What is Cryptocurrency Staking?

Last Update: October 17th, 2024

Cryptocurrency staking refers to the process of locking up your digital assets to support the operations of a Proof of Stake (PoS) blockchain network. By staking, crypto holders help maintain the network’s security and validate transactions, earning rewards in return. Unlike traditional Proof of Work (PoW) systems, staking doesn’t require extensive computational power, making it a more energy-efficient method of securing blockchain networks.

With the potential for generating passive income through staking rewards, it’s become a popular strategy among crypto users.

Whether you’re holding Ether (ETH), Cardano (ADA), or Solana (SOL), staking provides a way to earn more crypto while actively supporting blockchain projects. This guide will dive into the benefits, risks, and future of crypto staking, while exploring the platforms and strategies that make it accessible to everyone.

How Does Cryptocurrency Staking Work?

Proof of Stake vs. Proof of Work

In the early days of cryptocurrency, networks like Bitcoin used a consensus mechanism called Proof of Work (PoW). This method involves miners solving complex cryptographic puzzles to verify transactions and create new blocks. However, PoW is resource-intensive and comes with significant drawbacks:

- High Energy Consumption: Mining requires large amounts of electricity to power the hardware.

- Expensive Equipment: Miners need specialized and costly hardware to participate.

- Scalability Issues: As more participants join, the process becomes less efficient, leading to slower transaction times.

In contrast, Proof of Stake (PoS) provides a more energy-efficient alternative. In a PoS system:

- Staking Tokens: Crypto holders “stake” their tokens by locking them in a validator node or staking wallet.

- Validator Selection: Validators are chosen based on the amount of cryptocurrency staked, not computational power.

- Reward System: The more tokens staked, the higher the chances of being selected to validate transactions and earn rewards.

PoS has gained traction as a sustainable solution to Bitcoin mining’s energy consumption problem. Leading blockchains like Ethereum 2.0, Polkadot (DOT), and Cardano (ADA) use PoS to secure their networks, enabling participants to earn staking rewards while playing a key role in network security.

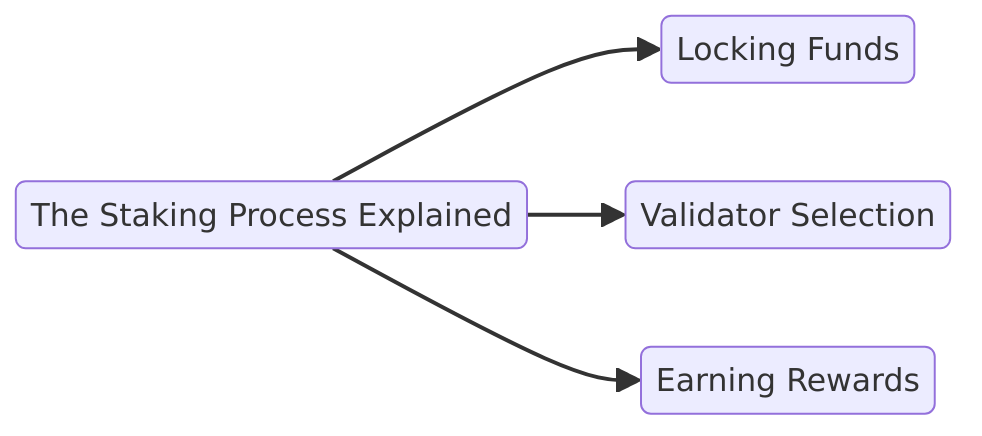

The Staking Process Explained

When you decide to stake crypto, you are essentially locking up your funds in a validator node. These nodes are responsible for verifying and adding transactions to the blockchain. The staking process involves three key steps:

- Locking Funds: You lock your cryptocurrency in a staking wallet or platform for a specific period, which could range from days to months, depending on the blockchain.

- Validator Selection: The blockchain’s algorithm selects validators based on how much they’ve staked. The higher the stake, the better the chance of being chosen to validate transactions.

- Earning Rewards: Validators who successfully verify transactions receive staking rewards, typically in the form of the network’s native cryptocurrency.

Instead of requiring expensive equipment, staking utilizes smart contracts to lock up funds, reducing energy consumption by over 99% compared to PoW systems. Moreover, staking rewards vary based on the cryptocurrency, ranging from 0.2% to over 100% annual returns.

What are the Benefits of Staking Cryptocurrency?

Staking cryptocurrency comes with several significant advantages, from earning passive income to supporting network security. Let’s explore these benefits in detail.

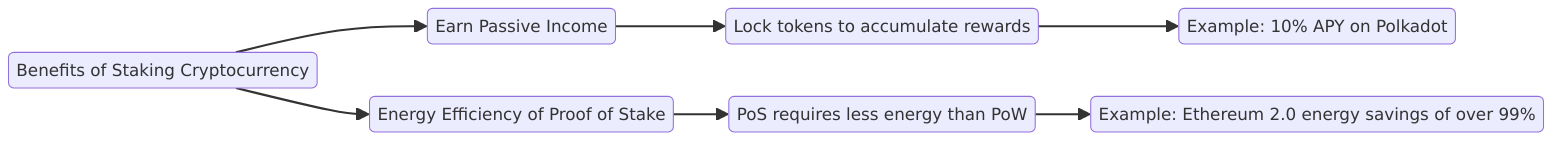

Earn Passive Income with Staking

One of the most appealing aspects of staking is the potential to earn passive income. By locking your tokens in a staking wallet, you can accumulate staking rewards over time without needing to trade actively. The longer you stake and the more tokens you lock up, the greater your returns.

For example, staking Cardano (ADA) can yield an annual percentage return of around 4-5%, while staking Polkadot (DOT) can offer returns as high as 10-12%. Some smaller or lesser-known tokens can even offer rewards of over 100% APY, though these often come with higher risk. The interest rates vary based on the blockchain, staking platform, and market conditions, but generally speaking, staking is an effective way to earn additional crypto while holding your assets.

Example: If you stake 1,000 Polkadot (DOT) at a rate of 10% APY, you could earn 100 DOT over the course of a year just by locking your tokens. This provides an excellent opportunity to grow your holdings, especially when compared to traditional savings account interest rates.

Energy Efficiency of Proof of Stake (PoS)

Another major advantage of Proof of Stake (PoS) is its energy efficiency compared to Proof of Work (PoW) systems, like Bitcoin. PoS blockchains use significantly less energy because they don’t rely on energy-intensive mining operations to validate transactions. Instead, validators in PoS networks are chosen based on the amount of cryptocurrency they have staked, which requires far less computational power.

For instance, Ethereum’s shift from PoW to PoS with Ethereum 2.0 is projected to reduce the network’s energy consumption by over 99%. This makes staking an environmentally friendly alternative to traditional mining. Not only does PoS reduce the environmental impact of cryptocurrency networks, but it also enhances the scalability of the blockchain, allowing for faster transaction processing.

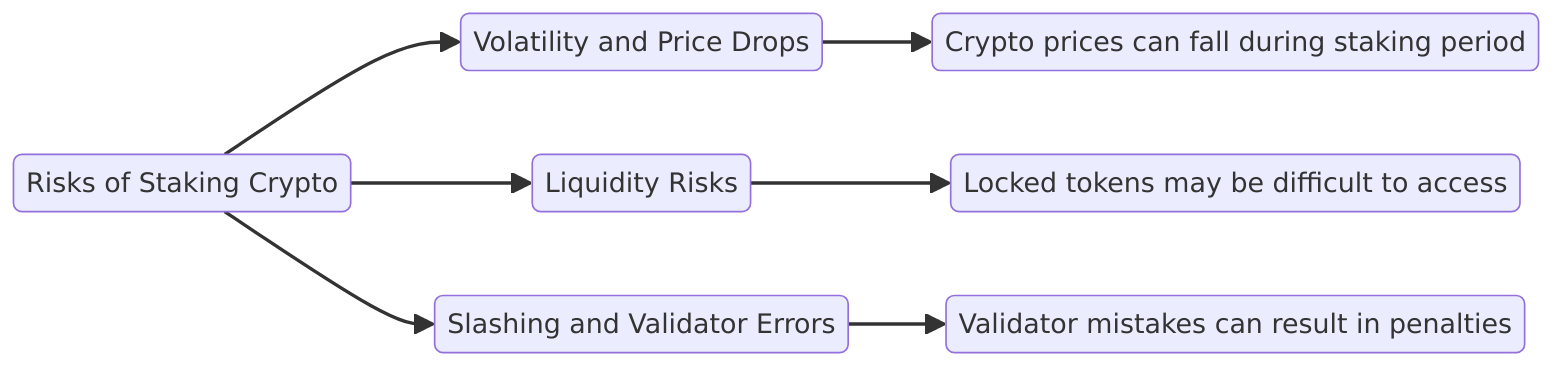

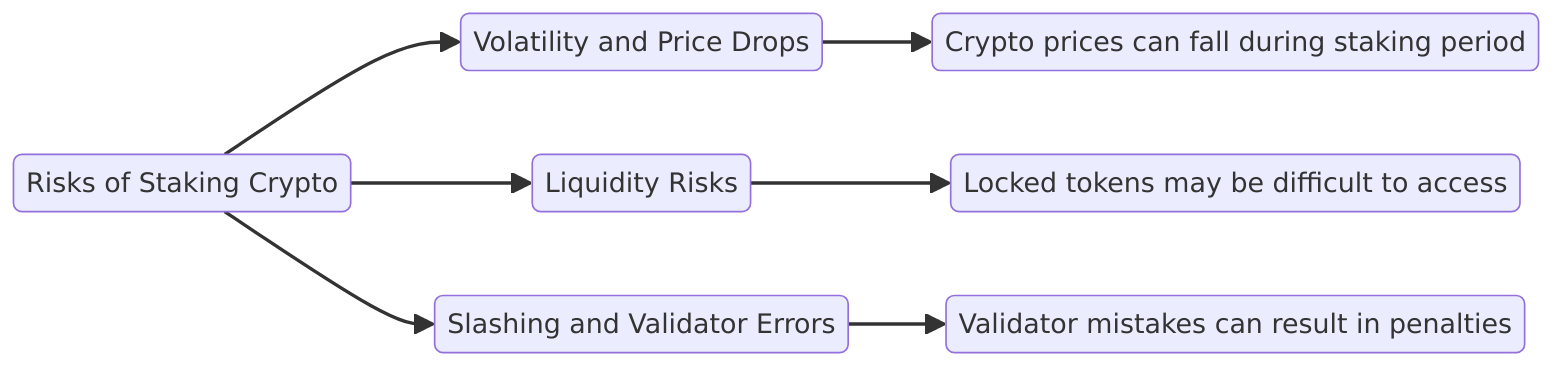

Risks of Staking Crypto

While staking cryptocurrency offers enticing rewards, it’s important to understand the risks involved. Let’s explore the key risks associated with staking and how they can impact your investment.

Volatility and Price Drops

One of the most significant risks of staking is price volatility. Cryptocurrencies are known for their unpredictable price swings, and staking tokens during a downturn can lead to substantial losses. When you stake your tokens, they are typically locked for a specific staking period, meaning you cannot sell or transfer them until the period ends. If the market takes a sudden downturn, the value of your staked cryptocurrency may drop, resulting in a negative yield despite earning staking rewards.

For example, imagine staking Ethereum (ETH) for six months, and during this period, the price of ETH drops by 30%. Even if you earned a 5% staking reward, the overall value of your holdings would be lower than when you started. This volatility risk can affect both large-cap and smaller-cap coins, making it important to assess market conditions before locking your funds.

Liquidity Risks of Staking Crypto

Staking also poses a liquidity risk. When you stake your tokens, they are locked in a contract for a set period, which means you cannot access them until the staking period ends. This can be problematic in situations where you need quick access to your funds, such as in the case of a market crash or an unexpected financial emergency.

For example, if you’re staking Polkadot (DOT) with a six-month lock-up period, and the crypto market experiences a sharp decline, you won’t be able to sell your tokens to mitigate your losses. Additionally, some staking platforms impose illiquid contract validators, which can further delay your ability to access your funds once the staking period is over.

Slashing and Validator Errors

Another risk associated with staking is the possibility of slashing. Slashing occurs when a validator in a PoS network is penalized for misbehaving, such as validating incorrect information or going offline during the validation process. When this happens, a portion of the staked tokens can be slashed (lost), reducing the overall amount of cryptocurrency you hold.

Slashing is often a result of validator errors or downtime, which can occur if the validator’s node experiences technical difficulties. While you can reduce this risk by staking through trusted staking platforms or staking pools, it’s still possible to experience slashing due to issues beyond your control.

Staking Options and Platforms

With numerous platforms offering cryptocurrency staking services, it’s important to choose one that aligns with your needs in terms of security, rewards, and usability. Let’s explore three of the most popular staking platforms: Binance, Coinbase, and Kraken.

Binance: The Leading Crypto Staking Exchange

Binance is one of the largest cryptocurrency exchanges globally and offers a wide variety of staking options. Users can stake multiple tokens, including popular cryptocurrencies like Ethereum (ETH), Cardano (ADA), and Polkadot (DOT). Binance is particularly appealing due to its high-interest rates on lesser-known tokens, some offering up to 100% APY.

A standout feature is Binance’s auto-compounding staking rewards, where the staking rewards are automatically reinvested to increase the overall returns. This feature works similarly to compound interest, allowing users to maximize their earnings without having to manually restake their rewards.

Additionally, Binance offers enhanced security through the Secure Asset Fund for Users (SAFU), an emergency insurance fund designed to protect users in case of hacks or unforeseen losses. Binance also provides a unique service called Binance Dual Investment, allowing users to participate in riskier investment products for higher yields.

Coinbase: Easy Staking for Beginners

Coinbase, the largest cryptocurrency exchange in the U.S., is ideal for beginners looking to stake their crypto with minimal hassle. The platform is known for its simplicity, offering an intuitive interface that makes it easy to navigate for new users. Coinbase provides staking options for major cryptocurrencies like Ethereum (ETH) and Algorand (ALGO), with interest rates ranging from 4% to 5.75%.

One of the key advantages of Coinbase is its staking protection. In the event that a validator misbehaves or gets slashed, Coinbase may compensate users depending on the cause of the issue. This protection adds an extra layer of security for users who may be concerned about the risks associated with staking.

Additionally, Coinbase offers a range of staking pools, allowing users to participate in staking even if they don’t have enough tokens to run their own validator node. This makes it accessible to smaller investors looking to earn passive income through staking.

Kraken: On-Chain and Off-Chain Staking

Kraken is one of the oldest and most reputable cryptocurrency exchanges, offering both on-chain and off-chain staking options. On-chain staking involves directly staking tokens on the blockchain, while off-chain staking allows users to lend their assets to Kraken, which then uses them to earn rewards. This flexibility enables Kraken users to stake assets like Bitcoin (BTC), Ethereum (ETH), and even fiat currencies like USD and EUR.

Kraken is also known for its secure platform, having never been hacked since its launch. It currently supports staking for 17 different assets with competitive rewards reaching up to 23% APY. Whether you’re looking to stake popular cryptocurrencies or participate in off-chain staking, Kraken provides a secure and user-friendly environment for both seasoned and new investors.

Auto-Compounding, Staking Stablecoins, and Inflation

In addition to traditional staking, crypto users can take advantage of features like auto-compounding and staking stablecoins, both of which can help maximize rewards and mitigate risks. Let’s explore how these methods work and their potential benefits, especially in terms of inflation-hedging.

What is Auto-Compounding in Staking?

Auto-compounding is a feature offered by several staking platforms that automatically reinvests your staking rewards back into the pool, allowing you to benefit from compound interest over time. Instead of manually restaking your rewards, auto-compounding does the work for you, significantly increasing the overall yield without additional effort.

For example, if you are staking Binance Coin (BNB) and earning rewards daily, an auto-compounding feature would take those rewards and add them to your staked amount, allowing you to earn interest on both your original stake and the rewards. This results in an exponential growth of your holdings over time.

Auto-compounding can drastically boost your annual percentage yield (APY), making it a powerful tool for those looking to maximize their passive income through staking rewards.

Staking Stablecoins: A Safe Option

For those looking to avoid the volatility associated with cryptocurrencies, staking stablecoins offers a safer alternative. Stablecoins like USDC, BUSD, and USDT are pegged to the value of fiat currencies, such as the US dollar, meaning they don’t experience the same drastic price fluctuations as other cryptocurrencies.

Staking stablecoins can provide relatively high yields compared to traditional banking interest rates, while also ensuring that the value of your staked assets remains stable. Platforms like Binance offer up to 10% APY on stablecoin staking, though the rate can decrease with larger investments. This makes staking stablecoins an attractive option for those seeking a low-risk way to grow their crypto holdings.

By staking stablecoins, investors can also protect their wealth from inflation, earning higher returns than those offered by traditional savings accounts while avoiding the volatility of other crypto assets.

Staking and Inflation-Hedging

In times of economic uncertainty, inflation can erode the value of cash savings. However, staking can act as a hedge against inflation, particularly for holders of stablecoins. Since stablecoins are pegged to fiat currencies and don’t fluctuate in value, staking them allows investors to earn interest that outpaces the inflation rate.

For example, with inflation rates exceeding traditional savings account interest rates, staking stablecoins at a rate of 5% to 10% APY can help investors protect their purchasing power. Additionally, many cryptocurrencies offer significantly higher rewards, making staking an attractive option for those looking to beat inflation through inflation-earning.

By staking your assets, you not only generate passive income but also safeguard your wealth from inflation, especially in an environment where fiat currency devalues rapidly.

What is the Future of Cryptocurrency Staking?

Cryptocurrency staking is evolving rapidly, offering both opportunities and challenges as the technology matures. As more people participate, new innovations are emerging, and regulatory bodies are taking a closer look at how staking fits into the broader financial landscape.

Let’s explore two key trends shaping the future of crypto staking: the rise of liquid staking and the growing potential for regulatory challenges.

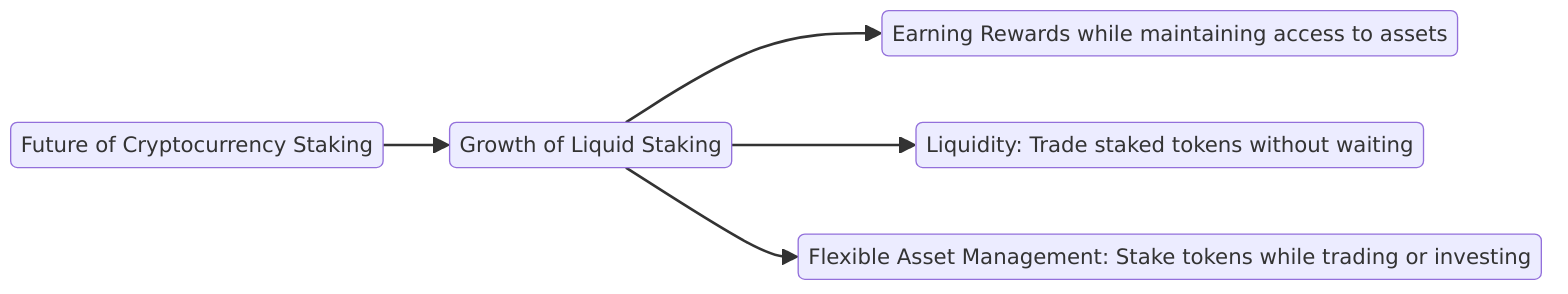

Growth of Liquid Staking

One of the most notable trends in the evolving staking space is the rise of liquid staking. Traditionally, when you stake cryptocurrency, your tokens are locked for a fixed period, limiting access and flexibility. Liquid staking solves this issue by allowing users to earn staking rewards while still maintaining liquidity.

Key benefits of liquid staking include:

- Earning Rewards: Stakers continue to earn rewards while keeping access to their assets.

- Liquidity: Liquid staking provides the ability to trade or move staked tokens without waiting for the staking period to end.

- Flexible Asset Management: Users can stake their tokens and, at the same time, trade or invest using liquid tokens that represent their staked assets.

For example, with Ethereum (ETH) liquid staking, you can stake your ETH in a staking pool and receive a liquid token that allows you to continue trading or investing without losing control over your staked assets. This flexibility appeals to users who want the benefits of staking without the drawback of locking their funds.

As more platforms adopt liquid staking services, this approach is expected to gain even more traction. It’s increasingly seen as the next step in making crypto staking both more accessible and user-friendly.

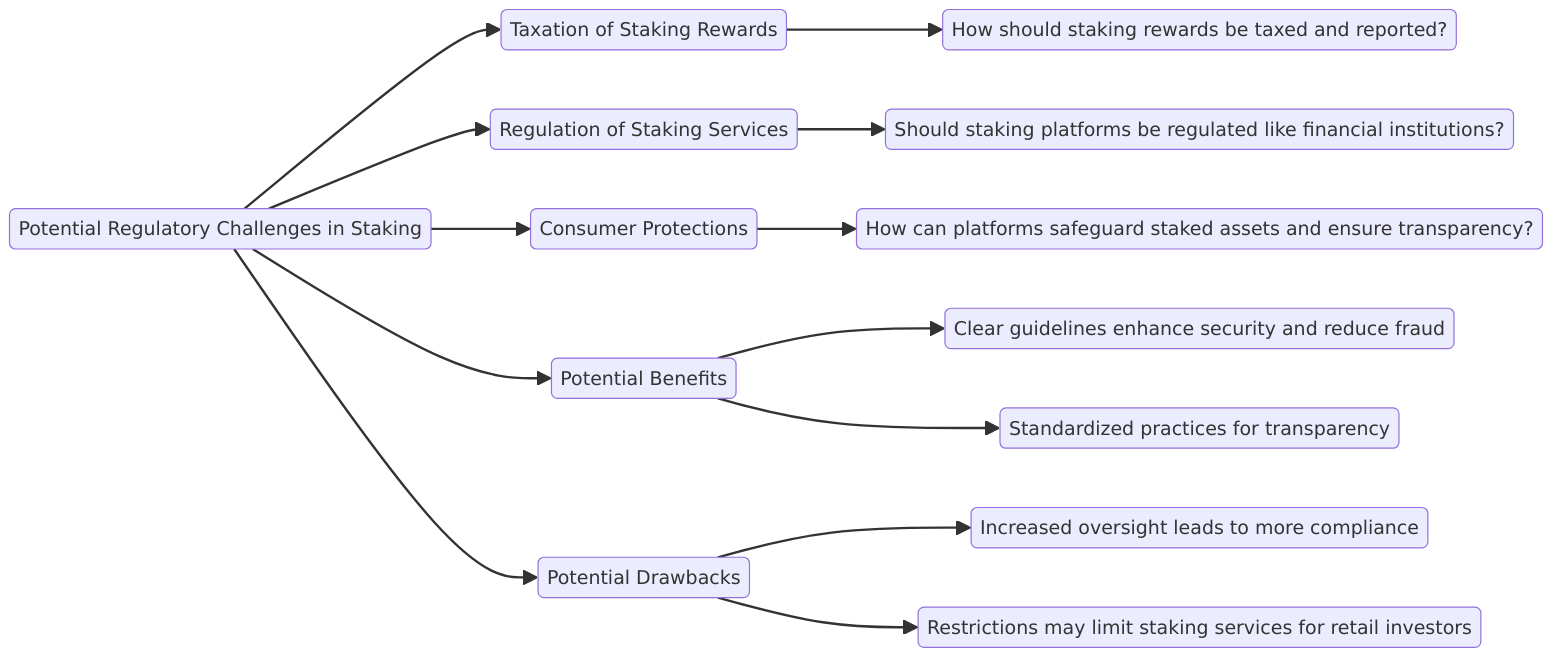

Potential Regulatory Challenges

As cryptocurrency staking becomes more widespread, it’s attracting attention from regulators who aim to protect investors and ensure market stability. Staking, especially through staking platforms or as part of staking as a service, presents several questions for regulatory bodies to address.

Some of the key regulatory concerns include:

- Taxation of Staking Rewards: Should staking rewards be treated as taxable income, and if so, how should they be reported?

- Regulation of Staking Services: Should platforms offering staking services be regulated like traditional financial institutions?

- Consumer Protections: How can regulators ensure that platforms safeguard users’ staked assets while maintaining transparency in how rewards are calculated and distributed?

The introduction of regulations could offer both benefits and challenges for stakers:

- Potential Benefits:

- Clear guidelines may enhance security and reduce the risk of fraud or loss.

- Regulations could introduce standardized practices, offering greater transparency for retail investors.

- Potential Drawbacks:

- Increased oversight might lead to more paperwork and stricter compliance requirements.

- Certain restrictions could limit the availability of staking services, especially for smaller retail investors.

Although some governments have started to roll out frameworks for cryptocurrency regulation, the global nature of crypto makes this a complex issue. Investors should stay informed as these regulatory challenges evolve, and consider seeking professional investment advice to navigate the shifting landscape.

Conclusion: Crypto Staking – Rewards, Risks, Future

Crypto staking has given investors a way to earn passive income while actively supporting the blockchain. Whether you like the energy efficiency of Proof of Stake (PoS), the staking rewards or the flexibility of liquid staking, staking is here to stay in crypto.

But staking isn’t risk free. From price volatility and liquidity constraints to regulatory changes, you need to know the benefits and risks before you jump in. For many staking is a way to grow their crypto holdings but like any investment you need to consider your financial goals and risk tolerance.

If you’re new to staking start by checking out your options, including platforms that offer staking services for beginners. See how staking fits into your overall investment strategy and consider the features like auto-compounding or staking pools that suit you.

As crypto staking evolves stay informed and make smart decisions.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins