Going Short on Crude Oil with Buyers Looking Exhausted

Crude Oil has been bearish on the longer-term charts, but it has formed a support zone above $70 and has been bullish throughout this year. The USD weakness has also helped and US WTI crude climbed above $80 earlier this month, where it remains.

Yesterday though, Oil prices remained mostly unchanged after the government crude reserves data showed a smaller-than-anticipated build in U.S. Oil inventories. That balanced out some weak economic data from Tuesday, although markets are still waiting on the US Q4 GDP numbers later today, as well as durable goods orders.

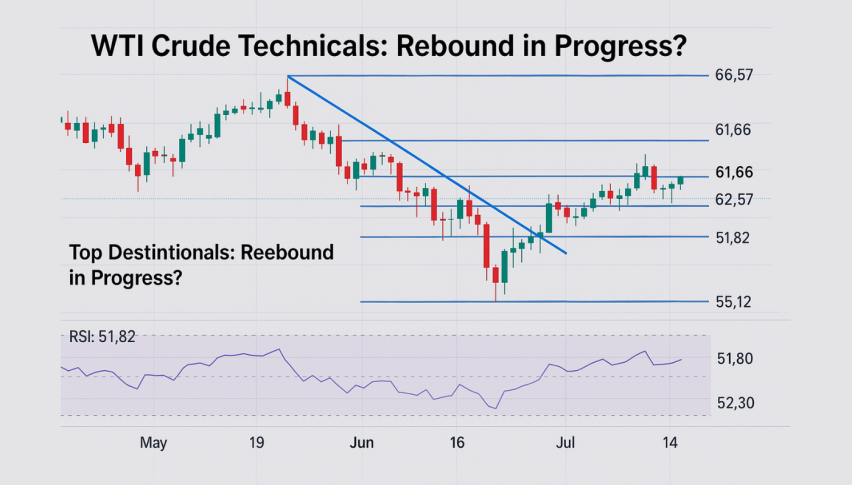

Crude Oil Daily Chart – Is the Retrace Over?

WTI Oil is overbought on the daily chart

UK Brent Oil futures settled at $86.12 a barrel, down a cent, while the U.S. West Texas Intermediate (WTI) crude futures settled at $80.53 a barrel, up by around 2 cents. Although after the increae in the previous weeks this month, US WTI crude has been finding it hard to push above the 100 SMA (green) on the daily chart above, This moving average has been acting as resistance for more than a week and seems like a good place to open a long term sell signal.

The stochastic indicator is also overbought on the daily chart. So, this looks like a bearish reversing pattern to me and we decided to open a sell signal in crude Oil yesterday. Yesterday’s weekly WIA inventories:

Weekly US oil inventory data

- EIA weekly crude oil inventories 533K vs +971K expected

- Prior was +8408K

- Gasoline+176K vs +1767K exp

- Distillates -507K vs -1121K exp

- Refinery utilization +0.8% vs +1.2% exp

- Production 12.2m vs 12.2m prior

- Implied mogas demand 8.14m vs 8.05m prior

WTI crude is largely unchanged on this but it’s less bearish than the API data released on Tuesday:

- crude +3.378 million

- gasoline+620,000

- distillates -1.929 million

- Cushing +3.928 million