have adverse effects on the economic outlook. The persistent UK inflation is dampening the image of the Conservative Party, resulting in a rollback of promised tax cuts to mitigate inflationary pressures and support the central bank’s efforts. UK Finance Minister Jeremy Hunt is engaging in discussions with industry regulators, emphasizing the importance of businesses not exploiting upbeat demand by raising profit margins, a phenomenon referred to as “greedflation.” The broader market sentiment reflects a risk-averse theme, with global equities showing lofty valuations and the upcoming quarterly earnings season approaching. Meanwhile, the US Dollar Index is rebounding following a corrective move, as the Federal Reserve (Fed) is widely expected to announce an interest rate hike in July. Analysts at Rabobank anticipate a more moderate pace of rate hikes, potentially skipping September and considering a second hike in November. Investors will closely

monitor the release of United States Durable Goods Orders data scheduled for Tuesday at 12:30 GMT.

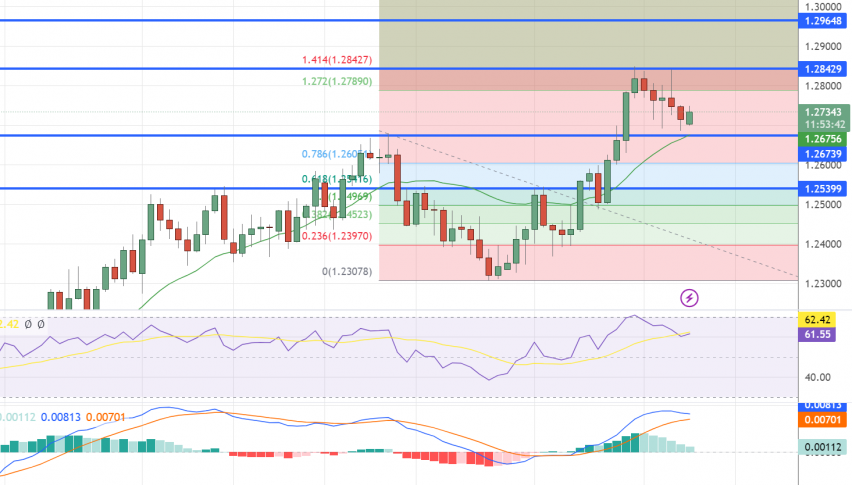

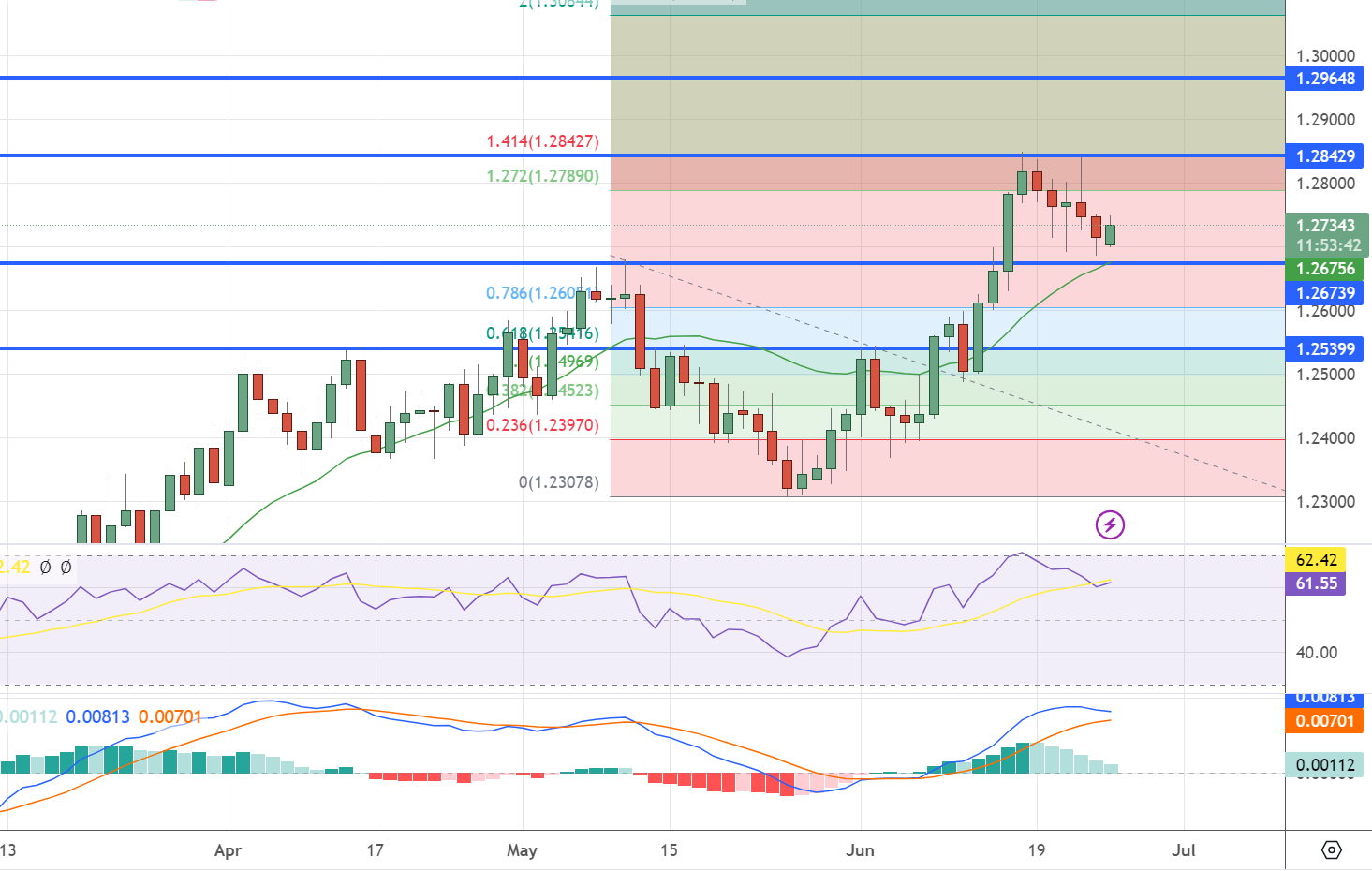

GBP/USD technical Outlook

The GBP/USD pair found strong support at the 1.2675 level, halting its decline and initiating an intraday recovery. This suggests the formation of a new bullish wave, with the initial target being the broken support of the primary bullish channel, now acting as resistance at 1.2815. If this level is breached, the price is likely to return to the mentioned channel and aim for further gains around the 1.2900 region.

As a result, we anticipate a continuation of the bullish bias in the upcoming sessions, supported by positive signals from technical indicators. However, it’s important to note that breaking below 1.2675 would halt the bullish momentum and potentially lead to a bearish correction in the intraday and short-term timeframe.

For today’s trading range, we expect support to be around 1.2660 and resistance at 1.2820.

For today’s trading range, we expect support to be around 1.2660 and resistance at 1.2820.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Index & Commodity Analyst

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments